![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

If everyone was ‘financially astute’ there would be no nurses, no care workers to look after your mum, no school dinner ladies and TAs to look after your kids, no delivery drivers to bring you your latest CRC purchase, and no cafe staff to supply you a post-ride cake and coffee.

Exactly, same tory BS along the lines of if everyone tried harder they can all be rich.

Retirement is a maths thing though as others have said. If you have more people living more years past retirement and claiming benefits then something is going to break. To fix that you need to lower the length of time they are in retirement or take more money from the workforce to pay their benefits.

Guessing if it were put to a referendum the workforce would kick the can down the road and say increase retirement age.

If they try to stop me accessing my pension at the age I was entitled to when I paid into it – that might see me get emotional. I am unhappy that they’ve slipped the age my NI contributions come to fruition – but 2 years at 9k pa is not a massive sum for me to invest to cover over what a 30 year period?

@poly but that is exactly what will happen.

Most (non state) pensions you can access up to 10 years before state pension age - at, in my case, about a ~50% reduction in annual payments if I take it the full 10 years early.

So you might be paying into your pension assuming you can access it as early as age 55-58 (depending on your age now), but that will increase if the state pension age increases in the meantime.

I was kind of hoping I might be able to access my local authority pension early at 55 next year if I needed to, despite the cut in monthly payment.

Is it the situation that it is now actually 57?

It's 57 from 2028, you'll be okay next year.

Ta Andy, gives me some leeway then. Obviously leaving it later is more beneficial, but needs might need it.

finbar - there's absolutely no need to rigidly fix the early retirement age (the age at which you can draw down private pension) 10 yrs before full retirement (the age at which you qualify for state pension). Depending on the problem they are trying to solve, and who they wish to placate they can set the rules accordingly. What I'm saying is IF they decide to change my "early retirement age" they may find me in the streets... If they give me sensible notice that my "full retirement" age is slipping again then I'll be more tolerant of that.

Logically that all makes sense, but why then are employees not drifting north as quickly as possible? and their employers chasing them North too (where business premises etc are also cheaper).

Because the same companies do different things in diffeent regions.

Can you explain your uni debt being £800/m worse of depending on region?

It was a somethingion of the housing delta (£600) and the student debt repayment (£200). In essence, housing and student debt in the SW (bristol) will likely cost you £1200 if living alone in a 2 bed place and £600 in the NW. Without the debt, you'd be closer to £450 in the NW.

Just a somethingion of cirumstances affecting peoples ability to save/plan for the future. My SiL has just bought a 2 bed house in the NW for £106k. A comparable sized house in a worse area on the outskirts of Bristol is £300-£350k.

Graduate engineer starting salaries have increased £8k or 30% in 13 years. House prices have almost doubled in the last 10. Pensions have gone from fainal salary schemes (4% buy in with 2% of that to AVCs) in 2012, to employer matched upto 10% in 2023. Fuel, energy and food have doubled in 10 years, but salaries have only increased by 35% average.

Do people REALLY not understand why some young people find it so hard? Is it REALLY because they bought a new iphone? Or a nice car? When you were young, with your first pay cheques, did you save it all?

And while you are doing that, Gov.uk will continually take more tax from said savings to try to not make that date get any further than it already is*

the vast majority of savings should be pretty easy to wrapper away from tax (£80k per year for ISA + pension combined) - I don't think you'll get a lot of sympathy if you're trying to save more than that (although you can, tax free, with things like EIS, plus there's premium bonds etc)

finbar – there’s absolutely no need to rigidly fix the early retirement age (the age at which you can draw down private pension) 10 yrs before full retirement (the age at which you qualify for state pension).

the law stops you accessing your pension pot prior to that. the age bumped up by a couple of years (from 55 to 57 iirc) pretty recently, LISA is already age 60

if you want to retire early, its best to have some of your funds in a place where you can access them regardless of age (ie standard ISA)

@Daffy - a significant portion of my first few years pay went to my folks as board & lodgings 😀

Phone / flash car / Netflix / carry outs etc are all up there as "important" purchases for younger folk and I can see why some folk have a go at them for wasting money on "trivia" instead of saving. However, their lot is, in general, pretty poor as regards housing availability, cost of living, energy/petrol prices and looking like they'll be working into their 70s. Add to that, there's a generation now growing up with the impact of Covid too. Faced with all of that, things looks pretty hopeless and financial security so far out of reach that I can't blame them for adopting a more carpe diem attitude.

Do people REALLY not understand why some young people find it so hard? Is it REALLY because they bought a new iphone? Or a nice car? When you were young, with your first pay cheques, did you save it all?

I remember my first few years, seemed to have no money after paying rent and car HP. I would look at more expensive cars / houses and wonder how on earth anyone could afford them. Then, eventually, after many pay rises and years later, suddenly that was me.

However, I had a career where each year you progressed and got paid more, which is far from the norm.

I will however admit, that many around me don't seem to have the same Scottish attitide to money that I have. I WILL NOT buy a coffee a day (£4* 5 days a week) from the shop! £1000 a year on okayish coffee? Are you f*rking kidding me?

That would pay for ALL of my internet, TV, Phone, car uinsurance and tax - OR...coffee...I mean, WTF?

A Pret subscription is only £30/month, so £360 a year.

Not that I drink coffee myself, never really liked it. Now Earl Grey Tea on the other hand, spend a small fortune on that in Tea Bags alone...

Phone / flash car / Netflix / carry outs etc are all up there as “important” purchases for younger folk and I can see why some folk have a go at them for wasting money on “trivia” instead of saving.

Even then I think it's overstated though! The proportion of under 30's with a driving license has gone down substantially since the 1990s. (not surprising when the average insurance for young people is nearly £2k!). So yeah, some people do have fancier cars than they used to. But nowhere near as much as the Mail would like!

I don't think there's actually a lot of evidence to suggest that regular young people are living particularly extravagantly compared to their predecessors.

Indeed, it was just spent on different things.

Radio Rentals vs Credit Cards,

fish and chips vs dominos or coffee

blockbuster vs Netflix

Kays/Littlewoods vs Apple/EE

Med holidays vs, well, Med holidays.

Car Personal loan vs PCP.

The difference is that in the past those things were maybe more affordable when considering housing/energy/food, thus still allowing for savings, etc. That’s now being squeezed so the 30/30/30 rule can’t apply.

Do people REALLY not understand why some young people find it so hard? Is it REALLY because they bought a new iphone? Or a nice car? When you were young, with your first pay cheques, did you save it all?

I did not save one penny. I bought cars, beer and fags and went on holiday a fair bit. I then bought my first house for £50k back in 1992 (3x salary) with a minimal deposit. And for pensions my first job for 7 years between 18 and 25 had a company pension where I am now going to get £6K per year until I die. Small amount compared to my 'actual' pension but funny to think that was from a job as an 18 year old.

So yes, we had it easy back then and very much lucked out but not much I can do about that.

I didn't save all my money when I was a working teen. But I already started the first of my pension plans . Traded shares on the stock market, was lucky enough to stag a few good ones and was lucky enough to make thousands.

Saving for a house must seem absolutely crazy for the 18 - 30 generation as prices are so high they will never be able to buy anything.

Maybe the government should actually lower IHTax to zero. Then band it at say 20 , 40 and 60%.

Yes you can leave your family a house but the government will take 20% . Leave them an estate worth north of say 2mill , and the government are having 60% of it.

Both my grandads worked in factories every day of thier working lives, retired at 65 and were dead by 75.

An 18 year old male now, assuming uk society doesn't crumble too badly, will make it to 90.

Both my nans hit the ton, so your looking at at least that for a female.

Both my parents died of natural causes when they were ~65.

I'm 60, and I'm still working. What a f++king mug am I.....

As for AI replacing people, so far it’s magical thinking IMO.

Wouldn't AI be perfect to do jobs that are not physically demanding, like pointing folk to the right aisle at B&Q. In other words precisely the jobs old folk are supposed to do?

Can you elect to stop paying NI?

In my family, the men don't make it into their 70's. Might as well divert the payment to the STW default - C&H's

We can all worry about not making it to retirement, but for me it's doing what should be the basic thing for humanity, making it better for the next generation, just now i don't think anyone is getting that feeling in many ways, retirement being one of those, the problem is no government looks further than 5 to 10 years in anything this big, it's impossible for them to fathom, or for all sides to back without trying to make political statements around it.

the problem is no government looks further than 5 to 10 years in anything this big,

The current lot haven't even looked that far ahead, they've just been lining their pockets (and that of their mates / pub landlords) as quickly as they can....

the law stops you accessing your pension pot prior to that

Fairly certain polys point is that there's not really a reason for that law you either have enough money to retire or you don't.

I suspect people were spunking their pot and then were reliant on the state pension. Leaving nothing to be drawn down for care.....

The current lot haven’t even looked that far ahead

Oh, they have - they’ve looked ahead much further than that. Just only thinking about where their prospects are concerned, not your or mine.

the problem is no government looks further than 5 to 10 years in anything this big

And neither does the electorate.

The smart political move would be (for at least those who have not started earning) to give them the option to not get state pension at whatever age, in return for some advantage – like better private pension arrangements now (most early career people will only be getting 20% tax relief compared to 40% for high earners!).

You mean go back to "contracting out"? Another legacy of the last 13 years.

There is a good calculator here. Currently an 18 year old male can expect to live to 86. I'm hoping the fact my dad got to 90 pushes my average up a year two or or else I'm counting down from 21 years left.

Should I go at 21 years I will have been on the OAP pension for 18 years. No wonder it is expensive.

Averages are just that of course. There are many stark divides like if you live on one side of a local park in Glasggow your life expectancy is 14 years less than if, like me you live on the other side in East Dunbartonshire.

"In the part of Drumchapel that overlooks the park, life expectancy is 68.3 years for men and 71.3 for women, while in directly opposite Bearsden, it is 82.8 "

https://scottishleftreview.scot/scotlands-divided-health-is-tantamount-to-social-apartheid/

Generation X are the least well provided in terms of private pension as the move from defined benefit to defined happened largely in their working lives, auto enrolement means the young are saving far earlier than my generation did.

Adding to what Bigrich said.

When I started my BT apprenticeship aged 16 back in 82, BT retired everyone at 60, the average age that anyone got to enjoy that final salary pension till was 61. Okay there would have been a lot a hell of a lot skew, due to the physical/mental toil WW2 would have put on those retiring and smoking. But at the time in '82 BT employed 250,000+ with a fair portion not in hard labour, so I guess a good sample of the general population. Did those pension actuaries at the time base their figures against that 12-18 months of payments, to sustain a final salary scheme. Said fund got buggered when it was raided to pay for early redundancies later on.

I'll get £409 a month off the scheme in 2 years time, as I put 12 years into it, but it'll get hammered on the income tax as no doubt I will still be working paying into that contrib pot as long as I can. Well until the OA in my fingers gets to the sod it I need to give up stage.

https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/healthandlifeexpectancies/articles/lifeexpectancycalculator/2019-06-07

/blockquote>

clickclickclick...clickclickclick...clickclickclick...clickclickclick... it only goes up to 111 boring.

As per a few above, I'm not so concerned about a rise in the state pension age but I am very concerned about the NMPA increasing further (moving to 57 from 2028).

I'm currently wondering about various strategies to use equity in the house for bridging any gap that opens up, if I have too much tied up in the pension.

Might rent the house out and live in a van for a bit or something

Here's an example of domestic fiscal policy in action . I left school in 1971 to work in a factory. I agreed with my mum that I would contribute to renting a colour telly , the only programme I really cared about was Top Of The Pops . It clashed with something mum wanted to watch so I lost . I said I wouldn't pay my share she said she'd send it back if I didn't. I tried calling her bluff and sure enough it went back!

Try telling young 'uns that today and they won't believe you !

Numbers out today

Moderate lifestyle = £31k pension

Comfortable lifestyle = £59k pension.

Seems high, but the former is close to where my current pensions would get me, which disappoints.

There to be challenged I suppose, I think the latter needs in excess of £1m on retirement, not many have that.

Source?

I would guess most people won't have 31k a year from any pension but would also question why you need 60k for a comfortable lifestyle when presumably things likes mortgage payments are long gone.

It is from this lot I guess - https://www.retirementlivingstandards.org.uk/

Basically an industry mouthpiece for a load of financial services companies.

Includes gems in the comfortable category such as 'Replace kitchen and bathroom every 10/15 years.' and 'Extensive bundled broadband and TV subscription.'

I would guess most people won’t have 31k a year

most people don't have £31k a year pre-retirement...

Yes… but we have below moderate lifestyles. Wear coats in doors, frugal home cooked meals, ancient old cars, etc. Who knows what “moderate” means… could be anything.

One thing’s for sure… it’ll include a mobile phone, flat screen TV, the occasional coffee… we didn’t have avocados in my day… 😉

Presumably this is a couple? Both getting state pension only gets them halfway there but yes 31K would be a lot for many people but then then don't have a moderate lifestyle.

31k a year blows my mind. Is that each so 62k for a couple.

When I'm retired and have no mortgage my days are going to be filled with hiking with a packed lunch, buying ingredients and cooking meals, gardening, visiting friends and family. Any holidays will be in term time. I have no idea how to get this to 31k

But is clearly utter nonsense.

When I’m retired and have no mortgage my days are going to be filled with hiking with a packed lunch, buying ingredients and cooking meals, gardening, visiting friends and family.

Sounds like death will come as a welcome release.

Well below the minimum as I expect most are. Of course there will be more than enough at the other end to keep inflating things that were once normal purchases out of reach.

My big pension spreadsheet shows that you need a pot of £1.9m at a 3% drawdown, or 1.4m at 4% drawdown to get the 59k comfortable situation (which a lot of people on above uk average salaries are probably going to expect - and just to make a assumption the vast hoards of IT middle management that makes up STW). The bbc article which has highlighted this ( https://www.bbc.co.uk/news/business-68222807) then goes on to say the average (joint) pot is like 275k.

So that's depressing. I thought I was doing ok on my pension and might be able to retire at 60, but it seems not (two kids and currently ok salary so ideally i'd like to be comfortable as I die!).

(Numbers for the minimum are 560k ish @4% and £600 ish @ 3% - haven't even got that at the moment!)

The average uk salary is 34k in 2023. So that means it would take 55.8 years to earn 1.9 mil if you saved every penny. Obviously unrealistic but illustrates the shitshow we are in, and how unhelpful the comments such as 'just plan properly / be astute" are as a solution. Its of course important to plan, but unrealistic to think we can all plan out way out if this mess.

Current lifestyle costs us as a couple ~22k a year and that includes private health care, occasional meals out, servicing our vehicle, fuel and bike park tickets.

Would imagine similar costs in 20 years time when we're settled down with a house.

Think it makes a difference if you're someone who buys things because they need it as opposed to because they want it.

It not the age, it's the mileage.

I got 10 year olds when my parents had 20 year olds and my pops had 30 year olds.

I can work cos i don't give a fudge.

I'm frugal but wish our expenses were that. Kids and houses are bloody expensive.

I think it depends on how you view comfortable, for some their comfortable normal lifstyle is someone elses dream, a lot of folk are a tad out of touch, many aspire to so much, thinking it will bring happyness and contentment...sometimes it does of course but often not.

For example 59k a year to me would be a huge income, but for many on here its pennies, yet i feel i have a good happy content life now on less than half that at 53 years old and still working, probably well into my 60's.

Of course i dont have a huge collection of expensive items, or have a 70k car or a 800k house or go on several ski trips each year, but then im not chasing that...im chasing do i feel happy more days than i dont.

I think content is something that is a thing of the past, imo a massivley increasing number of people chase the wrong things.

I think the younger generation are really suffering because of this...and its so hard now for young people to have hope in such a greedy world, particular the UK...

So much is taken out by the ever increasing few who simply never have enough and are never happy with what they have..

ashhhFull Member

The average uk salary is 34k in 2023. So that means it would take 55.8 years to earn 1.9 mil if you saved every penny. Obviously unrealistic but illustrates the shitshow we are in, and how unhelpful the comments such as ‘just plan properly / be astute” are as a solution. Its of course important to plan, but unrealistic to think we can all plan out way out if this mess.

Not accounting for compound interest it doesn't.

Taking your average salary of £34k and saving 20% of it into your pension for 45 years gets you the 1.9mil (well £1,867,123.83 actually) at a fairly conservative 5% growth annually.

I think the younger generation are really suffering because of this…and its so hard now for young people to have hope in such a greedy world, particular the UK…

So much is taken out by the ever increasing few who simply never have enough and are never happy with what they have..

Yeah this is a concern. I feel like my generation (40s) are probably the last for whom living in a mortgage-free house in retirement will be a reasonable 'normal' expectation. Me and MrsD scraped in by the skin of our teeth- the mortgage on our first-time buyer house is set to run until MrsD is 65, though hopefully we'll get it done sooner.

As people have kids later, spend more on rent, buy houses later (if at all), they won't have time for pensions. We'll have people on ever-smaller pensions, renting ever-more expensive housing from a small cadre of uber-wealthy landlords and private equity funds. Some will inherit half a house at 65 when their parents pop-off. The rest will be even more ****ed. Oh, and the declining birth rate means there's fewer of them too. Ouch

Home ownership among people aged 35-44 has plunged – ONS

Fair point..but I ignored interest and inflation. Given that my pension is around 5% and so is inflation at the moment it seems reasonable as a real world comparason. And i get that at 55 years rather than 45 (assuming the employer contribution is in the 20%).

And even at 45, assuming you get that salary in your mid 20s, you're still looking at 70 anyway! I

How many people on £34k could afford to save 20%? I know I can't.

How many people on £34k could afford to save 20%? I know I can’t.

Pretty much none I would imagine, in fact they can probably afford to save around 1% so would need to have some VERY good interest levels to get anything worth mentioning.

How many people on £34k could afford to save 20%? I know I can’t.

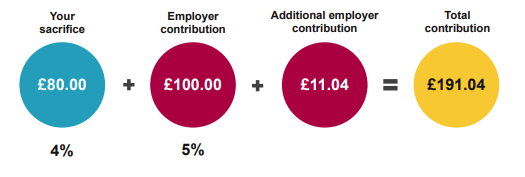

That 20% is broken down into 3 parts;

1) Employee contribution

2) Employers match

3) Gov't tax back / contribution.

Therefore to hit the 20% you're really only looking at 8(ish) percent contribution from the employee. I expect most people will be saving there or thereabouts.

I expect most people will be saving there or thereabouts.

I think you're being optimistic.

When I look about most employers seem to offer really poor pensions. my mrs is always looking as hers is ~ 3% matched. So a grand total of 6% I've never seen the gov tax back as most are paye. She can't afford any AVC's so it is what it is.

I'm lucky that my employer is much better, but it's bloody rare and one of the reasons I work where I do.

I think you’re being optimistic.

8% contribution was the default contribution about into the company pension scheme when I was a student in a call centre. Most jobs since have been of that sort of %.

On a quick look it would appear the gov't nest pension scheme is set at 8% too.

I pay 7% into a salary sacrifice scheme as this gets me the maximum contribution from my employer (8%). That is pre-tax/NI so AFAIK, point 3 has no effect on the amount saved.

So 15% of my headline salary is being invested, but I'm only saving 7%. At this time I can't afford to increase that and can't see that changing in the near future.

EDIT: just checked the pension portal and my employer also contributes their saving in NI payment so that's an extra 13.8% of my contribution.

Surely an immediate solution is to remove the higher rate NI payment and make it a flat rate?

Don't forget to take inflation into account. For your £43,000/yr "comfortable" figure you'd actually need an income of ~£92,000 if you retire in 30 years in order to enjoy the same spending power.

There's a reason your MP's final salary pension scheme is index-linked.

Most other final salary pensions schemes have been down graded.

What about down grading mp's pensions to zero to focus their tiny little brains.

Don’t forget to take inflation into account. For your £43,000/yr “comfortable” figure you’d actually need an income of ~£92,000 if you retire in 30 years in order to enjoy the same spending power.

There’s a reason your MP’s final salary pension scheme is index-linked.

inflation works both ways though - for sure the actual income you need is higher, but your input salary would have risen by an equivilent amount. Additionally, any debts you hold (such as mortgage) inflate away, so whilst £1000/month today might be a pinch, in 20 years time, its the equivilent of approx half that, leaving you with more space to invest in your pension

for sure, saving into a pension is hard, but life is all about compromises, at every income interval

inflation works both ways though – for sure the actual income you need is higher, but your input salary would have risen by an equivalent amount.

Really? I got a 3% raise last year and I'm expecting the same this year.

Really? I got a 3% raise last year and I’m expecting the same this year.

Agreed. Over a decade since my last pay rise. It'll only happen when minimum wage catches me I reckon. Doubt I'm unique.

Also bear in mind that the compounding has most effect on the early years when salary is likely to be some way below the median and pension contributions commensurately smaller too. I don't think 5% above inflation is a realistic return anyway though.

Most people earn much less than the average salary (mean) The modal salary is £23300.

Sauce https://rohan-tangri.medium.com/fooled-by-the-average-f254ff9bc08c

The only plausible way for an average earner to have amassed that sort of wealth is through highly geared investment in the housing bubble, which of course plenty of people have done, but that opportunity doesn't exist for everyone. (Or inheritance from rich relatives of course.)

I'm not working until im 71, f that. The only thing that makes work tolerable for 8hrs a day is counting down to the weekend and the idea of being able to retire and doing what I actually want to do 5 days of the week.

The only plausible way for an average earner to have amassed that sort of wealth is through highly geared investment in the housing bubble,

sounds awesome, where do I sign up? 1992? 😉

Over a decade since my last pay rise. It’ll only happen when minimum wage catches me I reckon. Doubt I’m unique.

An admin at work was somewhat bitter when she said that 30 years in the civil service had finally seen her salary come down to the minimum wage.

for sure, saving into a pension is hard, but life is all about compromises, at every income interval

Agreed. Few people understand the tough decisions I face chosing which Ferrari will be my next n+1.

I can see a lot of civil unrest down line as wealth is hoovered up by the minority creating a huge divide.

greed. Few people understand the tough decisions I face chosing which Ferrari will be my next n+1.

I'm sorry to hear you're having to slum it with the Prancing Horse, can we set up a Gofundme to help you get into something desirable?

I didn’t save all my money when I was a working teen. But I already started the first of my pension plans . Traded shares on the stock market, was lucky enough to stag a few good ones and was lucky enough to make thousands.

and the award for worlds most boring teenager goes to…

for sure, saving into a pension is hard, but life is all about compromises, at every income interval

What an utterly ridiculous statement. There are some extremely naive and fortunate/ignorant posts on this thread. Wild guess here, but you’ve never lived on or below the breadline have you?

In theory I'm ploughing thousands into my pension every year and should end up somewhere a bit below the moderate picture above. This means I drive a 15 year old banger instead of a nice Merc or whatever. However I will be extremely surprised if there isn't a tax raid on my pension before I get to use it. I reckon this'll be coming before I get my pension (aged 42):

- no state pension if you've over a certain amount of private pension or savings

- decent sized tax raid before I get it (maybe a 1% yearly tax from what the think tanks are publishing)

- end of tax free lump sum

- pension tax relief will be cut to 20% within a decade

- pension included in inheritance tax when you die (I believe it's excluded at the moment)

- ability to take private pension pushed into mid 60s

- all those freebies pensioners get gone (bus passes, free swimming etc)

Pretty sangine about it, I believe in progressive taxation and the money has to come from somewhere. I'll be bitter if NHS is totally gone tho but that point.