![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

Aye well johndoh you do never know. No one ever tells the whole story .

Learnt that lesson along time ago when my mate always had the best of toys.....When I was old enough I understood why. His parents had split and dad was trying to buy his love. He said he always looked in at my mum and dad and wished he had the family rather than the toys.

Look after you and yours and don't worry about the others. They wouldn't worry about you. There's usually always another side to every story.

Look after you and yours and don't worry about the others.

To be honest I try not to, but my wife comes home from school drop off quite regularly saying 'x is doing y' and it makes me feel like I am not able to provide for my family in the same way others seem to be able to do.

Everyones situation is different, i thought i had missed the boat through variable earnings (self employed) and being single or in relationships that didn’t last long enough to settle. i’m mid 40’s and only bought 2 years ago having been shafted by my bank (having 80k in savings with them but them not lending me a penny for a mortgage)

switched banks and i had to wait another year to buy thus paying more. bought a small flat in SE19 (good area, good street, cheapest property) and had to put down 65k as there was no way i could get a low LTV mortgage being self employed.

now 2 years later its gone up 120k and i’m in a stable relationship and between us we are sitting on 850k of property that we probably owe 360k on. its nuts when i think about it.

but i still think younger people can do it if you put your mind to it and don’t expect to be going out every night and having the latest gadgets etc. i did it with zero help from M&D.

i am surprised how little property has increased in some of the shires mentioned in this thread, i guess this is low wages that a keeping laid on things.

Cougar - Moderator

[i]What if you don't both earn 20k? What if you're single?

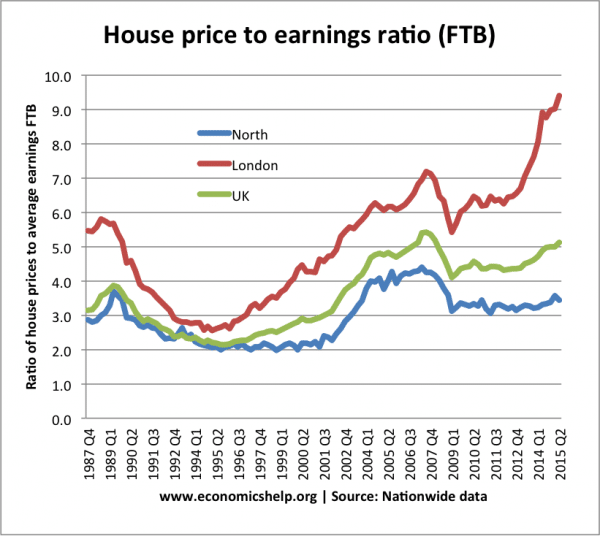

What if you're married with a partner who can't work, 2.4 kids and a spaniel?[/i]That's the point I was alluding to (badly). Time was, one salary could raise a family. Now we've got a situation where both adults have to work in order to keep a roof over their heads whilst maintaining a half decent standard of living.

That's precisely the aspect which Stoner's link is missing. The socioeconomic landscape has changed dramatically in the past 30 years. Not all families are geographically close anymore, childcare is common (and very expensive) both parents are likely to work full time.

Also, household income doesn't tell the whole truth. Earning £60k, you may have been to Uni and thus have loans which reduce your income by over £300pcm, childcare can cost over £1000, utilities are more expensive. the amount you have available for a mortgage (as decided by the bank) will be substantially lower than your 3* combined income.

Just how much income is required to buy a 3 bed house in an okay area in Bristol? You'd need to be earning over £80k, have no dependants, no debt and no life. Rent in Bristol can easily top £1000 for 2, add in utilities, consumables, transport and insurance and you're over £2500 per month. at £80 you'd be paying over £430 in student loans. You're left with £1000 per month before you've bought anything or done anything. lets assume you can save 85%. it'd be 3 years before you have a deposit...what happens if you're 30 and are thinking of starting a family? Do you wait? My £380k house has gone up by over £60k in 2 years, so the house you were aiming for, saving for, is now out of reach...If you have kids, your £1000 per month that you were saving isn't going to be there for long...

interest only mortgage makes sense if it is far cheaper than renting and you are investing the extra elsewhere for greater return

That's what I did and borrowed as much as I could starting from 1996 which seemed to me to be a good time to buy as were starting to recover from the nightmare of the late 80s/early 90s. Worked out rather well for me, I took risks but mitigated to a degree by having lodgers.

Yup! I really don't know how, but we do spend quite a lot on clubs etc for our children which really adds up – singing clubs, gymnastics, horse riding, music lessons etc – I guess we are investing in their wellbeing.

Not easy the pursuit of "upper middle class" ....

we are sitting on 850k of property that we probably owe 360k on. its nuts when i think about it.

It's nuts at a casual glance, TBH. (-:

The wife and I are currently saving like mad to get on the ladder, I'm 27 she's 2 years my junior, combined income of 55k ish, been renting for 4 years and recently got married so that blew our deposit, so started from zero again this new year. Looking around the 200k price for 3 bed place, around north Norfolk, we are putting away a large amount of cash in savings and we estimate it will take 2 years for the deposit alone.

We are told there are not enough new houses being built, but also that there are lots of empty houses, but perhaps not in the right places, and there seems little central will to alter things to push industry and tech start-ups to base themselves in lower cost areas. But the Market really is not going to sort this out.

I've often seen it quoted that there's over a million houses empty across the whole country, and certainly there seem to me lots of empty space above shops in many towns, space that's otherwise used as a junk store. Trouble is most of the property owners quote security as the biggest impediment to letting out those spaces; surely though having people living above the shop and others in the area keep it alive and add to security, being able to react quickly to unusual noises or activity at night or weekends.

European cities apparently have a much higher density of occupation within the main shopping areas, this has to be the answer for our cities and towns.

Why the **** did you blow it on a wedding? Serious question

All I know is that house prices are rising faster then I can get a deposit together and have been for the last decade for me.

I know we had the crash that dented prices but it also reduced the amount of money I could borrow so a house was out of reach. Doesn't help that I've been trying to get on the ladder as a single bloke earning £30k a year while based in South Wales. I could afford a place in Mid Wales, out in the sticks somewhere but then there's no work for me to do to pay for it!

I worked out various permutations with my dad (lifelong accountant so good with figures) last autumn and I've never been more than 70% there towards buying something, currently around 40% of the way. The 70% point was just before the crash, the bank then tightened the rules and I was back down to 30%. That affordability stress test hammers you if you're on one income. I won't buy a flat as it would be too expensive when you take into account the money you have to pay to management companies on top of your mortgage, a few people in work have been badly burned by that. We both came to the conclusion that I would have to wait for him and mum to pop it before I could afford something.

I have a friend who's currently looking to buy a house, nowhere near the South East, but a reasonably nice, rural area, lots of retirees, sod all modern amenities, crap broadband etc.

They're mid thirties, earn around £23k, have a deposit of £40k(ish), and really struggling to get a mortgage on pretty much anything over £150k, which doesn't get you much round here.

sort of bloke that goes round turning off all the light switches?Why the **** did you blow it on a wedding? Serious question

1 because we could afford to 2 because we wanted to

The only reason I was able to buy a house was that just before the crash the builders were giving away free deposits. Don't particularly like the house or the area (although neither are bad) but I'm very glad I did. We now have equity and everything.

Bring on the 50 year mortgage. That'll make things more affordable.

I remember my younger brother asking me to go in with him on a mortgage for a house in Bucks. Working and renting at the time - mid 90's - I baulked at the idea of spending a fair percentage of my beer & bird money on a house. What a moron. As mentioned earlier, Aylesbury had a significant increase in average house price over the years and could've netted me a tidy deposit on my family home. I grew up there but not a fan of the town versus the rest of Bucks and nearby Bedfordshire, and am often surprised that the prices have grown in-line if not more than other nicer areas.

I'm 40, and had it not been for the good lady her in doors and her motivation and drive to get our own home, I'd still be giving someone £900 a month 8yrs on.

It is doable, getting on the ladder in higher prices areas, but it takes effort and a bit of sacrifice.

Our neighbours rented their property a year ago, for reasons unknown, and the rent is £1200 a month. The young family that rent it must know that if they could get a mortgage, it's likely to be cheaper pcm.

London prices are starting to slow as demand lessons following people moving to Home Counties/Surrey/Kent etc., seeking more value for money. This is having a knock on effect on housing out this way. Great for me as my house has gained £100k plus the tiny amount I've paid off, but bad for as my next step would about £200k more - I could probably afford to move into London in 5yrs time at this rate 😉

Bought our first place in 2000 from my wife grand mother .

and then with a lot of help from family and hard work , we now have a 4 bed semi in north kent with a very affordable mortgage .

next month we are moving to France to a mortgage free house . we are keeping the uk one and going to rent it .

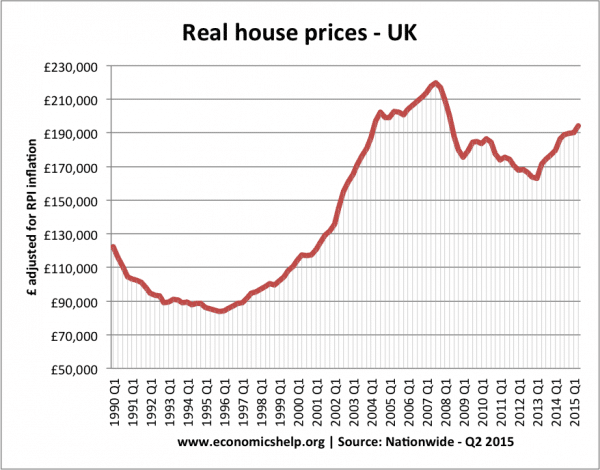

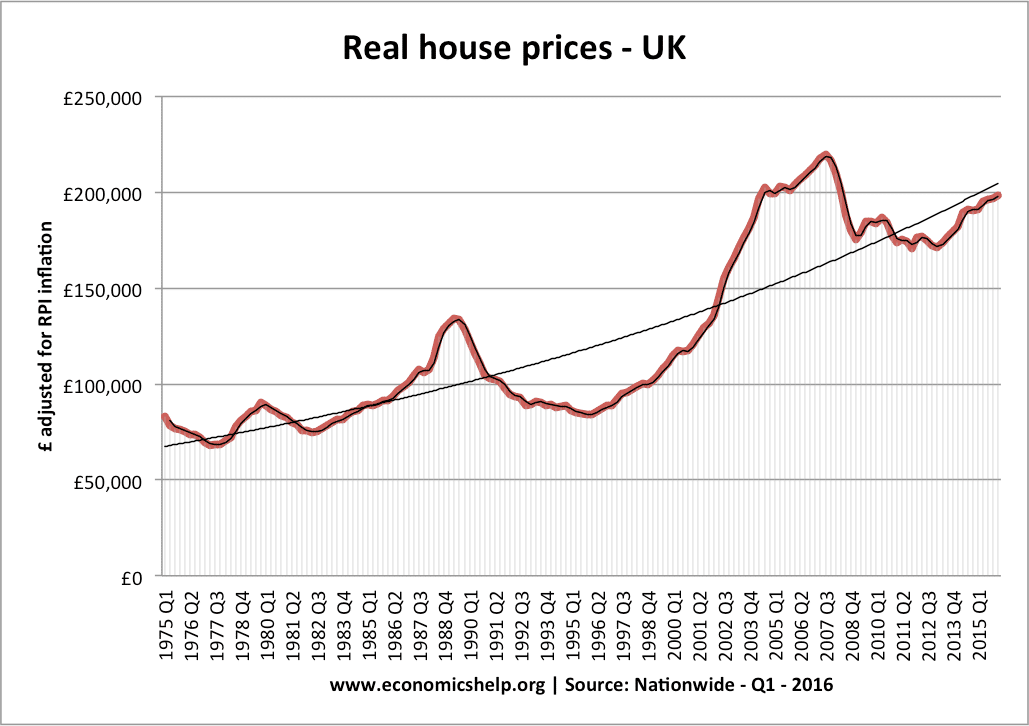

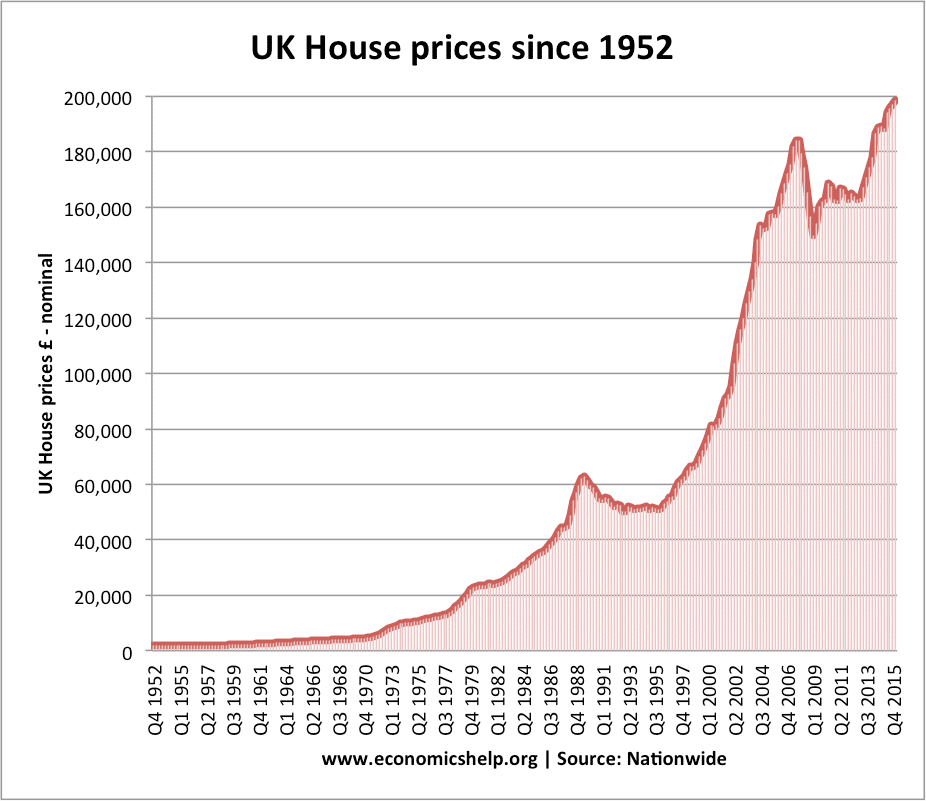

Housing will straighten itself out eventually - just read up on the psychology of speculative bubbles. We're on historic highs of prices and price to wage ratios only manageable because of historically low interest rates. It's not sustainable - we're talking election-losing situation here, affordable housing's essential to a working economy, it's not a speculative commodity like tulip bulbs.

All this 'supply and demand' guff is just that - the hyper inflation we've seen in London/SE the last few years has been billions of foreign money pouring in to prime central London (much of it being laundered) and the locals borrowing themselves to an early grave to try and keep up. 10% a year on house prices when wages are flat is almost entirely excess supply of money into a tight market, not 'demand'. BTL doesn't help as it just pushes up prices and takes supply out of the market (as well as increasing the risk of a bust when prices fall)

Osborne massively screwed up with HTB - and once he realised this he was too late with his stamp duty, killing BTL and other limits to the flood of cash, hence London is now unaffordable and the bubble's pushed out to the wider SE and even Bristol, Milton Keynes etc - the Tories need mass home ownership if they want to stay in power and the trend's in the wrong direction for them now.

As mentioned above - the banks are in a better position now to allow a fall, they were stress tested to a 35% crash - although in London that would only take us back to where prices were 3-4 years ago... Prime London's 12% down YOY so it could have started already.

Those on the 'winning' side are being duped into thinking they're rich whilst those of us who're not are either facing retirement in poverty, paying rent out of our pensions or massive debt to pay a mortgage and lower living standards for life - it's very divisive and massively reducing the amount of cash people have to spend in the real economy, providing jobs and wider economic activity.

London's losing out too - a lot of people leaving - even employers are complaining they can't afford to pay people what they need to live there - and knackering the most economically productive part of the UK isn't sensible. My cycling club's beginning to lose members too - it's impacting communities as well.

2017 will be interesting - Chinese money is slowing up, foreign buyers are renting to avoid stamp duty, 30 somethings are leaving London, Foxtons shares are dying fast (400p in 2014 to less than 100p now), BTLers are selling up before tax rules change in April, thousands of overpriced luxury flats coming onto the market and not selling, consumer confidence falling and the risk of the City losing its status because of Brexit...

The attitudes of the 'haves' is pretty unpleasant to watch as they blame the younger generation for 'spending all your money on phones' and totally ignore the fact its the actions of government, BoE, banks, builders, councils and existing homeowners that have created the crisis.

Sadly, the badly needed correction will do huge amount of damage to those who've failed to save or build a pension pot, assuming they could cash in their equity at a time of their choosing...

we are keeping the uk one and going to rent it .

And there you have one of the causes of the crisis. You know we have a major housing crisis in the UK - why don't you sell it to someone who wants somewhere secure to bring their kids up?

[img]  [/img]

[/img]

[img]  [/img]

[/img]

My opinions...

It comes down to a few factors

The end of jobs for life, mobility is a much bigger thing these days, as somebody posted above you can't always get a job and be able to live at home for x years.

From 97 things started to rise, that was the boom that lifted so many but in the end snapped. As another posted last of the 100/110% mortgages.

Sometime around 08 a straight faced IFA said the best course of action would be to take the highest LTV mortgage available on interest only as within 2 years the property would have grown enough in value to get a 25% deposit out of the equity..... There was some seriously bad advice going on that was all based on a rising market.

The other stuff - millenials splashing the cash on fancy food etc.

A lot of the people posting will have had a free education, grants at uni and much more. Average debt for a student leaving uni is huge these days which isn't going to help anyone. In plenty of cases ideal first homes will be subject to stamp duty and more.

The money that you "make" in the property market pyramid scheme (becasue it currently is one) is only released when you downsize at the end. In order for that to happen you need people moving up the ladder or at least getting onto it.

For this good jobs and affordable housing need to be closer together, mobility needs to be addessed (one of the factors leading to a lot of single property landlords) and a few more things.

It comes down to a national need/strategy really where planning, transport, regulation, banking and many other things need to be aligned in order to make a future where the split is healed.

why don't you sell it to someone who wants somewhere secure to bring their kids up?

Why should they? Maybe it's to be sold when juniors need a deposit? Or for care in old/age pension (not everyone has a conventional pension(I don't)) or maybe they just don't want to convert a fixed asset into cash.

Agree with this, I'm 36 and amongst friends it depends on whether life circumstances (e.g. met partner) were right round about 2001

Same here, I'm 5 years older than you but was the last to settle down, everyone found someone in the early naughties and hasn't moved since, I the few 3 or 4 extra years it took me to settle down was the difference between near the bottom and near the top of the boom. Consequently my mortgage is twice than any of there's despite living in a smaller house there's. And yet I'm lucky, my parents lent me the deposit and I paid it back within 2 years due to house price rises. I genuinely feel for those under 30, they have a rubbish deal and I'm not sure what's going to change that.

Yeah, Oxfords actually harder to find a nice place for semi sane money than Zone 1 in London.

I genuinely feel for those under 30, they have a rubbish deal and I'm not sure what's going to change that.

Move somewhere/invest in property somewhere with high growth and cheap houses - eg Asia.

Why should they?

Because - the wider community and economy can't afford it.

1. High housing costs killing the real economy

2. High debts reducing living standards

3. Forcing younger generation into lifetime of debt

4. Increasing homelessness

5. Couples not having families because they can't afford property big enough for kids, or having kids late and suffering the complications...

6. Massively long commutes from living miles from work = less sleep, more stress and depression, lower productivity

7. Both parents being forced to work and not being able to have one parent at home looking after the kids

8. Mental health issues in the young on the increase

9. Increased inequality

10. Setting ourselves up for another massive debt-driven bust when we're still on our knees from the last one.

11. Communities being torn apart as people have to leave where they live to go somewhere more affordable

12. London/SE struggling to find teachers/police etc as no-one on those wages can live there anymore

... need I go on? There's more than your own pension provision/family needs at stake here, or does wider society just not matter in the UK now?

5. Couples not having families because they can't afford property big enough for kids, or having kids late and suffering the complications...

That is a drain on the economy in of itself...as it's uncontrolled population decline, instead of sustainable decline that allows us to look after the old without resorting to ridiculously high tax rates.

10. Setting ourselves up for another massive debt-driven bust when we're still on our knees from the last one.

As the pressure and advice from our betters is that Property is a great investment etc. buy buy buy in damm you. Spend nothing and live on own brand beans for 5 years to get the chance to try and buy somewhere that isn't going to end.

Anyway just wait till the crop of shoddy pre fabs etc. are in a state where they are not worth buying that will be the next shock to the system.

a couple of points that don't always seem to get mentioned - most under 30's these days are still paying student loans and anyone under 24 now is likely to be paying that 9% until they're 51 (i know i keep banging on about this but still) - it makes it that much harder.

and 2 - the high interest rates of the 80's. The flipside was that debts inflated away pretty quick. My folks bought a house in 1980 for £10K, or about 3 years of dad's wage. Soon there was a period where the mortgage payments were about 100% of his take home - scary times - but they held it down and in a few years the balance on the mortgage was a few months of his wage, the house was worth 30K, and the mortgage payments were sod all, relatively speaking.

So on one hand the people buying houses now (hello) benefit from low interest rates, but on the other hand, zero inflation means that the mortgage payments will still be significant 10 years down the line.

or does wider society just not matter in the UK now?

It does, but why should those that saved and worked hard have a mass sell-off of assets to flood the market and suit those waiting in the wings?

The current owners could be seen as victims too.

Change will have to come from policy and the current government isn't going solve the problem.

I'll not want to sell my flat when I move in with the other half as we will want to use it for our retirement plus I don't want the cash liquidating it would release right now. What would you do? Have 160k in the bank earning 1% or somebody paying your mortgage off plus £300 a month? I never wanted to become a landlord, I'm not interested in having a BTL empire, I just don't want to sell my flat.

STU170 I do go round switching the lights off, I also have a house that's paid for and my two eldest in their mid 20s also have their own houses (with mortgages obviously) - incidentally neither have needed help from me (they saved up) - I suppose my approach would be to buy a house then save for a wedding - call me old fashioned... anyway off to turn some lights off.

MrSmith - MemberIt does, but why should those that saved and worked hard have a mass sell-off of assets to flood the market and suit those waiting in the wings?

Because those waiting in the wings are also saving and working hard. In many cases, harder. And while current homeowners have earned their homes, what they haven't earned is the huge price rises.

When you stop and think about it for a moment, the entire concept of property as an asset appreciating faster than inflation and wages is fundamentally unsustainable. The only question is how and when it stops.

It does, but why should those that saved and worked hard have a mass sell-off of assets to flood the market and suit those waiting in the wings?

If the public benefit outweighs individual benefit, yes. Besides, unless they are investment properties, most peoples house prices will devalue at the same rate as everyone elses - your purchasing power stays the same. There would just have to be a plan and a budget put in place for those who's hourse prices dip below what they have left to pay on their mortgage.

My first house in 1986 was £33k ish I needed a 10% deposit (about eight months wages) interest rates were 10% and my tax allowance was about £600 a year - take home pay was about £100 quid a week. Hardly a doodle then interest rose to 12% , I think I payed about half my wages in mortgage.

incidentally neither have needed help from me (they saved up)

How did they pay their rent while they were saving? Genuinely interested.

By sharing houses and living frugally and working their backsides off in good jobs

And always having part time jobs at uni

I'll not want to sell my flat when I move in with the other half as we will want to use it for our retirement plus I don't want the cash liquidating it would release right now. What would you do? Have 160k in the bank earning 1% or somebody paying your mortgage off plus £300 a month? I never wanted to become a landlord, I'm not interested in having a BTL empire, I just don't want to sell my flat.

And here is the problem, their is both nothing to make you or incentivise you to. My mum still has my grandmothers house rented out as it was a better way to handle it when she died, it's money that is sat there now worth 5x what she paid for it.

The government up until this point have done the safe thing as the cost of a price correction was considered too much politically. What comes next is anybodies guess but will depend which voters are needing to be pleased. (removing tax savings from ivestment property wold be an interesting tool)

What would you do? Have 160k in the bank earning 1% or somebody paying your mortgage off plus £300 a month?

LOL 1% a month in a bank, those kinds of banks are for the clueless. You can invest with pretty low risk and make 5 percent average yearly returns. Top investment managers will net you 15 percent average yearly returns - there is absolutely no need to hog houses to make good money.

**** me, I'd be laughing if I had 160k to put in a fund.

By sharing houses and living frugally and working their backsides off in good jobs

Fair enough. Respect to them.

Even the shared house market is stupid these days. I don't know what's changed but you used to be able to just rent a family house for say £500 and have a few of you living there and just split the rent. Now it's like the landlords have worked out that 3x bedrooms, plus living room (extra bedroom), plus cellar (bedroom), plus space under the stairs (single bedroom) = 6 rooms. 5 couples plus one single = 11 tenants x maximum housing benefit = 1 BILLION DOLLARS

When you stop and think about it for a moment, the entire concept of property as an asset appreciating faster than inflation and wages is fundamentally unsustainable. The only question is how and when it stops.

I'm fully aware of the house price crash graph, I have posted it here often enough! And if/when it comes I'm reasonably protected with 50% LTV and low income multiple. It's those sailing close to the wind leveraged to the max who might get a kick in the nuts. I just wanted a small 1 bed flat to own that was cheaper to buy not rent just like lots of other people.

brooess - Member

we are keeping the uk one and going to rent it .

And there you have one of the causes of the crisis. You know we have a major housing crisis in the UK - why don't you sell it to someone who wants somewhere secure to bring their kids up?

I don't think it's fair to single him out on this. The 'wider society' doesn't mean anything as far as I can see. People might pretend it does, but like recycling - it's just virtue-signalling. They'd probably burn it if no one was looking.

Everyone seems to be out for themselves, and I'm sure it's not just the UK either. Even people I love and respect can come across like Victorian mill owners when they start rubbing their hands together at the prospect of making money out of property.

I don't think it's fair to single him out on this. The 'wider society' doesn't mean anything as far as I can see. People might pretend it does, but like recycling - it's just virtue-signalling. They'd probably burn it if no one was looking.

Individuals are what make a society, if individuals don't change then society needs to force the change.

As for the phrase of the moment it seems to get heavily overused to denegrate people who are trying to do the right thing. Personally I recycle because it's not only the right thing to do but it makes a huge amount of sense when you consider resoures and landfill.

Then the final thing that will encourage behavioural changes is taxation, the tool for people to stubborn to change.

LOL 1% a month in a bank, those kinds of banks are for the clueless.

I assume you aren't thinking straight.

You can invest with pretty low risk and make 5 percent average yearly returns. Top investment managers will net you 15 percent average yearly returns

Only if you manage to pick the best ones each year, no-one can sustain that - where are you putting you're money now so I can check on your progress. 2016 was very good of course due to the fall in the pound - anyone who doesn't hold equity investments really missed out there.

no-one can sustain that - where are you putting you're money now so I can check on your progress.

Sure you'll make losses some years and admittedly 15 percent is really pushing it - but even the modest gains aren't to be sniffed at.

It's all about the long term...and given the housing bubble and how politically exposed that market is...I'd be steering my money away from property investment...unless I was interested in quick cash.

But I guess that could be my pessimism talking - that and I don't see why it's socially acceptable to **** the housing market in the sake of a bit more return, in comparison to investing in the markets which I find a whole lot less offensive - at least that money is helping to drive the economy and not the macro economic equivalent of a big fat leech.

I choose not to own a property to rent out as far too much effort involved and I have a decent chunk of capital in my own house, so yes I've put my money on the stock market and done well enough over the last 20 years. A bit wary of how things will go now but I've stuck with it through the bad times unlike some who get scared off then miss out on the recovery - such as the last 12 months when FTSE went up 27.5%.

Precisely, my wife tells me her colleagues get a little irritated by the people who ring up every week/month to ask why they've lot .0X percent - when you should be thinking long term.

such as the last 12 months when FTSE went up 27.5%.

Yeah, if you stick around you can make a good bit of money. As long as you have a set amount that you are willing to lose to make long term gain, then you can just sell off any rare gains like that, leaving in what you would have had - had that gain not occurred and thus play safe with your profits - not get too greedy and have a tidy little amount for a holiday or a new bike.

But most of it's over my head, I'm a biologist, I try to show some interest in her line of work - but I mostly zone out.

at least that money is helping to drive the economy and not the macro economic equivalent of a big fat leech.

😆

I don't see how it's funny to be honest, the increasing amount of renters will lead to spiking social care costs as people will have less capital in property to pay for their ridiculously long lives. What are we going to do with 115 year old renters in 2055?

Where as investing in the right markets drives growth and innovation....

If we want to move to an economy that can cope with automation over the next 25-30 years, where creativity, entrepreneurship and cottage industries are fostered - then surely we need a population that feels stable enough to take these risks - and that means still being able to keep a roof over your head if things go tits up. That requires a much higher supply of houses to achieve.

Yeah I agree. It was the way you put it 😀

then surely we need a population that feels stable enough to take these risks - and that means still being able to keep a roof over your head if things go tits up.

Indeed.

The conspiracy theorist in me sometimes thinks that this whole situation has been engineered to keep the young docile and diverted... No more rave-scenes etc - everyone's saving for a deposit.

Hah yeah....I dislike it when people accuse the bankers of being the leeches....it's all the ****ing bottom feeders that would trample over their 90 year old grandmother to not lose 5 percent on their homes, that are.

The conspiracy theorist in me sometimes thinks that this whole situation has been engineered to keep the young docile and diverted... No more rave-scenes etc - everyone's saving for a deposit.

The optimist in me hopes that the tech industries notice and pressure for change, the executives in these newer companies seem more liberal and will hopefully see the value of a more "playful" society.

Correct again.

The conspiracy theorist in me sometimes thinks that this whole situation has been engineered to keep the young docile and diverted... No more rave-scenes etc - everyone's saving for a deposit.

Where as what transpires is an ah F it approach where the chance of affording a house steadlily declines to the point your too old to get a mortgage 😉 Leading to people enjoying what they can at the time and not worrying about the future. Plan A might be just to encourage some of you oldies to shuffle off, watch out for the euthenasia bills coming

[img]

[/img]

[/img]

I wonder if chris2lou might ever want to come back perhaps that's why he keeps his house in the UK.have you ever tried to reach enter the UK property market after living almost anywhere else on the planet where houses cost less and are growth is less each year

Maybe I should sell up since I live in my second home half the year (I work in Angola)

Nah don't think so.

I see why Chris has kept his house and if you can't see that then your more blinkered than I thought.

Oh and what mikewsmith says about current cardboard box housing not last time is true. My dad's done stints as a project management contractor for most of the big Scottish builders -and been escorted off a few for refusing to sign off on shoddy buildings..... They are built to last the 10year guarantee and not alot more.

There are some builders building properly but they are generally more expensive how ever all that means is that the shoddy lot put their prices up. It's very hard to tell who's building a decent house and who's out to extract the urine massively.

and that means still being able to keep a roof over your head if things go tits up

Now there's an idea 🙄

I think another change is that my grandparents didn't live as long after retirement than people do now. That means a healthy estate to pass down to my parents. My parents will then have a much more comfortable retirement than I might as they will probably live a lot longer, using their estate to pay for caring needs. I'm not expecting to get the windfall my parents did.

we are keeping the uk one and going to rent it .

And there you have one of the causes of the crisis. You know we have a major housing crisis in the UK - why don't you sell it to someone who wants somewhere secure to bring their kids up?

Stamp Duty is a real dissinsentive to selling up, you don't get the money back when you sell, so you may as well keep the property and sweat the asset. If they refunded stamp Duty when you sold, that might encourage people to sell up.

Every time this thread (or a variant of it) pops I double check rightmove.com to make sure that you can still buy a flat in my town for less than the list price of a Ford Focus.

Checks........Yep.......One bedroom Flat for sale within a mile of my house for £17,000.

Three minute walk to the train station, less than an hour's commute to either Glasgow or Edinburgh.

I've been waiting for this "Bubble" for twenty odd years. It hasn't arrived yet.

Three minute walk to the train station, less than an hour's commute to either Glasgow or Edinburgh.

By less than an hour do you mean 59 mins to the central station, then a walk from there?

So 3hrs a day commute to decent jobs?

By less than an hour do you mean 59 mins to the central station, then a walk from there?

So 3hrs a day commute to decent jobs?

No, I mean that I can drive my car ( which potentially could cost more than my house) to pretty much anywhere in the Central Belt of Scotland and arrive at my destination within an hour or less.

If I was getting the train to the City centres It takes about 35 mins either direction to city centre stations.

Commuting times hare are considerably less than I've heard reported in most other major UK cities.

Not bad, so why the depressed house prices? It's a rarity try looking in a few other places

Not bad, so why the depressed house prices?

Seems odd to outsiders that all the residents are related 🙄

Not bad, so why the depressed house prices?

There are some proper shitholes between Glasgow and Edinburgh, so might be one of those.

It does, but why should those that saved and worked hard have a mass sell-off of assets to flood the market and suit those waiting in the wings?

I think these vast windfalls are already bookmarked to pay for nursing homes and NHS geriatric care (if and when the politicians get their heads out of the sand).

It's a rarity try looking in a few other places

It's because the town is, in the main, a post industrial shithole.

It is however, MY Shithole as I was born and brought up there.

But, then again it's still considerably less grim than most commuter towns that I've visited anywhere else in the UK.

I can ride out of my door and 10 minutes later I can be in the Clyde Valley paddling in the river.

I live in a detached Victorian 7 bedroom sandstone villa with a quarter of an acre of garden. I bought it in two halves (it had been split into upper and lower flats) and paid £125000 in total for it.

I live in a nice street, filled with nice houses occupied by nice people.

Why would I want to live anywhere else?

Why would I want to live anywhere else?

Works well for you, but if doesn't help if you don't want post industrial shithole miles from work.

It still doesn't change the fact that there is a massive housing problem in the UK as a whole

Which town?

paid 60K for a 2 bed semi in 2002, worth just under double that but the price has been at that for a number of years. Was 95% mortgage, could get one now if I was in the job of my choice with a combined income of 42k, would get a 120k loan with a 10% deposit for about 530 a month. Our first mortgage payments were £330 a month, although we now pay £485 as we have borrowed against the equity a couple of times.

Why would I want to live anywhere else?

Why would I?

Why would I?

Because Cardiff ? 😉

[i]^ fascinating link Stoner.[/I]

Except it talks of needing a +10% back into 1988, rubbish.

I bought my first place with 100% mortgage in 1985 and was on my 3rd by 1988 - 5% was fine, and even in 2001 when we bought the one before our current place.

FWIW it's all about location. In 1984 I could barely afford the rent in a houseshare down south. I then moved to Hull and bought a modern 2-bed flat for £21k, old 2-bed terraces were available for less than £10k.

My eldest has just bought near Knottingley, paid £120k for a 2-bed new build with garage - mortgage rate is decent (10% deposit) but the fees were almost as much.

I've considered moving somewhere far-flung like Scotland. But travel time would be pretty onerous even if my work do pay for it.

Just checked, and I could still buy a 2 bed house in LS28 for today prices with my wife for our combined salary in 2000 not adjusted for inflation,,, as we did in 2000.

I didn't particularly want to live there at that time, but it was a location we came up with based on all the compromises that ftbers have to make today.

As per stoners post, house price affordability is a function of interest rates and the price paid + LTV. It seems to me that the big change has been in LTV values as I managed to pull together 5% deposit from savings, loans and credit cards.

My wife bought a 2 bed flat in a not very nice part of SE London in the late 1990s for £50k. Her mate told her yesterday that her old place just sold for £440k. Alas, she moved out some years ago. I know it's London but by any standards it's insane. I've no idea how the average punter manages to buy any more. Even trying to save for a deposit is more difficult due to the miniscule interest rate and crippling rental costs. It's very very tough and I can see why people despair and, nightmare of nightmares, move back in with their parents.

I've no idea how the average punter manages to buy any more.

Simple answer to that - average punters aren't. Median London salary c£35k, 2-bed flat in Zone 3 £425k+

Only those with massive help from parents (average FTB deposit is c£90k in London) or those earning well above average salaries are buying. There's only so many people like that which is why transaction numbers are down c45% YOY and several places I know in Crystal Palace which were on the market 18 months ago are still unsold or have been taken off the market - no buyers at current prices. Foxtons share price collapsing tells you that transaction volumes have cratered too.

My South London cycling club has lost 6 members in the last year - mainly because we can't afford to live there any more, and based on the amount of Rapha amongst members we're not low earners generally speaking!

It'll straighten out eventually - demand for property isn't price inelastic - which will be pretty painful for anyone who bought in the last few years - mainly forced to by sky high rents and fear of missing out.

I was first looking for a house back in 1999. You could have a decent sized terrace in Scarborough for 40k but I decided to rent. Bawls.

I moved back home 2 years later and similar sized houses were up to about 50/60k. At the time prices were going up every month and by the time I bought my first house a year or so later I had to pay 75k. Kept that 3 or 4 years and sold for 125k which seemed to be the standard price for a decent sized terrace at the time. They went up a bit more but then the crash happened so the standard terrace is around 125/30k now.

Had I bought in 1999 I'd be mortgage free by now but I missed the boat. There's the split imo.

From the FT story this evening that prices are still, apparently, rising:

Spring 5 hours ago

No mention of volumes!I'm told there's no supply so are these figures must be based on a false or extremely restricted market. Clarity needed.

As usual the FT yahooing the market. No relation with the advertising dollars they receive for the Property Section I presume....

ReportShare12RecommendReply

Bananalyst 4 hours ago

@Spring Agreed. Nearly all the properties I've been looking at in London have been "open to an offer" according to the agent. It's a buyers market with cheap financing, how often can that happen?ReportShare2RecommendReply

Artemesia 3 hours ago

@SpringWhat is happening is that greater and greater chunks of London are becoming unaffordable and there are few transactions in those areas- only foreigners with dollars can buy. Further out and downmarket there are still some being bought with bank of mum and dad etc and prices are still rising. Soon there will be no transactions there either.

It is a huge (or should I say 'uge?) bubble which is bursting in slow motion because there is no single big trigger. Yet.

ReportShare6RecommendReply

/B 3 hours ago

@Artemesia @Spring and when it does burst? A week later: FT - nobody saw it coming. 2008 redux.ReportShareRecommendReply

Spring 3 hours ago

@Artemesia Agreed. No volumes suggests that someone is wrong and the market is not in equilibrium. The question is whether it's the seller or the buyer who's deluded.2-3% gross yield looks way out of whack to me for an illiquid asset that has a large cost of carry. I reckon you need 6%+ yield to justify buying a house so I won't give you too many guesses which side it is that's deluding itself.

I know in Crystal Palace which were on the market 18 months ago are still unsold or have been taken off the market - no buyers at current prices

Flat below me sold the week of brexit for £320k after 2 weeks on the market* to say there are no buyers is ridiculous, I too know the market round here and the 500k and up do not move as fast, anything 'reasonable' will sell. People are moving here because they can't afford dulwich or streatham as believe it or not here is 'value' round here. Overpriced stuff that's too close to the badlands of Anerly or a long walk to the triangle/stations/civilisation will take longer.

That said I couldn't afford to move here now.

*was on Location,location,location and bought by a lawyer. The 'lower earners are being priced out both in buying and renting. I know for a fact that 2 flats here were £600pm for a long time and the tenets left when it suddenly jumped to £800. It's now £1100.

@brooess. You Dulwich Paragon then? Me and my wife are both still second claim members and moved from Sydenham Hill to North Wales nearly four years ago with no regrets.

Judging by the amount of building going up around 9 Elms, Vauxhall and Battersea, the market for flats in London doesn't appear to be cooling - I expect most of it is overseas investors attracted by devalued £!

We stretched ourselves to the max when we bought our first house for 1990 with 100% mortgage - it recently sold for north of 5x what we paid. I couldn't afford to buy my current house now based on my earnings - luckily paid the mortgage off last year. Talking to work colleagues in their 30s who are trying hard to raise a deposit. Successive Governments kow-towing to property developers restricting builds, failure to invest in quality social housing and pensioners cashing in pensions to buy-to-let, effectively locking-out the market.

In London, I reckon anyone currently in their 20s is in a pickle. Like some of the other posters above, I live in SE London in an area that used to be relatively cheap.

A 4 bed house round here is now 1.25m.

Our previous place doubled in value between 2007 and 2015. Takes 2 good salaries to cover current mortgage.

The good news is that all this will finally sort out the enormous London vs everywhere else gap. Boom times ahead for Manchester, Bristol, Glasgow etc.

[i]"Reading a lot of threads which explain how hard it is for younger people to get on the housing ladder"[/i]

Its a media/government fantasy that only young people can't get on the ladder. I know of at least 3 people who are 40+ who cannot afford to buy any property in my city/area around it and none of them can afford the rents of anything other than a single room bedsit. They have no chance of ever having homes despite being reliable long term workers. The house and rent prices are just too high here for anyone on an average single wage.

Having a home in this area is dependent on having a romantic partner or long term reliable house mate who will risk buying with you or who will split rent as without 2 salaries, no home other than a bedsit is ever going to happen for the average worker.

For working single people of any age the situation is dire.

Unless people have kids in irresponsible circumstances (ie bedsit) the state no longer wants to know they exist... so eviction is a big fear as without kids no one gives a **** about you, no matter your other contributions to society or to tax.