![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

We pay in at the post office…no fees.

But it still costs you time for the handling. May be you could spend that time doing something that generated income?

No for me.

If you take away the alternative, you take away the incentive for other options to innovate. Outside of that even in Central London infrastructure is creaky. Junction boxes and mobile base stations are vandalised, poorly maintained or get flooded due to rain or leaky pipes at the best of times. I find it ridiculous that some retailers close doors rather than take cash when this happens. That's not even taking into account tourists from cultures that are still cash heavy.

Every time you spend £10 on a card with a shop/business the bank skims an amount from it.

If you spend £10 in cash in the same shop its still worth £10 not £9.90

If that £10 note is given in change its still worth £10 to use again and again without losing anymore of its actual value.

Going cashless dilutes our money and the banks are the biggest business to gain from it in charges and fees.

Makes me smile when people say i dont know how to spend it, ... try fuel in the car, a pint in the pub, haircut (our barber only takes cash) a magazine, toiletries in Boots, bits for your bike from an actual shop not CRC (oh hold on) etc etc...

Going cashless would be stupid.

the chippie near me has a minimum spend of £5 for card/contactless transactions

My local chippy has circumvented that requirement by increasing prices.

And why not. I'd honestly prefer that, it's convenient for all concerned and it's honest. But as it stands, if I want a bag of chips then I also have to buy several cans of overpriced Coke or go to the ATM round the corner which charges me £1.69 to withdraw a tenner. So what I usually do is walk to the good chippie down the road instead.

I bet that they are using a sumup or izettle for card transactions?They generally have higher fees but put less restrictions on the retailer. All of the main card reader companies and banks will black list a retailer who put minimum spends on transactions.

No idea. I'll try to see what identifying marks I can spot.

I wouldn’t mind betting the average cashless transaction for a pint in a pub saves at least 30 seconds of asking for an amount of money, waiting for the customer to give you some larger amount, walking to the till, typing in how much they paid, finding the correct change and walking back to the customer to inform them of the amount of change,

In my local, they'll already be serving someone else while you're paying by card or phone. Obvioulsy that can't really happen in a shop though, but I don;t think I'd be bothered about a coupleof pence increase in prices to cover the cost of the machines. Christ everyone seems to be taking the opotunity to put prices up when they can any way, we'd never even know about it!!...

This is a very good listen with some shocking stats on the use of cash and who is actually using it.

https://www.pushkin.fm/podcasts/hot-money

Turns out the amount of cash in circulation has been rising over the last few years and yet use by the public of cash has been reducing. Cash in huge quantities is being used to move criminal wealth around the world.

From the podcast.. Crimminal walks into a 'shop' that is actually a front for a money laundering operation with literally a massive bag of cash. He hands it over. 'Shop' takes a cut and then simply stores the rest 'in the back'. That money never moves. Crim then jumps on a plane to Quatar or some other location and when there walks into the nearest 'shop' and thanks to a call from the shop where he deposited his cash picks up another bag of cash from the local shop less a cut for the local 'banker'. Crim walks away with his cash in a bag - both 'shops' have skimmed a cut. No money has physically left either country and has been laundered nicely to boot.

The system works because there is a continuous flow of crims from one country to the other and cash is added and withdrawn at both ends. Totally untraceable and a network apparently set up by Iran to get around the financial sanctions placed on them. Iran has now allowed organised crime to use their networks.

I guess a cashless society would go some way to putting the brakes on that scheme.

I also just don’t trust governments. I would always like the ability to do small transactions without the government knowing or choosing if they like it.

What's the argument here exactly?

"Any further orders of business?"

"Why yes Mister Speaker, we have it on good authority that one reprobate going by the pseudonym of 'leffeboy' purchased one can of Tizer from the Tesco Express in Maidenhead yesterday."

My distrust of our current government knows few bounds. But I find it hard to get bent out of shape at the notion that they'd be concerned about my "small transactions" unless said transactions involved precision micro-scales and baggies.

No. How do you buy eggs, fruit, etc from honesty boxes when bikepacking without cash? Although I did see on one of Van Duzers videos that they have some system for informal cashless transactions n Sweden?

Venmo / Monzo?

Bitcoin?

The option that can, ironically, be tracked by governments (because HMRC would quickly figure out most peoples wallet ID when they paid their tax bill).

As a tradesman who often gets asked ‘how much for cash’ the answer is usually 50 quid more as I’ve got to waste an hour of my life going into town to pay it into the bank.

+1 when trying to sell stuff on marketplace. What are they expecting, that I'd consider giving it to them on tick and discount for actually paying upfront? Assume it's a cash only business with too much cash on hand, so add 20% Hassle Added Tax.

Pay your Tesco shop for a few months? Book a holiday though a travel agent? Pay for your petrol at petrol stations? Pay for dinner / lunches? and a million and one other forms routine spending.

Tesco - requires me to (remember to) take out more than I need from the pot and put it in my wallet.

Travel Agent - seems about as antiquated a concept as cash

Petrol - pay at pump

Lunch - the canteen has been cashless for ~20 years

The last lot of cash I had from clearing out the garage, ironically paid for some work on the house, which is probably a good reason to go cashless 😂

Every time you spend £10 on a card with a shop/business the bank skims an amount from it.

If you spend £10 in cash in the same shop its still worth £10 not £9.90

If that £10 note is given in change its still worth £10 to use again and again without losing anymore of its actual value.

Going cashless dilutes our money and the banks are the biggest business to gain from it in charges and fees.

A few of my tradie / small business owners often post this sort of meme on their Facebook pages. Every time they overlook the small detail of paying the tax due on the £10 worth of takings. 🙄

As I said before tax dodging only makes the rest of us have to pay more tax to make up the shortfall.

Naive question, but if we go completely cashless, surely the costs associated to using cards in small businesses etc would come down as it is the only method rather than an alternative, so that argument is a bit redundant?

As for the elderly, well it would be phased out wouldn't it, so the currently elderly wouldn't have to worry.

And for low income budgeting etc, again that phases out as those used to cash get used to the new way of budgeting via a banking app or whatever and long-term there'll be people who never used cash will just get on with it.

Maybe everyone would need to be issued some sort of basic banking app and card attached to a gov.uk account or something so that everyone has access to an electronic account they can use? Then private bank accounts are a choice on top of that.

Crimminal walks into a ‘shop’ that is actually a front for a money laundering operation

Probably one of the rediculous amounts of turkish barbers there seems to be on every street...

Every time they overlook the small detail of paying the tax due on the £10 worth of takings.

If it goes through the till as cash or card, the tax is still paid. 🙄

Naive question, but if we go completely cashless, surely the costs associated to using cards in small businesses etc would come down as it is the only method rather than an alternative, so that argument is a bit redundant?

Do you really think that without cash the credit card companies will lower their rates?

They are there to make as much money as possible.

Another point is that I can check cash to see if it's legit. If I take payment with a stolen credit card , the victim is refunded by me. So I've lost stock and money.

The amount of cash in circulation is flat rather than growing. It usually goes up in a recession (which is what this feels like even if it's technically not) as people switch from cards to cash to help manage their budgets. Card volumes are flat at the moment, values per transaction have dropped. Long term cash use will decline but it will take a long time to die. Every clearing bank used to have their own cheque processing centres (several for the biggest banks), we're down to one shared by all the banks in Northampton but cheques still haven't died despite the cost of processing. Sweden tried to phase out cash but even they've not gone the whole way. Cash will have a long, slow death and will probably outlast me.

Canary Wharf is cashless. I know that to some, it represents a lot that is wrong with society, but it would be interesting to look at what it means for the myriad retail business that operate there.

If I take payment with a stolen credit card , the victim is refunded by me.

Is that actually the case? I thought in this situation the card company took the hit.

I must have spent less than £50 cash last year. The only useful cash I have is the £5 I have as a tyre boot rolled up in my bar ends. In fact I'm not sure when I last opened my wallet as I always pay with my phone or watch.

I don't see a need to spend with cash when a number of banks/cards are offering cashback with every purchase (eg 1% at Chase)

We pay in at the post office…no fees.

Who do you bank with?

Barclays charge me the same fees if I pay in over their counter or at the Post Office.

If it goes through the till as cash or card, the tax is still paid. 🙄

“if” being the operative word

If I take payment with a stolen credit card , the victim is refunded by me. So I’ve lost stock and money.

Interesting, I thought the CC provider refunded it directly; didn't realise the retailer got stung. Appreciate its probably too much work for a small amount but presumably you could find out which transaction was fraudulent, check the time, check the cameras and work out who it was?

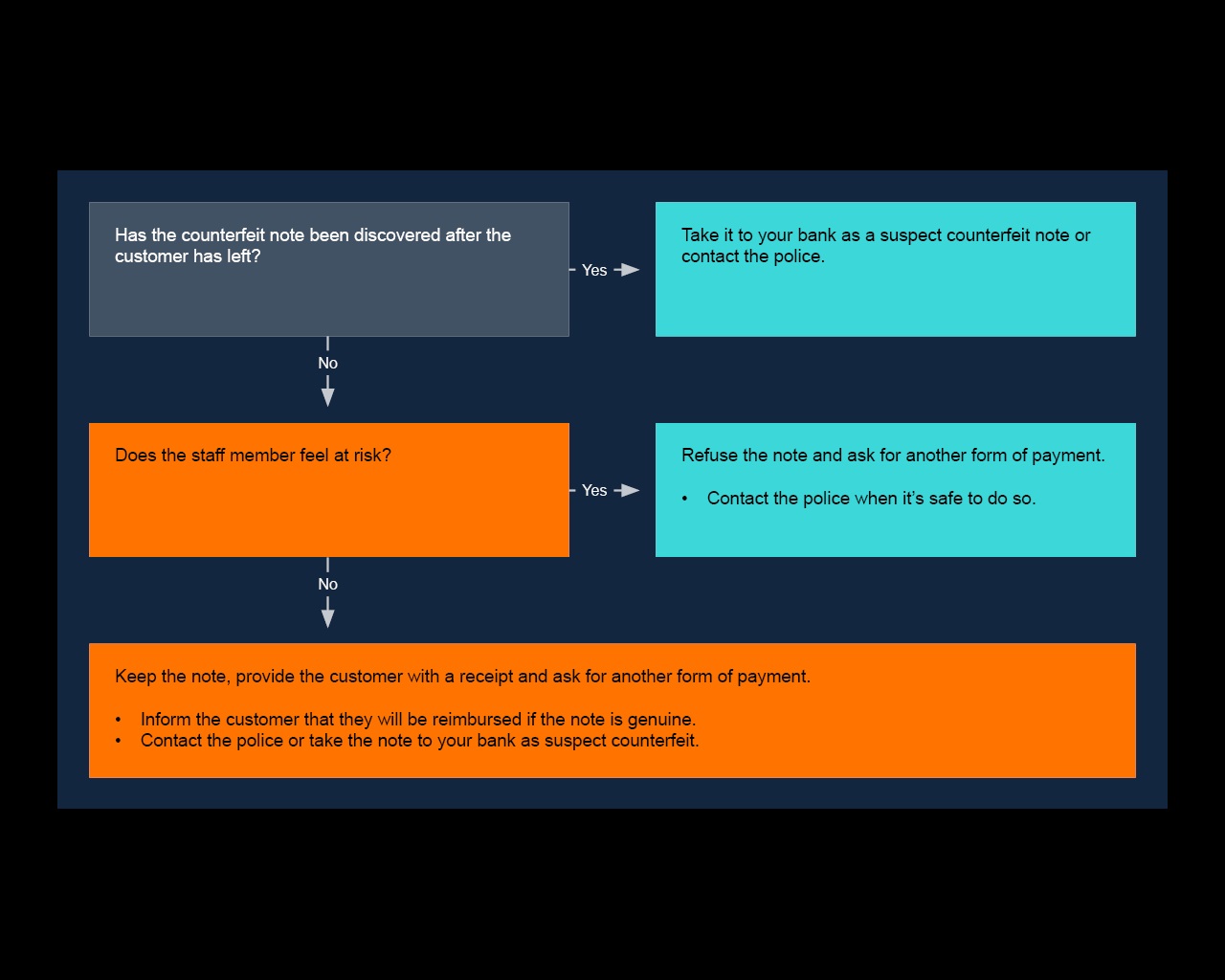

Have you (or any other of the small business owners on the thread) ever taken fake notes to the bank and had them rejected?

If the drawer is all ready open when you pay it won't be going through the books. Your 'local' Inspector of Taxes would appreciate a heads up!

Do you really think that without cash the credit card companies will lower their rates?

Well since lockdown card companies have been competing for business, in 2 years I have changed provider 3 times, each time for a better deal.

I've banked one dodgy note in 17 years.

Local Waitrose got stung last year with £50 notes. I'm probably more diligent than a Saturday girl on minimum wage.

Gobuchul I pay into a personal TSB account and then transfer it to Chase.

If I take payment with a stolen credit card , the victim is refunded by me. So I’ve lost stock and money.

I don't think that's correct.

How could you be responsible?

If it's contactless how would you ever know?

If they have the pin, how could you ever suspect it could be fraud?

Barclays charge me the same fees if I pay in over their counter or at the Post Office.

I'm with Santander (small business ac) bank charges are £40 a month with a deposit limit per year (over 250k?) And a 2.5k deposit limit per day at postoffices (unlimited at the bank). I don't think they do it anymore though....

“if” being the operative word

If you think that a business is a tax dodger don't do business with them - the point is the till logs the transactions which businesses base accounts on, regardless if it's cash or card. If they put the cash in their pocket and not in the till, then yes they are probably tax dodgers. But the same can be said for card machines, I could change the depositing bann to a personal account, Or sell business stock through a personal eBay account and not declare it on my tax return. Just because someone accepts cards, it doesn't mean that they aren't doing tax.

I don’t see a need to spend with cash when a number of banks/cards are offering cashback with every purchase (eg 1% at Chase)

Yes, because the card provider is still making money and charges more than 1% for the transaction 🤷♂️.

Interesting, I thought the CC provider refunded it directly; didn’t realise the retailer got stung.

When a retailer gets stung by a chargeback the retailer has to prove the transaction was taken in good faith with their card provider, this could include checking the time, check the cameras and work out who it was etc. obviously the retailer doesn't get paid for this. If you can prove it was in good faith the card provider usually has some sort of insurance that will cover the retailer and will payout to the defrauded customers bank. However the retailer will have a black mark on it's chargeback rating, too many chargebacks could mean a blacklisting by all card machine providers.

Gobuchul, we had a lady on the phone wanting to buy lots of stuff. All day she kept adding to her order. Fishy as ****.

I phoned World Pay to check the transaction was ok.They said it was.

I tracked the card down to being Australian and the lady on the phone wasn'tand when the lady phoned back I mentioned this and she hung up.

I phoned World Pay to give them a bollocking and to see what would happen to the Australian lady 3k out of pocket. WP said they would take it from us and refund her.

If I take payment with a stolen credit card , the victim is refunded by me. So I’ve lost stock and money.

1. Cardholder notices fraudulent payment on their statement or in app

2. Cardholder disputes the transaction with the card issuer (a chargeback)

3. Card issuer issues a chargeback to the merchant acquirer

4. Acquirer asks the merchant for proof of the transaction or provides or decides not to challenge the chargeback.

5. If the acquirer doesn't provide proof quickly enough, the chargeback stands. In that case the acquier charges the merchant.

6. If the acquirer provides proof, the issuer takes the hit. For example, when a South African bank was hacked and their cards cashed out in 7-11s in Japan, the issuer took the hit.

Someone always pays, it's rarely the acquirer or the card scheme as they just "switch" the transactions. The rules were designed to increase card use, so the cardholder rarely pays. It's usually the merchant or the issuer.

I phoned World Pay to give them a bollocking and to see what would happen to the Australian lady 3k out of pocket. WP said they would take it from us and refund her.

Ahhh - World Pay - now I know why you don't like cards.

We inherited World Pay on our 1st business, 99% online and the software was set up for them.

Absolutely bloody useless and incredibly expensive.

Customer service was terrible, web interface awful, paperwork totally confusing. They had a section titled "summary of summaries" FFS.

Also, you are talking about "cardholder not present" transactions, then you are responsible to take reasonable precautions to avoid fraud. Which you did.

All of the shop transaction are in person, there is no way I could be responsible for the fraud.

I tracked the card down to being Australian and the lady on the phone wasn’tand when the lady phoned back I mentioned this and she hung up.

Would you send stuff to an address that wasn't registered on the card?

Of course if the criminal had taken that money out of the victims purse or sock draw, they would be totally out of luck/pocket with no comeback whatsoever.

Rarely take my actual card out now, risk of loss or pocket scanners in crowded places (not sure if that was ever true or just a rumour)

Apple pay (or the android equivilent) requiring fingerprint or face ID, far more secure.

Not foolproof, as "hit him with this hammer until he gives you the phone and tells you the pin number" is still a possible way of robbing me.

Of course if the criminal had taken that money out of the victims purse or sock draw, they would be totally out of luck/pocket with no comeback whatsoever.

Unless they had home insurance 🤷♂️

Have you (or any other of the small business owners on the thread) ever taken fake notes to the bank and had them rejected?

One £20 note. It wasn't rejected so much as confiscated. I was told they could tell by the feel of the paper but they wouldn't even let me touch it so I could get an idea what they were on about.

Would you send stuff to an address that wasn’t registered on the card?

The lady wanted to pay over the phone and send someone to collect.

Unless they had home insurance 🤷♂️

do they just beleive you when you said you had X amount of cash?

One £20 note. It wasn’t rejected so much as confiscated. I was told they could tell by the feel of the paper but they wouldn’t even let me touch it so I could get an idea what they were on about

I was in Lidl once when the cashier confiscated a £20 note from someone who tried to pay using it. I think their obliged to do this. They customer wasn't happy at all. Understandably if they'd been handed it.

I stopped carrying a wallet at all.

Broadly similar here.

What's actually in my wallet?

Store cards? All on an app. Payment cards, Google Pay. A loose tenner, back pocket. Photo ID, OK this is valid but how often do you need photo ID right now? Police will give you a producer, the vast majority of places like Post Office collection offices who have posters up saying photo ID required never bother to check. What else, stamps? It's a handy place to keep them but I can't say as I've ever found myself halfway down the high street with a sudden urge to post something.

Cash is grubby, think of everyone's hands/pockets that they go through before they end up in your hand. Probably less colds/flu/germs with cashless

I was in Lidl once when the cashier confiscated a £20 note from someone who tried to pay for it. I think their obliged to do this.

This is an interesting one. What is the actual legal stance here, anyone know?

A store is well within its rights to refuse acceptance of payment, both via suspect notes and legitimate ones (despite what the 'legal tender' brigade might have us believe). There is no onus on them to be forced into accepting any form of payment at all.

A bank can and will confiscate fake currency without recompense, sucks to be you.

But can a store take fake money off people and then go "sorry, bye!" Let alone being obliged to even? This feels like shaky ground to me.

I provably use cash weekly, but always carry it.

Often spend less than a tenner in a shop or cafe and ask if they want cash or card - there choice if they want to give 20p or whatever to the card provider for each transaction. A lot of small businesses with small value purchases would prefer cash.

I've also been the only one on a ride able get a snack in a shop or cafe when the internet is down, because I carry an emergency tenner.

Doing away with cash altogether raises all sorts of issues around exclusion, as already mentioned.

But can a store take fake money off people and then go “sorry, bye!” Let alone being obliged to even? This feels like shaky ground to me.

If people try to deposit or use fake cash in the post office this is exactly what we are instructed to do. Same for most of the larger chain shops I believe.

Doing away with cash altogether raises all sorts of issues around exclusion, as already mentioned.

There is a bit of chicken and egg around this though. We could deal with those edge cases if we planned to remove the cash alternative.

But can a store take fake money off people and then go “sorry, bye!” Let alone being obliged to even?

I had this problem the other way round. Back when counterfeit pound coins were in the news they were pretty easy to spot if you looked. I got one in my change and told the cashier, she looked at me like I was insane, gave me a different one and put the dodgy one back in the till.

“It costs to use cash”

No it doesn’t.

Zippy - it does - in your case it costs your time, it costs the post office time, it costs TSB and Chase for processing the transaction, you might not get a bill directly but none of them are charities so someone is paying for the processing.

However it might be costing your customer too - there are fewer free cash machines than there used to be - so they may well be paying to get cash out. Even if they are not paying directly they may have the inconvenience of going to a cash machine, costing potentially both in time, or in some cases in parking costs etc!

I'm mostly cashless nowadays. Have my cards in my wallet, Google Pay on my phone and whatever on my Garmin. So I always have some form of cashless payment method on me.

I do keep a tenner in the back of my phone case for when I'm out on a ride and the coffee wagon only takes cash. Coins just go in a pot at home as I can't be bothered with shrapnel. I'm pretty sure the kids use it and spend it at the local tat shop on dodgy chocolate and energy drinks 🙂

In recent history there are only two occasions that I haven't been able to pay. 1st was the coffee van at Curbar Gap. Usually they take contactless but the machine wasn't able to connect to the internet as everyone at Chatsworth show was smashing the local cell. Was fine I used my emergency £10 and someone else managed to do it via paypal.

Second ocassion was the Cutlery Works in Sheff. They are card only since Covid which is fine until their internet goes down and they have no backup. So had cash but they had no way of accepting or processing it. Funnily enough it emptied out pretty quickly when no one could buy any food or drink.

I don't think we should go cashless for most of the reasons mentioned previously, there should always be an option to use cash.

No - the UK should not go cashless and probably won't go officially

But many changes take place without being planned.

When the big supermarkets are the only places with cash machines will they be tempted to charge for cash withdrawals, which would probably cause many to stop using cash altogether.

I only pay with cash to get some change for the occasions I need it. Mostly I pay contactless with my phone.

But if I am making a small purchase from a small business I do pay with cash, as I assume they don't have the negotiation power to get a good transaction rates.

Tim

No, I don’t always use cash but I do always carry it and I refuse to give a single penny to any business that will not accept cash

I think I'm the opposite; I object to businesses that will refuse to take non-cash payments.

Not until those of us who grew up without any form of digital payment are dead and buried and then only once digital payment is the norm and is accessible for all.

I think I’m the opposite; I object to businesses that will refuse to take non-cash payments.

Me too. and assuming its a want, not a need, I'll happily forgo buying anything from them.

Of the various lunch options available to me at my office, I patronise pretty much exclusively the one which was the first to offer card payments. The last one to get a card machine - they held out for quite a while, so I would never go there - has apparently got one now. Too late, off my list, will never go there again.

Cashless transactions are a perfect tool to harvest data and behavioural information about individuals by banks, corporations and the government. So in the absence of cash, best hope that you agree with whichever government gets into power, and that your data is kept secure and is not used for nefarious reasons.

But hey, I guess that's the march of progress and in a world of over-sharing on social media, it seems that personal privacy is valued less and less these days.

Slowly but slowly, the pursuit of efficiency and safety at all costs (profits for large corporations - sold to us as convenience), over and above many of the little quirks that used to make life rich, spontaneous and enjoyable, and yes sometimes inefficient, continues.

Hence I will always try to use cash wherever possible. Use it or loose it as they say. And you might miss it when it's gone.

As has already been mentioned a few times, there's a significant segment of society that rely on cash.

Open Banking is starting to increase usage too (Pay by Bank, Pay with Bank, Payit etc), which is essentially a bank account to bank account transaction, cheaper than card txns,.moves instantly and doesn't involve any card details being shared.

There's a way to go before it's ready to properly compete with in person card txns, but there's already great use cases around bill payments, in app payments etc HMRC is probably the biggest user currently and the government is legislating quite heavily for UK banks to invest and drive competition for the card schemes.

Yes, bring it on. Cash is hassle to use and costs everyone to handle.

People seem to think that the current bank/card charges will remain exactly the same for the rest of time and it’ll be far too expensive for everyone at all points. That’s not the case and lower costs will be needed to allow a cashless society to go ahead. Charity boxes will have a contactless thing where you scan and donate £2 or whatever. Its not rocket science.

Same point for EVs, they will come down in price and only then will it be a game changer for society. Yet all the anti EV lot post that its too expensive and always will be so it’ll never work.

Same for renewable power, hydrogen generation etc.

Cashless transactions are a perfect tool to harvest data and behavioural information about individuals by banks, corporations and the government. So in the absence of cash, best hope that you agree with whichever government gets into power, and that your data is kept secure and is not used for nefarious reasons.

1) Assumes a nefarious government has the resources to bother looking at your bank account

2) Assumes that they don't already (they can if they want / have reason to)

3) Struggles to reconcile with the fact that affluent people tend to already be "cashless". Unless the government really needs to know what Chinese thecaptain is using, what exactly are they to worry about?

But hey, I guess that’s the march of progress and in a world of over-sharing on social media, it seems that personal privacy is valued less and less these days.

A fair point, but not really relevant. I "trust" facebook to show me crappy adds based on my predilection for cute dog videos. I trust my bank to not share my shopping habits and keep the 1's and 0's that represent my account secure. They're both pretty explicit in what they're upto with my data.

Slowly but slowly, the pursuit of efficiency and safety at all costs (profits for large corporations – sold to us as convenience), over and above many of the little quirks that used to make life rich, spontaneous and enjoyable, and yes sometimes inefficient, continues.

I drive a British car built in the 70's, I pay for the spare parts for it by card not cash.

One is an enjoyable novelty, the other is just a faff.

No one* has nostalgia for having to scrabble through the ashtray of change for the pay and display machine, or cutting their day short in a hurry because the meter was about to run out when we can now just tap in and out at the barrier.

Same with the London Underground, remember the faff of queuing for the ticket machines?

Busses with their "correct change only".

That awkward bit of the taxi journey where you paid with a fiver and paused for change because it wasn't quite payday and you weren't going to tip for his insights into the football results?

*this is the internet, someone will prove me wrong

the little quirks that used to make life rich, spontaneous and enjoyable, and yes sometimes inefficient, continues.<br /><br />

such as?

what have I missed out on?

Now, given the general anti authoritarian/governemnet attitude here I am surprised at the objections to cash. To my mind it is a way of stopping anyone knowing what I am buying and using that data for all sorts of purposes including targeted advertising. Tother thing is that cash is safer to lose. If I lose it all I lose is the few quid I carry. If I lose my card what a pain including dealing with the banks t claim back everything nicked with contact less buying. Also giving money away electronically is a pain. Not all of us on line bank.

Rarely take my actual card out now, risk of loss or pocket scanners in crowded places (not sure if that was ever true or just a rumour)

Apple pay (or the android equivilent) requiring fingerprint or face ID, far more secure.

+1.

I get really pissed off every month having to take money out for a haircut (very first world issue)

The emergency 20 quid in saddle bag for a cab thing though is very true. Cash in an emergency where your phone has died or whatever definitely is an issue. I've roleplayed the situation though and feel almost any passerby will let one make a phonecall for a cab, and the cab driver will wait at the door for you to go in and grab a bank card to pay with so in reality it's a safety net out of irrational worry.

Don't businesses have to pay to process cash, anyway? I do as a small business owner from reading the biz bank's spiel

Eventually coins and notes will die whatever. Like paying for things with goats and chickens died.

For the concerns about the poor, elderly, and potential to be tracked, just need a digital wallet card or gadget that tells you how much is in it, not linked to a bank account and can add/remove from it as easy as someone handing over cash.

Only issue is if you kept all your money in it and lost it. If you lose a tenner you still have the rest of your dosh under the bed.

To add security so only you can use it and can invalidate a lost card and restore it on another, requires an account and back to the tracking issues. Though a tin foil hat could be the answer.

Only places that I use that don't take any alternatives to cash;

- Chinese takeaway

- Haircut

- Window Cleaner

- (Very occasionally) dodgy cash wash places.

It's the Chinese takeaway that makes be laugh. There's about four locally and none take anything but cash, whereas every single other takeaway (5x Indian, 2x Thai, 2x chippie, 4x kebab, 2x pizza) all take cards. I'm sure that the first Chinese that starts to take anything other than cash will clean up, but they seem very stubborn.

I'm not seeing much empathy with those struggling with their budget due to poor mental health, poverty or a lack education here.

Cash is vitally important for this group and for that reason I'd make it illegal not to take cash.

No one* has nostalgia for having to scrabble through the ashtray of change for the pay and display machine, or cutting their day short in a hurry because the meter was about to run out when we can now just tap in and out at the barrier.

My heart sinks when I I drive into a car park and it’s a pay by app only car park! Because it’s never the app I already have installed. ☹️

I have an ashtray full of shrapnel.

HTH! 😃

Seems to different ideas threading through this …

”I want to do everything without cash”

(I’m onboard with that)

”I want everyone else to do likewise”

(which seems myopic to me)

I've been cashless for years, have a £20 in my phone case which I use maybe once or twice a year when we cycle to a random cafe whose card machine is down etc. That's pretty much it.

Good riddance is all I can say to cash.

Ah, just remembered P&D machines in the Lake District seem to still need coins in remote car parks.

I quite like cash but never use it.

A recent birthday saw me get cash. I gave to my wife for her Christmas do so they could split the bill. The same folk gave me monopoly money for Christmas and transferred the digital money. .

My heart sinks when I I drive into a car park and it’s a pay by app only car park! Because it’s never the app I already have installed. ☹️

Good news coming on that front - there's a national car parking scheme coming that will aggregate all of the apps, so you just choose your preferred partner.

I’ve not used cash for ages and have no real use for it. There are some proper tinfoil hat conspiracy theorists on here. Our government can’t do anything remotely efficiently. Anybody really think they are spying on us en masse?

I’d be more than happy for money to continue existing. As long as places take both options and the annoying bastards on eBay stop asking “How much for cash mate?”

It’s the Chinese takeaway that makes be laugh. There’s about four locally and none take anything but cash, whereas every single other takeaway (5x Indian, 2x Thai, 2x chippie, 4x kebab, 2x pizza) all take cards. I’m sure that the first Chinese that starts to take anything other than cash will clean up, but they seem very stubborn.

interesting, our local Chinese is the only place left that doesn’t (also I think the only local T/away with no online ordering option). Way back long before Covid it used to and then I think went through some ownership change and no longer did. I always assume it’s a tax dodge - but is it push back against the sort of invasion of privacy in China that comes from the gov monitoring every transaction? I was in China about 8 years ago and it was very hard to use cash.

Our government can’t do anything remotely efficiently. Anybody really think they are spying on us en masse?

Personally it's not the government that worries me. Purchase history and data is already a huge commodity in its self worth hundreds of billions. The value of the data that supermarkets gain from reward cards is massive and that's just one small sector. If 100% of our purchases are digital the data and spending habits that information gives is going to be worth a fair bit more.

Cashless transactions are a perfect tool to harvest data and behavioural information about individuals by banks, corporations and the government.

Only if the law changes. Companies are very much not allowed to collect, store or use this information unless you explicitly give your permission. And if you give your permission for data to be used for something, they are very breaking the law if they use it for something else. Companies do get fined for this in a big way.

Purchase history and data is already a huge commodity in its self worth hundreds of billions. The value of the data that supermarkets gain from reward cards is massive and that’s just one small sector. If 100% of our purchases are digital the data and spending habits that information gives is going to be worth a fair bit more.

How does it worry you? You have agreed to your personal data being used in this way in the T&Cs of these services. You did read the T&Cs, didn't you?

Why does that worry you?

– (Very occasionally) dodgy cash wash places.

An actual money laundering business, wow!

What Molgrips said.

The reason that the supermarkets get so much value from the data is that they know who are and you've allowed them to process your data, that's the value exchange you agree with them when you sign up for their loyalty scheme.