![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

are part time workers not entitled to buy houses?

If they can afford it. Owning a house is no more an entitlement than owning a german luxury car.

[url= http://www.thedailymash.co.uk/politics/politics-headlines/cameron-realising-britain-just-really-hated-gordon-brown-2015041097247 ]Getting back to the election....[/url] 😆

It's interesting there isn't really anything much happening today election wise, we are all arguing about other stuff.

When people come out with meaningless hyperbolic soundbites like this it's very difficult to take them seriously. Have you ever considered a career as a politician?

The irony.

The country was on the brink if bankruptcy. George Osbourne felt it necessary to release an emergency budget caused by the debt the nation was in

Labour broke the country.

It was also based on a huge creation of public sector jobs.

Oh noes - giving people decent jobs to do useful things that help people. How awful.

The country was on the brink if bankruptcy.

What a load of utter bollocks. Can you provide some evidence for this please? Or is it just another one of those things that 'everyone knows'? 🙄

Quite a few. Start with this one

http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/5816377/Is_Britain_going_bankrupt/

That blog is pure speculation.

Here's what the (Tory) Treasury Select Committee chairman had to say:

The chancellor, George Osborne, came under fire today from MPs on the Treasury select committee, charged with "misleading the public" for claiming the UK was near bankruptcy in the weeks after he took office. He was accused of using inflammatory language to justify massive public spending cuts.The committee chairman, Tory MP Andrew Tyrie, said Osborne's claim that Britain had been "on the brink of bankruptcy" was "a bit over the top". He also challenged the chancellor's claims that his emergency budget had been progressive, accusing him of "over-egging it a bit".

Or here's Lord Turnbull, former head of the Civil Service:

An interesting exchange at Treasury select committee this morning, where Lord Turnbull – former head of the civil service – seemed to question George Osborne’s claim that Britain was on the brink of bankruptcy until now.Chuka Umunna: “You said that you didn’t think the issues that had been raised in relation to sovereign debt and the UK were relevant. What did you mean by that?”

Lord Turnbull: “Well I always thought that we were capable of producing a financial settlement that wouldn’t take us into Irish and Greek problems. Secondly, a very large part of our debt was domestically held. If people are going to sell gilts they’ve got to buy something else. Who are these great shining examples of people who are issuing rock solid debt you want to buy?”

Chuka Umunna: Do you think it is accurate to describe the UK as being on the brink of bankruptcy?

Lord Turnbull: No, I don’t.”

Or Nobel-prize winning economist Paul Krugman's view:

The narrative I’m talking about goes like this: In the years before the financial crisis, the British government borrowed irresponsibly, so that the country was living far beyond its means. As a result, by 2010 Britain was at imminent risk of a Greek-style crisis; austerity policies, slashing spending in particular, were essential. And this turn to austerity is vindicated by Britain’s low borrowing costs, coupled with the fact that the economy, after several rough years, is now growing quite quickly.

Simon Wren-Lewis of Oxford University has dubbed this narrative “mediamacro.” As his coinage suggests, this is what you hear all the time on TV and read in British newspapers, presented not as the view of one side of the political debate but as simple fact.Yet none of it is true.

But no - carry on boldly stating the Tory party line as if it's uncontrovertible fact. 🙄

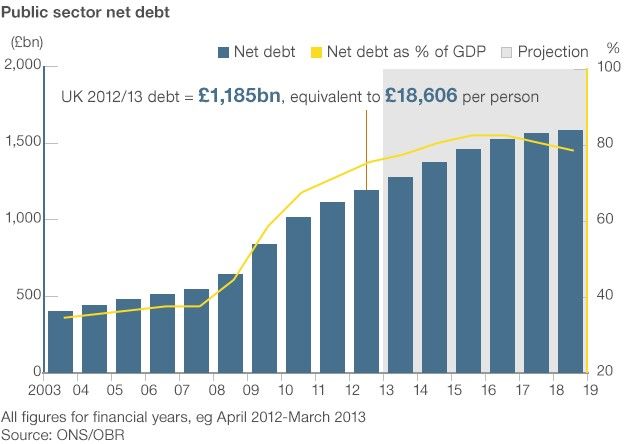

Digga - there has been no reduction of debt; it has more than doubled since 2010. Arguably, this is due to austerity economics.

Digga - there has been no reduction of debt; it has more than doubled since 2010. Arguably, this is due to austerity economics.

What is clear is how much worse the debt / economy would have been without austerity. France tried the "Labour Plan" of increased spending and big tax rises on the wealthy and its failed totally

Have you got some more up to date figures or is this another one of those things that 'everyone' knows, so you don't need any evidence?

@grum that piece you linked to showed London and the South East accounted for 19% of the Help to Buy purchases, so thanks for posting a link to make my point 😉

From memory the North West was the biggest user. The Help to Buy price limits are quite low with respect to London prices

jambalaya - Member

It's interesting there isn't really anything much happening today election wise, we are all arguing about other stuff.

after yesterdays 'dead cat'......... a Lynton Crosby meme- throwing a dead cat on the table when loosing an argument- saw fallon pushed in to calling milliband a backstabber to get away from the damaging (for the tories) non-dom debate

everything seems a bit flat- dead cat success!

Anyone lookup UKIPs Johnny Rockard. I have to confess I checked some of his material really wished I had not 😥

yeah im glad I didnt

I don't mind jobs being done, but any rational person should object to non-jobs being created, just for the sake of it and just to buy votes. Cynical and wrong.grum - Member

Oh noes - giving people decent jobs to do useful things that help people. How awful.

For the record, governments cannot, strictly, 'create' jobs; they can raise funds - through taxation or debt - to fund a job. And that does not necessarily mean it is a real, worthwhile job for the country or the employee.

Government jobs. Yes a good idea to create local employment in much needed areas and usually at a lower cost, the downside is that when the government needs to cut spending you are at risk. The big issue is why we have so little private sector job creation outside London and the South East.

Smashing, so you'd advise an endebted mate to go out and apply for a few more loans and credit cards?Ben_H - Member

Digga - there has been no reduction of debt; it has more than doubled since 2010. Arguably, this is due to austerity economics

That the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.

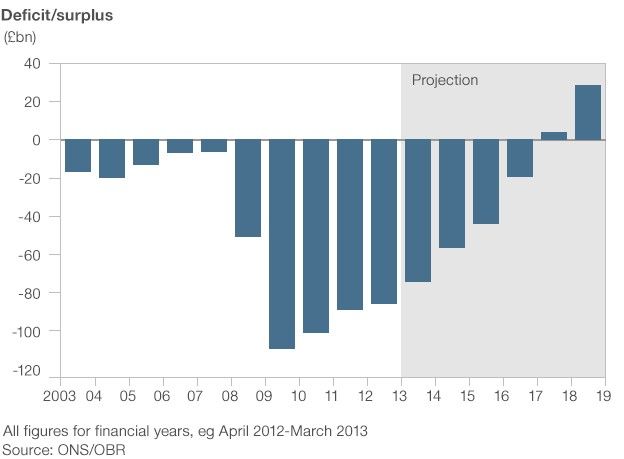

The deficit [i]is[/i] being cut but the mess cannot be unraveled in one go without even more drastic measures which, I am guessing, neither you nor I would want to see. I am not a particular supporter of the coalition, but have to say (especially compared to France for example) they have managed well.

Fill your boots on facts: http://www.bbc.co.uk/news/business-25944653

digga - Member

That the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.

or that austerity isnt the solution?

That the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.

Ah so we're back to - the debt keeps increasing (and the Tories have failed on their promises on the deficit, let along the debt) and it's still Labour's fault, despite them not being in power.

If the debt had been cut would you be thanking Labour, or is it only their responsibility when things go wrong?

What is clear is how much worse the debt / economy would have been without austerity.

Ah someone else with the magical ability to predict alternate realities with complete certainty. 🙄

I think it was more a comment of the state it was in when handed over (and let's be fair, it was f***ed).

If the finances really are that screwed, then you can see why the SNP are making headway against the two main parties. By stating the bleeding obvious..... that spending £100 billion+ on some big boys toys, so we get to wave our willy around on the world stage, may not be the best use of taxpayers money

or that austerity isnt the solution?

Indeed, as we can see from the consistent economic growth outshining our own in those neighbouring countries which pursued a stimulus rather than austerity model!

Oh...

As a Conservative I have no pleasure in exposing David Cameron's deficit claims. However, as long as the party continues to talk down the economy via the blame game, confidence will not be given an opportunity to return. For it is an undeniable and inescapable economic fact: without confidence and certainty there can be no real growth.Below are the three deficit claims - the mess. The evidence comes from the IMF, OECD, OBR, HM Treasury, ONS and even George Osborne. The claims put into context are:

[b]CLAIM 1[/b]

The last government left the biggest debt in the developed world.After continuously stating the UK had the biggest debt in the world George Osborne admits to the Treasury Select Committee that he did not know the UK had the lowest debt in the G7? Watch: Also, confirmed by the OECD Those who use cash terms (instead of percentages) do so to scare, mislead and give half the story.

Its common sense, in cash terms a millionaire's debt would be greater than most people. Therefore, the UK would have a higher debt and deficit than most countries because, we are the sixth largest economy. Hence, its laughable to compare UK's debt and deficit with Tuvalu's who only have a GDP/Income of £24 million whilst, the UK's income is £1.7 Trillion.

Finally, Labour in 1997 inherited a debt of 42% of GDP. By the start of the global banking crises 2008 the debt had fallen to 35% - a near 22% reduction page 6 ONS Surprisingly, a debt of 42% was not seen as a major problem and yet at 35% the sky was falling down?

[b]CLAIM 2[/b]

Labour created the biggest deficit in the developed world by overspending.Firstly, the much banded about 2010 deficit of over 11% is false. This is the PSNB (total borrowings) and not the actual budget deficit which was -7.7% - OBR Economic and Fiscal Outlook March 2012 page 19 table 1.2

Secondly, in 1997 Labour inherited a deficit of 3.9% of GDP (not a balanced budget ) and by 2008 it had fallen to 2.1% - a reduction of a near 50% - Impressive! Hence, it's implausible and ludicrous to claim there was overspending. The deficit was then exacerbated by the global banking crises after 2008. See HM Treasury. Note, the 1994 deficit of near 8% haaaaaah!

Thirdly, the IMF have also concluded the same. They reveal the UK experienced an increase in the deficit as result of a large loss in output/GDP caused by the global banking crisis and not even as result of the bank bailouts, fiscal stimulus and bringing forward of capital spending. It's basic economics: when output falls the deficit increases.

Finally, the large loss in output occurred because the UK like the US have the biggest financial centres and as this was a global banking crises we suffered the most. Hence, the UK had the 2nd highest deficit in the G7 (Not The World) after the US and not as a result of overspending prior to and after 2008- as the IMF concur.

[b]CLAIM 3[/b]

Our borrowing costs are low because the markets have confidence in George Osborne's austerity plan and without it the UK will end up like Greece.Yes, the markets have confidence in our austerity plan and that's why PIMCO the worlds largest bond holder have been warning against buying UK debt.

The real reason why our borrowing costs have fallen and remained low since 2008 is because, savings have increased. As a result, the demand and price for bonds have increased and as there is inverse relationship between the price of bonds and its yield (interest rate) the rates have fallen. Also, the markets expect the economy to remain stagnate. Which means the price for bonds will remain high and hence, our borrowing costs will also remain low.

Secondly, the UK is considered a safe heaven because, investors are reassured the Bank of England will buy up bonds in an event of any sell off - which increases the price of bonds and reduces the effective rate. Note, how rates fell across the EU recently when the ECB announced its bond buying program. Thirdly, because, we are not in the Euro we can devalue our currency to increase exports. Moreover, UK bonds are attractive because, we haven't defaulted on its debt for over 300 years.

David Cameron would like people to believe the markets lend in the same way as retail banks lend to you and I.

[b]Overall, when the facts and figures are put into context these juvenile deficit narratives and sound bites ("mere words and no evidence") simply fail to stand up to the actual facts. The deficit myth is the grosses lie ever enforced upon the people and it has been sold by exploiting people's economic illiteracy.[/b]

So, David Cameron when are you going to apologise?

Cameron is playing the blame game to depress confidence and growth to justify austerity. Secondly, to use austerity as justification for a smaller state to gain lower taxes. Thirdly, to paint Labour as a party that can not be trusted with the country's finances again. Therefore, we Conservatives will win a second term because, people vote out of fear. The latter strategy worked the last time in office (18 years) and will work again because, in the end, elections are won and lost on economic credibility. Hence, as people believe Labour created the mess they won't be trusted again.

Finally, as the truth is the greatest enemy of the a lie I urge you to share this on Facebook, Twitter, blogs, text and email etc etc. So the truth can be discovered by all. Finally, have no doubt, people have been mislead by the use of the following strategy:

"If you tell a lie big enough and keep repeating it, people will eventually come to believe it" Joseph Goebbels

http://www.huffingtonpost.co.uk/ramesh-patel/growth-cameron-austerity_b_2007552.html

I'll ask the question again, because clearly some people are struggling with the practicalities of the situation, which is really very, very, very simple, even for someone who's never properly thought about the subject and is finally getting to it on a Friday afternoon:kimbers - Member

digga - Member

That the debt increased despite austerity ought to tell you something about the magnitude of stupidity the coalition treasury inherited.

or that austerity isnt the solution?

[b]If someone (imagine someone you actually like) is badly in debt, would you advise them:

A.) Not to incur further debt and to try to consolidate or reduce debt, possibly also by reducing outgoings? Or,

B.) **** it, pile up some more debt (which eventually comes at higher and higher interest rates of course as the markets lose confidence) and, in fact, spend a bit more?[/b]

Clue: there are no magic beans.

digga - people are not countries. Your analogy is completely invalid (and childish).

[quote=grum said]digga - people are not countries.

Eric Pickles comes quite close.

This^^^ I LIKE!

Eric Pickles comes quite close.

😀

I'll ask the question again, because clearly some people are struggling with the practicalities of the situation, which is really very, very, very simple

This is one of the key problems - it really isn't that simple at all, but people like to try and bring everything down to a simple level because they struggle with more complex issues.

depends [b]digga,[/b] what[b] you[/b] are [b]investing[/b] your[b] borrowed [/b]cash [b]in[/b] ?

are [b]you [/b]putting [b]it [/b]toward [b]infrastructure, [/b]education, [b]healthcare,[/b] social [b]care[/b], welfare [b]that [/b]will [b]ultimately[/b] benefit [b]the[/b] nation

[b]or [/b]taking [b]the [/b]other [b]path[/b] reducing [b]spending[/b] on [b]all[/b] those [b]things [/b]so [b]that [/b]short [b]term[/b] growth [b]slows [/b]to [b]a[/b] trickle [b]and[/b] long [b]term [/b]leaves [b]you[/b] with [b]an[/b] uneducated, [b]unhealthy,[/b] deprived[b] and[/b] unsupported [b]society[/b]....

of [b]course [/b]keep [b]it[/b] simplistic[b] and [/b]abstract [b]if[/b] you [b]like[/b] , i[b]ts[/b] a [b]sunny [/b]friday [b]after a[/b]ll

Debt wrecks nations just as surely as it bankrupts individuals. There is no magic solution.grum - Member

digga - people are not countries. Your analogy is completely invalid (and childish).

People like to make it look and sound complicated - obfuscation has always been a neat way to hoodwink - but, in the end it is not.

Huffpost is a joke, try something more rigorous: http://www.economist.com/news/finance-and-economics/21605934-argentina-ponders-its-next-step-imf-suggests-new-rules-broke

Debt wrecks nations just as surely as it bankrupts individuals.

so mortgages wreck you? car loans?, credit cards? paying for american assistance in WW2 ?

keep em coming, I can see how you got your username 😉

People like to make it look and sound complicated - obfuscation has always been a neat way to hoodwink - but, in the end it is not.

Just because you struggle with more complex explanations doesn't make these issues simple.

I'm not sure how posting a link to an article about Argentina that doesn't even mention the UK is supposed to prove anything.

I already posted a link to an article by a nobel prize winning economist - but obviously it was too complicated for you.

digga - MemberIf someone (imagine someone you actually like) is badly in debt, would you advise them:

A.) Not to incur further debt and to try to consolidate or reduce debt, possibly also by reducing outgoings? Or,

B.) **** it, pile up some more debt (which eventually comes at higher and higher interest rates of course as the markets lose confidence) and, in fact, spend a bit more?

Analogies between people and countries are stupid. But, hey, it's Friday.

My brother's deeply in debt. But he borrowed more to invest in his business and as a result, he can sustain and repay that debt. Austerians would have had him keep using his old, outdated kit, then been surprised that he can't make any money.

@digga is absolutely right here

Many people don't like austerity as they'd got used to living on borrowed money. Its quite compelling politically to have "the rich" pay for everything, because the "the rich" means someone else. Just look at furory creating by putting VAT up (to a similar rate the Germans and French had been paying for years btw), a tax paid by most instead of someone else. We still have one of the lower rates of VAT in the EU.

[url= http://www.vatlive.com/vat-rates/european-vat-rates/eu-vat-rates/ ]link[/url]

Austerity has absolutely worked. Many people may not be better off or even as well of as in 2007 but that should be no surprise as 2007 was an economy built on unsustainable levels of personal debt and a rising government budget deficit. With the changes in banking regulations banks couldn't economically lend that amount of money today.

Grum

[i]Ramesh Patel worked in finance from investments adviser with JMC Financial Assets, to commodities brokers in metal and currencies with Capital Assets. As well as a CEO for Proactive Internet Marketing and Brown Pound Publishing. Current working on a book on the UK deficit Myth and the real agenda of the right and left.[/i]

I can't find any information or trace on those companies he claims to have worked for, or anything further about him

Any ideas?

kimbers - Member

depends digga, what you are investing your borrowed cash in ?are you putting it toward infrastructure, education, healthcare, social care, welfare that will ultimately benefit the nation

The Weimar republic tried that - building Autobahns and so on. Didn't work out well for them (or the rest of us, for that matter). An investment must improve either GDP or GDP per head, not all of the things you mention could possibly do that.

It is a real world lesson in where debt can land you. Fundamentally, how or why do you feel we are immune to it?grum - Member

I'm not sure how posting a link to an article about Argentina that doesn't even mention the UK is supposed to prove anything

Looking at spending on public sector, it's widely documented how, if this rises to too high a proportion of GDP it causes many difficulties. A real world example is Greece, right now.

My brother's deeply in debt. But he borrowed more to invest in his business and as a result, he can sustain and repay that debt. Austerians would have had him keep using his old, outdated kit, then been surprised that he can't make any money.

However in 2008 the general businesses environment in the UK and around the world would have meant that his investment would not have paid off, his business would have kept shrinking anyway.

France tried what you are suggesting and it hasn't worked. Spectacularly so. But they did create a 66% tax rate (after the 75% one was declared illegal) and they did find many very rich people left and took many billions with them. They have a wealth tax there too btw, doesn't work so well if the wealthy leave though. But hey how you can say nasty things about them in the press as being "unpatriotic", so yo get to win points for the pantomime boo hiss

[quote=ninfan said]

I can't find any information or trace on those companies he claims to have worked for, or anything further about him

Any ideas?

Someone else was sniffing around too.

http://brackenworld.blogspot.co.uk/2012/10/did-ramesh-patel-get-paid-for-this.html

How about addressing the points raised rather than an ad hom? Are you going to try the same trick with Paul Krugman?

That article is from 2012 and has been widely discredited, not least because no one was actually making the specific claims it purports to bust.

Debt is fine whilst you can afford repayments. As Argentina and others have found, unlike with fixed loans, and even more so than with mortgages, the rate the markets demand from you can change rapidly.

I think I have found 'Brown Pound'

Companies house no 05648211

Brown pound UK ltd, based in Wolverhampton, with Ramesh as director, listed as agents in the import of leather and textiles, then changed name to Autotrust breakdown services ltd...

How very curious

Huffpost is a joke

says the man who quotes the Telegraph !

Debt is fine whilst you can afford repayments. As Argentina and others have found, unlike with fixed loans, and even more so than with mortgages, the rate the markets demand from you can change rapidly

Exactly. The UK had to go to the IMF under Labour in the 1970's

[i]n 1976 Britain faced financial crisis. The Labour government was forced to apply to the International Monetary Fund (IMF) for a loan of nearly $4 billion. IMF negotiators insisted on deep cuts in public expenditure, greatly affecting economic and social policy.[/i]

[url= http://www.nationalarchives.gov.uk/cabinetpapers/themes/imf-crisis.htm ]National Archives - Cabinet Papers / IMF[/url]

Greece, loans from the Troika 2%, market rate 10%-20% The Greeks seem to have ignored how much of a favour the eurozone is doing them

Any other Harvard-Keynsians you'd like to wheel out while you're about it? http://www.zerohedge.com/news/2015-03-23/paul-krugman-wrong-about-uk-and-borrowinggrum - Member

How about addressing the points raised rather than an ad hom? Are you going to try the same trick with Paul Krugman?

Groupthink means a lot of intellectuals have the same opinion. It does not make them right.

Debt is fine whilst you can afford repayments. As Argentina and others have found, unlike with fixed loans, and even more so than with mortgages, the rate the markets demand from you can change rapidly

You mean like when we lost our AAA+ credit rating under this government?

Almost every country around the world negatively impacted by the financial crises has pursued policies of "austerity", ie budget cuts. Aside from conspiracy theories what that tells me is that those are the correct policies.

You mean like when we lost our AAA credit rating under this government?

Our rating went down less than it would have done under alternative policies which would have seen much higher levels of debt.

So digga - you think a blog where they don't even attribute the articles is somehow more credible?

jambalaya - again you have an amazing ability too resent your opinion on what might have happened in alternate scenarios as undisputed fact. FFS.

Difficult to take that article very seriously:

The Greek Finance Minister Yanis Varoufakis used to be such a US academic and part of that Krugman-ite anti-austerity set. But he’s very quickly found that in the real world things that were easy to preach about from afar prove rather harder to do when it comes to it.

That is precisely not what Varoufakis has found. He has found that the EZ have the muscle to impose austerity on the Greek economy even though it has patently failed to solve the problem. He has found a political defeat, not an economic one.

UK

.........................................1997..../....2007

National Debt (Bn).......................348bn.../....500bn

Budget Deficit (Bn)......................0bn...../....36bn

Public sector pension liabilites.........270bn.../....730bn

Personal Debt (Bn).......................503bn.../....1346bn

Off balancesheet PFI liabilty............5bn...../....300bn

VAT - just on that link I posted earlier, can you imagine the fuss there would be if someone proposed VAT on food like there is in the rest of Europe. Don't forget the united states of europe will require harmonised tax rates.

France 5.5%

Germany 7%

Belgium 6%

Netherlands 6%

Spain 4%

Ireland 4.8%

But grum can't you see all the evidence points to what I say as being correct ? The only example I can think of the alternative no to austerity policy has been France, they tried it, it didn't work and now they are cutting spending.

And for the record I am of course putting across an opinion

DrJ - Greece had two choices, accept the EU bailout or go spectacularly bust and exit the euro. Whilst most of us think Greece cannot escape its debt mountain its choice is to go bust and exit the euro NOW. That's much worse. There is realistically no other option, the taxpayers of the eurozone are not going to write off Greek debt no matter how the Greek's try and dress it up.

says the man who quotes the Telegraph !

Says the man who quotes the guardian!

The Guardian v Telegrapgh reporting on the same events has been quite amusing this week

Have fun everyone, have to go. POETS day today.

we all know that telegraph content is determined by any advertiser that pays them the cash ala HSBC

and of course we also know that osborne pledged to match labours spending plans while in office, so round we go again....

We all know that both papers have an agenda. They are as biased as each other. Insulting one is insulting them both in my book.

Totally - agreed. But equally, some things are just fact and are widely reported, by all, so they're not always wrong. By contrast the Huffpost rarely has anything without some author angle.kimbers - Member

we all know that telegraph content is determined by any advertiser that pays them the cash ala HSBC

Yes, this is quite so, although once in office and in possession of the full facts (and the kind note left in the treasury) they did have the sense change tack.kimbers - Member

and of course we also know that osborne pledged to match labours spending plans while in office, so round we go again.

@jamba - what you say may or may not be correct, but my point is that it is not Varoufakis anti-austerity policies which have failed, since he never got the opportunity to try them out.

Its quite compelling politically to have "the rich" pay for everything, because the "the rich" means someone else

Lets just gloss over the glaring inaccuracy as no one is asking the rich to pay for everything:roll: Its compelling because its fair. If you must try and explain others views try a little harder will you or I will draw an equally lazy, and uncharitable, caricature of your view 🙄

you have an amazing ability too resent your opinion on what might have happened in alternate scenarios as undisputed fact

Whatever happens he will still be 100 % accurate :?h

That one really did make me laugh even for here

can't you see [s]all the evidence points to what I say as being correct ?[/s]I THINK I AM RIGHT

What is the sense in writing that? its does not matter what view a politician or an economists has they all think they are based on reality. It does not make it the correct view.

Groupthink means a lot of intellectuals have the same opinion. It does not make them right.

That is not really what groupthink means*

You would need to prove

1. It was actually a group

2. That this was actually happening.

* i am not going to debate it with you just read the wiki link will you.

although once in office and in possession of the full facts (and the kind note left in the treasury) they did have the sense change tack.

You mean the recession happened ? they entered the election on a pledge of austerity , cuts and balancing the books. I am surprised you have forgotten and got that so wrong, its almost as if you wrote it , irrespective of the facts, just to defend him and have a pop at labour.

This illustrates the problems of defining things in crude political terms (and also avoiding the facts)

So LWers argue that it is unfair to blame Labour for the problems that arose under their watch but fair to criticise the Tories for problems that arose under their watch and vice versa. But that clearly doesn't make sense.

Grum is correct to observe that the Labour party was not unilaterally responsible for the crisis (nor were the bankers) and has posted evidence that supports that. That does not exonerate them (Labour)though (reasons given earlier.

The Lord Turnball (? cant be bothered to go back) is a little silly though because foreign investors are the single biggest holders of UK gov debt (followed by the BoE). If they lost confidence, then there was an obvious indirect cost in terms of the cost of servicing UK debt and the crowding out effect on the private sector.

Equally austerity and impact on GDP. Cutting spending and increasing taxes will directly reduce aggregate demand (national income). But lets not forget that at the moment we are still running a deficit ie revenues < spending, its just that the gap is getting smaller. Nonetheless, debt continues to grow. So austerity George has still been spending more than he collects, just not to the same extent. the real trick he got away with was to relax austerity but maintain the façade to the market that he was not doing so. Cheeky but smart. But then he got caught out by weak earnings leading to weak tax revenues and guess what? No party addresses the cause of that - our chronic productivity problem. They (esp Lab) gloss over this with the Min Wage band aid instead of dealing with the underlying problem. Plus ca change!

And lets not also forget that a large amount of gov debt is off balance sheet so the 70-80% number is nonsense anyway!!

and of course we also know that osborne pledged to match labours spending plans while in office, so round we go again....

Apples and pears - this was a commitment to 2% real not the 4.4% real that had preceeded it under Labour or the 0.7% under the Tories.

That's much worse

Than a 25% reduction on economic activity, 30% wage deflation and high 20s% unemployment.

Tell the folk in Greece about "much worse" and see if they agree!

that clearly doesn't make sense.

True we should judge them on how they handle what happens on their watch rather than just what happens.

No one can control the market [ even less so a global one] Blaming anything other than its nature for the cycle of boom and bust is foolish.

As for Labour, they should be storming into power on tbe back of the last 5 years of Conservative non governance. They should be genuinely embarrased they are where they are in the polls.

Right-wing commenter Jeremy Warner in the Daily Telegraph doesn't agree with you, he thinks it should be the Tories who should be embarrassed :

[url= http://www.telegraph.co.uk/news/general-election-2015/11525783/The-economy-isnt-working-a-miracle-for-the-Tories.html ]The economy isn’t working a 'miracle’ for the Tories[/url]

[b][i] Nine times out of ten, it is perceived economic competence that determines the outcome of British elections; the party that leads the polls on economic management ends up winning. Yet this time, the rule doesn’t seem to be holding.

Judged by polling on which party has the best policies on the economy, the Tories should be romping to victory. [/i][/b]

I agree. Not that a government which significantly delayed the recovery and which quietly dropped planned cuts and other economic targets to give the economy a little boost a year or so before a general election can be credited with economic competence, but that a political party which is perceived to have economic competence generally can expect to do well in the polls.

And as the result of an extremely compliment right-wing press, excellent marketing skills, and the utter and breathtaking inability of the Labour Party to effectively challenge the Tories or even defend their own record, spineless, pathetic, and scared of their shadows that they are, the Tories are able to portray themselves in the eyes of a less than well-informed but significant section of the electorate as economically competent, absurd as that is.

Surely we are talking about degrees of economic incompetency Ernie?

And to think for a brief while Gordie and Ed were actually doing a reasonable job of minimising incompetency before hubris took over!

Still for a historian. GO could have done even worse.

It is quite extraordinary that CMD lacks the balls to play the economy card though. Still given that he is

even embarrassed about his education (instead of celebrating it) perhaps that is not totally surprising!

Still the odd thing is the desire among some to let these folk run large sections of the economy!!!!!

Ran out of policies ? 😆

Still given that he is even embarrassed about his education (instead of celebrating it)

No he is not he is merely shrewd enough to realise that voters see him as the man of privilege and its probably best to not over play his private education background as it mayl cost him votes.

The cadre of folk who would celebrate this , as you do, is very very small. I dont think you had to go to eton to work this out.

* its also possible he does not want to highlight the fact he was done for smoking pot at eton .

Synopsis?

The labour poster might as well guarantee everyone their own aladdin's lamp with three wishes and be done with it. Running the NHS for patients not profit takers is pretty astonishing pledge when it was Labour that saddle NHS trusts with £300 B of PFI debt.

Still given that he is

even embarrassed about his education (instead of celebrating it) perhaps that is not totally surprising!

Why on earth would anyone wish to celebrate priviledge ? its not as if dave dragged himself up from a sink estate is it.

Education is (one of the) best investments that anyone can make in themselves and in their children. If you have been lucky enough to enjoy its benefits, that is a cause for celebration and more importantly you should make the most of it.

To waste the opportunity is a much bigger crime and that IS something to be ashamed of.

Of course, those who prefer to waste it and have 'real' (sic) il-educated (deputy) prime ministers don't have to look too far back in history to see the folly of that idea.

The last Tory leader who did drag himself out of a sink estate wasn't that fondly remembered, iirc?

Bartholomew (oh, that sounds a bit privileged) starts an article well today in the Torygraph

[b]This is a make-believe general election – an elaborate game in which highly intelligent people pretend that they are debating major policy issues[/b]. They profess to get very cross with each other over minor things.

Someone from Labour says that spending more than 6 per cent of the NHS budget on private providers is a diabolical betrayal of all we hold dear whereas spending 4 per cent – the level under the last government – is absolutely fine. Radio and TV presenters go along with this play-acting because if they pointed out that the stated differences in policy are relatively small, their interviews would be too obviously trivial. Meanwhile, everybody in the broadcasting studio knows that all of them are keeping quiet about really important things. The politicians are under strict instructions not to mention them. They are like shameful family secrets not to be discussed in front of the children.

Quite. The lack of perspective is breathtaking, still we could simply vote on the basis of whether someone is seen as being a posh git instead!!!!

[quote=just5minutes opined]The labour poster might as well guarantee everyone their own aladdin's lamp with three wishes and be done with it. Running the NHS for patients not profit takers is pretty astonishing pledge when it was Labour that saddle NHS trusts with £300 B of PFI debt.

So the tory head office are back at the negative stuff then 😕

In 1992 PFI was implemented for the first time in the UK by the Conservative government of John Major......Despite being so critical of PFI while in opposition and promising reform, once in power George Osborne progressed 61 PFI schemes worth a total of £6.9bn in his first year as Chancellor......Also, research has shown that in 2009 the Treasury failed to negotiate decent PFI deals with publicly owned banks, resulting in £1bn of unnecessary costs.

Bloody labour eh doing what the Tories started and continue to do 🙄

If you must negatively campaign it probably better to pick something the Tories did not start and still do.

IMHO PFI is poor value for money [ I have no desire to defend labours record in this respect] BUT they have all done them. To try and blame labour for them requires one to ignore the facts just to make party political motivated point.

If you have been lucky enough to enjoy its benefits, that is a cause for celebration and more importantly you should make the most of it.

Well he became PM is that not enough for you ?

It also seems you are advising the PM to say I had enough money to go the best private school in the country and therefore enjoy the benefits [ only money can buy] of this. Furthermore I used this advantageous start in life to help me become PM and rule over you...rejoice in my success.

Again its not hard to work out why he is choosing to not make such a big thing about it.

I do agree masses amount of wealth allows you to buy advantage for your kids.

We only disagree in that I think this is unfair and you are comfortable with the wealthy entrenching their [ already substantial] advantage.

I think you are also being pretty rude about Prescott and his status whilst telling us all off for calling Dave a posh git 😕

I don't think you should have to hide it. Unless your equally privileged chancellor of the exchequor has repeatedly claimed "we're all in this together" when we're blatantly not. At that point, you probably do need to be a bit careful what you say, so you don't appear to be quite so much of a ****.

just5minutes - MemberThe labour poster might as well guarantee everyone their own aladdin's lamp with three wishes and be done with it. Running the NHS for patients not profit takers is pretty astonishing pledge when it was Labour that saddle NHS trusts with £300 B of PFI debt.

What would be truly astonishing would to build on a mistake.

So perhaps just5minutes you can explain why the Tories want to do precisely that?

Or perhaps you can't?

Equally astonishing is the claim that a health care service being run in the interests of the patients rather than profit is comparable to a wish granted from a magic lamp.

Perhaps you can also explain this astonishing claim too just5minutes?

But then again perhaps you cant?

.

And very funny ha ha the incomplete draft of a template leaflet, something which all parties use. BTW the leaflet seems to be out of all proportions to the doormat it landed on, how big was it?

To waste the opportunity is a much bigger crime and that IS something to be ashamed of.

This kind of opportunity is directly linked with priviledge.

Im still strugging with your concept that priviladge ought to be celebrated.

Perhaps the struggle comes from misunderstanding what "it" is that should be celebrated? 😉