![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

I'm wondering how much longer it can go on for? A family member bought her house for around 80k in 2002 and got it valued last month at almost 400k (it's a 3 bed semi in north-west England).

If you had a deccent desposit and were OK'd for a small mortgage, would you be holding off or going all out to get on "the ladder"? What are the chances of seeing an 08 style crash? Unlikely, right?

You’d need more than a decent deposit and a small mortgage to get on the property ladder at the moment. ****ing huge deposit and mortgaged until you’re dead is more like it.

It's been done to death. I doubt itll crash. It may flat line but itll never plunge low in my opinion.

Where in NW as some places have gone insane

@ duncancallum: South Liverpool. Yes, it's completely insane. I saw a 1-bed going for 180k the other day. There's a flat at the end of my dad's road. It's up for sale, gets bought, and then a few months later up for sale again but for another 10-15k.

Nope I don't reckon it will, the country is just becoming unaffordable everywhere, as opposed to the cities & SE.

Its ok though, a lot of the soon to be newly-unaffordable-for-their-residents parts of the country voted for Boris. He'll fix it. Fo' sho.

It's not just the UK, if it is a bubble, it is a global housing bubble, and if it crashes, well then all bets are off - buy gold, guns, bitcoin, and head out to the Compound for the New Order to emerge.

What can be looked at from one perspective as a UK property bubble could be seen from another angle as a devaluation of paper money.

Calculating house prices in units of gold is quite interesting. At current prices, the ratio is close to the historical average.

Our entire economy is based on house prices not crashing, if they were to crash we would be in a huge recession with interest rates going up, jobs going down and the usual crisis' that it would bring.

Worst case is house prices going down a few percent, or steadying off, it's not just a supply and demand issue that's pushing house price increases over the years, it's the market it supports and household debts that it covers.

So long as there is access to cheap.credit the can will be kicked down the road.

I don’t remember a house price crash in 2008!! We sold our house not long after that and possibly there was a small blip but nothing that reduced prices long term.

I know there’s a few on here convinced they’ll be a crash, but I just cannot see it - although I expect the current insane growth to level off! COVID didn’t cause one, nor brexit - if anything the economy is booming now. There are a huge number of new-builds going up or planned here (SE) so maybe they’ll be more competitively priced when finished, or the builders will offer help-to-buy etc. Can’t see the price of established properties dropping though, especially those in desirable locations/with outdoor space etc. What would cause it?

As long as houses are seen as investments, not homes then growth will continue apace.

Looking at it from a sterile financial perspective;

A family member bought her house for around 80k in 2002 and got it valued last month at almost 400k

Works out at an average of just below 8.5%pa return which is broadly in line with other asset classes thought the period. I would suspect therefore house prices will continue to increase at this normal* level for the foreseeable.

*it’s clearly more batshit crazy than normal but house prices is what we as a society have decreed to use as the foundation of our entire economy.

So long as there is access to cheap.credit the can will be kicked down the road.

This for me entirely. I think the whole housing shortage/lacking of building is a bit of a red herring and it's ultimately cheap credit that will make/break the housing market. But, as had been said, the whole economy seems to be unpinned by the housing market so boris will do everything to prop it up.... scary stuff

The only way I can see it happening is if a LOT of social housing is built with right to buy taken completely off the table. Part of the reason for the price of housing is the buy to let market (or investment). The better off are pricing the less well off out of home ownership, then renting housing to the less well off for unaffordable amounts of money, profiting off the fact the lower paid can't get a mortgage for the same home.

This government will never build hundreds of thousands of social housing properties. They'll continue with the lower quality "affordable" housing. In my area that equates to earning over £50k a year (top 5% of earners) to afford to buy a 2 bed terrace.

If you had a deccent desposit and were OK’d for a small mortgage, would you be holding off or going all out to get on “the ladder”? What are the chances of seeing an 08 style crash? Unlikely, right?

First recollection I have of "houses are too expensive, how long can this go on" conversations was in the mid 90s, I wonder if that person is still waiting for prices to become "affordable"

I dont see anything changing without government intervention on a massive scale or large scale economic collapse. I'd not be waiting for either of those personally.

And exactly what was the long term impact of the 08 crash, did houses suddenly become cheap?

Probably the people who’ve taken advantage of it will disagree, but along with the other privatisations that’s been an absolute disaster IMO.with right to buy taken completely off the table

No.

We've been having this question on here for as long as I've been a member....certain posters have been predicting a huge crash is just around the corner for that entire period.

The 08 'crash' was what.....nainly people on 100%+ interest only mortgages ending up in negative equity because house prices stagnated/dipped a few %. I certainly didn't lose any money on my property during that period, neither did any of our neighbours that sold around then. That was hardly a huge crash and is probably the worst case scenario that we'll see in the next few years. A global pandemic doesn't seem to have too much of a negative impact on prices, so I'm not sure what exactly will in the next few years?

Climate crisis could shake things up. Ebola pandemic would probably cause a bit of a stir I'd imagine.

It is 100% a seller's market currently....potentially leveling off ever so slightly, but that is the market that you'd be buying in to. I'd still buy personally, but if it was somewhere that you plan to sell again in the next 2 years then I'd be a bit more cautious. Taking advantage of the current borrowing rates is definitely a consideration for you though too.

We might see house price drops in some small areas. There are moves to reduce the number of short-term lets and Air BnB properties around us. That might cause a few extra houses to appear on the market.

You can never know when the next crash will be, the only thing that is certain is that you get older and start to run out of time.

I bought my first house last year, aged 40, as I could hear the clock ticking. I managed to get it at a reasonable price - and I'd manage to put down a healthy deposit through years of saving. And I knew I didn't want to buy a flat.

So I can withstand a correction.

I spent many years just hoping for a correction, but it didn't materialise. But that's not saying it won't happen - when you get crazy activity like the last few months, it's often the sign of a market top.

No!

I can't see it happening... At least not unless the country goes properly bankrupt and then the value of your house will be the least of your worries.

We've seen time and time again governments saying 'there is no magic money tree'...

But yet there clearly is a magic money tree when it suits.

If you buy a house and then stay in it for a long time it doesn't matter if the prices go down as you won't be selling it. What caused the disaster in late 80's was interest rates of over 10%. Imagine if interest rates went to 10% now and how many people would be returning their keys and losing any equity they had in their house.

It’s very location dependent

Even within the same town.. In my locale I can get a LOT more for my money if I'm prepared to buy in one of two areas that are... How can I put this politely...

'wretched hives of scum and villainy.'

I'd rather a smaller place in a nicer neighbourhood.

Labour shortage -> wage increases -> inflation -> interest rate rise -> disaster

The UK has been a demand led market for decades and I can't see it abating any time soon. There are half the amount of houses on the market in my town than there were last year. Went to see a completely rundown one in a decent area today. It went on the market Wednesday and there have been 19 viewings so far. Everything is in high demand at the moment, which would normally push inflation up but no one can buy anything, so it's all a bit weird. Currently trying to nurse my bald rear tyre as a replacement isn't possible for a few months at least yet.

Labour shortage -> wage increases -> inflation -> interest rate rise -> disaster

would interest rate rise be such a bad thing?

would interest rate rise be such a bad thing?

Won't cause a crash, the BoE/FCA has mandated for several years that all mortgage applications are stress tested at higher interest rates specifically to prevent this scenario.

So long as there is access to cheap.credit the can will be kicked down the road.

Until someone gets cold feet and starts to realise the likelihood of it ever getting paid back is zero. See also 'sub-prime'.

In my opinion there will be a large uptick in repo's as people who are recently mortgaged to the hilt see their food/clothing/etc prices go up by 10% and the repayments are too much for them.

Even within the same town.. In my locale I can get a LOT more for my money if I’m prepared to buy in one of two areas that are… How can I put this politely…

‘wretched hives of scum and villainy.’

I’d rather a smaller place in a nicer neighbourhood.

It isn't really 'more' for your money if your quality of life isn't satisfactory. A home (as opposed to a house as investment) is more than the square footage on the floor plan.

I'm in total agreement. Even the newbuilds that aren't boxy little shacks are so close to each other that if you trip over going out of the patio doors you end up in next door's 'garden'. I suppose this is an advantage on a lot of newbuilds, though. Being built on flood plains mean packing the houses on top of each other so you can run planks from roof to roof and reach high ground. 🤷♂️

One side effect of banking laws introduced after the 2008 crash was ring fencing high street banks deposits (so the investment arm can't invest them). This has meant that a lot of high street banks are sat on billions in savings which they can't invest as they normally would; so they are flooding the mortgage market with cheap loans as it's pretty much their only way of generating a return on the money. Combine that with people saving more during CV-19 and it has created even more cheap mortgage offers...

would interest rate rise be such a bad thing?

From a moral point of view or a practical economic one?

If people are mortgated to the hilt and rates go through the roof, what do you think will happen?

If people are mortgated to the hilt and rates go through the roof, what do you think will happen?

They'd have to really rise to cause a significant increase in repossessions.

Current stress test is 3% rise combined with capped loan to income multiples.

https://www.fca.org.uk/firms/interest-rate-stress-test

What happened on 08 was more of an overstretched mortgage crash, the house prices recovered and mortgage defaulters didn't, prices dipped for how long?

Unless you change your house every other year it's not really the right question, will mortgage rates rise? maybe a more realistic one, house prices along with pretty much all prices will always go up in the long term, the rates we pay to borrow the money to buy them is the problem.

Dannyh gets it.

It's not just the mortgage rate going up it's costs in general

Right to buy was a great policy abysmally implemented. The proceeds should have all gone back into building new housing stock immediately, if done properly it could have been self sustaining, even with discounts what the properties were sold for should have been more than the cost to build a new house.

Cheap credit at ridiculous multiples of income have created this mess, a massive interest rate hike and immediate capping of what people can borrow, maybe back to 3.5 times salary are about the only way house prices will return to affordable levels. Meantime more and more wealth will be concentrated with fewer people as more are forced to rent, people with parents with property might have a chance themselves, how people without help will ever get on the ladder I have no idea. Social mobility peaked in the 80s with funded university and affordable house prices, social mobility has been going downhill ever since driven by the policies supposedly designed to increase it, student loans and loads of credit.

The proceeds should have all gone back into building new housing stock immediately, if done properly it could have been self sustaining, even with discounts

I am not sure about that. It would have slowed things down but ultimately if the state are giving things away cheap it would eventually hurt.

For the OP I am tending to go with no. It should do but we currently have our entire economic model built around propping it up so whilst said bubble would should burst everything else will be sacrificed first.

In the past idiots who over extended would have been screwed by the high interest rates but now the savers will be sacrificed to save them which becomes a vicious circle.

That and all the donations to the tories by the housebuilders to keep the shit first time buyers schemes going helps prop it up.

They’d have to really rise to cause a significant increase in repossessions.

It's not repossessions I thinking about, it's the reduction in disposable income which will reduce consumer spending which will then be another drag on the economy.

Of course we need a dramatic reorganization of the economy but that would be better done proactively whilst we still have the means to live well in a different way; rather than to try and rebuild after a catastrophic crash.

We live in strange times. Was recently listening to an economist on r4 who was arguing that everything indicates we should have much higher inflation and would be in recession, but western governments are stuck in a cycle of printing money (which is what in effect is happening), which means all bets are off

I'm not going to pretend to understand economics, but didn't interest rates reach something like 15% in the 80s? House prices were much cheaper on paper, but the cost of buying was not - unless you had cash, of course.

Those kinds of interest rates would be game over for most buyers at current prices, and with records levels of money printing, and manipulation of inflation figures, how are we to avoid inflation and rises in interest rates in future? Do the old rules no longer apply - are we living in a new economy? Or is my understanding of it completely wrong?

They’d have to really rise to cause a significant increase in repossessions.

Current stress test is 3% rise combined with capped loan to income multiples.

https://www.fca.org.uk/firms/interest-rate-stress-test/a >

‘The PRA and the FCA should ensure that mortgage lenders do not extend more than 15% of their total number of new residential mortgages at loan to income ratios at or greater than 4.5

Prior to the financial crisis in 2008 , mortgage interest rates were around 5% and the income multiple you could borrow was closer to 3.

We're still dealing with the consequences of the crisis and interest rates have been artificially low for a decade because of it.

That stress test doesn't sound like its stressing things enough to be honest.

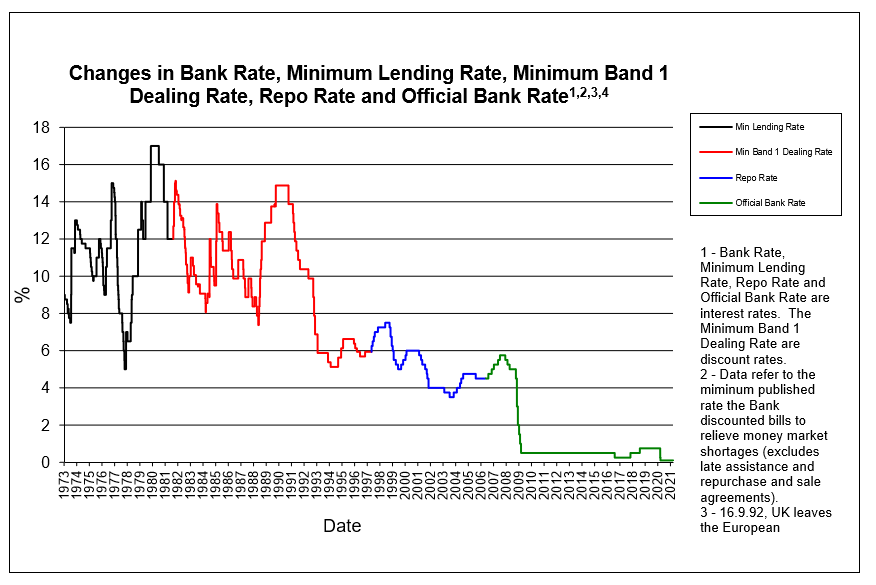

^ That chart is terrifying for somebody looking to buy a house at current prices.

Our entire economy is based on house prices not crashing, if they were to crash we would be in a huge recession with interest rates going up, jobs going down and the usual crisis’ that it would bring.

Can you explain this some more. I've heard it loads, but not the detail behind it. Note that I'm specifically interested in the causality in the direction stated. I totally get that if interest rates go up and jobs go down and we hit a huge recession then house prices crash, but I don't understand the immediate causality of the reverse as you seem to have stated it.

Is there one?

Do the old rules no longer apply – are we living in a new economy?

Gordon Brown abolished 'Boom and Bust', just before the 2008 crisis...

.

It's not called an economic cycle for nothing

^ That chart is terrifying for somebody looking to buy a house at current prices.

Care to explain for the economically challenged? Just that interest rates are likely to shoot up at some point?

Care to explain for the economically challenged? Just that interest rates are likely to shoot up at some point?

Try any mortgage calculator at 15%... You'll see your monthly repayments multiplied several times over.

A couple earning 60k can borrow around £350k

On interest only mortgage:

At 1% interest per annum thats 3,500 interest or 300 per month (ish)

At 4% interest that's 14,000 per annum or £1200 per month (ish)

At 15% it's £42,500 per annum interest or £3800 per month (ish)

Capital repayments add about £1k per month to those figures.

So basically if interest rates go back to 4-5% the mortgage repayment doubles for that couple.

Just that interest rates are likely to shoot up at some point?

Currently its hard to image in scenario where that would happen. Lots has changed over the decades the circumstances which caused previous peaks (oil crisis, ERM, etc) are all one off events from the past which aren't going to repeat themselves. However, that's not to mean that some unforeseen new event won't trigger a new rise.

Also, interest rates are set by the BoE (with permission from Parliament), so they are effectively a political instrument as much as an economic one. If you find yourselves in a situation where a rise in interest rates would cause great damage, you can choose not to increase them, assuming the penalty for not doing so isn't worse.

So, the upshot is no one has a realistic scenario which would return interest rates to double digits; but that's not to say it's never going to happen. 15/20 years ago if someone predicted a time of consistently low interest rates at around 1% or less, they've have been called mad and yet here we are....

I’m not going to pretend to understand economics, but didn’t interest rates reach something like 15% in the 80s? House prices were much cheaper on paper, but the cost of buying was not – unless you had cash, of course.

We didn't have QE in th 80s. QE holds interest rates down, when there's a risk of them rising they turn the QE taps back on. They've made a conscious decision to inflate the property market and the rest of the economy so those with property feel richer, and those without very much poorer. I'd say there's almost no chance of them reversing this policy.

I’m not going to pretend to understand economics, but didn’t interest rates reach something like 15% in the 80s?

Not for very long, the main spike was a doomed attempt to keep the £ in the ERM at a stupidly high value, the market kept saying 'no way' and the chancellor kept putting up interest rates. He failed, the £ was ejected, interest rates came back down and George Soros walked away a billionaire (betting against a fool supporting an untenable position was a pretty easy win).

The proceeds should have all gone back into building new housing stock immediately, if done properly it could have been self sustaining, even with discounts

The councils were barred from doing this by the Tory govt.

There is capacity to build more (pre Covid effect on material availability) but house sellers will only release in phases to keep prices high despite having planning consent on a vast site.

The last house price crash was c92-94 that’s when a lot of people had negative equity and repossessions were rife. We bought in 94 and saw countless repossessed houses.

In the end we bought a 3 bed semi with garage, bigger than average garden for the site and conservatory for less than the price friends paid for a 2 bed terrace with no garage 5 years previously on the same site.

My first mortgage was at 17.5%,and had to wait four months for it. The house only cost 8k though.

“ Care to explain for the economically challenged? Just that interest rates are likely to shoot up at some point?”

I think the point is that they can’t go down any more really. I don’t understand why anyone who is remortgaging isn’t locking in as long a fixed rate as they can find. Yes it might be a few fractions of a percent higher than a variable rate but I’d rather know what I’m paying for 5 years right now than have a nightmare in 2 years when my low special offer rate runs out.

I’ve just got a decent 5 year fixed and I’m going to overpay when I can so I’m in a decent position when I have to change the deal again.

There’s going to be big problems if the rate rises even a couple of percent in the next couple of years as payments will increase a lot for some people who have stretched themselves and can no longer get the affordable deals on mortgages.

I guess some people see that they might be saving a few quid compared to a long term fixed and not really looking to the future too much (which to be fair is pretty scary for some and who knows what’s going to happen in world finances in the next few years!!?!?).

We didn’t have QE in th 80s. QE holds interest rates down, when there’s a risk of them rising they turn the QE taps back on.

in my opinion that's backwards.

Interest rates rise to slow the amount people are spending (and thus drop inflation) and drop to increase the amount people are spending (and thus increase inflation)

qe invents money to buy things that otherwise funds would buy. These funds then buy other stuff, pushing more money around the economy, and driving inflation.

increasing qe has the same effect as lowering interest rates. Its been done as you can't (without difficulty) drop interest rates below zero to stimulate the economy.

It is possible to use qe to slow the economy (instead of raising interest rates) but it'd be by reversing some of the QE deals already done (ie the treasury selling gilts that they bought and destroying the money), not by turning the taps on.

There was a good article on the FT on pandemics and interest rates.

Last June, the Federal Reserve Bank of San Francisco put out a paper on “The Longer Run Economic Consequences of Pandemics”. The authors studied the rates of return on assets in the wake of 19 significant pandemics stretching back to the 14th century.

As they say, “the results are staggering, and speak of the disproportionate effects on the labour force relative to land (and later capital) that pandemics have had throughout the centuries”.

Not good news for rich people, but “following a pandemic, the natural rate of interest declines for decades, reaching a nadir about 20 years later, with the natural rate about 150bp [1.5 percentage points] lower had the pandemic not taken place”.

That “natural rate” has also shown a secular decline over the centuries, from about 10 per cent in medieval times, to 5 per cent at the start of the industrial revolution in the west, to near 0 per cent today.

In other words, you will really earn nothing on your money now after correcting for inflation and speculative excess. And then some of the profitless pile that remains will be taken away.

Even though both wars and pandemics cut short huge numbers of lives, the SF Fed study says: “The effect of war goes the other way: wars tend to leave real interest rates elevated for 30-40 years, and in an economically and statistically significant way.”

When you think about it, this sustained pattern makes sense. Wars destroy property and disperse money, while pandemics kill people and leave structures intact, like neutron bombs. So plagues lead to fewer people relative to land and cash, which should lead to wages going up relative to rents and interest rates.

https://www.ft.com/content/7cbbcf95-da03-44d4-b63c-bb4c82b70add

There’s going to be big problems if the rate rises even a couple of percent...

This is what I don't understand. People keep saying it's not going to happen. And maybe it won't... But as a lay person just trying to make sense of it, my concern is that current low rates are the exception rather than the norm, and anybody taking out a mortgage to be repaid over the next 20 or 30 years, or more, is relying on those rates to hold for the entire duration. To the untrained eye, looking at charts like the one posted above, the probability of that happening seems incredibly low.

I'd love to know why that's not the case because I'd quite like to put my mind at ease.

There’s going to be big problems if the rate rises even a couple of percent…

This is what I don’t understand.

Neither do I. All mortgage applications for the best part of 10 years have been stress tested at 3% above current rates, so a 2% rise won't lead to a significant rise in mortgage defaults.

I’d love to know why that’s not the case because I’d quite like to put my mind at ease.

If you going to worry about something over the next 20-30 years, climate change would be a far more worthy subject!

But as a lay person just trying to make sense of it, my concern is that current low rates are the exception rather than the norm

Some people are saying they won't go up, but they are thinking of the 15% we had in the 80s. That's unlikely because that was a specific situation which won't really apply in the next few decades. Also, it's politically nearly impossible to raise rates that high since the fallout would be terrible and people remember what happened last time.

Also, now we are in the business of printing money to keep inflation low.

I'm trying to figure out if deflation is a risk for the UK in the next few decades.

Neither do I. All mortgage applications for the best part of 10 years have been stress tested at 3% above current rates, so a 2% rise won’t lead to a significant rise in mortgage defaults.

You say that but beyond the first application I did.... They did not seem to give two hoots about my current situation.

Just that I had a job and had not missed payments.

That is I've never had to send bank statements or payslips.

They would have no idea what my situation is.

So maybe your bank's more responsible than mine....but don't be fooled into thinking all are

So maybe your bank’s more responsible than mine….but don’t be fooled into thinking all are

Last time I applied was >20 years ago and paid mine off >10 years ago....

Ok so your applying what the media tells you to the real world and believing that's how it actually works.

molgrips

Full MemberAlso, now we are in the business of printing money to keep inflation low.

Eh, printing money drives inflation, it doesn't keep it low.

(according to traditional economics anyway. In reality we've been printing mountains of money since the last crash and the inflation that everyone says is inevitable still hasn't arrived)

But printing money just devalues the currency over the long term.

Was there not an African country or some Eastern blok country where people were paying for loafs of bread with carrier bags full of bank notes?

Imagine having a vending machine selling cans of coke, but the price is wired directly to the value of the currency in real time .. And you physically cannot put coins into it fast enough to ever pay for a can of coke.

Ok so your applying what the media tells you to the real world and believing that’s how it actually works.

To be fair those were exactly the hoops I had to jump through when we remortgaged. Did involve a change of banks though.

Was there not an African country or some Eastern blok country where people were paying for loafs of bread with carrier bags full of bank notes?

Weimar Republic (interwar Germany) or possibly Zimbabwe.

Also, now we are in the business of printing money to keep inflation low.

Eh, printing money drives inflation, it doesn’t keep it low.

Sorry typo, I mean printing money to keep rates low.

To be fair those were exactly the hoops I had to jump through when we remortgaged. Did involve a change of banks though.

Indeed but not all banks are equal was my.point.

There has always been a way to get a mortgage and I guess there will remain

Ok so your applying what the media tells you to the real world and believing that’s how it actually works.

No, I was reading the rules from the FCA website.

https://www.fca.org.uk/firms/interest-rate-stress-testAnd just because your mortgage application didn't appear to follow them doesn't mean they aren't generally applied. Given that the FCA can revoke permission for a bank / BS to offer mortgages you would expect compliance to be good. I'm pretty sure banks etc are obliged to report salary multiple stats to the FCA.

And on a more general note, if you don't believe the media (at least the main stream sources) you're on a pathway to Q-Anon, Covid hoax etc. For all the faults in the UK, we have pretty decent media / news coverage (front pages of tabloids being the exception).

Well I guess time will tell.

As Danny pointed out the rate is a small part of the equation.

You might find it surprising that it's not just STW pondering such 'what ifs'. The BoE has a whole team of people collecting data and running models looking at such things. From which they adjust the lending rules etc to try to steer the economy away from any rocks. The great thing is, it's all released on their website every quarter.

https://www.bankofengland.co.uk/quarterly-bulletin/quarterly-bulletins

So you can see their modelling, assumptions etc.

Is it guaranteed to avoid a future recession, of course not, there are always unknown events which will occur and knock the economy off track; but most of the obvious ones are regularly wargamed.

E.g. they regularly stress test banks to see if they could cope with 15% unemployment, 10% mortgage default rate and interest rates at xx%; and those that fail the test have to hold more cash in their rainy day funds.

Sorry typo, I mean printing money to keep rates low.

That is incorrect too. We are printing money to avoid lowering rates any further

The BoE has a whole team of people collecting data and running models looking at such things. From which they adjust the lending rules etc to try to steer the economy away from any rocks.

Indeed, but they don't make the decisions, or are even listened to much on things that affect the economy, for example BoE was dubious about brexit and...they did it anyway, who needs experts?

In broad terms the biggest economic factor in any country is what the government does, loosing control of GDP would surely be the first indicator?

This is a very hot topic on here at the moment. It sounds like the OP wants to know if it’s better to buy now or wait and take advantage of a price crash. My friend is in the same boat and asked for my view. I’m not an analyst but work with a team who analyse property data. You can’t predict the future but you can make a judgement based on the data. So, whilst the stamp duty holiday partially caused higher prices, it was more likely to do with the pent-up demand from prior years once Boris was elected where we had more government stability than we did in the past – with small majorities / Brexit and the like. To illustrate this, the market bounce back was very strong (even before the chancellor put in place the stamp duty holiday) and actually Scotland’s demand is still high now, yet their tax holiday ended back in March.

Add the pandemic, which meant that people were not spending money – saving sums rapidly and therefore wanting to spend it. There is an underlying demand which is exceptionally strong. Demand is still outstripping supply. This only means one thing – increase in prices.

Next year will likely be more modest growth but there will be growth, unless its property in the £1.5m+ price range, which will start to fall and distort the overall figures.

We had a big uplift in million pound homes this year (as price rises tipped them over), so if you are buying under £1.5m, that’ll be me by some way, buy as soon as you can because prices will rise further, no?

I said this in other threads - we need 2 million new homes in the UK and the housebuilders are only doing 150k a year at the minute, or thereabouts.

Indeed, but they don’t make the decisions, or are even listened to much on things that affect the economy, for example BoE was dubious about brexit and…they did it anyway, who needs experts?

Well the BoE didn't do Brexit, the Government did. In terms of financial stability they do control who can lend how much to whom on what terms and they can rein banks in with cyclic stability buffers etc, so they have quite a few levers to pull. But, obviously is the government decides to declare war on China, for example, they don't have the necessary levers to insulate us from the knock on effects.

(according to traditional economics anyway. In reality we’ve been printing mountains of money since the last crash and the inflation that everyone says is inevitable still hasn’t arrived)

This is dead wrong, sorry. Sure - the flawed RPI/CPI measures of inflation aren't reflecting it - but look at asset prices, including the subject of this thread - property.

but look at asset prices, including the subject of this thread

This isn't an accident, it's policy. Successive governments (including labour) abandoned their traditional role of enabling an economy which provides well paid jobs in favour of an economy which provides cheap and highly available credit. The key to this is holding down interest rates no matter what. It nearly imploded in 2008 until they figured out they could sustain a low (consumer) inflation/low interest rate economy with QE. The trade off is massive inflation in assets (shares as well as property), which makes voters who already hold them richer, and anyone who doesn't much poorer. Like most bubbles it will burst eventually but not until they've done everything possible to sustain it. The real scandal of this policy is that the money printing benefits those who are already rich, rather than those who need it.