![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

Anyone done it? By massive (by my standards) would be approx. 40% of my takehome on a historically low interest rate, with a term that ends in my early 70s.

This seems absolutely stupid, but, it is the only way I can afford a family home in an area I'd be happy to bring up kids.

How on earth do people on 'normal' salaries even the national average afford anything in the south.

My house has jumped 7% this year (great, but the place we want to move to have jumped 12%).

Only people winning this stupid merry go round are those charging % in sales, tax etc...

I know poor attempt at a rant, but it can't keep going this way can it?

Does your wife/partner work? If we are talking national average range salary I'm guessing you will need two salaries coming in for anywhere considered 'nice' in the South.

How your kids turn out is way more to do with you and your Good lady, rather than some nice area, or well thought of school. A lot of people can't seem to comprehend this.

how certain are you that you will get a mortgage into your early 70s?

are you just raising the topic for debate or seriously considering a larger mortgage?

What multiple of salary is being offered by lenders these days?

Discussing it the other day, our joint income is about £42k, three times that just about buys the cheapest property in our village. Really worry for people coming through now, it's madness.

40% of take home doesn't sound [i]that[/i] high. That said you need to do the calcs based on rates rising, although I don't think they will anytime soon. If it really is a stretch then I'd look at other areas. Plenty of nice bits of the country outside the usual hot spots.

[i]Anyone done it? By massive (by my standards) would be approx. 40% of my takehome on a historically low interest rate, with a term that ends in my early 70s.[/i]

We had a 3x my salary (non working wife) in 2001, but interest rates were at 6 or 7% so it worked out at somewhere in the region of 33% of my net.

Didn't particularly worry about it, as I'd had previous mortgages with double-digit interest rates and we owed nobody anything else.

Turned out fine as inside 10 years the rate dropped to 0.5% and the value doubled - the future? No idea...

Reckon it's possible if ....

If ... you can see the property as a house and not a home.

By that I mean.... if it goes wrong, you can sell the HOUSE without emotion and not think you're giving up a HOME with all the emotion that it might cause to you and yours (important to get the mrs thinking like this... kids don't care where they live, as love as they are loved, right?)

It may well work out great and you may wonder why you ever worried... or it might cost you a few (lots really) quid.

Depends whether you are talking about your individual income or combined household? My mortgage is almost exactly 40% of my monthly take home, about 30% of the combined (though in reality all my wives is pumped into childcare anyway).

I don't really think it's the % that really matters, it's the absolute. 40% of a monthly take home of £1k would leave you in a much tougher situation than 40% of a £10k monthly take home for example.

you mean the monthly payment is 40% of your net monthly salary?

If so then yes, in 1989 I took out a mortgage where the monthly payment was more than 100% of my salary. fortunately my wife had a job paying the same as me, well until my eldest turned up in 1991 and the second in 1993.

That was a tough ten years but it does improve.

If you want to get a property you have to be committed. you are playing the long game.

I'm paying 40% of my take home in mortgage payments at the moent, but only so that I can get it paid off at 46, I wouldn't want to pay that much til I'm bloody 70.

I don't live in the Deep South though.

...but it can't keep going this way can it?

Well the other option is falling prices and negative equity.

The best we can hope for is 10yrs of stagnating prices, but there's little sign of that.

We're doing the same thing now. Our house (with 6 years left on the mortgage, we're mid 30's) is sold stc.

Made an offer on a place last week that would see more than double what we pay now per month for another 30 years.

As has been said, it's the absolute figure that counts more, our living costs won't change that much if at all. The extra per month on the mortgage is worth it for the new location, lifestyle etc.

What's the point of money in the bank these days? Enjoy it, if that means new house/location then go for it.

The best we can hope for is 10yrs of stagnating prices, but there's little sign of that.

June 23rd, apparently...

I'm 52, have a £220,000 mortgage that I need to pay off before I'm 65. It scares me.

Noticed on BBC today that house prices have slowed to c8% - so merely 5.75 times inflation.

Lessons learned from the Credit Crunch and longest recession in history = 0.

As for the OP, these days I think they've largely done away with multiples of income or % of income - it's all about income v expenditure so if you're pretty frugal otherwise it might be okay - I wouldn't worry too much about interest rates, the Gov / BOE have lost their balls about increasing them to slow house prices as it turns out that has the side-effect of slowing housing prices...

It's the early 70's thing that would worry me, not sure you should and I'm not sure any bank is going to gamble on your working till then.

I really don't understand how people in London can afford to live if their mortgage payment is above 60% of take home pay. What about other bills and that stuff called food? Also, who actually lends them so much that its this percentage?

Me, not a cat in hell's chance.

But then I'm very much of the view to keep fixed costs down to a minimum and enjoy the other stuff.

I wonder where you live? If you're in the south, it's definitely a very different situation to up north...

Average salaries are higher too so money left for bills will likely be higher even after a big mortgage. Also property in London doubles every 10 years pretty consistently so you can sell up after a while and buy something decent elsewhere so worth a bit of a stretch.I really don't understand how people in London can afford to live if their mortgage payment is above 60% of take home pay.

I wouldnt but thats just me , id rather put my time into my kids than slaving at my desk to live in a nice area.

A few years ago I had an interest only mortgage of £280k on a £40k salary in a very desirable area with repayments of approx £1200 per month.

Sounds nuts but we probably paid the same for our mortgage, as some do for rent.

We did have over £200k equity in the property and the property went up by over £100k in 2 years in the period 2008-2010.

I now have a much more manageable capital and interest mortgage on a smaller property on a less desirable but still reasonable area ,but it's not made anything like the same increase.

I prefer having a smaller mortgage now but as always it's a considered balance between risk NM ow and potential future reward. My brother has just moved from a the same size house in a nice area to a similar size one in a slightly less nice area and is now almost mortgage free.

in 1981 my folks found themselves with a mortgage repayments slightly over 100% of my dad's take home, mum out of work, 2 babies under 18 months old, an 18% interest rate and living off child benefit.

fortunately the interest rates subsided and dad got a promotion but it must have been terrifying! 😯

I pay 40% take home pay in rent for a house far too small for my kids - unsurprisingly can barely save anything.

40% of your take home? Or family take home?

We weren't far off the former when we took it out, but less on our joint income, and it was a high LTV (95%) and thus high interest rate (5.69%), the idea being that after the 4 year fix ends we'll be able to remortgage using any additional equity/anything we've paid off to get a better LTV against what I hoped would be a similar interest rate.

Fix ends next May and I reckon we'll do better on the interest as the base rate has obviously stayed lower than I anticipated. Both of us earn a reasonable amount more now too.

Not sure I'd do it without an end in sight.

We've no mortgage just now and have a house move and hopefully purchase on the horizon. The amount we've been quoted by the lender will allow us to buy what is (to us) a scarily expensive house, and mortgage payments will be 27% of our official take home pay.

I think anything above 30% would make me feel slightly uneasy, 40% I just wouldn't do.

We currently owe approx. £260k on a house worth around £550k.

(No we don't live in a mansion - just a converted bungalow in a nice bit of London)

Repayments are approx. £1300 PCM.

It is about 30% of our combined take-home pay.

I'd not want to spend anymore than this.

Interest rates will not stay at this low level for the course of a mortgage . I would check what the repayments would be if they went up to 10% or more and see if I could still service the mortgage at that rate.

I would go for it with the proviso that you may sell and downsize when you come to retire. Assuming a 25 year term hopefully any kids should have moved out making this a viable option.

Mortgage advisor suggested a 35 year term, to minimalise payments and have the flexibility of a low rate and overpay if you have the spare cash. Apparently past retirement is fine now. She even said some lenders on certain mortgages would go up to 100 years old! I thought they'd tightened up on this stuff. Will explain the prices still going up.

Want to live in Southampton where our work is. Work life balance is good, salaries okay. Obviously good parenting is important in bringing up kids right, but a good school gives them an even better chance.

3/4 beds in chandlers ford start around £500k, in the catchment for the right school add another £30k.

Can get a 10year fixed in low 3%s though noth sure I want to be tied for that long.

From the comments above looks like chucking a massive chunk of take home on a mortgage is the norm.

@Ramsey - my thoughts, so I've fixed for 10 years and I'm trying to pay back capital early.

How does one determine the right school catchment area ?

I live alone, have a mortgage 4.5x my salary, over a long period. Repayments are about 33% of my take home.

Each to their own, it does sometimes worry me, but not to the extent of making me want to move. I didn't choose to buy the house, it kinda became mine... Long story but I transferred the mortgage into my name 4 years after moving in. I don't think they normally given such a high salary ratio these days.

I could move to a smaller / cheaper place, but I like it here, feel that I am improving the house (adding value) and like the area / life style. I can understand why you may want to stretch yourself for the house / area you like.

Oh... my mortgage also runs into my 70's, but I am overpaying while I can to reduce the term (worth considering if you can at all once you've moved in. My mortgage also allows me to withdraw any overpayments if required so I see it as my house fund... pay the mortgage off early if possible, but also a reserve of cash incase the roof blows off)

OP I think it depends on what other savings you have, eg pension lump sum to pay down/off in the future or savings to tide you over when you are not earning.

FWIW I think my first mortgage was 40% of salary but I was expecting career progression/pay rises and I got a fixed rate (10% phew floating went to 16%)

My arse is getting twitchy about borrowing more off the bank to build MrsTGA her extension/new kitchen, although I'll be sticking at 20% of our combined take home just doing it for a few more years (until 60 instead of 55). Probably an unnecessary phobia of mortgages though, and it seems like that's not too bad.

As an aside, when she says 'you're not having a new bike before the kitchen gets done', that means the same as 'as soon as the kitchen's done you can get a new bike', right?

Would I do it? No. People borrowed 4-5times salary then the last recession happened. If inflation jumps could you afford to ramp up repayments?

People I know lived in houses 3times more than what we are borrowing, each to their own. I'd rather live in a normal sized house and relax. I've never been into one upmanship, who cares.

As for Chandlers Ford, 500k? WTF. Where do people work etc to afford that locally?;??! London? Inheritance or massive risk and a Audi/etc lease on the drive? In the last recession lots of people fell foul with their mortgage due to car etc repayments that threw them over the fiscal edge.

My mortgage is currently more than 50% of my take home pay.

Interest rates will not stay at this low level for the course of a mortgage . I would check what the repayments would be if they went up to 10% or more and see if I could still service the mortgage at that rate.

This. Absolutely.

Rates are at historically low levels, put there to stop total collapse of the system. They WILL go up during the term of your mortgage, esp if you go for a 35 year term...

I really would wait until after the referendum before making any decision about getting a tonne of debt to buy a house in London or SE. BTL changes are kicking in, prime London appears to actually be falling in price and inflation has begun to pick up (slightly)...

If you're being advised to take a 35 year term mortgage at that % of take home pay at current interest rates, I'd personally take advice from someone else - that's tantamount to mis-selling IMO - it's a staggering debt burden to take on...

Quick question, of anyone's brain logic is working better than mine.

If you start a mortgage that you can make a lot of overpayments into, and potentially pay off in 10-12 years, are you best to get as long a term as possible to reduce monthly payments and total interest paid over the life of the mortgage?

Its about 50% of mine and I'm paying all of it at the moment while Mrs CD is on maternity leave. Will be tough but manageable until the kid(s) are at school.

3/4 beds in chandlers ford start around £500k, in the catchment for the right school add another £30k.

Have you shopped in the CF Waitrose? It may put you off moving there!

Brooess +1

Anyone who says 'you can/should', get a second opinion from someone without a ulterior motive. Just because you can doesn't mean you should.

Why are we soo debt friendly in the UK?

I still remember my Mum saying 'never buy on the never-ever'.

Ours is £210k and won't be paid off until I retire but repayments are only approx 28% of joint take home pay. Got a couple of small short term debts which will be paid off next year then I'll start overpaying.

Doesn't worry me too greatly as the property is worth around £600k so if we needed to we could downsize.

How does one determine the right school catchment area ?

Reputation, inspectors reports, exam grades. "Right" is subjective, but plenty info available to make that judgement.

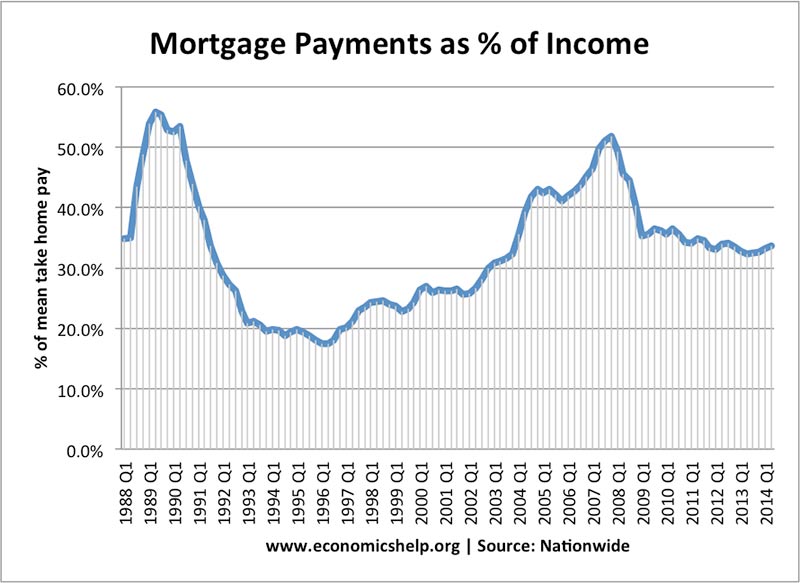

Those graphs are a bit worrying in the light of the increased deposit requirements for first time buyers since the crash(es).

When we bought our place we were offered up to 450k on income multiples.....

Now i know folk who took them up on that at the time gloating about how their new build needed no work.

We did not. Even half hat was more than enough for the time being- we did how ever pretty much save the other half.....

I also know the gravy train has stopped for now up here and i know many are using foodbanks , handing back cars and barely scraping by for the interest only portion of their monster mortgages.

How would you tide over a redundancy ?

Only one thing is certain, interest rates will rise at some point. Could be a few years yet but it's coming. You do have a choiceb

It would be interesting to look at a graph that shows the availability of cheap credit. How does that relate to the increase in house prices.

What is also interesting is that the government does not count house prices when it works out what inflation is. This seems wrong.

While that is true that doesn't mean it'll happen anytime soon or by a significant amount. The last rise was 10 years ago. Of course you'd be a fool not to allow for it in your calculations but it's also foolish to assume it will happen soon and miss a good opportunity.Only one thing is certain, interest rates will rise at some point

mine is considerably more than 50% of my take-home pay. Its my second house. Its due to run out when in 69 at the moment. I cant overpay at all as its too much.

The reasoning behind having such a large mortgage is I lost a lot on my first house. (purchased for 110k in Brighouse a the height of the property boom, spent about 15k on it and sold for under 80k) I had to roll this mortgate into the next.

Looking at the area we wanted to live in we could have got an amazing house in a rough area (the pub at the end of the road was on fire when we went to view it!) anything like a nice area and people wanted silly money for a 3 bed semi. It was a decision we made to spend a but extra to get a detached house as we thought it would hold its value better after loosing so much first time.

if either of us loose our jobs were out of there. My glass is always half empty but I still see this as being the best option.

Nickjb your right but this is long term and I'd agree that interest rates are going to stay low for some time. But if your on the edge at today's rates with two incomes until your 70? Good luck with that plan.

I made a decision a long time ago not to have a huge mortgage and bought affordable. Has meant we enjoyed our life rather than being stuck in huge property. Has also meant I've retired early. There's more to life than a mortgage. You can choose another path.

We've paid 40% of household on mortgage or rent for ten years now. It's hard and our entire income goes on living, any niceties have to come from the paypal ebay selling account.

No choice for us if we want to live in the SE. (It's our choice, not blaming anyone etc disclaimer)

Like they say sometimes the best is the enemy of good enough

Reputation, inspectors reports, exam grades

i havnt met a teacher yet who reckons those are good ways to measure a schools performance.......

(im married to a teacher so have a number of teachers in my social circle....)

Price of housing - artificially high

Cost of borrowing - artificially low

Is that a scenario which supports possibly over-extending yourself?

Price of housing - going up

Cost of borrowing - low

How about that?

As to which is correct is anyone's guess but based on the last 10 years it's this, and right now it's this. Over the next 25 years???

Has meant we enjoyed our life rather than being stuck in huge property. Has also meant I've retired early.

But you don't have to stay in that huge property. I could sell our house, buy another outright and still have £100k in my pocket.

i havnt met a teacher yet who reckons those are good ways to measure a schools performance.......

Well given that "try before you buy" is not an option, and between those 3 things it covers pretty much all the information readily available to parents to help in decision making, what would you/they suggest? Just chuck them in anywhere and hope for the best?

I could sell our house, buy another outright and still have £100k in my pocket.

based on the presumption that house prices dont fall at precisely the time you are forced to sell.....due to cheap credit being eradicated or other reasons......

its not a particularly liquid asset to play with imo.

What is also interesting is that the government does not count house prices when it works out what inflation is.

Well house prices shouldn't be included, as they're not directly a regular cost, but mortgage payments are and they're included in the RPI but not the CPI.

"what would you/they suggest? Just chuck them in anywhere and hope for the best?"

not at all - just pointing out that getting your self to the eyeballs in debt to get into the catchment area of a school that you think is the best may not be the best idea based on the quality of the information your given.....

my catchement area through blind luck is cults academy and a few friends commented on how lucky we were to get a house in that area....now that gets good reports/and inspection reports - had a good reputation - and good exam results..... it also has a massive drugs problem and of course recent incidents......

I think that is the key. When we bought our current house we went for a middling option. If we'd have gone for a cheaper house then we could have saved a little more but spent the last 8 years living somewhere less nice. If we were feeling a little more daring one of the options we were considering but obviously didn't go for would have left us with £500k of equity by now! Making money is easy in hindsight 🙂 One of the reasons for our caution was the constant advice that interest rates were so low they could only go one way and that house prices were artificially high.But you don't have to stay in that huge property. I could sell our house, buy another outright and still have £100k in my pocket.

could sell our house, buy another outright and still have £100k in my pocket.

not a retirement income.

not at all - just pointing out that getting your self to the eyeballs in debt to get into the catchment area of a school that you think is the best may not be the best idea based on the quality of the information your given.....my catchement area through blind luck is cults academy and a few friends commented on how lucky we were to get a house in that area....now that gets good reports/and inspection reports - had a good reputation - and good exam results..... it also has a massive drugs problem and of course recent incidents......

I don't disagree on the point re. up to eyeballs for that sole purpose. I'm not looking for an argument, genuinely interested in what you would suggest to assess school quality over and above Reputation, reports and exam grades as I suggested. In the example above Cults clearly falls down on the reputation point even if the other two are good. There's not a lot more information apart from those 3 things that I can see being readily available to parents, so you have to do the best you can in piecing information together from those sources to make the best choice.

based on the presumption that house prices dont fall at precisely the time you are forced to sell.....due to cheap credit being eradicated or other reasons......

They would have to fall an incredibly huge amount for my not being able to at least sell and buy somewhere else. And if they fell by such huge amounts then there would be a lot more people in massively worse positions than me...

not a retirement income.

No, but just owning a house outright is a retirement plan in the first place - the person above that bought a smaller house and has now retired was clearly in a very good financial position for other reasons then just only buying a small house.

Good option nickjb

What 3/4 beds are you looking at that are 500k in CF. Detached with Land? Quick Zoopla search shows 3 beds at £250k.

How fixed are you on CF. E.g. if you look in upper Shirley 3/4 beds semis with decent gardens can be had for less then 400k. Its a great area for bringing kids up with the common so close. Good schools and easy access to town (or out of the city). And more importantly much nicer housing stock than CFs 70's rubbish.

i have no idea doug , my whole point was the above that using those three factors to justify getting up to eyeballs in debt is silly because they are not great indicators - i do agree they are all you have as a parent. Ill ask around what they would do - other than ask the teachers(networking) at the school they are looking at though and let you know on FB if i get any useful nuggets.

Trying to get thornden catchment. 4 bed detached, garage. My searches aren't showing anything much below 500k. Also looking in upper Shirley or bassett. I hear mixed reviews about the secondary. There are some places in the 400k mark if you go semi and on the busy roads. There is a lovely place on kineton rd, 4 bed detached, garage, offers in excess of £570k. That is ridiculous.

May end up in bitterne as prices (relatively) more reasonable. I've started looking wider given the stupid prices, I can get detached properties in Colden Common, Nomansland, Bransgore for the £500-550 mark. Wife doesn't want rural though.

Rates wise, people have been saying they go up for years and prices go down. In hindsight we should have massively stretched ourselves (rather than be sensible) 10 years ago and we would be in a much better situation.

I estimate the cost of moving to be in the region of £25k so I don't want to move into a place, and then basically want to move again in 5 or so years paying out another £25k. The idea is this is a 20 year home. Get kid (hopefully kids) through school into uni and see how we are getting on. Long fixes are attractive given the certainty but I;ve worked out it'll cost in the region of £3.5k more per year over the current lowest 2 year deal.

As for brexit - if we do leave, it'll be years and my expectation is it would mean rates stay lower for longer due to the ensuing chaos. BTL is an interesting one, and would potentially mean lower demand for my current property but probably not the ones I am looking to buy. Could that reduce prices, maybe, but if my intention is to stay for 20 years and I can afford the repayments it is of less concern.

It feels like a huge gamble....

it is but usually stacked in your favour especially if you are looking long term. I'd imagine somewhere like upper Shirley is a pretty safe bet. Nice houses in a good location in a prosperous city.It feels like a huge gamble.

Colden Common is hardly rural though, thought it would have been expensive due to proximity of M3.

I don't really know Colden common, it just came up on the search...I should qualify wife's rural = not in Southampton (or Bournemouth)

I think I had too great an expectation of what I would be able to afford for what will be 5 times the current mortgage we have.

I think I had too great an expectation of what I would be able to afford for what will be 5 times the current mortgage we have.

I think lots of people get into that situation when they realise that it isn't just the house cost that they have to factor in but all the extras.

Look for something that needs work doing on it if you are looking long-term. We did that and three years later we are getting there, but there are still things we can't afford to do just yet.

Discussing it the other day, our joint income is about £42k, three times that just about buys the cheapest property in our [s]village[/s] housing estate. Really worry for people coming through now, it's madness.

Fixed, no need to thank me.

I'm currently paying 33% of my take home pay towards the mortgage.

Things should improve once my partner goes back to work. When this will be I do not know as we have a 3 week old baby and plan to have another.

It is a concern, however I have just accepted for the next 3 to 5 years, money will be tight.

I do hope it gets easier.

We went eyeballs deep (sounds rude) last year, near Reading so probably a little more expensive than Southampton. ~30% of take home, but more like 66% going into the joint account to cover bills and other expenses (and build up a little bit of a war chest).

The logic is/was;

* Promotion and inflation will hopefully erode the repayments quicker than any interest rate rises.

* Only doing it once means that if prices do continue to go up we're getting 8% (or whatever) of a big number, not ending up buying the same house in 5 years with it's value having gone up 45%.

* It needed some work, so hopefully when the fixed rate ends we can get it re-valued and that in itself should reduce the loan to value and get us better rates to offset any rates rises.

Long term plan is to move back up North, which if price differentials stay as they are would mean getting a significantly nicer house and retiring at 50 😉 . So the risks (to us) are:

* Short term - the mortgage is big at the moment (and I'm about to be made redundant)

* Long term - not retiring at 50, it's a nice risk to have to be fair!

So if we make it through the first ~5years we're probably home and dry.

I don't really know Colden common, it just came up on the search..

From what I've seen when I drive through it looks nice. I've heard that Thornden pushes up prices in CF but only you can decide whether a high ranking school is the most important criteria.

I've never understood why so many people are willingly to live on the very upper limit of what they can get away with borrowing. It's surely common sense to know that a lender wants you to be locked into a contract to repay the loan, for as high and long as possible. To me, it's just idiocy to go down that route and end up struggling to meet repayments, an potentially facing financial ruin. Just so you can appear 'better' than others.

Some neighbours have just sold for a silly amount. God knows how the new owners can afford it. Surely they must now be in debt for a very long time? The sellers are moving to a much cheaper area, and to a bigger place, but they are moving to somewhere which cost the same as the place they just sold, when they bought it. Therefore, they now have a massively reduced mortgage, and much less stress in life. They will be able to pay off the debt a lot earlier, and reap the rewards of their 'investment' much sooner, than if they'd gone with the maximum that their lender was offering. Very shrewd indeed. Unless the new owners have paid off a big chunk already, or are in very well paid jobs with rock solid security, I fear they may well end up with a life of misery, should any disaster befall them. Too many people just don't have any contingency plan. The lenders won't care,as they'll get their money whatever happens.

We're in the extremely fortunate position of having zero mortgage, zero debt and relatively very low expenditure. Coupled with not having kids, it means we could enjoy far more 'freedom' than most. We could sell, make a mint, and buy somewhere really nice somewhere else. We could also get a mortgage for something really crazy. But we already live somewhere really nice, in our opinion, and aren't interested in moving, or incurring new debt and stress. Our lawn is a lovely colour.

I think too many people are chasing rainbows. And there really is no pot of gold awaiting them.

I've never understood why so many people are willingly to live on the very upper limit of what they can get away with borrowing

it makes sense at the beginning as usually income rises, prices go up, LTV goes down and then it gets cheaper.

though history has shown us that isn’t always the case.

i think the bigger question is how long can you pay the mortgage for if you lose your job? most people have no savings plus a bit of unsecured debt. that would worry me more than a mortgage payment on the slightly high side but having years worth of payments at hand.

(i’m risk averse so mortgage is 20% of take-home and the other halfs is about 30% on her place but we both have a reasonable amount of equity in about 700k of property.)