![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

I've been paying NI since I was 16 (now 42), but have only been paying into a pension since 2011. 2 years with one provider and now 10 with my current. My current scheme is salary sacrifice and final salary based on 1/100. My employer pays 24% into this and I pay 4%. My employer also puts an additional 2% into an AVC pot. I have the option of paying up to 15% more into the AVC pot...Should I? And if so, at what rate?

I'm likely to retire at 65 (I actually like my job), so would have 35ish years of full contributions along with the state pension.

Pensions are relatively new to me.

Should I? And if so, at what rate?

It probably depends on what you can afford, what other debt you have, what you want to do in retirement etc. I expect that talking to a proper financial planner type person would be beneficial. (and 24/4 sounds like it's already a good deal to me!)

If you can afford it do it IMO. the more the better. You never know what will happen in the future. I minimised some of my pension years ago - saved a few hundred and lost me thousands. I regret it

If you can afford to pay more into your pension - do it, upto the additional 15%.

A complete no-brainer.

As much as you can afford, then some more. Typically half your age as a percentage is a rough guide, and your employer is being generous already. Provided that taking the tax-free lump some is maintained (we shall see) this is a very tax-efficient means of saving, it is also inheritance tax free, if that is a factor in the future.

I have tried to maximise my pension contribution over the years, at the expense of other luxuries. I could retire, but like you, I like my job - and the kids aren't yet off the payroll 😀

35 years contributions in a 1/100 scheme means, roughly, you'll get a pension of a third of your salary. That's quite an income drop on retirement. And is it based on your final salary, or your average salary over that time? Clearly there's potentially a massive difference.

Personally I'm whacking as much into a pension as I can afford, because I want to retire as soon as I can, and have as financially comfortable retirement as I can. MrsIHN is doing the same, and has the qualifications to back that decision up.

Oh, and the NI thing - pfft, it just means you'll qualify for the full state pension, which is currently about £900 a month which, while but nothing, is also not mind blowing.

If it's a final salary scheme what impact does increasing contributions have?

full state pension, which is currently about £900 a month which, while but nothing, is also not mind blowing.

No but from personal experience once you are retired, don't incur the expenses of going to work (travel, beer, Greggs, etc.), no mortgage, it goes a surprisingly long way.

What are your AVC's buying you ?

You say its a final salary scheme - so are the AVC's buying you more years of contribution against the 1/100 accrual rate?

Or is it more like a separate defined benefit where you are reliant on the stock market for investment gains?

If only is all I can say! If you put in 4% and your employer 24% then you are one of the lucky few. Although that doesn’t sound right because even a basic workplace pension would see you contributing 5%.

If you don’t pay separately into a private pension then definitely you should put extra into this one.

If only is all I can say! If you put in 4% and your employer 24% then you are one of the lucky few.

It's pretty typical of the financial sector. I spent my last decade at work with a bank - I put in the max of 6%, employer contributed 23%. Made a pretty significant difference to my pension pot in a short time. Which is why it's hard to leave the industry once in it.

The scheme I was in paid 3 years pension as a lump sum, which was less than the 25% that you can take tax free. The scheme did, however, allow you to take your AVC pot as a lump, to top it up to 25%. So I put enough into AVC to do that. If I could afford more, and I have enough left in my annual allowance, I put it in a SIPP. Unless there's a reason to use AVCs, such as being able to take it as a lump, or because the company will add to it, a SIPP provides more diversity and flexibility.

You never know what will happen in the future.

Pessimist mode - saw a quote / tweet against the current climate projections yesterday:

Everybody is working hard to save as much as possible for a future that doesn't exist.

Against that, the irony of my pension being invested in sustainable funds.

Climate anxiety, me? Plus nuclear anxiety.

(I'm saving as much as possible on the off chance we make it there)

Or is it more like a separate defined benefit where you are reliant on the stock market for investment gains?

It's a separate pot linked to investments. I can choose the risk portfolio.

Although that doesn’t sound right because even a basic workplace pension would see you contributing 5%.

It's correct. I was (almost literally) the last member of staff to have this pension plan. It was actually closed to new entrants before I joined the company, but my paperwork was originally issued before the closure, so they allowed it to continue, despite the long negotiation to get me on board.

42? LIttle bit older than me.

FWIW I am basing my plans on there being no state pension when I hit age 68/69 - or rather, it will be means-tested out of existence for anyone of reasonable means.

So I am banking solely on my personal pensions.

Everybody is working hard to save as much as possible for a future that doesn’t exist.

Further irony - I wonder if that tweet will encourage people to jizz even more of their cash now on more cars/tvs/rattan effect garden furniture /other crap made from oil and shipped here from China.

Are you a homeowner Daffy?

If so I'd be making sure you are mortgage free before retirement as priority No.1.

The cautious approach is pension payments vs mortgage reduction - and indeed deciding on whether to move to a more expensive property. No point missing out on important things just to be rich in retirement.

FWIW I didn't bother on pension until I was a higher rate tax payer and had the house I wanted with a manageable mortgage

Are you a homeowner Daffy?

If so I’d be making sure you are mortgage free before retirement as priority No.1.

I am and will be comfortably clear before retirement.

ypically half your age as a percentage is a rough guide,

it should be half the age you start contributing. So if you start at 30, whack in 15%, if you start at 40, whack in 20%, etc. Its a bit vague as it depends on when you want to retire and is a bit s..t for older folks (if you start at 60, 30% of your salary in won't make much difference), but there ya go.

I'd agree with the above, throw in as much as you can if you're a higher rate taxpayer. If you only pay 20% tax now, its unlikely to be particularly advantageous

Oh, and the NI thing – pfft, it just means you’ll qualify for the full state pension, which is currently about £900 a month which, while but nothing, is also not mind blowing.

But the sum needed to get an index linked lifetime pension of £900 a month is.

I'd only pay any extra in if you'd no other debts, and be aware that any money you do put in is there for good - so a nest egg to cushion any 'blows' ought to be created first.

I’m not well off, but could reduce disposable income substantially to pay into the pension…

I don't have much to add beyond:

My employer pays 24% into this and I pay 4%.

24% is super generous benefit...or am I just an impoverished charity worker?

24% is super generous benefit…or am I just an impoverished charity worker?

What I don't understand is that figure being quoted alongside the 1/100ths final salary figure. Surely it's one or the other.

WGAS whst perc the employer is paying if the OP is going to get x/100 at retirement.

Most pensions are DC ( 24%) or DB (x/100)

This one purports to be both, which is messing with my brain.

Help....

I’m not well off, but could reduce disposable income substantially to pay into the pension…

Do you have a clear understanding of what your pension could look like with the current payments and what the difference would be if you paid in X% more, and do you have a clear understanding of whether that would support your desired lifestyle in retirement? If your current pension (and mortgage etc) plans already allow you to live as you choose in retirement then there's less incentive to add more (a bit of a safety net is always worth it). There's not much point losing current disposable income to build up your pension if it's still going to be sat in the bank when you die.

It’s worth checking that you’re not lacking any NI contributions because for a relatively small amount you can make them up and get a good return.

I seem to remember that although on average people tend not to save enough for retirement, that gives a deceptive picture.

There are many people who make no planning whatsoever for retirement. In fact many of them are currently living in debt with cars on PCPs, high personal debt and a large mortgage. You’d be surprised how outwardly well off they appear.

These people are quite numerous and bring the average down a lot.

Amongst those who do save and plan, I believe that quite a few end up over-saving because they believe that in retirement they’re going to carry on doing the same things that they did when they’re working, when in fact they don’t tend to.

Interestingly, I believe that the data for the health of men who retire is pretty bad. Men have a tendency to vegetate after they retire, so if you’re a man, who has a job where it’s possible to keep working after retirement age, then it may well be best to. This also alters the pension equation quite significantly.

It’s pretty typical of the financial sector.

'cking Ada, I'm in the wrong game!

PS pension advisers have a financial incentive to tell you to save more*.

*unless you’re wealthy enough to actually be able to employ a wealth manager.

PS pension advisers have a financial incentive to tell you to save more*.

This is very true.

And as ever, they compare to 'average' and base things on 'wouldn't you like a nice holiday and a car when you retire?' which sucks you into panicking about retirement.

The deadline for missing NI contributions has been extended (again) by 2 years, by the way! Just announced today

If you are a high rate taxpayer I would max out the avc s, you won't notice it after a while.

First question in any pension discussion is how much do you want to have when you retire? Huge amount of rubbish and some truth available on line. Some people say 2 thirds of your normal income others will quote figures from https://www.retirementlivingstandards.org.uk/ - You need to make your own mind up based on your lifestyle.

Then look at your DB scheme, look at the state pension and work out if there is a shortfall which you will need to make up in other income. If there is shortfall think about how you want to fill than. Putting more into a pension is great but may lock the money away beyond when you want to access it. I want to finish work @ 55 but will not be able to access my pension pot until 57. So I know I need 2 years worth of cash available outside of my pensions. (And those first two years are likely to be more expensive years than later in my retirement if you want to do a round the world trip, splash out on new car etc.) If you are happy to work until 65 this is not an issue and AVCs may make tax efficient sense right now.

All of this is gamble - you might drop dead at 55 and never access your pension. Then it becomes about inheritance tax planning which is a whole new thread!

db (not a financial advisor!)

What I don’t understand is that figure being quoted alongside the 1/100ths final salary figure. Surely it’s one or the other.

WGAS whst perc the employer is paying if the OP is going to get x/100 at retirement.

Most pensions are DC ( 24%) or DB (x/100)

This one purports to be both, which is messing with my brain.Help….

Truthfully, the 24/4 doesn't matter much unless comparing against another job with a different scheme; it's a DB pension with an allowable lump sum payment, which I believe the total contribution does count toward....?

The other part of the scheme is the AVC (Additional Voluntary Contributions) which I can pay a maximum of 15% (in addition to the 4% I pay toward the DB scheme) and which is tax deductible.

I am a higher rate tax payer - I DON'T work in finance.

Its a hard question to answer without knowing more about how you are set for rainy day funds and other, more easily accessible, investments for other life events - kids going to uni etc

if you are a higher rate tax payer then adding to the AVC's seems attractive as you immediately get 40% tax relief and other beneficial side effects like potentially taking your salary below the child benefit threshold if you have kids.

but, that all comes at the cost of locking that money away for probably 20 years (assuming retirement ages goes up again before you get there - its already gone from 55 to 58 by the time I can get my pension) .

So unless I really had loads of disposable income I'd probably put a smaller % in the AVC and direct the rest to a stocks shares ISA - you don't get the tax breakes going in, but you don't pay tax on the proceeds either.

So unless I really had loads of disposable income I’d probably put a smaller % in the AVC and direct the rest to a stocks shares ISA – you don’t get the tax breakes going in, but you don’t pay tax on the proceeds either.

But rather than an ISA, you could put it in a SIPP. Then you get the tax breaks (ie, the tax band you're in after retirement rather than when working, and 25% is tax free). You have more control over money you've put in a SIPP than in AVCs, but go for the AVCs if there are other benefits, like the company putting something in if you do.

I have limited savings - 6-12m of current outgoings dependent on what level of lifestyle I wanted to keep for the family. I do have some other assets available if required, but they're not substantial. No debt other than a mortgage and a small home improvement loan which is paying itself (1.49% rate).

My outgoings are around 1/3rd>2/5ths of monthly income. At 15% contributions (in addition to the 4%), it would be a significant chunk of monthly income.

Based on various online calculators, individually, I'd be on the cusp of comfortable, but with my wife, we'd be comfortable. With the AVCs, that would push us well into comfortable, but at the expense of the present. It's hard to ignore the tax saving, but...what about now? Arrrrgh!

Do it.

I hate threads like this, it makes me realise how unprepared/oblivious I am to what I should be doing. And I’ll be 40 in a couple of weeks so should probably get on it 😬

I’ll keep an eye for any handy generic advice in here!

I hate threads like this, it makes me realise how unprepared/oblivious I am to what I should be doing. And I’ll be 40 in a couple of weeks so should probably get on it 😬

Yeah, you should.

I’ll keep an eye for any handy generic advice in here!

If you want generic advice, you won't get much better than "the best time to start saving is twenty years ago, the second best time is now".

I hate threads like this, it makes me realise how unprepared/oblivious I am to what I should be doing. And I’ll be 40 in a couple of weeks so should probably get on it 😬

I’m hoping I’ll die just before retirement age as it’s that or poverty. Decent life insurance so Mrs F and the kids will be okay.

Sounds like the OP is in a good place to maximise contributions in a tax efficient manner.

I hope to retire in 4-5 years (aged 57 at mo) and am paying a load into my company scheme, with annual lift outs to a privately managed Investec fund. The target has always been to get to the golden £1M pension pot, but that’s not looking too great these days..

There is so much conflicting advice as to what size of pot is enough to maintain a good lifestyle.

35 years contributions in a 1/100 scheme means, roughly, you’ll get a pension of a third of your salary. That’s quite an income drop on retirement.

Obviously that's true but:

(hypothetical numbers loosely based on national averages), £30k at 30 doesn't go very far paying for pension contributions, a mortgage, and kids if you have them. £10k at 65 on the other hand goes a lot further (plus £10,700 state pension).

No state pension at 65. 67 or 68 now

There is so much conflicting advice as to what size of pot is enough to maintain a good lifestyle.

Depends very much on how expensive your lifestyle is and if its for one or two people

Last time someone put up some tables on tjis it suggested you needed more than i ever earned as a nurse for you pension just to be comfy

Men have a tendency to vegetate after they retire, so if you’re a man, who has a job where it’s possible to keep working after retirement age, then it may well be best to. This also alters the pension equation quite significantly.

This is where I am at the moment. I shall be 60 at the end of the year and have a couple of pensions that are almost enough to live on - since I live very frugally. It would have been enough, if it weren’t for the recent cost of living crisis. However, I have a fear that I may well vegetate. So, despite being desperate to retire for the past 30 years, now my plan is to reduce to 2 days per week - then along with my pension I should take home close to what I’m currently earning.

What to do with my lump sums is confusing me at the moment?!

Coke & hookers then waste the rest.

so if you’re a man, who has a job where it’s possible to keep working after retirement age, then it may well be best to. This also alters the pension equation quite significantly.

S’what I’ve done. I was doing a job I enjoyed that payed fairly well, I’d paid off my mortgage so I kept on going. Until I got made redundant at the end of March, so I applied for my state pension. I’m 69 next month, I’ve got £948 pension, although that may go up 10.5% soon. I also got a £12,300 lump sum, which isn’t to be sniffed at.

I’ve also still got two of the six personal pension accounts I set up to pay off my mortgage, and a whole bunch of workplace pension plans set up by employers over the years, and they’re all in the hands of a local financial advisor who’s having to deal with a bunch of people who really don’t seem to want to let all that money out of their clutches. No idea why that might be… Hoping soon to find out how much I’ll have to top off my state pension every month. Be nice if it gave me a final salary equivalent.

24% is super generous benefit…or am I just an impoverished charity worker?

Both! 😅

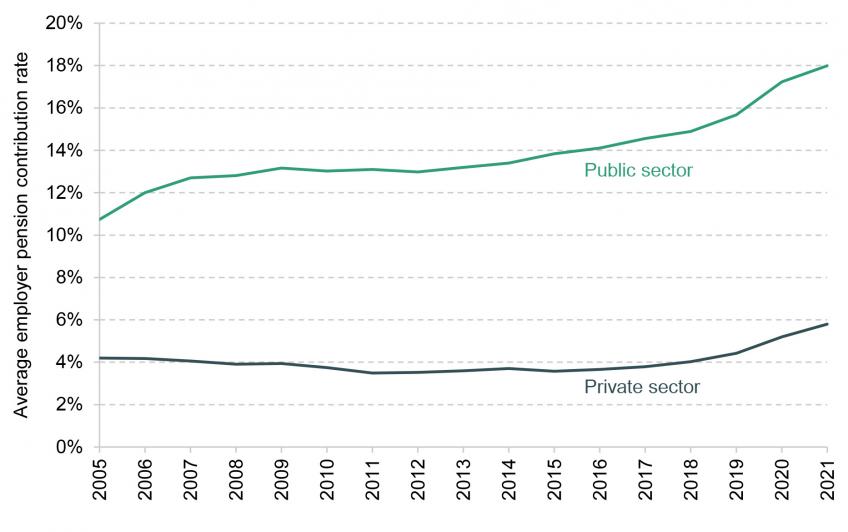

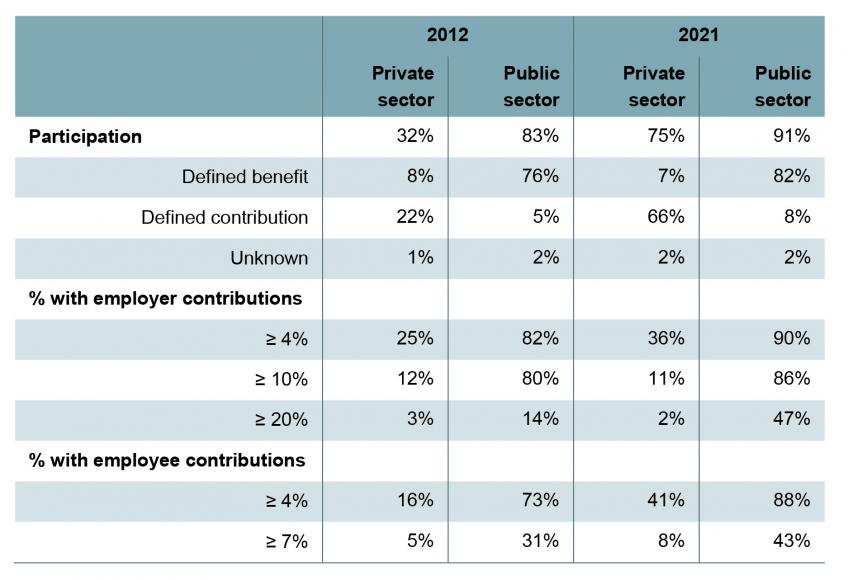

I am a poncy public sector worker and I get 11% employer contribution. MrsDoris is private sector and gets 5%.

24% seems absolutely astonishing to me.

I put in 7% and my employer puts in 14%. I thought that was industry leading. Maybe it is for retail.

Pension planning is tricky. You don't know how long you will live for. Or how much a week you will need, immediate needs can be calculated, but in 5 or 10 years time, who knows

I hate threads like this, it makes me realise how unprepared/oblivious I am to what I should be doing. And I’ll be 40 in a couple of weeks so should probably get on it

I'll be 50 next year, have no clue about retirement!!

Mrs TJ had a 25% employer contribution in one job. It came about because they were on public sector payscales ( but a charity) but wanted to give the staff a significant raise and this was the easiest way to do it. Highly unusual tho

no clue about retirement!!

The basics are really quite simple. At 67 you should get about £10k per annum from the government to live on. On top of that, take whatever you have saved up by whatever means and divide it by the number of years your are going to live for. That’s your new annual “Salary”. Roughly speaking you should be aiming to have enough money to fund the lifestyle you’d like/need to live in for that period.

Assume you live to 87, and want to live on a £30k a year lifestyle you need another £20k for 20 years or £500,000 (it’s 25% more cause it’s taxed). Assuming you have nothing, at your age you need to save approx £2600 a month to reach that target at 67.

IANAFA of course and this is a gross simplification of all the facts I’ve assumed and more.

Average public sector employers contributions is 18%

47% of public sector employers contribution are greater than 20%

I guess the big question these days is what is retirement? For many people there may never be the opportunity to 'stop working'. But that is ok if there are jobs available and suitable for the people who want/need to continuing working. Clearly some jobs take a physical/mental toll on people and simply carrying on working is not possible.

Despite my job being office based which I could continue to do, I want to stop at 55 and take some time to travel. That doesn't mean I will never work again (but I'm also not naive and recognise getting a job at +60 may not be easy).

So we saved hard and I've been lucky in my career so now have a nice pension pot across 2 DB and 1 DC schemes which means removal of the LTA was welcomed. This pot plus savings in ISAs means I can realistically stop at 55 and focus on other things.

Was this the right decision - who knows!? I know people my age with no savings. They spent their late teens and twenties (some even their thirties,) paddling and climbing whilst I was working and paying into a pension. They now look at me and wish they had saved more. I look at them and wish I had paddled, climbed and travelled more.

Not sure what I'm trying to say to be honest. Enjoy your life, try and be happy, be nice to people and don't worry too much about retirement 🙂

and am paying a load into my company scheme, with annual lift outs to a privately managed Investec fund.

Lift outs sounds interesting. My company adds NI to my contributions so effectively i think i get my money doubled compared to taking cash, but my 6 year old fund is still worth almost exactky what i put into it. I was wondering if i coumd transfer some of the money out to a less shit fund...

There is so much conflicting advice as to what size of pot is enough to maintain a good lifestyle.

Agreeed, but its no surprise given that people cant even agree on what a decent/ liveable/ comfortable salary is.

I'm working on the basis of £600k pot being very very comfortable for a person as part of a couple. £2k pcm minus a tiny bit of tax perhaps indefinitely. More if you're happy to eat into the principal

I can realistically stop at 55 and focus on other things.

Was this the right decision – who knows!? I know people my age with no savings. They spent their late teens and twenties (some even their thirties,) paddling and climbing whilst I was working and paying into a pension. They now look at me and wish they had saved more. I look at them and wish I had paddled, climbed and travelled more.

Not sure what I’m trying to say to be honest. Enjoy your life, try and be happy, be nice to people and don’t worry too much about retirement 🙂

Lovely 🙂

The basics are really quite simple.

Yep, thanks I understand the concept of retirement and that I'll need some money. What I have no idea about is how much I'll have when I get there!

I’m working on the basis of £600k pot

Currently or at the end ?

I'm hoping/thinking 55, but i expect it'll be closer to 60 potentially.

35 years contributions in a 1/100 scheme means, roughly, you’ll get a pension of a third of your salary. That’s quite an income drop on retirement.

Yeah, but limited tax, no pension outgoing, no NI contributions, possible state pension, AVC pot all means that total annual income is a lot higher than it seems on paper. Coupled with no mortgage, no energy costs and limited costs to run a car...you should have a lot of disposable income.

So, assuming all debts including mortgage paid off, how much do you think you need as an annual pension to live a comfortable life? No luxury cruises to the far east but regular eating out and a bit of travel.

Was this the right decision – who knows!? I know people my age with no savings. They spent their late teens and twenties (some even their thirties,) paddling and climbing whilst I was working and paying into a pension. They now look at me and wish they had saved more. I look at them and wish I had paddled, climbed and travelled more.

I fall into the 'worked for a charidee most of my life, spent many happy days outdoors, now worry about my pot' category. Though with mrs_oab's health of recent, I think a case of 'one life, live it' is becoming our attitude.

For me its around £15000 a year cos that is what i have. I'm 62 so that will go up at 67. I do have a lump of capital tho which is a big safety net

You have 2 choices. Decide how much money you need and work until you have tbat much or decide when you want to retire and live on how much money you have then..

Coupled with no mortgage, no energy cost

no energy costs? how?

35 years contributions in a 1/100 scheme means, roughly, you’ll get a pension of a third of your salary. That’s quite an income drop on retirement.

That's the question, isn't it? Individually, I think it would be around £30k minimum. Council tax is still high, food is a lot, there will be other utilities, which could easily still keep outgoing at over £10k. I'd still want to be saving a little for unforeseen and children will almost certainly require support, so maybe another £10k. £10k of disposable income would be nice for stuff and things. As a couple, that could reduce to maybe £25k as the bills are shared?

So, assuming all debts including mortgage paid off, how much do you think you need as an annual pension to live a comfortable life?

its all a matter of opinion - but heres one orgs stab at it

https://www.retirementlivingstandards.org.uk/

minimum standard of living £12800 per year

moderate £23300 per year

comfortable £37300 per year

all for a single person, not couple

Currently or at the end ?

At the beginning of retirement. Or the end of working. Defo not now 🙁

I’m hoping/thinking 55,

Me too. But the missus just laughs at me.

.

35 years contributions in a 1/100 scheme means, roughly, you’ll get a pension of a third of your salary. That’s quite an income drop on retirement.

Yeahbut, as daffy alludes to there's loads of stuff that changes. Currently I only actually spend about 29% of my salary. The vast majority goes on tax, NI, pension contributions and savings.

no energy costs? how?

Massive solar/electric/ASHP system.

My solar plant means my electric will be zero cost this year. If I double the size of the array, couple it to an ASHP and a thermal store, it'll remove the need for oil at £900/y.

Water will be the only cost.

The comfortable level is well above average income and more than I ever earned as a nurse

Somewhat out of touch

Oh FFS TJ. Let's not do this again. That's why they've named it " comfortable".

Thats the whole point of what they're saying. It's the upper end, the lucky ones, the rich ones...

Of course it's above bloody average, the top end is always above bloody average. That's why it's top end.

HTH

it is very hard to assess, I set my target, which I will not achieve, on retiring early 60's with a £1M pot. The reality will be 2/3 of that at very best. Wife would probs retire same time, and has a poor NHS pension. So state pension will likely kick in somewhere around 6or 7 yrs post retirement, and using the various calculators I felt that an annual personal retirement income of 40k would be nicely comfortable, as an aspirational figure.

Also, the need is not linear, and I have very much witnessed that with my own parents, who retired early 60's, with my dad passing away a few years ago in his late 80's and my mum still around, aged 90.

In the first 10 years of their retirement they spent a shed load, as they were living overseas on their sailing boat most of the time, with travel back to UK a few times a year. By the time they got to their late 70's they were back in UK, and then sold their boat and life became a lot slower, and I reckon their spend probably halved. My mum is on her own and quite independent, no car anymore, and probably spends under 1k a month all in, with coffee shops, lunches a few times a week and twice a week cleaner/home help person.

So by my reckoning, hoping to live for 25 years post retirement, I think we can budget on retirement income in the first 10 years eating up 50 - 60% of the pot, then reducing commensurately for the remaining 15 years or however long we last..

Whether there will be any inheritance for our kids will depend on the latter I guess !

This is a somewhat depressing thread.

My employer pays 8% and I'm paying nothing. I need to start paying in soon. I'm 40. I do have a previous pension but that isn't much. I decided when I moved here to England and started this job that I needed the disposable income to help me live as I was living on my own, but then that makes it more difficult to sacrifice part of my income. I then got a mortgage for the first time last year which is a term length that should see it payed off before 65. Now with increasing rates and the cost of living, paying into the pension and taking on a larger mortgage next year (renewal time) means that I'd be taking quite a huge hit if I started paying into the pension. Not ideal at all, but that's the reality. I don't lead a lavish lifestyle at all.

The generalist

Its totally out of touch. They are saying that to be comfortable in retirement you need an income significantly higher than the average earnings for someone in work. Its baloney

My parents have a retirement income for both of them around that. Multiple 5 star foreign trips a year.. new car every couple of years. Way above comfortable and that was supporting two of them

Its infuriating how out of touch stuff like this is

Perhaps if they had put the categories as managing comfortable and well off it wouldn't look so much out of touch and unreasonable

I guess it come down to lifestyle expectations. If your used to having £3k pcm drop into your bank account from your employer then trying to survive on half that will appear impossible

If you have only taken home £1500 PCM then living on £300 a week will be fine. You live within your means. This would be a few years taking £16k,pa out of a ppp. Then, at 67 taking £6k, pa as you now get state pension. So £275k still alot of money.

Thats stopping at 57. Plus 20 years life 67 to 87 on state plus drawing down ppp.

This is a somewhat depressing thread.

My employer pays 8% and I’m paying nothing. I need to start paying in soon. I’m 40. I do have a previous pension but that isn’t much. I decided when I moved here to England and started this job that I needed the disposable income to help me live as I was living on my own, but then that makes it more difficult to sacrifice part of my income. I then got a mortgage for the first time last year which is a term length that should see it payed off before 65. Now with increasing rates and the cost of living, paying into the pension and taking on a larger mortgage next year (renewal time) means that I’d be taking quite a huge hit if I started paying into the pension. Not ideal at all, but that’s the reality. I don’t lead a lavish lifestyle at all.

@stcolin - I was in a similar situation and moved jobs to address it. I was surprised to find that there are still some VERY VERY good public sector pensions available (DSTL being the most recent example - their employer contribution starts at 26%!) and many multi-national private firms also have good pensions. Don't despair, but consider thinking laterally to address it. When you're sub 40, it's all about striving and surviving, but post 40 it seems more about strategy and long term planning for things you've barely considered (or willfully ignored as they're unpleasant to consider and seem too big to solve.) It's still doable - there's 25y!

Thats the whole point of what they’re saying. It’s the upper end, the lucky ones, the rich ones…

Plus those of us who've worked hard for 40 years since leaving school at 16!

But not those that have worked hard for 40 years since leaving school at 16 but had a poorly paid job?

Its totally out of touch. They are saying that to be comfortable in retirement you need an income significantly higher than the average earnings for someone in work. Its baloney

Just because you can live on this, don't assume others can and/or want to.

You for example never had kids, we still ensure our kids are doing ok - especially as they've kids now too. We want to be in a position to help in case they need it, just like my folks & grandparents were for us.

You've also got a flat on rent too haven't you?

You’ve also got a flat on rent too haven’t you?

The flat is included in the £15k.

Isn’t it... 🤔 otherwise the £15k figure is utterly meaningless

TJ. Tell us you did include the flat in the £15k

Yes I did include the flat income.

£15000 is not a lot I agree. I chose to retire at this point and have to live on what I have. I am extremely lucky in also having a chunk of capital although just to make you feel bad 😉 I only got that 'cos Mrs TJ died

A pension income for a single person of much more that the national average wage just to be "comfortable" is absurd. If thats so then only a small% of folk will ever be comfortable in retirement.. IIRC those numbers are from a financial services company and IMO its about trying to scare folk into using their services. to have a pension that big you have tohave been amongst the more well off folk

In the borders- are you really meaning to insinuate I have not worked hard since I left school?

.

.

.

.

.

.

.

.

.

..

Actually you are right I spent a lot of time part time and took a good few years out 🙂

I didn't get my shiz together till I hit 40 and have just retired at 53.

Max pension contributions each year, was 40k, now higher I think from the last budget.

These sites saying how much you need are crap. Only you know what you need so start logging your spending to determine where it's going.

Currently living off ISA and can access my private pension in a few years pending further government meddling.

With a few clicks you can download the complete calculations they've used:

(Doesn't stop people disagreeing with what Loughborough Uni selected for costs of course, but it is transparent)