![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

MrsMC and her brothers have PoA over her parents finances and/or are executors of recently deceased fathers estate. I have thus far kept out of all this, as we are 200 miles away from her family and it hasn't been my role other than to offer supportive noises at the right moments.

Seems that as PoAs they put some of the money from the sale of their parents house (needed to cover MiLs care costs) into premium bonds temporarily while they got proper financial advice. It seems they have each done some in their own names rather than in her name, though I'm not sure that is correct. It now seems that they had an agreement that any "winnings" on the premium bonds would be kept by the person holding those bonds.

My immediate reaction is that if they are acting as attorneys and holding the premium bonds on behalf of their mother, then any winnings/interest on those funds belong to their mum and not themselves? And that if they were really unlucky and OPG did an audit on where the money they were looking after had gome and found this, then there could be repercussions?

I suspect that this isn't a huge worry to her two older, semi-retired brothers, one of whom tends to see legal niceties as a game to be played if the chances of being caught are low.

However, if MrsMC were caught up in some even minor financial breach of trust enquiry, that may impact the professional registration and/or DBS check that she needs to be able to work and earn the money that keeps a roof over our childrens heads. And I imagine that my HMRC employers wouldn't be too impressed if I knew/suspected but did nothing about it.

Am I over reacting to this, or do I need to have a tricky conversation that starts "I know that you've just lost your dad and that your mum has just had to go into a home but we need to have a serious talk...."

Didn't show up but thought it was fixed?

I doubt they can legally hold those winnings but depends on the POA / mothers wishes.

That's properly not right. They are supposed to be acting in the best interests of the Mother, not borrowing money for the sake of gambling to win some money for themselves.

Thanks TJ - her mother doesn't have capacity, so any wishes would have been arranged via her father who had capacity until his death.

Just seems a potentially dumb thing to do for the sake of a few £25 prizes, although I can hear her brother saying "it's not doing any harm"

If mother does not have capacity to consent to that then yes they are bang out of order. Perfectly OK to put the money in premium bonds but not to keep the prizes - its the same as taking the interest off the account. Its effectively theft or fraud i would have thought

I could be wrong but you're not meant to profit from acting as POA, deriving income from a bond windfall could easily be seen as profiting from what is still the MIL's estate.

Could they not have set up bonds in MIL's name with all three POAs having access to administer the account?

I can hear her brother saying “it’s not doing any harm”

Till he has to explain the arrangement to HMRC...

Did they take any professional advice before doing this?

Just seems a potentially dumb thing to do for the sake of a few £25 prizes

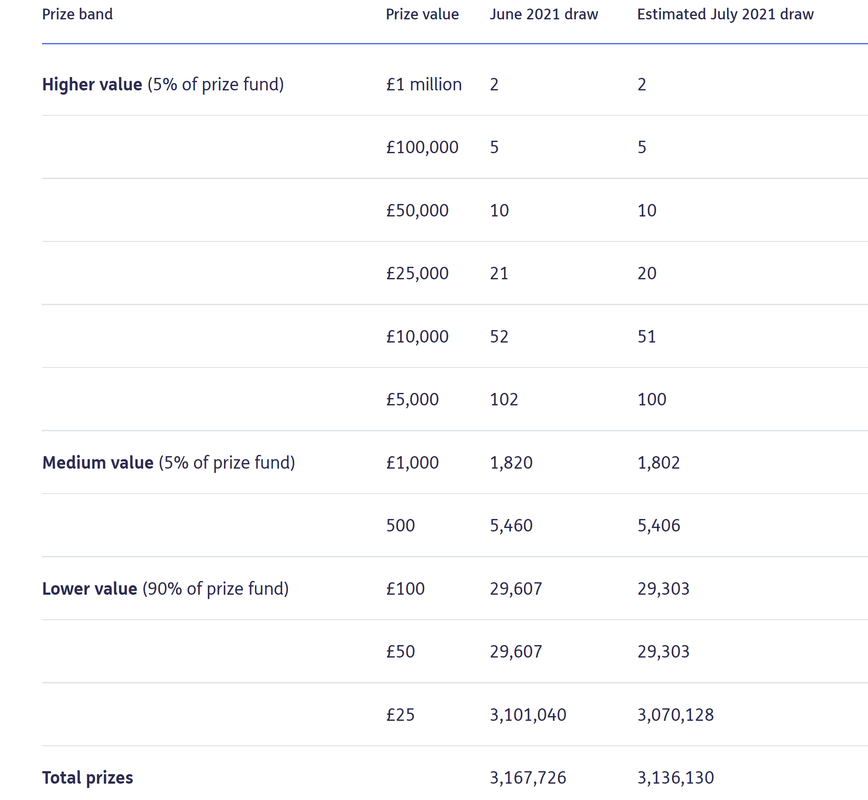

possibility of much more than a few £25's

All sounds very wrong

Thanks all, I think you have confirmed my thoughts.

Need to find out exactly what the arrangements were/are and make sure any winnings go back into the pot.

FFS.

Put winning money into more premium bonds.

All premium bonds to be sold kin the future to pay for long term care, or in the event of death, liquidised and added to the estate as cash to be distributed ad per the will.

Not sort of gambling, IHT avoidance scheme where a single family member benefit s at the bereft of others

As power of attorney you are not supposed to profit by doing it so the winnings need to be reinvested in more premium bonds for the benefit of their mother.

They should really hold them in the name of the person they are POA to be completely transparent. Ask them what they plan to do if they win the jackpot.....keep it to themselves, divide between the POAs or actually give it back to their mother.

I'm sorry if I sound cynical about this but dealing with another's finances/estate does seem to bring out the worst in some people.

Money and friends is a nightmare. Money and relatives is next level. People (some) are greedy

I’m sorry if I sound cynical about this but dealing with another’s finances/estate does seem to bring out the worst in some people.

Seen this before

Money and friends is a nightmare. Money and relatives is next level. People (some) are greedy

I don't think they're deliberately being greedy, I just think they haven't understood the legal implications of the thing they've spent weeks put in place.

If I'm being generous, this could be an innocent "brilliant idea" to invest cheaply for a short time, while everything is sorted. If on the other hand, I'm being cynical; it sounds like risk free gambling with someone else's money with a nice little potential payoff...

I'll leave it to the OP to decide.

Bear in mind this is my wife of 20 years involved in this.....

Keeping the winnings would be a serious breach of trust with consequences that could include annulment of the PoA and/or prosecution. It might fix the problem if the attorneys were to write a statement to the effect that "We have purchased Premium Bonds on behalf of our mother. We did so under our own names as we were unsure whether the PoA provided authority to purchase them in her name. Any winnings will belong to her and we will manage them on her behalf." It would probably need to be witnessed, ideally by a solicitor, who could also advise if the wording was correct.

If you want I can try and get a solicitors answer from work tomorrow afternoon?

My brother and I have POA for my mother. I do most of the money stuff. Everything is in her name. all dividends etc (including premium bonds because she likes them) are paid into her named account.

My brother and I claim expenses e.g. buying paint to paint her house before it was let out. We keep detailed records in the same way as for work expenses and both can see all transactions.

I'd suggest that all the premium bonds be moved to an account in your MiL name including any winnings ASAP.

Never mind the potential winnings, putting the bonds in their names in the first place is surely wrong?

If you want I can try and get a solicitors answer from work tomorrow afternoon?

That would be helpful thanks. I've a colleague who is ex OPG as well who I will speak to tomorrow.

Still waiting to get the full facts and background on the premium bonds, only a couple of days since her dad died, it's not the best time to be hassling her to be fair.

So they've taken her money for a "risk-free" gamble, and promise to pay back the capital.

Some combination of dishonest, incompetent and/or thick seems to cover it.

No-one who has bothered to read the guidance could possibly think this was ok and it doesn't take a solicitor to address it.

No-one who has bothered to read the guidance could possibly think this was ok and it doesn’t take a solicitor to address it.

That's my concern. With no thought to the consequences of being caught doing this.

"That would be helpful thanks. ...." no probs, I will post a response as soon as I get one.

The offence is Fraud on a power, and can lead to up to 7 years in jail, but it won't in this case. We dealt with a case a couple of years back where a couple had spent 250k of their elderly neighbour's assets and they got 2.5 years each.

Technically they have done wrong, the bonds should have been bought in her name, and any prizes reinvested up to the 50k holding limit. The OPG won't be interested as the power of attorney dies with her. The police won't be interested unless significant amounts have been misappropriated.

So as long as the prizes are paid back into the estate and declared as a part of the administration there shouldn't be a problem.

Thanks NJA.

Technically they have done wrong, the bonds should have been bought in her name, and any prizes reinvested up to the 50k holding limit. The OPG won’t be interested as the power of attorney dies with her. The police won’t be interested unless significant amounts have been misappropriated.

Was this a way to try and get £150k worth of premium bonds tax free?

How would the rest of the family feel if one of them won £1M and kept it to himself, what if it was 50k, and in 5 yrs time all mums capital has been spent and she’s got only basic “state” care and something that funding really would help? What if half the bonds he owns are his and half are hers by proxy (ie he already owned £10k of bonds and then used her money to buy another £10k). How easy/traceable whether this was his or her? And if he’s reinvested winnings from his own holding and her holding and the reinvested bond wins it’s going to be even harder to determine who should be the winner.

I don’t think it matters whether it’s illegal, technically illegal but most unlikely to be prosecuted or an obscure legal loophole; the prospect of getting in a dispute with the rest of the family if and one wins even moderately would make this a stupid idea for me.

If my husband worked for HMRC I’d certainly not tell him if I was going to do this! If my brother in law worked for hmrc I wouldn’t even be suggesting it to my sister!

If my husband worked for HMRC I’d certainly not tell him if I was going to do this! If my brother in law worked for hmrc I wouldn’t even be suggesting it to my sister!

Not if it leads to him sitting up past midnight trying to decide whether to risk his job or his marriage.

As I may have mentioned earlier in this thread - FFS

It may depend on how your parents in law will was set up but before you act just make sure that the premium bonds haven't been bought with your brother in law's inheritance from your father in law and are on effect nothing to do with your mother in law's remaining assets.

Yes we have a poa in place and the above comment 're work expenses is spot on. It has to be transparent, particularly if there's any iht liability further on.

Stressful situation though, pot of money, spiralling care costs, unknownntime span, multiple hands in the pot.

I’d suggest that all the premium bonds be moved to an account in your MiL name including any winnings ASAP.

You can only invest £50,000 in on person's name (which is why (I assume) the OPs wife/family have split the money over multiple names.

The plan to keep any winnings sucks though.

As POA you've got to only act in the person's interest.

Sort of similar situation, SIL want's to sell her house, and buy MIL's house (MIL in care). Started moving stuff in etc (MIL's now a storage area for SIL). She wanted it 'cheap'. We've had to say, no. We can't sell it to you as there is a 'charge' against the house for her care. If we sell the house, we pay the council, but then the care fees rise by £20k per annumn as it's not negotiated via the council now.

You can't have the house until MIL has died. SIL saw her ar$e, and isn't selling her house, but has left all her crap at MIL's. My wife isn't popular, but she's appointed to manage MIL's affairs, and increasing her care costs by £20k per year is not fair.

Let’s not beat about the bush. Taking the money and holding it in their own names is dishonest at the outset. There’s no way in the world anyone could argue that her giving them an interest free loan with no collateral could be in her best interests. Planning to keep the winnings is just the icing on the cake.

Worst case, one of them is stupid enough to have done something else unrelated that is similarly idiotic, gets declared bankrupt or sued for a large sum and the money (in *their* name, remember) disappears. That would be fun for all concerned. I know that’s a long shot and in all probability there will be no repercussions, but that doesn’t stop it being wrong.

Not if it leads to him sitting up past midnight trying to decide whether to risk his job or his marriage.

I'm not sure you need to risk either. First thing is, does your wife realise that what she is complicit in is potentially tax evasion, possibly illegal and at best a really bad idea. Your OP suggests that the lax attitude to their responsibilities is the brothers' not your wife's? Now when you choose to bring it up is where you'll need some diplomacy but if you've survived 20 yrs of marriage presumably you've learned something about that!

To morecash, I have asked one of the solicitors but haven't got a reply yet , will post any reply I do get though.

Knowing solicitors they probably won't commit to any answer without knowing quite a bit more information. For what it's worth my opinion is it seems wrong if they have brought the PBonds in their own names and probably wrong to keep any winnings themselves. I never know why some people seem to like to play the game, as you put it, if it gets discovered (even if that's low) it will more than likely bite back firmly.

I'd be concerned about what this does the the estate. Is there a potential issue with tax evasion/avoidance down the line? If you wife works in a finance job what effect would this have? Smells a bit of someone wanting the money before the demise of the owner and also avoiding this possible tax. The holding on to the winnings is wrong and I bet they change tune if someone else wins big.