![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

As a lot of people are finding my insurance has gone up by about 50% this year and like most in looking at ways of minimising that.

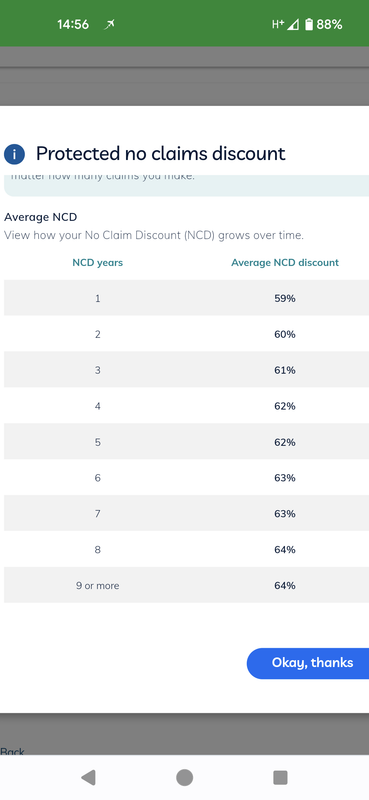

I've added by default for years but it seems pncd is costing me a fair chunk - over 15% of the policy value - and to all appearances a single claim in the year will reduce me to 4 years ncd which makes a difference of 2%. Obviously my policy would go up if I claimed regardless.

Admittedly multiple claims in the year would further reduce the discount but there's probably other things to be considered at that point anyhow.

So, is there really any benefit after about 6 or 7 years?

That's the insurance game / scam.

If it was 'worth it' then they wouldn't be offering it at that price. They've got all the data to price it at a level that works for them, and on balance of probabilities it won't therefore be worth it for you. But sometimes it is.

There's also sods law that says if you've built up full NCD, the moment you allow it to lapse......

I don't even know what happens to an unprotected NCD after an incident - does it go back to 0?

matt_outandabout

Full Member

I don’t even know what happens to an unprotected NCD after an incident – does it go back to 0?

Drops down 2 years.

A lot of people with protected no claims also don't realise that this'll also happen to them if they have 2 claims in one year (or 3 in 3 years) as you'll drop down anyway. They also often don't realise that your premium will go up after a claim anyway. Had some lovely conversations about this when working for Direct Line many moons ago

I guess so.

Protected NCD does feel like a con as you still pay more if you make a claim. Just not quite as much more as if you don't have it.

Drops down 2 years.

A lot of people with protected no claims also don’t realise that this’ll also happen to them if they have 2 claims in one year (or 3 in 3 years) as you’ll drop down anyway. They also often don’t realise that your premium will go up after a claim anyway. Had some lovely conversations about this when working for Direct Line many moons ago

2 years even if it's your fault? (You shunt into someone , 100% your fault)

So one would go from 10years to 8years? I swear there's no premium difference between 8/10 anyway.... If so.... Right... I definitely will be removing it from the next renewal!!!!!

2 years even if it’s your fault? (You shunt into someone , 100% your fault)

No fault claims don’t affect NCD. However a claim with an uninsured driver, hit n run, whatever might still screw you ever (depends on the provider)

Anything beyond 5 years is just marketing. Expect to drop from x to 3 in one go.

EDIT: I am generalising a little here e.g. Admiral's discount keeps going up until 9 years, and only comes down in steps of 2. Definitely others that dont work that way though, so worth checking your own policy

Drops down 2 years.

So one would go from 10years to 8years? I swear there’s no premium difference between 8/10 anyway…. If so…. Right… I definitely will be removing it from the next renewal!!!!!

Mine will drop to 4 years (that's a big drop in number of years) ncd with one claim, and then a year for each subsequent claim in a 12 month period.

At 4 years I get 62% discount (my arse) at 9 and above I get 67% discount... That's according to their own schedule which I assume wasn't there previously since I'm only thinking about it this year...

Ah, I lied. Not 67% with 9+ years.

Don't think about it in terms of years - find out the percentage discount it equates to. Losing 2 years no claims might only change your percentage discount from 60% to 55% so possibly not worth bothering with depending on the cost of it compared to your policy premium. If you're going to go from 35% to 10% then it may be more beneficial (but only if you have an accident)

find out the percentage discount it equates to.

⬆️5% max, assuming I don't go to zero years... ⬆️

If it was ‘worth it’ then they wouldn’t be offering it at that price

Yeah, I guess really I'm wondering if there's some "hidden" benefit to it or if it really is the money for old rope it looks like.

Uninsured driver promise from some companies protects your NCD, assuming you aren't to blame

Sometimes covers excess too