![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

My Dad has lived in his council flat for 30 odd years and has just been given a right to buy offer on it. Valued at 96k and he can have it 28.5k which is a no brainer. However he works as care assistant on not great money and is just turning 66 and could retire next year. The rent he pays now is about £350 pm. He has about 5k he could put towards it but needs to raise the remaining £23k

Does anyone know whats the best approach to finding the money. Will he be able to get a mortgage at his age? On affordability he could easily do it. Even paying monthly what he pays now he could clear it in 6 years. Could I guarantor it somehow if needed? I’m even thinking worst case I could take a loan for it and he can pay me back the amount he pays now in rent? Just wondering if anyone has dealt with a similar situation or can offer advice?

My partners auntie bought her dad's council house some years ago in similar circumstances. It set her up with a nice retirement fund a couple of years ago when the old fellah sadly turned up his toes, (aged 90, he'd had a good life) I don't know if this was some kind of shady, not within the rules transaction, but I wish I'd have been able to chip in at the time!

Are you able to buy it as joint owner with your dad?

Obvs a mortgage would be the best option and if you did a joint purchase he could keep the £5k in reserve.

I've no idea what the rules are, but if you can't do a joint purchase maybe you could loan him the money to buy it and then sort out a joint mortgage or something afterwards.

if you are able to get an unsecured loan for that amount then I'd do that and get him to cover the payments.

assuming it will transfer to you if he were to die then it seems very low risk.

I'd be digging a bit deeper.

The 'profit' sounds great but is it really worth £96k?

• What are the other flats like.

• Is it in a good area.

• As the owner he'll be liable for repair costs - can he afford those.

• Can he pay the mortgage when he retires.

• Can he cope with increased payments if interest rates rise.

• It will become an asset if he ends up in care so could be swallowed up in care costs.

At a certain age there's a lot to be said for being under council care.

And sorry to be blunt, but it sounds like the real benefactor of any property value would be you, not your dad.

I work in mortgages.

Pension income is a guaranteed income so he will be able to get a mortgage. All lenders have different criteria, some lend up to 85. You could ring round the lenders yourself or employ a broker.

If he'd rather not make any payments get normal residential mortgage then immediately replace it with an equity release who's criteria allow for remortgages but not for purchases. nb some equity release companies don't like ex Council but with that ltv he should be okay. Don't worry about old rumours of equity release stealing all the equity at that ltv should be okay.

He will be required to prove his pension so get requesting evidence of that before you begin.

Any questions dm or on here, happy to help.

FWIW I got an 11 year mortgage at 64 for 6x the amount you want with a combination of earnings and pension. A good broker should see you right although lending criteria has been tightened since the beginning of last year. Platform, the intermediary branch of the Co-Op bank is where we ended up.

@the-muffin-man I’m not in any way interested in this as something I may benefit from. My dad has never had a pot to piss in and I have gone through life never expecting for one minute I may ever get an inheritance and have built my life accordingly. This has come out of the blue is about whats best for him. However I take your other points about care costs etc. it does need thinking through, but on the face of it, it seems silly not to take the offer at such a discount.

In regards to the value. Its in a good area of south liverpool (allerton) and so even though the estate itself isnt the best, I would think £96k could well be right.

I’ll look into a joint mortgage maybe but wasnt sure on that with already having a mortgage myself.

Sorry @Jekkyl. Crossed over with your post. Sounds promising will dig deeper and thanks for offer of help. 👍

Sorry - didn't mean to offend. Looking at it, it was badly written!

I'm just saying be careful of losing the benefits he already has that he would be giving up.

May I ask why he has been given an RTB offer? If he's lived in the flat for that long then he could have bought it a long time ago through RTB.

What The Muffin Man says is an interesting point, I have no doubt that it would be a wise purchase from a investment perspective but council houses should be kept up to a certain standard and receive regular maintenance. By purchasing the flat you will be taking on the responsibility for maintenance that would otherwise be covered in the rental cost.

As others have said, I’d be taking equity out of my own property, buying this one and allowing my dad to live in it rent free with the proviso that he pays the ground rent and maintains it, possibly with some assistance from you for big items such as windows, etc.

As you mention it's a flat, I'm assuming it would be sold as a leasehold? Any ongoing charges (e.g. ground rent, service charge, etc...) to a freeholder to consider? Are there any arrangements in place for maintenance that might make this expensive, or difficult to deal with in some other way?

I ask this as my partner's mum owns the flat she lives in, and the management company that look after the block are a bit of a nightmare. Any work required has to be arranged through them, awarded to their pet contractors at, seemingly, way over market rates. And generally appears to be a half-arsed job. However, as the occupier has no direct relationship with the contractor that has done the work, any snagging or re-work also has to be arranged through the management company, which makes getting *anything* done very long-winded.

If it's for your dad's interest, then why bother? He's got security being a tenant of the council and the flat stays in social housing stock for the next old boy to enjoy for 30 years. If it's so you can flip it for ££££££££££ then ok, not judging.

Check with any other leaseholders if there are any major works/bills in the pipeline, you might find yourselves on the hook for £££ if you aren't careful.

Thanks for the responses, i’ll try and cover some of the questions below.

@the-muffin-man No offence taken, your overall points were valid and have been echoed by others.

It would be leasehold with a 125 year lease at £10pa

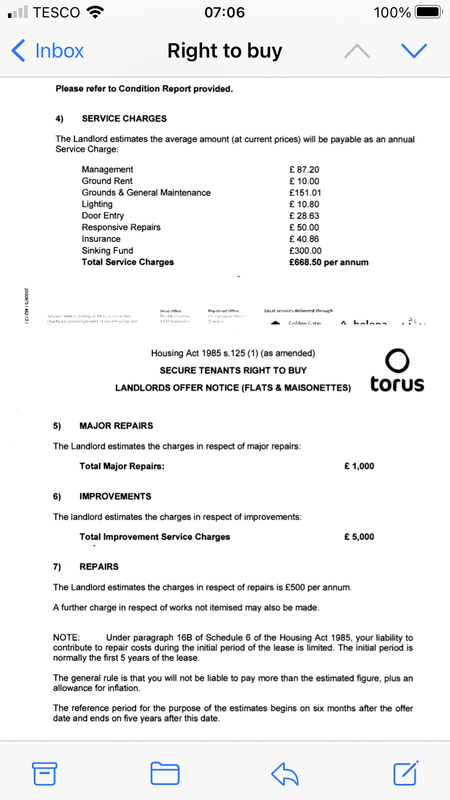

Below is the statement in the offer letter about expected costs from maintenance and repairs etc

I’ve no idea why the offer has come forward to be honest. I’ll try and find out a bit more on that.

The whole issue of the benefits of remaining a tenant are very valid and it definitely has made me reconsider if its the right thing, but ultimately its my Dads decision and just trying to help him with the money side of things. I’ll have a discussion though and put those points to him.

Again, appreciate the replies.

assuming it will transfer to you if he were to die then it seems very low risk.

Death is one thing - care in later life is another - The thing to guard against is the property being used by the authorities to pay for future care costs. If you're putting money in then make sure theres a 'security' on that money - meaning should the property be sold the value you you have put in comes back to you (just as if there was a mortgage on the property the mortgage company would get their loaned value back) The council will similarly have a security for a few years relating to the discount - if the property is sold or transferred in x number of years after the RTB they;ll claw some or all of their discount back. Residential care costs would eat the value of that house in less than two years.

I helped my girlfriends mum buy her house. I just gave her the money but with a security meaning that under whatever circumstances the house ever gets sold in the future the money I put in gets returned to me. But I have no other stake or ownership in the the house- no rent gets paid to me in return. I'll just get the money back one day.

Are you able to buy it as joint owner with your dad?

Not really - the tenant is the only one with a right to buy - the RTB discount isn't available to anyone else. There are various ways to help someone buy a property but not by being a joint owner.

I’d be digging a bit deeper.

The ‘profit’ sounds great but is it really worth £96k?

Doesn't matter, it could be worth half the valuation and it's still a good deal.

I’ve no idea why the offer has come forward to be honest. I’ll try and find out a bit more on that.

Suspicious cat is suspicious.

Council knows of big repairs coming and wants as many tennents in the block off their books as possible to minimise their exposure ?

Suspicious cat is suspicious.

Council knows of big repairs coming and wants as many tennents in the block off their books as possible to minimise their exposure ?

Did cross my mind

That's why I was interested in the RTB being offered, you wouldn't usually expect a council to actively want to sell off its housing stock at a loss.