![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

I finished my last contract at end of 2020 - straight before lockdown 3 - so didn't bother looking for work, and have got out of the habit.

Financially, I don't really need to work. Mid-fifties, main pension kicks in at 60, and enough in non-pension cash/investments to not work until then

I've been working longer contracts (2 years or so) plus extended breaks between for about 10 years so I have a very good handle on what I spend (plus mortgages paid off last year). I do need a bit less when I'm not working (£10 day for commuting/lunches pre covid) - but generally I just don't have an expensive lifestyle.

I'm not fully committed to whether I'm retired or not yet as I miss the social aspect of work - I may get a part time job, if not it will be voluntary work. But at the moment I'm happy pushing my climbing grades, running and hiking loads.

... the reason I think retirees are money savvy is for a few reasons. For me it's

Firstly, conscious of being on a income that isn't likely to change significantly and big purchases from savings pot that is shrinking makes you reflect on purchases.

Secondly - not buying stuff because of work stress and using shopping to feel better

Thirdly - more time to shop around (edit for big stuff...)

… the reason I think retirees are money savvy is for a few reasons. For me it’s

Yep, I've had some weird conversations with retirees eg one was explaining how he bought bread in supermarket x, but cheese in Y as bread was 1p a loaf cheaper. I have absolutely no idea what a loaf of bread costs and no interest in it either.

Your outlook obvioulsy changes when you no longer have a monthly salary payment arriving!

It has forced me to look closely at 2 very old DB pensions I have, both of which I though would give me a small but guaranteed income. After speaking to both it looks like they each have transfer values of over £30k but the annual income is trivial. I understand the benefits but would much rather have the transfer value to manage within my own SIPP and take out larger amounts over the next 20 years but this requires IFA approval which will eat into the amount....

We don't worry about the cost of small stuff either.

...but I have a real strong sense of value built into purchase of bigger stuff.

52 here. Paid off the mortgage 12 months ago. Kids are still quite young so I'll have to see them through as much education as they want.

However, the 10 year countdown has begun and we are going on my wife's 60th. Every spare penny is getting pumped into the pension after a year of buying toys and generally spending it like it was water.

I knew the change from 55 to 57 was on the cards, but didn't expect it to be this early. Did I miss something? I'm 55 in 2030, so think I'll be affected by this. Have I got this wrong.

Updated 20th July 2021... So 3 weeks ago

General description of the measure

This measure increases the normal minimum pension age (NMPA), which is the minimum age at which most pension savers can access their pensions without incurring an unauthorised payments tax charge unless they are retiring due to ill-health, from age 55 to 57 in 2028.

glad this thread is still going.

firstly anyone worried about how much you need to retire, it is far less than you think.

me and the wife are doing very well on 50% of what we had coming in monthly. and saving a bit still. and as we have been unable to do much for the last year or more, our whole amount has not changed as we have not spent on anything big.

and i am yet waiting for the boredom to kick in, as i have been told it will do.

2 grandkids under 18 month keep us busy 2 or 3 days a week, the pottering about on our bikes looks after the rest of the week. oh and the greenhouse we built. tomato's, chilli's and herbs galore.

i have to say, that i would live on beans on toast now, rather than going back to work to earn more money.

so people, of you are worried about it, dont be, just get on with it and cut your cloth accordingly....... ;o)

in 2028.

Phew, just scrape in before that 🙂

FFS I'm 56 in 2028.

Well said ton. MrsMC is convinced we'll be working full time till we are 67 and I'm trying to convince her we could both be part time at least well before then

I'm delighted to report that as of yesterday I'm officially Un-retired!

I'm 68, been working for the last 15 years or so as a self-employed carpenter/designer and maker of lovely bedroom furniture. I had a major spinal op last October which restricted my abilty to lift and carry heavy boards so in February I thought I'd pack it in. For the last 5 years I've been working 3.5 days a week so when the wind blows I go windsurfing, when it's nice I go cycling and when it's Thursday I have some grandkids to entertain.

Well after I "retired" I did a bit more windsurfing and cycling, but I also had days where I felt I'd accomplished nothing that fulfilled me. And I found that those days when you skived off when you should have been working were much sweeter. "Sorry Mrs Tomkinson, I can't come today, it's too windy".

So I picked up a couple of nice jobs. Will earn me a few bob and will put a bit of structure back in my life. And I'll have just as much constructive free time because I'll have to plan and not waft about.

And no, the only daytime TV I've ever watched (or ever will watch) is the Tour de France.

I feel invigorated and I don't think I'll be having any less fun. I can afford to be straight with my customers that I work 3 days a week, but I just don't know which 3 they'll be.

Oh, there is one drawback. Since the op I've needed to employ a casual labourer to help me with the lifting. He's a a Baggies season ticket holder and I'm Villa (or F***ng Villa scum as Eddie would phrase it). But as we both have a hatred of the Dingles and the Clay'eads it works out OK.

Read it again @Kryton57. I turn 55 September 2027 so have until 31st December 2027 to activate it, as do you.

take scheme benefits before age 57 after 5 April 2028

Aha yes, so activate up to April 4th Age 56 would be fine. Phew.

And another thing...

Never (as TJ can attest) put off stuff because you're saving it for when you retire.

It's heartbreaking to hear at funerals all the things they were planning to do, but never did because they were saving up.

@bigjohn it sounds like you have found the perfect balance.

My FIL loved golf but had had several serious back injuries including an op that had removed 2 of his vertebrae! He was hanging on to improve his pension all the time his back was slowly worsening (he had a physical job) I managed to to convince him the extra few quid per month would be little use if his back became that bad he could not play golf. He listened to me and retired quite soon after and played gold for a number of years until his overall health and age stopped him but happy I convinced him...

I knew the change from 55 to 57 was on the cards, but didn’t expect it to be this early. Did I miss something?

Meets the gold standard of "you know a law is s..t when the government excempts themselves from it"

However, members of the firefighters, police and armed forces public service schemes will not be affected by this increase.

It's also worth noting that this will go up to 58 at some point in line with the pension age going to 68 for those reaching that age after 2045 too

FFS I’m 56 in 2028.

But you'll be 55 in 2027 ie before they change it, so you can start taking your pension then.

I'm trying to find out a little more on the transition as I turn 55 in 2027 but want to convert my DB scheme via cetv. What's not clear is whether this is ok or whether the fact converting essentially means its 'new' and therefore access is only from 57. Doesn't appear that level of information exists yet.....

Meets the gold standard of “you know a law is s..t when the government excempts themselves from it”

Also see lifetime allowance, which is twice as high for those on final salary pensions eg MPs!

Also see lifetime allowance, which is twice as high for those on final salary pensions eg MPs!

Nope, it isn't. It's the same for everyone.

People with final salary pensions don't have any money in them. They have a promise of future benefits.

you know a law is s..t when the government excempts themselves from it”

Can you explain this please ?. I cant get it.

I've never ever suffered boredom since retiring (early) 7 yrs ago. Self-directed project after project. Currently in a bidding war which might lead to the next big project. If anything, I'm dying of excitement.

Nope, it isn’t. It’s the same for everyone.

Not really, DB pensions get scaled to become an equivalent value to be compared against the lifetime allowance. The current scaling factor of 20x annual income is far more generous to DB pensioners than DC pensioners.

Eg DB paying 50k per annum. 20x £50 = £1m, under lifetime allowance.

No way could you an annuity paying £50k pa with the lifetime allowance as a DC pensioner.

You'd be off your heed to buy an annuity anyway.

I'm aware that DB's get assessed towards the LTA and (if compared to the CETV) appear to offer more "cash" before the high tax kicks in, but they really don't. As I've said, there is no money in a DB pension.

I know that DB is considered the golden pension etc etc but it's not the be all and end all. I've transferred mine out into a SIPP and am over the moon at the benefits now available to me that a DB didn't offer.

And I'm not an MP. 🙂

As I’ve said, there is no money in a DB pension.

Maybe you mean unfunded DB pensions (eg Police, MPs etc), but most private DB schemes have billions in them....

In the UK it's in the trillions: https://www.thepensionsregulator.gov.uk/-/media/thepensionsregulator/files/import/pdf/db-pensions-landscape-2019.ashx

but they really don’t.

Feel free to show your workings....

The pension fund has money in it.

You're defined benefit pension is not money, it is the promise of benefits , index linked, for life.

It is not "cash" that belongs to you. Hence no they really don't, there is no workings because you cannot put a cash value on benefits that are not money. Those include the promise of payments to a spouse, death benefits etc.

I know they are paid in cash but are not "money in bank" somewhere waiting for you.

You’re defined benefit pension is not money, it is the promise of benefits , index linked, for life.

It is good to get a different perspective from the usual "gold standard" DB pensions stuff. The PPF guarantees are all well and good but how much are they worth if several large schemes collapse and empty the pot. Although, if that happens, then I guess DC pensions will also be hit pretty badly.

On the flip, all the stock markets have been going up pretty steadily for more than 10 years. Which I think has given a an overly reassuring impression on the stability of DC schemes and their value compared to DB schemes and annuities.

... but it is interesting that the FTSE today is barely higher than its level in 1999. And the Nikkei is still some way short of is value in 1990. Of course the Dow has done much better - but past performance is no guarantee of future gains etc. I don't think a substained 50% market correction in real terms (adjusted for inflation) over a 10 year period is off the cards.

My inclination, for peace of mind, is to have a balance of fixed income (DB, annuity, state pension) and investment income. With hopefully having enough fixed income to get by.

Can you explain this please ?. I cant get it.

Governments pass laws all the time. Most laws are a compromise. For example, restricting immigration is good for headlines, and bad for business. The government know it's going to make things harder, so there are specific things to allow it not to apply to nurses, as not employing foreign nurses would make life hard for the nhs

Likewise here, they want to change the law to make everyone retire later, except things like firemen, armed forces (who are all employed by the government), because upping their retirement age would make recruitment harder. I know they are physical jobs, but not significantly more so than manual labour, so it's bs.

You’re defined benefit pension is not money, it is the promise of benefits , index linked, for life.

It is not “cash” that belongs to you. Hence no they really don’t, there is no workings because you cannot put a cash value on benefits that are not money. Those include the promise of payments to a spouse, death benefits etc.I know they are paid in cash but are not “money in bank” somewhere waiting for you.

Where do I start...

cannot put a cash value on benefits that are not money

You can very easily. You ask an insurance company to provide the same benefit and they will give you a one off cost for buying such a policy.

but are not “money in bank” somewhere waiting for you

It's not money you can freely access, but the actuaries have to ensure that there is money in the bank waiting for you that can provide the benefits you are due. Normally its invested in shares and bonds rather sat in a Tesco instant access savers accounts.

there is no workings because you cannot put a cash value on benefits that are not money

You should really talk to an Actuary, as you've just implied their entire profession doesn't exist.

On the cash owed to you front, one of my DB pensions collapsed and liquidated recently and I've actually had the 'cash owed to me' returned. I basically got a percentage of the total pot (which was billions) allocated based on the ratio of my costed benefits divided by the sum of all pensioners costed benefits (as costed by an actuary). I'm due another cheque soon as they found some more money after the first major settlement and I am owed another chunk of the left over cash.

So, going back to my original point. If you compare £50k pa index linked DB pension with 50% widow allowance against the equivalent DC pension and how the are affected by the Lifetime allowance it's very simple. You ask an insurance company for the price to buy such a policy (annuity rates are easy to look up) and you'll find it costs more than the lifetime allowance. Where, as MP getting a DB pension with the exact same terms would not breach the lifetime allowance. Hence, there is a clear lifetime allowance benefit for DB pensions...

I am in a similair position of thinking of retiring at 57, and have been researching stuff for a while now (analysis paralysis...), so I thought I'd dump some thoughts here in case it helps anyone... I'll put numbers so people can see how it maps to their monetary situation.

I've always been an investment slacker, not paying much attention and concentrating on my software engineering job. I did start a London Life pension early on but that didn't go so well and ended up with one of those pension 'graveyard' companies.

In December the company I worked for managed to get themselves sold and I made £406k from my EMI share options. I also took a settlement of about £60k and left them in February.

The company had started a HL SIPP scheme in 2016 and I had been contributing to it via salary sacrifice (as a higher rate taxpayer) and ended up contributing about 22% of my salary.

Before I left the company I dumped as much as I could into the SIPP to max out this years contribution allowance, and also the last 3 years. I then consolidated all my other pensions into this one HL SIPP and ended up with about £500k in there.

I hadn't got any ISAs so I maxed out last years and now this years allowance with some Scottish Mortgage investment trust.

I paid off what was left of my car loan and also the mortgage.

My HL SIPP had been in their balanced fund, which had only been mediocre in performance. I sold that and then had £503k in cash waiting for me to decide what to invest it in...

I then bought about £60k of Fundsmith and £60k of Fundsmith Sustainable just so some of the money was working.

Initially I had thought that I could use my share options money to launch myself into a career of stock picking, or swing trading, before realising that this is a very risky route with little chance of real success, or at least beating a market tracker fund.

[A membership to Stockopedia meant that stock picking might have worked to some extent, but when you start considering retirement then the risks of losing capital look much scarier.]

I also played around on the Bitstamp exchange with ETH to get some 'skin in the game' as I heard that you need to do this if you want to get accustomed to the 'markets' and volatility. I managed to lose some money by leaving it in ETH overight and then panicking and selling at a low point, and then spent some time trying to pull it back and seeing how spreads and commisions get in the way, etc. It was a useful exercise for education and experience reasons, laarning how difficult it is to 'time the market' and about behavoural finance.

I then looked into retirement and started playing with the free simple pension predictor calulators (the Which one is probably best - https://www.which.co.uk/money/pensions-and-retirement/pensions-retirement-calculators/income-drawdown-calculator-a5pj57u5134k).

My basic idea was that I have enough money in the ISAs and outside of the SIPP to support about 10 years of about a £35k equivalent salary which will get me to 67 and state pension age, so I just need to make this money grow at the inflation rate. Then I will access my SIPP in conjunction with the state pension, and hopefully my SIPP will have grown to be bigger than it is now. The SIPP then needs to keep growing at inflation or better.

And I have the equity in the house to back up my plans - if I move to Wales from Surrey I could free up £200-300k.

[Following on in the next message as this site is having a problem with large messages...]

I also found these sites:

and

https://evolvemyretirement.com/

Both are subscription although the fees aren't large.

I've used the RetireEasy site more but the EvolveMyRetirement site does Monte Carlo simulations based on your projected portfolio returns whch is probaby a more desirable modelling as it models disaster scenarios.

Both sites reckoned that I could retire, dependant on future growth rates of my portfolio. On RetireEasy I have modelled reducing my income continually from 70ish which increases my chance of success and is also probably realistic.

And there is the crux of the problem, determining what future growth rates, and inflation rates, might be...

Having determined that I could possibly retire I started looking into this more, watching videos from these sites:

Edmund Bailey: https://www.youtube.com/channel/UCCi9h7nlb1VMnGd0TDj6Dbw

Chris Bourne: https://www.youtube.com/channel/UCNKnBa8i3ROnBtAnisJdMMQ

Ben Felix : https://www.youtube.com/channel/UCDXTQ8nWmx_EhZ2v-kp7QxA

PensionCraft : https://www.youtube.com/channel/UC9OIwUcx-Uss7xj7s1P5XGw

and probably the most useful :

Next Level Life : https://www.youtube.com/channel/UCbsDR27rGCFdDKQVRl_tgEQ

I then bought some 'Vanguard FTSE Global All Cap' and 'Vanguard Lifestrategy 100' in equal amounts, and kicked off a transfer of the SIPP to Interactive Investor as the HL platform fees are too high, which is a big factor if you are thinking of retiring (think of it adding 0.45% to inflation).

[Note that you can keep the fees down on HL if you use investment trusts and ETFS, but I determined that I might want to only use funds when I am older and even less financially competant...]

[And some providers charge fees for going into drawdown and for making UFPLS withdrawels, one factor which led me to Interactive Investor.]

Then Meaningful Acadamy launched their retirement planning site and I joined, after watching some of their youtube videos.

https://meaningfulacademy.com/

The joining fee was £495, which is a one-off fee. I think it goes up shortly, or maybe has. I missed joining as a 'founder' which would have been cheaper. He is a financial planner and there is a series of videos on retirement planning and, notably, the initial joining fee gets you access to Voyant Go (£120 p.a. after the first year) which is a planner that many advisors use and not normally available to retail users (or so I understand).

I haven't started using it yet but will do shortly. I am hoping that it, and more analysis of the output from the other two tools, will help me with the planning of tax.

So my main point of analysis paralysis at the moment is how to structure my portfolio to give both a decent reliable return and copes with the dire 'Sequence of Return' risk which could blow everything out of the water.

Some portfolios are also much less dependant on their start dates than others - 100% equities looks particulary bad for this, especially with US CAPE ratios looking so high, so my current choices may not be so great...

I am obviously working on the 4% type of rule, although in the UK this should be more like 3.1% apparently.

Many advisors (Morningstar, Meaningful academy) advise using buckets of risk, with a cash buffer (0 risk but deflationary) at the start and then each bucket taking more risk to get more growth.

However my problem with this is that the overall return rate is reduced as you are parking maybe 5 years or more of money with substandard return rates, which will affect your chances of not running out of money.

Plus they talk of the highest risk in the end bucket, which would probably be 100% equity as many advise, but there is always the possibility of a crash that takes longer than the prior buffering buckets to recover, so meaning that you are drawing down on depressed equities, which is fatal if done early on.

For a retiree there is a strong suggestion that, even now, a traditional 60/40 portfolio is a better choice for your riskiest portfolio. They have steadier (less volatile) return profiles that, over certain periods of time, can return better results than the aggressive portfolios whch have dipped and are still trying to recover that dip at the time when you need them for withdrawal.

And there's more suggestion that keeping the portfolio as separate asset classes, rather than hidden behind a Lifestrategy fund, and taking your pension withdrawals as part of the portfolio rebalancing process (with a cash buffer to use if all asset classes are depressed) is an even more successful strategy.

And there is the attractive 'Golden Butterfly' portfolio which looks very consistent. minimising volatility and start date risk and therefore providing higher safe and perpetual withdrawal rates:

https://www.youtube.com/watch?v=x37HSWNJquk

I know Bonds look bad now but they also have in the past. This portfolio also provides more asset classes to 'rebalance' and so less chance that they will alll be depressed at the same time.

And another idea I have picked up is that, if you can keep that SIPP at a decent level through retirement (perpetual withdrawal rate) you can then use it to buy an annuity later on, when the rates will be better because you are older and therefore closer to the 'end'.

This is desirable as your financial competance reduces with age and so you want to free yourself from having to mange your portfolios as you get older.

Today Amazon should be delivering the Bogleheads books in investing and their 3 fund portfolio, which might give me some more ideas.

Where do I start…

No idea mate

You can very easily. You ask an insurance company to provide the same benefit and they will give you a one off cost for buying such a policy.

An annuity is not a DB pension. And it would take up vastly more of your LTA cause they are shite and appalling value for money.

t’s not money you can freely access, but the actuaries have to ensure that there is money in the bank waiting for you that can provide the benefits you are due. Normally its invested in shares and bonds rather sat in a Tesco instant access savers accounts.

So it's not money in the bank then ?

On the cash owed to you front, one of my DB pensions collapsed and liquidated recently and I’ve actually had the ‘cash owed to me’ returned. I basically got a percentage of the total pot (which was billions) allocated based on the ratio of my costed benefits divided by the sum of all pensioners costed benefits (as costed by an actuary).

So basically they gave you a CETV in lieu of the benefits owed to you ?.

I could do this all day but you're last line about MP's just implies a chip on your shoulder about have's and have nots so I'll bow out.

Fair play @bullshotcrummond providing numbers. Your savings pot is on the large side and I suspect much more than many of us will see but it is useful to see actual numbers.

Both sites reckoned that I could retire, dependant on future growth rates of my portfolio. On RetireEasy I have modelled reducing my income continually from 70ish which increases my chance of success and is also probably realistic.

I think this is very important and has been mentioned on this thread prior. I have spent a number of hours forecasting my income and outgoings each year up until I am 72 (when my wife starts to receive her state pension) and I can recommend it. I dont want a £40k+ income when I am 75+ so my pot needs to provide me with a good income over the next 10 or so years. I have factored in that I still have a mortgage (not ideal but done for a number of reasons which have paid dividends) but once that is finished in 4 years my outgoings fall off a cliff. I estimate I can go now with relatively large outgoings for the next 18 months before they reduce then after the mortgage finishes I will only need a very small income from my savings before being dependent on the state pension plus some small DB pensions. Pension shaping is where its at!

And another idea I have picked up is that, if you can keep that SIPP at a decent level through retirement (perpetual withdrawal rate)

Isn’t 4% the magic number? Edit, sorry I read the full text above after I read Bullshots post fully. I’m a similar position to him with less money, and a vastly simplified notion of investing but watching it grow for another 7 years plus a mortgage equity seems to be the trick. I’m planning to live a relatively simple life after 60 and having consolidated expensive pensions into Vanguard funds I’ve diverted my direct debit equivalent to there also as pound share investing.

It’s easy to get trapped in the system though, I transferred 15k from an ISA to Vanguard which is sitting as cash - I won’t invest it as the markets are so high currently. Yes i know, “time in” rather than “timing” yet…

This thread has been a very valuable learning curve to get to that point.

It used to be, it's been revised up.

I transferred 15k from an ISA to Vanguard which is sitting as cash – I won’t invest it as the markets are so high currently.

I'm in a similar position. I've been holding onto a cash ISA pot for a bit too long so transferred it to my S&S ISA. I'm very wary of sticking it all into funds straight away because I know for a fact there will be a crash the next day. I've put 1/3 into funds and am contemplating what to do with the rest. Wondering if I might be better off taking it out as cash then putting it into the SIPP with a bonus from the government. I think there will be very little difference in real terms but not sure. Probably need to do a spreadsheet.

THis is a great thread - thanks to all for your views and information. I am meeting a financial adviser tomorrow to go through options for money management and how I get out of work in Jan 22 when I am 55 and 2 months.

A question to those who talk about managing their own SIPPs and investments: are you actually following the markets on a daily basis and moving your investments around? Or are you paying a stockbroker or other professional to do this for you?

The more I read the more I realise I have no idea how to manage money. So I think I must pay someone to manage it, but obviously I begrudge paying someone out of my hard earned savings/pension/pot. But that is something I guess I need to get my head around.

My SIPP is with Intelligent Money.

I let them do all the work for a small fee and do not need or use an IFA

All my tax and financial planning is provided by them as part of the service.

I transferred 15k from an ISA to Vanguard which is sitting as cash – I won’t invest it as the markets are so high currently. Yes i know, “time in” rather than “timing” yet…

I’m in a similar position. I’ve been holding onto a cash ISA pot for a bit too long so transferred it to my S&S ISA. I’m very wary of sticking it all into funds straight away because I know for a fact there will be a crash the next day.

Wondering if I might be better off taking it out as cash then putting it into the SIPP with a bonus from the government.

i stuck a wodge of spare cash (£1000 from memory) into my SIPP and then waited for the government top up before investing it all.

im aware that i could and should probably stick some into my SIPP as a regular DD/SO and that itll sit there until i invest. my SIPP is with HL which comes recommended but has fairly high transaction fees, so do you generally wait until your DD pot is quite large and invest once, or are some of you investing your DD contributions each month and paying (probably) smaller transaction fees? do they work out the same whichever way you do it or is it better to invest a lump sum maybe twice a year say?

A question to those who talk about managing their own SIPPs and investments: are you actually following the markets on a daily basis and moving your investments around? Or are you paying a stockbroker or other professional to do this for you?

The more I read the more I realise I have no idea how to manage money. So I think I must pay someone to manage it, but obviously I begrudge paying someone out of my hard earned savings/pension/pot. But that is something I guess I need to get my head around.

i know nothing about managing money either, and also begrudge paying a financial advisor to take a cut each year, so took advice from learned financial gurus (one in particular, you know who you are :-)) on here on how to invest over a good spread of funds.

later on i read a book (RESET i think it was called) that gave advice on what to invest in, Lifestrategy funds etc, and how to do it, and it was pretty much identical to the advice i got from here.

i give the fund a cursory glance maybe twice a year or so, never play around with it (i dont really know how to anyway), just leave it to do its job.

i read a book (RESET i think it was called) that gave advice on what to invest in, Lifestrategy funds etc, and how to do it, and it was pretty much identical to the advice i got from here.

i give the fund a cursory glance maybe twice a year or so, never play around with it (i dont really know how to anyway), just leave it to do its job.

+1

Jeez, I just did a big reply but forgot to copy it elsewhere and this pants forum has lost it!

As soon as I started thinking about retirement I realised that I nned to control my spending more and wrote a spreadsheet to do it. Although people say that you need a certain percentage of your old income to survive I am not sold on that idea - I think it is easy to switch to living more frugally, especially with my new spreadsheet helping me.

I'll describe it here in case it gives anyone some ideas.

I've arranged it as monthly pages, 12 months plus a start page.

The start page lists the balance of my main account and my expense account, and my annual expenses, along with their opening balances - which are the amounts brought forward from the previous years spreadsheet.

Each annual expense line lists the amount accrued for it so far, its 'claim' on money in the expense account.

Some annual expenses have a due date, and some are estimates of expenditure, like food or petrol.

The expense account also has a 'float' amount in it, which accomodates paying for a known annual expense before it has accrued a years worth of contributions.

Each montly page lists the income for that month, and also the balances in the main and expense accounts.

It then repeats the annual expenses listing and adds a monthly expenses listing.

(Annual and monthly expenses can increase as needed).

When a receive the income amount I immediately put the total for the monthly annual expense contribution into the expense account, and the speadsheet shows the increased accrued amount for that expense.

As the monthly expenses are pulled from my account by DD I tick them off in the spreadsheet.

I therefore know how much of my account is 'committed' to monthly expenses and how much isn't as is available for spending.

I then have a table to list expenditures, which reduces the account balance, and another for 'claimable' expenses, where I list the annual expense they is being claimed against. I then transfer that amount back into my account from the expense account.

At then end of the month I can see any excesses that I have accrued against estimated costs, like food, and claim them back into my account by putting an entry in the claimable expenses.

At the end of the month I may have an uncommitted balance left in te account, so I take less income the following month.

The spreasheet is in Excel and names all the tables that the numbers are in so I can refer to the previous months numbers 'easily' and I use the INDIRECT macro to create formula that can be copied across sheets because they calulate the table names from the month of the current sheet.

No VBA as that is against my religion.

I may move to Google sheets dependant on watching a tutorial video on it.

Basically I have gone from no monitoring of my spending to fully monitoring and controlling it, and it has been pretty painless apart from writing the spreadsheet.

Fair play @bullshotcrummond providing numbers. Your savings pot is on the large side

I got lucky - my old pots had grown a bit (although less than they could of) but it was the salary sacrifice that 'rescued' me, plus the luck of realising the share options.

Shows how important it is to start saving from an early age so they amounts you have to save are much smaller.

The JL Collins book would make an excellent Christmas present for younger relatives, assuming that they will read it!

sn’t 4% the magic number?

That number is based on the US, in the UK is it more like 3.1%.

But you are in Europe, aren't you, which has a stronger stock market, so that number might be OK.

See

https://portfoliocharts.com/2017/06/09/your-home-country-is-inseparable-from-your-withdrawal-rate/

I’m very wary of sticking it all into funds straight away because I know for a fact there will be a crash the next day. I’ve put 1/3 into funds and am contemplating what to do with the rest.

Tell me about it !

If convinced of a crash you could keep some in cash and then buy more equity when they go down - you won't know when it has reached the dip though but you will still be buying at a better price so decreasing the time to recovery. Have a rule, say buy at 30% down, and stick to that.

History has shown that timing the market like this can be difficult and people have been predicting a crash based on high equity valuations for a long time now...

Or keep some in Lifestrategy 20 as this bounces back much faster (it seems) than a full equity account, and the returns seem quite resiliant to going negative.

Then if there is a big correction sell the Lifestrategy 20 once it has recovered and buy the full equity funds as they are still recovering.

That's not advice though - do your own research 🙂

The more I read the more I realise I have no idea how to manage money. So I think I must pay someone to manage it, but obviously I begrudge paying someone out of my hard earned savings/pension/pot.

If all else fails Vanguard do a low-cost advice service - you can only use their funds but that is probbaly only a problem if you want to do esotric stuff:

https://www.vanguardinvestor.co.uk/financial-advice

A question to those who talk about managing their own SIPPs and investments: are you actually following the markets on a daily basis and moving your investments around? Or are you paying a stockbroker or other professional to do this for you?

It's very unlikely that the 'professional' will have much more idea than you about where to put the money!

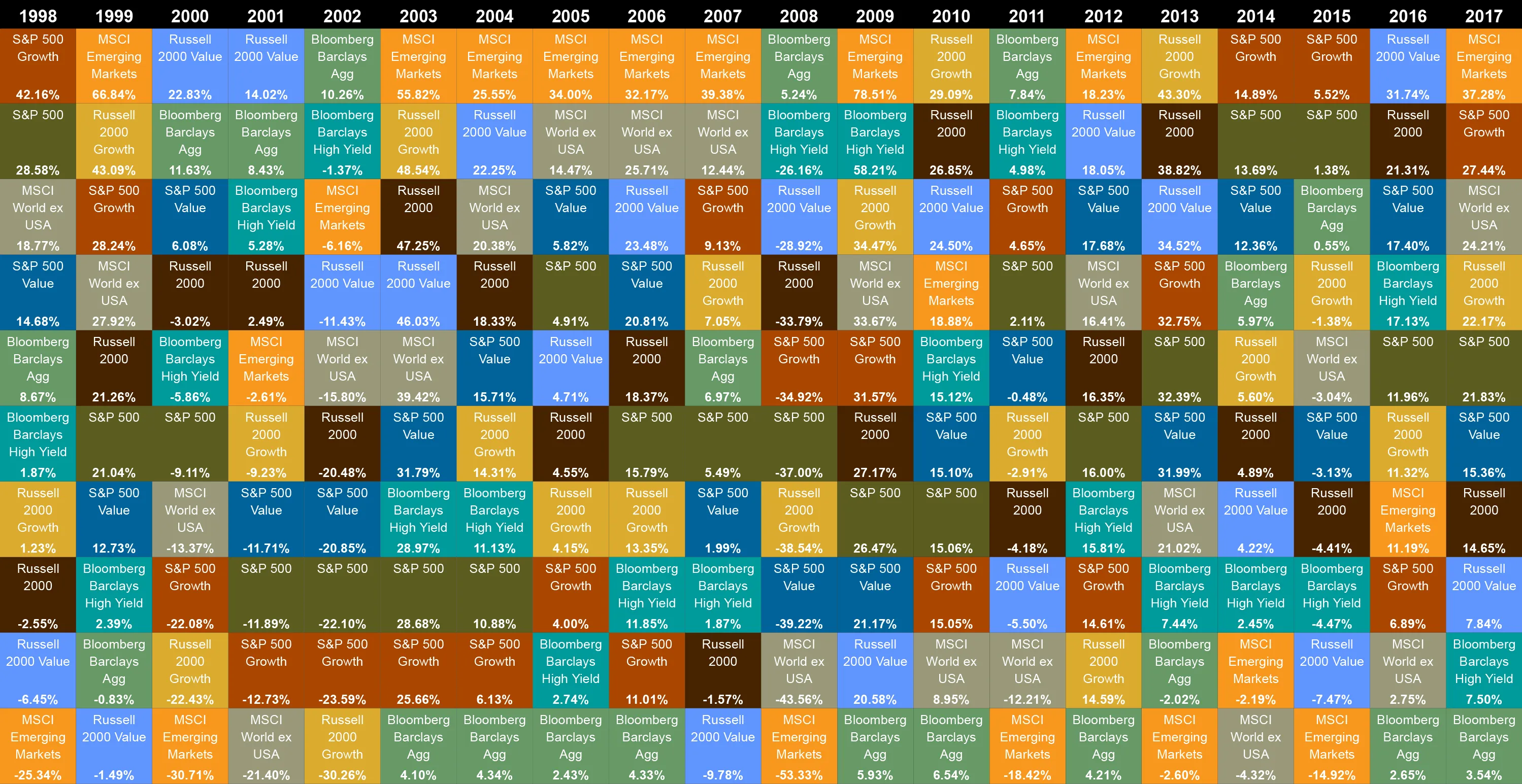

As the periodic table of investment returns shows the returns for different asset classes is pretty random and unpredicatable:

https://money.com/investing-callan-periodic-table-investment-returns/

So it is best to have a portfolio of different asset classes in the bet that some of them will preform well that year.

Vanguards Lifestrategy funds, or fund of funds, go someway towards this diversity.

The golden butterfly portfolio I am looking at is similairly diverse and has much less start date dependency than some, which is important if investing a lump sum as it has a big effect of the return you will see.

https://portfoliocharts.com/portfolio/golden-butterfly/

https://portfoliocharts.com/2016/04/18/the-theory-behind-the-golden-butterfly/

Start date sensitivity means that it can be better to go for Lifestrategy 60/40 over Lifestrategy 100, for example.

Vanguard FTSE Global All-Cap is nearly all equity (some REITS) but it is diverse across regions and an awful lot of companies so achieves some diversity that way, and should be safer than 100% equities of one country.

That number is based on the US, in the UK is it more like 3.1%.

Dynamic spending rules also help make withdrawals work with a higher degree of success:

https://www.forbes.com/advisor/retirement/dynamic-spending-rules/

After a little bit of thinking and a staycation drop in adrenaline it’s occurred to me that “retiring” at 57 without the state pension is probably a bit of a pipe dream. I’d have a projected £25k-ish pa income from SIPPs by then, but 19 and 15yo kids to fund. Both have long term child accounts we saved into from thier births intended to fund universities - currently £19k and £9k respectively - but we’ll need to convince them not spend it on cars, round the world trips, hair products, tech, Glastonbury etc first 🙂

Looks like I’ll be working into my 60’s after all and need to reinvigorate myself to the next 10 years of working, currently feeling very morose about by current job and on the crux of a job offer to start something new albeit related.

On the plus side, the markets have dropped significantly from earlier in the week to the point that when I get home I’ll have one eye on the S&P500, ftse and DJ with a view to getting that ISA cash invested.

On the plus side, the markets have dropped significantly from earlier in the week to the point that when I get home I’ll have one eye on the S&P500, ftse and DJ with a view to getting that ISA cash invested.

Vanguard's ftse global all cap only down 0.88% this week, hardly significantly, although fortuitously coincided with my monthly DD deposit 🙂

Vanguard’s ftse global all cap only down 0.88% this week, hardly significantly, although fortuitously coincided with my monthly DD deposit 🙂

....suggests that your DD is invested immediately rather than waiting for you to invest, and reminded me that i didnt get a response from the question below, and am still procrastinating. any input please?

im aware that i could and should probably stick some into my SIPP as a regular DD/SO and that itll sit there until i invest. my SIPP is with HL which comes recommended but has fairly high transaction fees, so do you generally wait until your DD pot is quite large and invest once, or are some of you investing your DD contributions each month and paying (probably) smaller transaction fees? do they work out the same whichever way you do it or is it better to invest a lump sum maybe twice a year say?

thanks

On the plus side, the markets have dropped significantly from earlier in the week to the point that when I get home I’ll have one eye on the S&P500, ftse and DJ with a view to getting that ISA cash invested.

Stop trying to trade and get the money invested then leave it.

Time in the market over timing the market.

I have a DD set to go in on a fixed date each month - the fancy pants name is "Pound Cost Averaging". In reality it's just a DD set to go out automatically on payday.

Some times you'll buy "high" compared to the rest the month sometimes you'll buy "low" for the month but regardless of the price you bought at today, in 10+ years time todays price should be pretty much irrelevant, especially once dividends are re-invested and compound interest really kick in

There’s no fees for buying funds, only shares and etfs and investments trusts.

HL only starts to look bad for platform fees once your portfolio gets large.

Stop trying to trade and get the money invested then leave it.

Time in the market over timing the market.

I am aware, thanks. Just returned home with access to Vanguard an acknowledge there funds haven't dropped as much at the markets, I'll get that in.

Nice one.

Lots of times the bloomberg feeds etc will not reflect what you see in your portfolios.

It can also be hard to keep abreast of what is actually in your portfolio due to re balancing etc, but that is why you pay a fee to fund managers.

Let them sweat it. All you need to know is that your money is on an upward curve over a period of time (which is not a week or a month btw lol)

The track record for active fund managers is not very good though, only 1 in 5 beating an index of their market. Even ones that beat it for a while tend to transition to poor performers.

They need to outperform an index fund by the differential in their fees, both ongoing and the more hidden fees, like transaction costs.

I still get drawn to Fundsmith though as their strategy of choosing winners in a sector and then holding them seems good and has worked for a long time.

But if you compare them to their relevant global index they have been down for a little while now.

So generally a broad index fund is less risky over the long term.

There’s no fees for buying funds, only shares and etfs and investments trusts.

so i could have say a £50 DD going straight into my HL account each month, and then i log in a few days later and stick it onto one of my 6 funds for no fee?

and same again next month, wait til the DD goes in, log in and chuck into a different fund etc. all for no fee?

im guessing my investments are funds rather than shares, its a spread of stuff like vanguard japan stock index and fidelity index US etc...... funds rather than shares yes, so no fees?

thanks

thanks, as you rightly say, no fees for buying/selling funds, so i assume then that i can keep adding to them as many times as i like without paying fees then.....

and they are funds, not shares yes? i only ask as its a stocks and shares SIPP and its all double dutch to me 😄

stocks, shares, funds, equities, indexes, investment trusts, gilts, dont understand a word of it 🤣

A fund is basically a collection of shares, or some other asset, rather than just that share, or asset.

On the app/website have a look at your sipp and what things are in it, click on each entry and it will probably show you more detail. You should be able to tell from there.

I’ve no individual shares in my account show can’t tell you what it would look like, and I’ve moved my sipp to interactive investor so can’t tell you what a fund would look like, but it should be obvious.

Share Funds are normally suffixed as Income or Accumulation, one pays the income out to you, the other invests it by buying more shares.

Shares will probably show you nav and p/e on the performance charts.

Investment trusts are shares as you are buying shares in the company that invests, not the companies themselves.

When you buy a mutual fund, they will then go out and buy the shares.

so i could have say a £50 DD going straight into my HL account each month, and then i log in a few days later and stick it onto one of my 6 funds for no fee?

Don't know how HL work it, but with Vanguard, I set up DD each month for say £500 to go into the "Make Scruff Stinking rich - Accumulation" fund.

Vanguard takes the DD and once received the cash automatically puts it into the correct fund / split of funds. It's all hands off from my perspective and set to run on autopilot.

When you buy shares or etfs you will know the amount you are paying, which will be the offer price. There may also be a commission.

When you buy a mutual fund you specify either the total monetary amount or the number of units required on the order. The order then goes to the fund manager. If they get it before 12 that day then they will determine the price of the unit after 3pm, and that determines how many units you get for your amount, or what you pay for for the specified number of units.

That’s why you don’t know the price you are paying with a mutual fund and things take a while.

You can set up automatic purchases on HL as well

So stepping away from 'RetirementFundTrackWorld' - a question for the retirees.

Before you retired did you have a clear idea of how you would be spending your time, and did you actually end up doing that?

I haven't retired yet but hope to in the coming year so I am seriously starting to think about this.

I plan on devoting some serious time and effort to becoming conversational fluent in French, we ski regularly and have budgeted to continue doing this in the retirement plan. I'd love to get to the point where my conversations with the locals can be in either language. I plan on rejoining a tennis club and volunteering a day a week at the local animal sanctuary.

I really enjoy pottering in the kitchen so my other half is looking forward to being well fed. I suspect a good friend is going to be retiring about the same time as me so I might even have a buddy to hang out with while the other 1/2 continues to work.

It goes without saying that I'll continue to exercise but might enter a few events just to keep the motivation up. I think my retirement initially will be an extension of my day off, the only new thing is the volunteering .....

Before you retired did you have a clear idea of how you would be spending your time, and did you actually end up doing that?

I thought I would spend my time walking/hiking, cycling, restoring my Guzzi Le Mans, volunteering for the local Wildlife Trust and maybe picking up a couple of other voluntary posts. I've done all of those except the Guzzi. I'm 10 months into retirement now, and have no regrets (apart from not getting anything done on the Guzzi). I seem to have prioritised fitness activities (the walking and cycling) over other things, and would have done more so if we hadn't been locked down most of that time. I intend to do more multi-day hikes and bike rides next year, assuming the pandemic restrictions allow.

The retirement option came up much sooner than I expected so I had no plan.

I considered re-skilling as a tour guide but looked into it a bit and realised that the sort of thing I fancied would actually involve a lot of time away from home - and my daughter was still quite young.

Looked at the voluntary sector but I found the level of organisation pitiful and knew it would frustrate me.

Accidentally fell into working in a bike shop and the rest is history.

I guess I knew that, with a working wife and young daughter, I wasn't going to give up all work at age 50, decided I'd have to do something, but just needed the right thing to come along. Being open to new/different was the key.

Before you retired did you have a clear idea of how you would be spending your time, and did you actually end up doing that?

thank **** someone has stopped talking about boring ****ing money bollox.

our plans were to go touring in europe on our bikes for a few month to start with.

but with the virus happening, and having 2 new grandkids in the last 18 month, our plans have changed for now.

we cycles 4 or 5 days a week at present and the rest of the time is looking after the grandkids.

once they are in nursery and school we will be heading to europe for a long long tour.

so yes we did end up doing what we planned i suppose. we cycle most of the time.

Before you retired did you have a clear idea of how you would be spending your time, and did you actually end up doing that?

Yes....pretty much. Cycling and walking and a bit of travel...(managed that, barring the last 18 mths) but also renovating a barn and moving abroad...not yet managed that, we've done 99% of the graft but just the small matter of emigrating post covid and post cancer to come. Life is what you make it.

thank * someone has stopped talking about boring * money bollox.

Agreed. I was going to post something after your previous post saying how inspiring it was and how happy it made me. Never got round to it and next time I opened the thread it had completely lost that joie de vivre vibe. Instead of stories celebrating the joy and release of retirement it had turned into Excel spreadsheets and checklists a budgets and loads money people telling us what fad wads of cash they are putting away. In short it had become just like working life itself.🤑

So go on Ton, tell us about retirement itself. Cheer us up.😊😍

thank * someone has stopped talking about boring * money bollox.

Instead of stories celebrating the joy and release of retirement it had turned into Excel spreadsheets and checklists a budgets

I'll just post this link then 🙂

https://www.retirementace.co.uk/

As he says

"On finally accumulating sufficient investments to retire I realised that the easy part was accumulating the money (even though it didn´t feel that way at the time!) the true challenge was devising a strategy that would ensure the funds outlived me whilst not having to live like a pauper."

This site is a UK site and shows his portfolio decisions, as most of the popular portfolio structures might leave you broke if the market goes wrong at the wrong time. Not much joy from that point on...

Before you retired did you have a clear idea of how you would be spending your time, and did you actually end up doing that?

I've not retired yet, but near and it's easy - everything I do know but with the work 'blocking' out my days.

We've a Steading, so always something needs doing - that gets in the way of my cycling. Hopefully I'll be cycling more than at the moment (presently 'only' 3 times a week 🙂 ).

Before you retired did you have a clear idea of how you would be spending your time, and did you actually end up doing that?

I had a fair idea. Five years into retirement and some things have gone the way I expected and some haven't. For example I've done a fair bit of cycling but not as much as I'd expected. However the reason for that is I've found lots of other new interests that are filling much of my time.

Five years ago I'd expected retirement to be brilliant. In reality it's been utterly awesome. Not the slightest regret about doing it. Mind you I still haven't written that best selling novel yet!!

So go on Ton, tell us about retirement itself. Cheer us up.😊😍

first thing, stop worrying about having enough money. we are living of half we had when working. it is ace.

like i said, we cycle on the days we dont have the grandkids. but like today, we will cycle with em too. i have a weeride on my bike, and a hamax on the wifes bike.

we take em on the canal to a local park with everything a babysitter needs. most important, coffee van.

regarding coffee, the joys of riding somewhere, even into town, and just sitting with no timescale, sipping coffee, watching the world go by, it is a great feeling.

we sometimes take a alpkit stove, and make a brew wherever we head on the bikes.

we built a couple of plastic greenhouses too, and have a glut of fresh red and yellow tomatoes. oh, and chillies and basil and chives. never had the time for stuff like that before. now we seen time rich rather than cash rich, which is what we wanted.

when i started this thread, i asked if anyone was prepared to live a meagre lifestyle to enable them to retire. well i am glad we did, as i feel rich in other ways now.

spending whole days of quality time with the grandkids is one of the biggest rewards.

spending time cooking is a love now too. even started doing a bit of bread making to have with my homemade tomato soup.

also, not having to cram things in on a weekend is ace. going shopping on a wednesday morning, when places are empty, just brilliant.

and through the lockdown, we all know how busy local paths and trails were. now folk are back working, it is quiet and peacefull again.

so, if you are thinking about it, stop thinking and start doing. stop worrying about finances. you may not live long enough to reap what you are saving for.

become time rich. it is ace.

Being one once obsessed with time keeping, I gave up wearing a watch (might be a bit unpopular on here). I've spent ages in art galleries. Took up wood carving. Cycling and walking. Leisurely boozing. Visiting medieval churches. Just started restoring some oak doors (will be paid with a massive tab). Listened to RTE's Ulysses about 4 times. My Mrs is retiring end of Oct, she's booked meals out, health spa, leccy bikes round the reservoir, a castle for her 61st, threatening a boat trip across the pond, we've sold our property and are moving up north. Kin loads going on. All a bit random, some planned much not. Don't miss work one bit and happily living on just over half my last salary.

Ton

That's all very well, but a bit hard to assimilate in that format. Could you put it into a spreadsheet please with exact timings, costs, balance before and after and an amortised £ per Happiness quotient please 😉

This is very dangerous to read right now - completely over my job (and career) and have the means to retire early (like 48 early !). Worried I am 'giving up' when it feels more like 'just starting' ! Heartening to read all the positive stuff so thanks.