![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

Firstly, creation of what some regard as money by (commercial) bank lending, the fractional reserve and so on. And secondly debt owed by a government in overseas currencies, failure to pay whereof appears to be a signal for economic woe.

Commercial bank money works on a different circuit to goverment spending - but is underpinned by the BoE. Commercial banks have accounts at the BoE to keep reserves in check.

We don't really have fractional reserve banking in the UK.

It's mostly in the form of loans that have to be repaid. So not what I would call net money. Government money doesn't have to be repaid.

Debt over-seas, can you be specific?

Some UK government debt is denominated in $ or €. Presumably those currencies are needed for something. So the national economy is connected with currencies over which the UK government has no control in a fiscal kind of way, not just because of trade etc.

Ah, UK foreign denominated debt is tiny.

About 8Bn I think. It changes all the time.

Worth remembering on the other side of the balance sheet whenever another country saves or invests with the UK they have to make Sterling investments.

And further to all this exports are a real cost (because you're getting rid of a resource) and imports are a net gain (because you're swapping something you have an unlimited access to - money for a someone else's resource.)

MMT is the description of the way the state spends.

Exactly and that is all that needs to be known about MMT (assuming people have read about it/listened to lectures etc,.). And as part of how it works high inflation is not a good thing.

And as part of how it works high inflation is not a good thing.

And yet again today we're told interest rates are to rise again, punishing everyone but those who hold assets and have large savings. The refusal to use fiscal policy to reign in inflation is going to crash the economy, all so the asset values of the rich can be protected. It's madness.

And yet again today we’re told interest rates are to rise again, punishing everyone but those who hold assets and have large savings. The refusal to use fiscal policy to reign in inflation is going to crash the economy, all so the asset values of the rich can be protected. It’s madness.

But how do you propose to use fiscal policy to control inflation?

Increase VAT?

Increase general taxation levels?

You need a mechanism that impacts the majority of the population to reduce demand.

Taxing wealth isnt going to reduce demand in the economy.

It'll raise government revenue, and redistribute funds, but wont have any meaningful impact on inflation.

Its just numbers on a balancesheet, not money which is flowing through the economy.

If interest rates were going up to double digit figures then I'd be the first person to say its wrong, but they are only being raised to "normal" historical levels. The only people being hurt are those who have borrowed in excess of their means.

But how do you propose to use fiscal policy to control inflation?

MMT economists have been pointing out for ages that that this inflation would rectify itself after a 2-3 years.

Adding income to interest just stokes inflation at the higher end.

Taxing wealth isnt going to reduce demand in the economy.

The wealthy have taken too many resources - taxing them limits their ability to do this.

Taxing wealth isnt going to reduce demand in the economy.

This particular bout of inflation is not caused by excess demand. It's caused by profiteering. Raising interest rates at the moment is probably inflationary. It's hard to avoid the conclusion that it is being done in order to increase unemployment and keep the proles in their place.

The only people being hurt are those who have borrowed in excess of their means.

Maybe their means were okay before the pandemic and the BoE have now created a problem for them that didn't need to happen?

It's been demonstrated time and time again driving interest rates to put people out of work to lower inflation is a terrible way to *fix* the economy.

You just end up with defaults, and the state having to support them with less productivity.

Monetarism doesn't offer good outcomes.

And further to all this exports are a real cost (because you’re getting rid of a resource)

You are swapping a resource for foreign money. Is the distinction between foreign money and "money the gov can print" relevant?

Interesting and irrelevent aside, I recently learned that yer actual notes and coins are not made by the BofE but by the Treasury (via sub-contractors), which sells them on at face value, a nice little earner for them.

Taxing wealth isnt going to reduce demand in the economy.

Demand in the economy is not the driver of this inflation. It's energy prices mainly, with a bit of brexit to amplify the impact. If you hadn't noticed, demand is in freefall, yet prices are still rising. What we need to be doing is taxing wealth and using that money to put a ceiling on energy prices. This idea that people have too much money is nonsense.

The only people being hurt are those who have borrowed in excess of their means.

And why has that happened? Because asset prices have been protected at the cost of everything else. People haven't borrowed what they have to buy luxuries, they've done it to keep a roof over their heads and to pay the bills. This isn't a case of a few reckless people borrowing too much, it's millions of people who face bankruptcy as a result of property prices and energy prices being allowed to rise, and then having the boot put in by rising interest rates.

I'd watch the full Jon Stewart piece on apple about inflation. Economists like Larry Summers are responsible for this situation.

Taster

You are swapping a resource for foreign money. Is the distinction between foreign money and “money the gov can print” relevant?

The foreign money has to be converted to pounds for them to purchase UK products. The BoE and its agents create all the pounds.

In the USA the Chinese exporters have to transact in dollars and have a US based account. The US creates all the dollars.

But how do you propose to use fiscal policy to control inflation?

Surely it depends on what is causing the inflationary pressure? There has to be an agreement/admission that the Fossil Fuel (which includes automotive and aircraft industries), Real Estate, Finance, and (to a lesser extent than in the USA) the Arms Industry are all too out of control, all too dirty and take up waaay too much of our resources, they must be tackled (made smaller or come under steadily increasing regulation to make them cleaner) one way or another. And that's probably true of many other industries who are using their greater purchasing power to increase profits at the expense of the public.

And why has that happened?

Because interest rates were lowered meaning debt became cheap and people could borrow a higher percentage of their earnings to spend on housing.

Which lead to people outbidding each other pushing up prices.

Energy prices are falling. The wholesale market is roughly where it was 12 months ago and thats now starting to feed into the domestic market. You'll be seeing deals below the Energy Guarantee soon.

According to Rone, we should have done nothing, left it 2-3 years for the market to sort out itself.

Energy is at the root of most inflation as I have been led to understand.

You can't do anything without it.

Imagine if we put that state money to work in the UK for energy solutions?

According to Rone, we should have done nothing, left it 2-3 years for the market to sort out itself.

Inflation is not falling as a result of interest changes. It takes 2 years for that to work according to them.

In fact didn't inflation (CPI) go up last month?

Because interest rates were lowered meaning debt became cheap and people could borrow a higher percentage of their earnings to spend on housing.

Which lead to people outbidding each other pushing up prices.

And hey ho this is the economy that the Tories and the BoE created! That is the whole point of MMT - you monetise personal debt if the government doesn't spend its own money.

So you've basically observed monterism doesn't work then.

Fine by me.

According to Rone, we should have done nothing, left it 2-3 years for the market to sort out itself.

Nope. In the short term the government should subsidise bills. That's what MMT says. And it partly did.

The state did its job and did we all get excited about the national debt when you got your £66 a month?

Lol.

It’s energy prices mainly, with a bit of brexit to amplify the impact.

And climate change hitting Southern Europe and beyond.

War, nationalism & burning the planet.

The expected further interest rate increases will be counter productive, but ultimately a decision made in another country (USA)... the UK is but flotsam on the waves generated by bigger countries and political/trading blocks (I exaggerate, but we do not exist in isolation).

I've never said that one solution is perfect.

You need to adjust your approach based on the circumstances.

MMT works for one off situations, War/Pandemic/Investment

But not to patch over day-to-day issues within the economy.

And hey ho this is the economy that the Tories and the BoE created!

Lets not forget that this started in 2008

Labour started it, and the Tories have continued it (along with most western governments)

MMT works for one off situations, War/Pandemic/Investment

But not to patch over day-to-day issues within the economy

MMT describes all government spending day to day (and black swan interventions which tend to highlight that the government controls the purse) - with central banks. For the last 45+ years.

There is no working or not working in that sense.

You're conflating Q/E and MMT.

Lets not forget that this started in 2008

Labour started it, and the Tories have continued it (along with most western governments)

I agree the big parties of the West tend to be market driven. They all drank the cool aid.

Because it appeared to work throughout the 80s/90s but we were just transferring state asset created wealth to a few lucky people.

We are paying now.

Lets not forget that this started in 2008

Labour started it

You say that as if it was a party political thing done just to keep people happy? Lets not forget that in 2008 we came close to the entire banking system collapsing. The only thing that prevented that, and the resultant economic collapse/depression was the bank bailouts, zero interest rates, QE etc. The govt of the day in 2008 deserve a huge amount of credit for preventing what would have been a catastrophe. Or presumably you'd have been happy for your savings and pensions to be wiped out, your bank account to be frozen and your salary not to be paid just to keep to the status quo on interest rates?

This is why Chew is mixing stuff up.

2008 is known due to its large Q/E operation.

MMT started in the early 70s.

They're related - but he needs to know the difference from a technical point of view.

Most people think Q/E is money printing. It's not.

There's a great podcast on Q/E here.

You say that as if it was a party political thing done just to keep people happy?

I didn’t say that at all

You’ve just half quoted me to make a point.

If you’re going to quote me, at least quote me in full.

Rone said it was a Tory policy.

It was a policy implemented by the government in power at the time. Which in 2008 was Labour.

And I agree it was the write thing to do.

But what was the root cause of the issue?

People where lent money they couldn’t afford to pay back. Everyone new that, but failed to act and have been propping up that system ever since.

People where lent money they couldn’t afford to pay back. Everyone new that, but failed to act and have been propping up that system ever since.

Not because interest rates were too low. People were lent sub-prime loans because a bunch of fraudsters in the banking system saw a way to make a quick buck. The reason people have to borrow too much is because asset prices are inflated as a matter of government policy. That's what monetarism is, protect asset holders, punish everyone else. Your solution of hiking interest rates does nothing but punish the victims.

People where lent money they couldn’t afford to pay back.

People who shouldn't have been; were offered loans that they couldn't pay back by businesses that knew that but took a gamble on it anyway hoping that it would all work out in the end, and were subsequently bailed out by the rest of us. So they were proved right.

Like I said, the finance industry needs it's wings clipped for sake of the rest of us.

Rone said it was a Tory policy.

It was a policy implemented by the government in power at the time. Which in 2008 was Labour.

I think things are getting mixed up.

I wasn't referring to the GFC - although what is being said here is correct.

I was saying it was Tory policy (and Labour in recent times) - for consumers to benefit from low interest rates. It underpins the idea of monetarism and encourages people to borrow. That's the economy they delivered. Debt based.

So when interest rates go up (by deliberate BoE choices) - it seems a bit rich to say - people are living beyond their means - when they were encouraged to take on cheap debt, as that's what out economy was built around.

*Especially* when wages have lagged too.

And ultimately not much choice if you wanted to buy a property.

Latest news inflation is barely shifting.

That's because inflation is partly being topped up by income interest - by raising rates, and profit gouging.

Interest rises are a effectively a tax on people with debt - and a payment to people with assets.

Richard Murphy on LBC shortly.

*Especially* when wages have lagged too.

If we want to go to the root it was the abandonment of the policy of pegging wages to productivity back in the 60s/70s. As referenced in that David Graeber talk I posted, western economies, driven by neo-liberal ideologues fearing the expansion of socialist policies, decided to replace good wages with accessible credit, and replaced the right to economic security with political rights. Then the debt bubble blew up in 2008 and they have no idea what to do other than to paper over the cracks. Neo-liberal monetarism has had its day. MMT-based government interventionism is probably going to be the next phase in western economic policy (at least it should be).

Interest rises are a effectively a tax on people with debt – and a payment to people with assets.

This is the crux of it. You'd think the labour party would recognise the open goal staring them in the face, but instead they prattle on about balance budgets and not being able to afford to pay doctors and nurses.

And sorry to mention it again, but in that Graeber video he talks about the morality of debt and how those who are in debt are seen as inferior to those who aren't. That is our economic system in a nutshell, and something that is amply demonstrated by Chew's comments about people borrowing 'beyond their means'.

This is the crux of it. You’d think the labour party would recognise the open goal staring them in the face, but instead they prattle on about balance budgets and not being able to afford to pay doctors and nurses.

Yeah - I despair with that bit.

The only person who wanted to make substantitive change was ousted by the right-wingers, centrists, and their media pals. I can't see that opportunity arising again in our lifetime.

But here we are.

It's hard to believe how we've ended up with all the worst possible options.

Communist broadband FFS.

Communist broadband FFS.

It was wildly unpopular on the doorstep for canvassers.( I know, I was one of them)

but instead they prattle on about balance budgets and not being able to afford to pay doctors and nurses.

Because politicians have largely painted themselves into a corner about it. If Labour start to talk about the economy in a different way the Tories will pounce on it, It's a traditional attack line for them every election (that works on the doorstep) and they'll accuse Labour of "fantasy" economics or "magic money trees" or whatever. Plus from their side it sounds to the electorate like you take the economy seriously, that you wont spend frivolously, that you'll take care of folks money, you might scoff, but lots of folks don't trust Labour with taxation.

It was wildly unpopular on the doorstep for canvassers.( I know, I was one of them)

Voters get what they deserve. 🙄

Plus from their side it sounds to the electorate like you take the economy seriously, that you wont spend frivolously, that you’ll take care of folks money, you might scoff, but lots of folks don’t trust Labour with taxation.

See above.

Voters get what they deserve.

You can’t ignore them though.

That broadband policy… made perfect sense economically and socially… I was one of the few praising it on this forum… but people don’t trust the state or politicians when they present policies like that which are good for all of us. They only see costs not benefits, especially indirect ones. Whatyagonnado?!

It was wildly unpopular on the doorstep for canvassers.( I know, I was one of them)

Interesting. What was methodology and how many did you ask?

A YouGov poll, consisting of 3,653 British adults, found six in 10 (62%) supported such a move, almost three times as many people as were opposed (22%).

Whatyagonnado?!

Well you see that's the legacy form the idea that they're paying for it with taxes.

It's funny how they hardly believe anything that benefits them and then believe all the stuff that doesn't benefit them.

Super clear article about Government 'debt'.

https://twitter.com/robert19pearson/status/1648630083857395713?t=0jLZ3xatVbxMjSQkv7m1YA&s=19

Interesting. What was methodology and how many did you ask?

I didn't need to ask! as soon as they realised I was canvassing for Labour they'd let me know!

"d'you think we're too poor for sky?"

"we've got broadband thanks, we don't need the govt using it to spy on us looking at porn"

"d'you think we need handouts?"

and many variants of that.

Ah, you were canvassing in somewhere like Windsor. It must have been proper posh as it was quite popular with Tory voters according to YouGov, in fact more Tory voters supported it than opposed it.

"Among Conservative voters the proposal received a mixed reaction, with 45% pro and 41% against."

That's a really good thread from Verity. The BBC will probably sack him for it.

It was Margaret Thatcher who particularly popularised the myth that running a country was very similar to looking after a household budget.

Misinformation and myth creation has always served the the Tories well, and generally speaking the Labour Party has gone along with them.

An obvious recent exception was Jeremy Corbyn's successful political campaign as leader to expose austerity as a false solution.

"Any woman who understands the problems of running a home will be nearer to understanding the problems of running a country."

- Margaret Thatcher

.

the delusion that financial choices are the same for a government as they are for households or firms

Yup, the same with regards to firms.

https://hbr.org/1996/01/a-country-is-not-a-company

Lol and here is what the BoE think of you asking for better wages. Again we didn't cause this mess.

But you can suck it up.

It's time the BoE was put under direct fire from the government.

Verity is on his own with all this.

Here's the BBC editorial line.

https://www.bbc.co.uk/news/business-50504151

What's even stranger is the BBC only recently conducted an investigation into the way their journalists assume the regular household narratives and were encouraged instructed to look beyond it.

"we’re all worse off, and we all have to take our share.”

Oh why doesn't he just regurgitate the Tory-LibDem austerity slogan "we're all in this together"?

It's interesting btw how in the entire article the word austerity doesn't appear at all, even though that is exactly what is being talked about.

It's almost as if "austerity" has become an unmentionable word. I wonder why.

Good summary from Richard Murphy on his blog.

The BBC should, in the interests of objective reporting, present a balanced view on the national debt https://www.taxresearch.org.uk/Blog/2023/04/25/the-bbc-should-in-the-interests-of-objective-reporting-present-a-balanced-view-on-the-national-debt/

Andy Verity in a good tussle with pro monetarist worm head Ex Chief Of Staff - Rupert Harrison. (under Osborne)

https://twitter.com/andyverity/status/1650817730621087747?t=-pAb8x7l2OAnN6YkX9l8Rg&s=19

Some good info.

Lol and here is what the BoE think of you asking for better wages. Again we didn’t cause this mess.

But you can suck it up.

The BOE are just playing the hand they were dealt and telling the cold hard truth... If you want to blame someone, blame people who voted for brexit.

The BOE are just playing the hand they were dealt and telling the cold hard truth… If you want to blame someone, blame people who voted for brexit

Brexit is not the issue specifically.

And that is not a hand that has been dealt them. Wages are not driving inflation.

The BoE are adding to inflation with interest rate rises. So they've got a nerve taking this stand. The BoE are operating a one trick pony approach - blame people needing more money to live.

That's a disgrace and a limit of monetarism's a ability to solve problems. So no I don't accept your view - raising interest rates is a choice.

This is not a Brexit issue - this is a culmination of 40 years of right-wing policy choices that causes more problems than it solves.

(I'm not disputing Brexit isn't in there somewhere but low wages are a product of neoliberalism which features under EU membership too.)

It's beyond ironic that it's Harrisons policies that have been shown to be incredibly stupid and damaging. How do idiots get into such positions of power?

UK is the worst performing G7 country, and worst performing European country... there's a common denominator here, brexit, with the side effect of enabling 'Tory extreme: turbo edition'.

The Governor of the BoE is also a chief Brexiteer so a double whammy then according to your logic.

The Governor of the BoE is also a chief Brexiteer so a double whammy then according to your logic.

Since 2020... So a Tory stooge then?

Asked whether Brexit was contributing to the country’s underperformance, he said that “there is an effect” from leaving the EU, including a “long-run downshift” in the level of productivity.

“It’s not [an impact] we’ve been surprised by. As a public official I’m neutral on Brexit per se, but I’m not neutral in saying these are what we think are the most likely economic effects of it,” he said.

UK is the worst performing G7 country, and worst performing European country… theres a common denominator here, brexit.

The common denominator is the UK being a total **** up when it comes to making good political choices.

It wasn't good before Brexit you know.

(GDP is also not the best metric for assessing a country's success and well-being.)

UK is the worst performing G7 country, and worst performing European country… theres a common denominator here, brexit.

Do you honestly believe that? That the UK is the worse performing country in Europe? And do you realise 5 of the G7 countries aren't even in the EU?

Can MMT help when people want to trade (import/export) with other economies? We still have a world with different currencies...

I think it should be called MMP

Modern Monetary Policy

It’s time the BoE was put under direct fire from the government

That had not worked out well for Turkey. Why would the UK fair better?

My argument against it (as an economic theory) is that it only works in isolation. It doesn't seem to explain how two, (possibly competing) interests, would interact.

E.g. Foreign investment is affected by the relative attractiveness of each sovereign economy.

Do you honestly believe that? That the UK is the worse performing country in Europe? And do you realise 5 of the G7 countries aren’t even in the EU?

Note the comma.

worst performing G7 country, and worst performing European country

Although I do conceed I meant EU member, rather than European country, as if we are talking strictly geographically, the UK certainly brings the average down.

That had not worked out well for Turkey. Why would the UK fair better?

How is it working out well for us currently?

Turkey are cutting interest rates to cut inflation now as raising rates shock horror raises interest rates.

(I'm not saying interest rates caused the inflation) but there is scant evidence that raising rates actually works. But banks just keep at it.

Turkey's inflation has fallen since they lowered interest rates as much as I can discern.

Supposed we should always qualify that inflation is different for everyone and we are often referring to CPI or PPI.

My argument against it (as an economic theory) is that it only works in isolation. It doesn’t seem to explain how two, (possibly competing) interests, would interact.

E.g. Foreign investment is affected by the relative attractiveness of each sovereign economy.

There is large chapter in the deficit myth about about trade balances.

Point is if you invest in your own economy with your own money and become productive you are likely to attract foreign interest.

It works in isolation because a sovereign currency issuer is exactly that.

Crucially the big economies all tend to be economies that MMT describes. USA, JAPAN, CANADA etc.

It's not a model of how business affairs are conducted.

And also it's not really an economic theory, it's an actual description.

I know it's labeled a Theory but it's different to say - something like the laffer curve which is just made up. MMT is different as it is based on a set of actual trackable real procedures rather than being an idea.

Although I do conceed I meant EU member

Well Sweden is an EU member state and its economy is performing worse.

https://www.aa.com.tr/en/europe/sweden-struggles-with-poverty-as-recession-looms/2862911

And have you seen Poland's inflation rate?

The UK's economy isn't doing well, without doubt, but it isn't the worse in Europe, and most G7 countries aren't in the EU. You might want to blame brexit for poor economic performance but there is no obvious evidence of a brexit "common denominator" from the examples that you give.

* Turkey mistake. Should read:

Turkey are cutting interest rates to cut inflation now as raising rates shock horror adds to inflation.

Sorry I put interest rates twice. Didn't make sense.

Can MMT help when people want to trade (import/export) with other economies? We still have a world with different currencies…

Sigh. Can we please get past the lazy counterpoints to MMT where there is lots of material refuting these points.

Wiemar Germany

Zimbabwe

If it worked why isn't everyone doing it?

It will devalue the currency.

You won't be able to trade with other countries

etc..

Please just go and read The Deficit Myth. All these points are covered in a lot of detail. Now, does anyone have anything original to say against MMT? If so lets have it.

Yea that book looks interesting (I read chapter 5), very US-centered though. I just think there will always be competing pressures and individuals who want to do their own thing.

All eyes on the Fed this afternoon. Expected 0.25%

Could pivot? Unlikely.

Relevance is - we usually follow. Consensus is - close to pivoting but I think they will go until they break something.

Yea that book looks interesting (I read chapter 5), very US-centered though. I just think there will always be competing pressures and individuals who want to do their own thing.

It is but most of it is interchangeable with slightly different terminology and obviously the dollar being the reserve currency.

Recent Richard Murphy (as guest) stream talking clearly about MMT. FF to 12mins if you want to get past the intro as it's Scottish centric. I'd watch it all because there's some nice clarity at the beginning.

That video sums up my scepticism about the proponents of MMT. The video is not really about MMT, it is a series of policy assumptions that MMT is crowbarred into supporting, in this case Scottish independence.

In terms of supporting your argument through this thread, none of the people in that video have any professional credibility as economists. Murphy is a retired accountant. Van Sweeden has a degree in Anatomical Sciences. Thomson has a degree in Green Economy.

That video sums up my scepticism about the proponents of MMT. The video is not really about MMT, it is a series of policy assumptions that MMT is crowbarred into supporting, in this case Scottish independence.

In terms of supporting your argument through this thread, none of the people in that video have any professional credibility as economists. Murphy is a retired accountant. Van Sweeden has a degree in Anatomical Sciences. Thomson has a degree in Green Economy

Just stuff of interest that's all.

Yes there is a Scottish thrust to it of course but there's plenty of info for MMTers that stands.

I think you're underselling Murphy there. He's done a lot of stuff and for sure he's been an accountant but these are the numbers people that stumble upon the reality of government spending.

If you want a the full picture then I listed plenty of comprehensive links above without the Scottish slant.

In terms of supporting your argument through this thread, none of the people in that video have any professional credibility as economists. Murphy is a retired accountant. Van Sweeden has a degree in Anatomical Sciences. Thomson has a degree in Green Economy

That's not a fair appraisal. I'm simply posting clips of interest - the supporting material is all the way through this thread.

In this thread we have mentioned.

Professor Stephanie Kelton:

Stephanie Kelton is a professor of economics and public policy at Stony Brook University. She is a leading expert on Modern Monetary Theory and a former Chief Economist on the U.S. Senate Budget Committee (Democratic staff). She was named by POLITICO as one of the 50 people most influencing the policy debate in America.

Professor Bill Mitchell:

William Mitchell is Professor of Economics and Director of the Centre of Full Employment and Equity (CofFEE) at the University of Newcastle, NSW Australia. He is also the Docent Professor of Global Political Economy at the University of Helsinki, Finland, and JSPS International Fellow at Kyoto University, Japan.

Professor Richard Murphy - Sheffield

Professor Richard Murphy co-founded the Tax Justice Network, the Fair Tax Mark and Finance for the Future. He founded and directs Tax Research UK. He co-created the Green New Deal and remains an active member of the Green New Deal Group. He is the founder-director of the Corporate Accountability Network.

Richard created the concept of country-by-country reporting which, with the backing of the OECD, is now in use in more than 90 countries around the world to identify tax abuse by multinational corporations. Richard created the concept of sustainable cost accounting.

Steven Hail:

Steven Hail is Adjunct Associate Professor at Torrens University and Research Scholar at the Global Institute for Sustainable Prosperity, with a Ph.D. from Flinders University, and a M.Sc from the London School of Economics. He was from 2002 until December 2020 a lecturer in the School of Economics at the University of Adelaide.

Assc -Prof Pavlina R. Tcherneva

Pavlina R. Tcherneva, Ph.D., is an Associate Professor of Economics at Bard College, the Director of OSUN’s Economic Democracy Initiative, and a Research Scholar at the Levy Economics Institute, NY. She specializes in monetary and fiscal policy coordination and employment policy.

And if you want some gravity on the mechanics of how the spending works -

Here is the paper on UCLs site for "Accounting Model of the UK Exchequer/The self-financing state: An institutional analysis of government expenditure, revenue collection and debt issuance operations in the United Kingdom"

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2022/may/self-financing-state-institutional-analysis

I suppose you could just believe Larry Summers?

None of the people above have tenure at a major university in an economics chair. Your position in this thread appears to be that MMT helps to understand how government income/spending works and why classical economics doesn't necessarily explain this well. The word 'policy' keeps appearing in their bios supporting my point that MMT seems to be crowbarred into supporting a set of assumptions about how the world could and should be.

None of the people above have tenure at a major university in an economics chair. Your position in this thread appears to be that MMT helps to understand how government income/spending works and why classical economics doesn’t necessarily explain this well. The word ‘policy’ keeps appearing in their bios supporting my point that MMT seems to be crowbarred into supporting a set of assumptions about how the world could and should be.

They have political opinions and roles too? Stephanie Kelton was an advisor for Bernie Sanders but her book avoids too much political posturing with examples of Reps and Dems doing stuff incoherently.

Happy to discuss or look at any model you might have with the supporting evidence.

None of the people above have tenure at a major university in an economics chair.

I don't know how to respond to that really other than to ask are they the ones currently advising UK political parties?

None of what you say puts forward an argument for MMT not being an accurate description. Just because an economist then goes to make a prescriptive case - so what?

there's no doubt that 4 professors support MMT, but thats a really really small number. looking at them

Bill michell - not mentioned on the university of helsinki economics dept https://www.helsinki.fi/en/faculty-social-sciences/research/disciplines-and-research-units/economics or newcastle economics dept https://www.newcastle.edu.au/school/newcastle-business-school/people/people/economics

Steven hail is part time at a university thats been in existance all of 11 years

stephanie kelton isn't mentioned on the economics department of stony brook university

https://www.stonybrook.edu/commcms/economics/people/faculty.php

there's far more qualified people in economics (more qualified anyone on this thread) who think its nonsense

A 2019 survey of leading economists by the University of Chicago Booth's Initiative on Global Markets showed a unanimous rejection of assertions attributed by the survey to Modern Monetary Theory: "Countries that borrow in their own currency should not worry about government deficits because they can always create money to finance their debt" and "Countries that borrow in their own currency can finance as much real government spending as they want by creating money"

https://www.kentclarkcenter.org/surveys/modern-monetary-theory/

there’s far more qualified people in economics (more qualified anyone on this thread) who think its nonsens

So you show me a survey and that is evidence of what? That some economists have an agenda to support monetarism?

You know I'm embarrassed for the one of them put this:

"On the second statement, Eric Maskin at Harvard observed: ‘There will come a point where the currency is so debased that further spending becomes difficult if not impossible.’ And Larry Samuelson at Yale added a further reference to history: ‘Creating money can finance a great deal of spending, but incidents of hyperinflation, collapse and other crises indicate there are limits."

I mean did he not notice that when the USA spent/created trillions its currency got stronger?

It's pure neoclassic twaddle. You can't debase a currency just because MMT is a thing. And virtually all historical records of hyperinflation relate to supply shocks. There's plenty of research.

Looks it's up to you what you believe and who you believe but that survery tells me nothing about government spending. It tells me some economists might have an agenda. And Summers' name is all over it. He was made to look silly by Jon Stewart recently.

Of course some economists don't believe it! And of course MMT is heterodox. But I'm not going down a route of here is a bit of info I found on the net that someone else might be better at economics because they filled out a survey or went to a better University.

There are more MMT detractors than supporters for sure. So what?

Given that neo-classical economists have designed and supported economic policy which has resulted in the trainwreck of an economy we now see where in the US 0.1% of the population own 90% of the wealth, where the market has completely failed to deliver the supposed competition which would keep prices down and productivity up, where public services are collapsing due to lack of govt investment, and monopolies in every sector extract unjustifiable profits from working people, I'm not sure we should give them too much respect. The system all these economists have pushed on us as being the only solution has failed. If MMT was being proposed by this lot I'd run a mile.

Creating money can finance a great deal of spending, but incidents of hyperinflation, collapse and other crises indicate there are limits.”

Isn't that what's being said by MMTers? I don't think anyone supporting MMT says that you can spend unlimited money, do they? I think it's just a different model of the same thing, and the main difference seems to be simply the order in which you do things. Traditionally you'd expect to have to have a view to balancing the books before spending, whereas with MMT you can spend and then tax later. Which is the same as borrowing loads, isn't it? The only difference is that traditionally borrowing loads is seen as bad, but in MMT it's not, because MMT. Right?

Given that neo-classical economists have designed and supported economic policy

I thought the point about neoliberalism is that you don't design economic policy, you just let people get on with it, which results in massive inequality but that's the natural order of things and if it makes us really rich then that's hardly our fault is it?

Isn’t that what’s being said by MMTers?

Yes you are correct but we keep going around in circles about this I reckon.

It's practically the first thing MMTers say but detracters use it all the time for some crazy reason.

MMT would also say it's never borrowing to spend - it's issuing bonds to drain reserves. It funds nothing.

Mainstream conflates bond issuance with borrowing - which takes place right at the end of the spending cycle and doesn't fund spending.

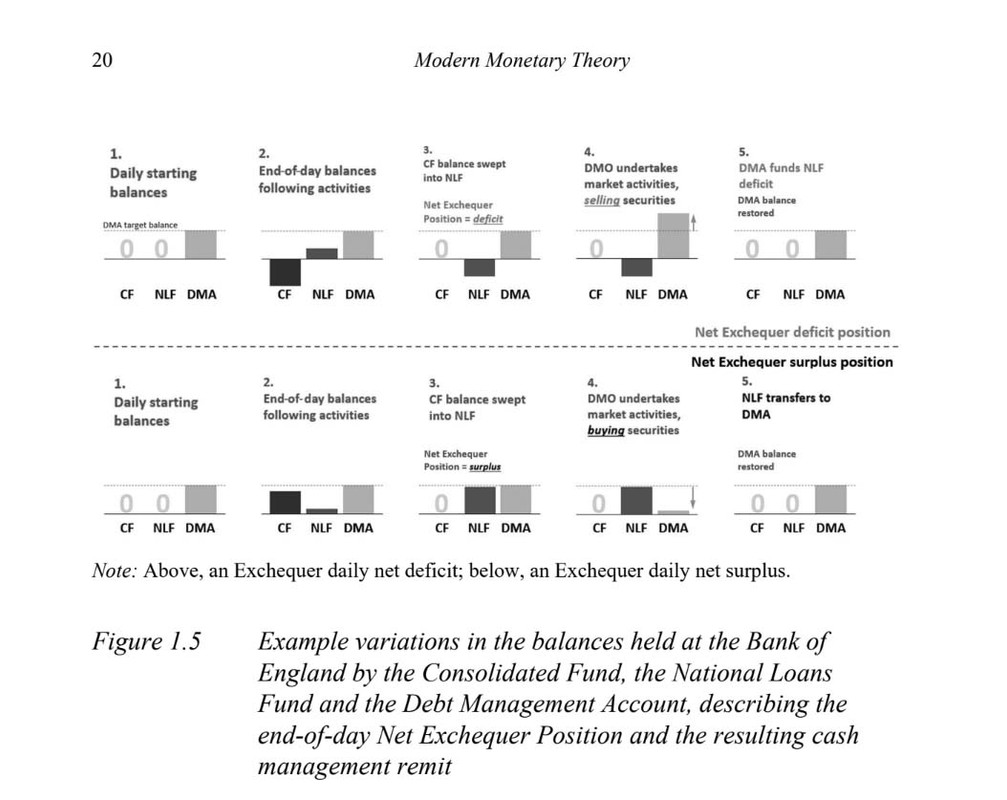

here's the visual for the daily spending cycle:

Some Notes:

"The daily accounting cycle results in a net cash surplus or cash debt being

held in the National Loans Fund. Under the current policy framework, this

end-of-day position motivates reactive policy undertaken by the DMO known

as ‘cash management’ and which involves the trading of government securities

with the private sector. This activity is usually construed as a ‘borrowing’

exercise where the government has to raise funds in order to spend. As we’ve

seen, though, the government has no requirement to source cash from the

private sector in order to be able to spend because cash is made available by

the legislative processes described."

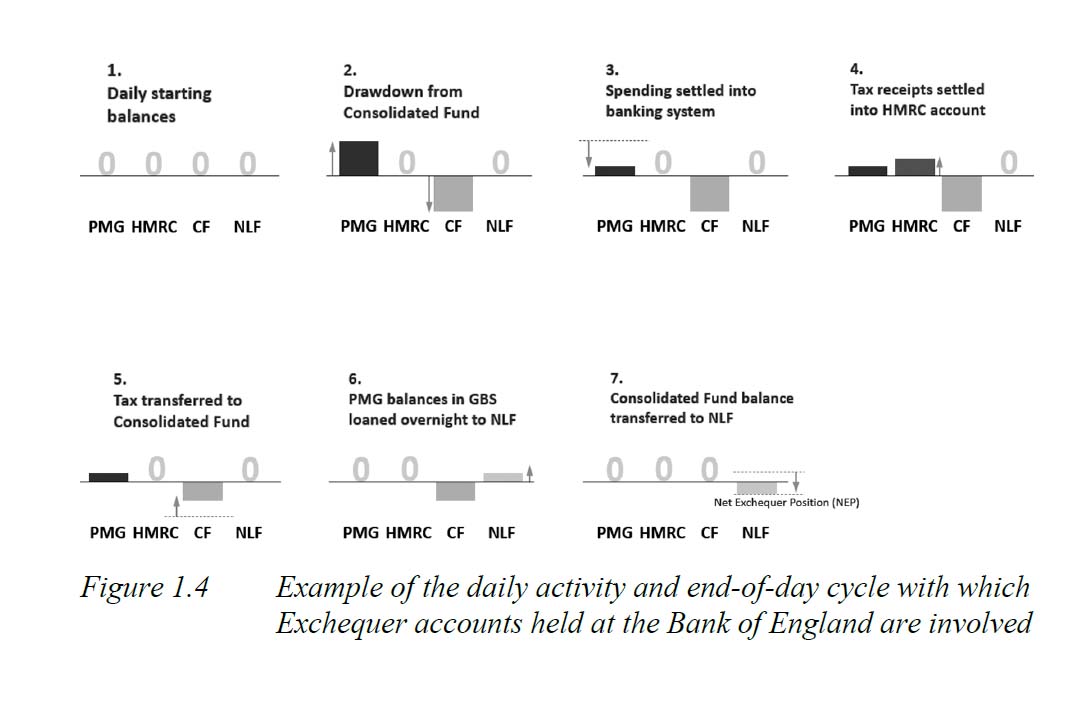

"The cash management process is illustrated in Figure 1.5 which describes

two scenarios: that of a daily Exchequer deficit (above), and a daily Exchequer

surplus (below). In the first step illustrated, the Consolidated Fund and the

National Loans Fund start the day with a nil balance whereas the DMA has its

prescribed target balance. During the day, activity on the Consolidated Fund

and National Loans Fund (see Section 1.4.3) causes variations in their respec-

tive balances (step 2), and at the end of the day the balance on the Consolidated

Fund is swept into the National Loans Fund (step 3). The resulting balance

then represents the Net Exchequer position and it is the DMO’s task to offset

that quantity. In the case of an Exchequer deficit, the DMO achieves its objec-

tive by selling government securities which serves to increase its own balance

over the mandated target balance (step 4). The DMO then transfers its excess

balance to the National Loans Fund which has the effect of zeroing the latter

and restoring the Debt Management Account to its target level (step 5). In the

case of an Exchequer daily surplus, the process is similar except the DMO

needs to buy securities from the private sector in order to dispose of the excess

cash."

I thought the point about neoliberalism is that you don’t design economic policy, you just let people get on with it, which results in massive inequality but that’s the natural order of things and if it makes us really rich then that’s hardly our fault is it?

That's because they believe markets are naturally levelling, and better without goverment inteference. Trickle down etc.

But it drives money upwards.

The point being the markets have actually been enabled by governments and central banks.

whereas with MMT you can spend and then tax later

Which is what already happens.

I thought the point about neoliberalism is that you don’t design economic policy

Nope. Neo-classical economists have spent the last 40 years telling us there is only one way to run an economy, by removing the intervention of the state and the bargaining power of workers to allow capital and the market to operate unhindered. The result was supposed to be higher productivity, lower prices, the widespread availability of goods and services, and the empowerment of an asset-owning population. Not quite worked out that way has it?

Damn I missed my edit time window.

Here is Fig 1.5