![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

"Let them eat biscuits"

"Let them eat biscuits"

chocolate coated?

c'mon Outofbreath, time to stop winding the "little boys" up - its quite a shock to hear the news that rich people don't like paying tax

Nope, but it was a shock to hear that people don't think ISAs are tax avoidance, or that the cycle to work scheme isn't tax avoidance or that they can come up with a workable definition of the legal point where avoidance ends and evasion begins in one sentence when every free country in the world finds it an impossible task to define and legislate for it.

Nope, but it was a shock to hear that people don't think ISAs are tax avoidance, or that the cycle to work scheme isn't tax avoidance or that they can come up with a workable definition of the legal point where avoidance ends and evasion begins in one sentence when every free country in the world finds it an impossible task to define and legislate for it.

Top tip: we're less stupid than you think, and you're less clever than you think.

It was a shock to me to realise that by simply residing here i was tax avoiding everywhere else in the world

This also has the benefit of actually being really what you said rather than simplistic distorted version of a complicated discussion.

EDIT: actually they ^^^ said it better than I could

but it was a shock to hear that people don't think ISAs are tax avoidance, or that the cycle to work scheme isn't tax avoidance

That's because they're not.

But you would rather pretend to be clever than try and learn something.

can come up with a workable definition of the legal point where avoidance ends and evasion begins

There is a workable definition of where avoidance ends and evasion begins - Is there a tax loss and is it permanent, deliberate and concealed (or something like that)? Its working out where tax planning ends and avoidance begins that's tricky.

It was a shock to me to realise that by simply residing here i was tax avoiding everywhere else in the world

Which is odd because I'd have thought that the 'being resident somewhere with a nice tax regeme' thus avoiding tax in all the other countries wouldnt be a grey area for you. F1 drivers living in Monaco for instance.

Look its not funny , its not what you said*, its not what I said you said and its really really dull

YAWNS at the moving goalposts.

* i make the assumption you have not mistaken me for a Monaco F1 driver as your flights of fancy are clearly far more outlandish than they are insightful or funny.

Whats even funnier is those syphoning off an ever increasing amount of money from the public purse (allowed to do so by government ministers with an interest), avoiding tax personally and as a business entity, while ramping up costs to the end users us and selling it as a saving.

Many legitimate UK businesses have gone to the wall as a result of not being able to compete with foreign corporations, who are able to sell significantly cheaper as a direct result of their off-shore tax avoidence, an advantageous position many were unable to exploit.

The corruption is old news! has been quietly nurtured over many years, runs extremely deep and is arguably part of the business world. Is it accetable I don't think so!

To me there seems to be an agenda of converting everything to corpoarte rule for the sake of easier goverment administration, diffusion and obfuscation of responsibility creating an environment where it's eaiser to run roughshod over people, nice butties for all involved, with a blind eye turned (those making the rules direct/indirect stakeholders) to all the indiscretions.

I wonder if the internet shills are benefiting directly/indirectly or are just toadie lickspittles.

Whats even funnier is thoseThat'ssyphoning off an ever increasing amount of money from the public purse (allowed to do so by government ministers with an interest),

If you're talking about an EU country let's hear more detail about this.

The UK tax rate, is what it is, to pay for the infrastructure that all combines to make the UK a good place to do business and earn money. All the schemes within the UK that allow you to offset some expenses against tax are part of that scheme and legitimate.

Shifting your profits earned from UK infrastructure to somewhere else that doesnt incur anything like the expense so can charge less is theft(whatever the crooks call it) from the UK current account and may explained why we have gone £70 billion into the red during the same period this tax evasion has developed.

That our politicians are part of the scam makes them crooks too.

That our financial companies facilitate it makes them crooks too.

Insuspect if it came out the money laundering aspect of the business would be more unsavoury than the tax theft.

Makes you proud to be British.

Say someone bought a knife instead of a cake... not to cut the cake, but to mug other people's cakes and build up a stockpile of cakes that will never be eaten.

Pretty handy investment that knife, as soon enough, the mugger has enough cake to lobby the baker and get him to change the recipe with a commission payable.

The new recipe is a success and the baker is able to charge a bit more.

The baker pays commission to the mugger, who uses the money to buy more knives and employ people to spread his enterprise overseas.

All the cakes he accumulates he hides away from prying eyes, whilst the shortage of cake available to the majority leads to austere times.

Don't get me started on the biscuits...

So Cameron now says he did profit from his dad's offshore company

http://www.bbc.co.uk/news/uk-politics-35992167

#CurseDavidCameron 😆

Politicians never learn. You knew his cock was in the custard with the silly statement yesterday and for relatively small sums of money (judging by the latest news). Muppet.

Covering up always ends in tears.

Gotta be a fair few nervous Tories Bojo, Osborne, Goldsmith, Hunt, etc ,must be happy that the anti EU tabloids are currently being nice to them

What he said

Of course Dave benefitted from it is is how his dad made his money

Everyone knew the answer anyway but he has not helped himself with slimy PR answers.

Personally i will be very surprised if all millionaire daddy gave him was what has been stated- its small fry for a millionaire to pass on . Clearly daddy knew how to pass on his assets without tax so I dont think he would have been that remiss with his own kids.

kimbers - Member

Gotta be a fair few nervous Tories Bojo, Osborne, Goldsmith, Hunt, etc ,must be happy that the anti EU tabloids are currently being nice to them

I assume you count Chuka as a Tory. Given his Ibiza pad....Owned by his mother, through an offshore trust. Just using the legally available ways to create tax efficiency and all that. Bit like the previous Labour leader's family and their tax arrangements around the father's house. Not illegal, but.....

Either way, I suspect very few will come out of this well. On any side of the fences.

Oh, and the Graun and their Cayman Islands office.....

I assume you count Chuka as a Tory.

Pretty much actually, didn't he coin the phrase 'blue labour' ?

I think none will come out looking well, it just depends on who the media focus on.

Except possibly Corbs does he have an offshore stash ?!!!

tho I'm sure once the Referendum is over normal service will resume and he will be the focus

So first three questions for QT

Cameron's slush fund

Tata being bought by a slush fund

Eu referendum pamphlet paid for by a slush fund

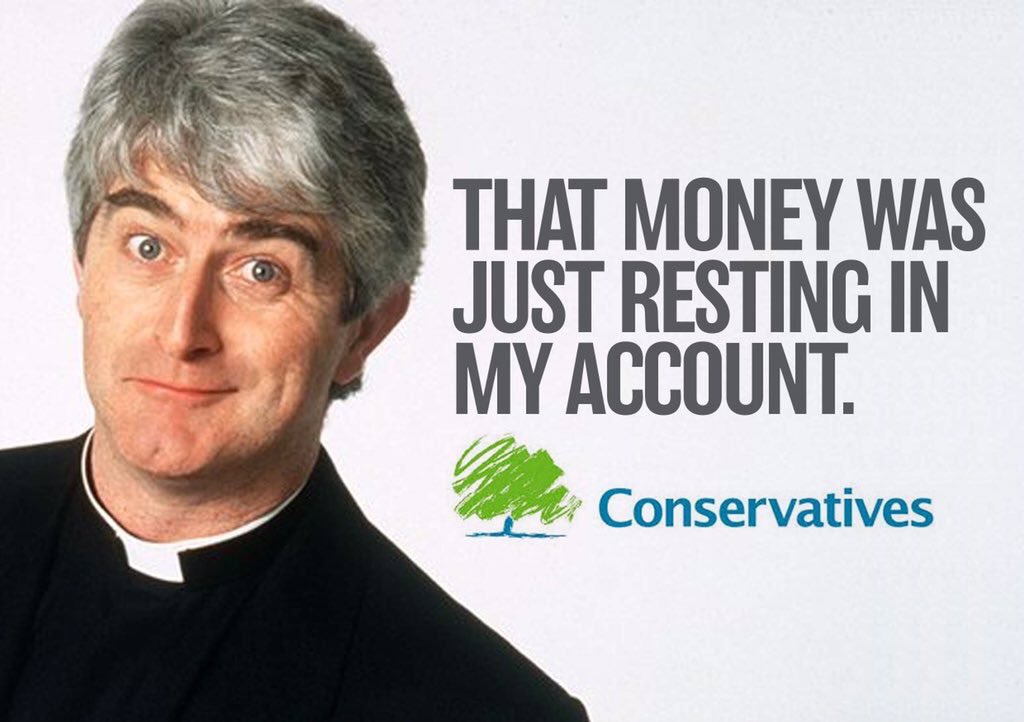

[^ no need to pay the Saatchi slush fund for the next election poster 😀 ]

Damn, three first....I suppose they have to keep nutty Carswell frothy

Panama Q2

Just Tata to go (unfortunate choice of words)

Did Corbs get his bike on C2W ?

I can see the headlines already....

Enough QT, seeing Toby Young on newsnight was bad enough, I cant take any more BS, bed

Carswell seemed relatively sane compared to the economist on the right

Also re Corbs cyclinh clobber,I speak from experience, your shellsuit will get chewed up by your chainring after a few pedal turns...

Q3 should we nationalise steel 😉

a few years ago I got a large bill from the Dutch tax authority for a period of time when I was neither living nor working there

Buying personal services but no VAT paid whilst on holiday ? 😉 (sorry could't resist)

Sorry to repeat myself but tax evasion exists at all levels of society, tradesmen agreeing to a lower price for cash is tax evasion. I'd not be surprised if the total amount of tax evaded that way exceeded all the legal tax avoidance via offshore trusts by some margin.

I am genuinely surprised at the Cameron furore. Its been common knowledge for years he had a trust fund setup by his father, the trust income (£19k pa) was fully declared to HMRC and taxed at Cameron's top rate (40%). Ronnie Corbert avoided IHT by gifting his wealth to his kids more than 7 years before his death, Cameron senior could have done the same and both are totally legal

@kimbers supposition from me but I think Cameron's trust was moved from Panama to Ireland as Cameron had no need for secrecy as trust was perfectly legal and also not least as Panama is seen as rather "dodogy" so an attempt to head off the sort of newspaper storm we now have (that failed obviously)

@JY Chapeau but I have been banging on EU and tax way before the Panama papers. Will ease off as not necessary

I would be amazed if any of your guesses were true.I'd not be surprised if the total amount of tax evaded that way exceeded all the legal tax avoidance via offshore trusts by some margin.

That is one of your least likely guesses.

If I was a Labour MP with dubious finances, I'd be losing sleep! The Tories will be desperate to divert attention and hold up a sacrificial lamb, ironically demonstrating "we are all at it together".

I bet City of London accountants have been rushed off their feet this week!

Nope they'll brass it out and it'll be bau by May.

[quote=morris77 ]Prime minister of Iceland did the right thing to quit office.

Indeed and given what he'd done then quite rightly so.

I wonder if Jimmy Carr will say anything? Cameron publically accused him of moral wrong doing when it came out that Carr had been avoiding tax...although maybe Carr will just say "well we really are in it together..."

@ Edenvalleyboy et al - can you please explain how Cameron avoided tax? He's paid income tax at the right rate on the dividends, and he would have paid capital gains tax on the increase in the investment, had it not increased by less than his allowance (which is available to all).

Can anyone making comments in this thread actually demonstrate how tax has been inappropriately avoided by Cameron in this context? If he'd directly invested in shares rather than via Blairmore he would have paid exactly the same amount of tax surely???

[quote=edenvalleyboy ]I wonder if Jimmy Carr will say anything? Cameron publically accused him of moral wrong doing when it came out that Carr had been avoiding tax...although maybe Carr will just say "well we really are in it together..."

Are you saying Dave was avoiding tax too ?

I wonder if Jimmy Carr will say anything? Cameron publically accused him of moral wrong doing when it came out that Carr had been avoiding tax...although maybe Carr will just say "well we really are in it together..."

Cameron hasn't been avoiding tax. He's actually paid more tax than if he had put it in an ISA.

As for Jimmy Carr, who cares what he says or thinks? He's a tax dodger.

can you please explain how Cameron avoided tax?

Can you explain why he did not just say all of this openly and explain it fully when given the chance ? Can you explain why he sold his shares prior to becoming PM ?

The PM knows why this is toxic, even if you do not.

Its pretty obvious the sn of a man who made his money form tax avoidance schemes, if for no other reason that it paid for his education and food etc, has benefitted from tax avoidance schemes.

Ronnie Corbert avoided IHT by gifting his wealth to his kids more than 7 years before his death, Cameron senior could have done the same and both are totally legal

Are there any other examples of people being able to predict the date of their own death to avoid inheritance tax? Or is it a spooky supernatural gift possessed only by the little bespectacled fella?

@junkyard yet again you are unable to deal with the underlying issues. There has clearly been poor management of the message by Cameron, that is obvious However that doesn't mean that his actions (or indeed his father's actions) have been anything other than entirely appropriate.

It's only 'toxic' because as per usual no-one understands what the hell they are talking about.

In all probability there are people on this thread indirectly invested in an offshore UCITS via their pension scheme. They are perfectly legal vehicles - an investor doesn't avoid any tax.

[quote=bainbrge ]

It's only 'toxic' because as per usual no-one understands what the hell they are talking about.

In all probability there are people on this thread indirectly invested in an offshore UCITS via their pension scheme. They are perfectly legal vehicles - an investor doesn't avoid any tax.

+1

Incredibly poor PR stuff from Number 10 but this is a storm in a teacup.

PS the real issue here is where all the dirty money domiciled in Panama or BVI comes from, and whether crimes were committed in accruing it. Why on earth is everyone bleating on about a perfectly legal bog standard fund which the PM had a minor stake in, when the real story is the embezzlement of BILLIONS by kleptocrats across the globe.

Just unbelievable and a disservice to the people who have really suffered as a result of offshore shenanigans (i.e. most of the population of the developing world including China!).

Who bought that Corbett portrait that was in the classifieds a few years back, has the value note increased, would it be a wise investment to move it offshore?

Cameron knows he looks bad, every paper has it on their front page after he used politician speak to try and deny it earlier in the week, hes made their job even easier, of course we all know it's part of the right wing civil war over the EU, even Bojo tried to slag the guardian when questioned on Tuesday in a half arsed defense of Dave, despite that particular allegation surfacing in the Telegraph.

With friends like these...

PS the real issue here is where all the dirty money domiciled in Panama or BVI comes from, and whether crimes were committed in accruing it. Why on earth is everyone bleating on about a perfectly legal bog standard fund which the PM had a minor stake in, when the real story is the embezzlement of BILLIONS by kleptocrats across the globe.

You forgot the bit about possible links to Embezzlement and Asset stripping of a successful company as a means of consolidating control of the Arms trade by a shadowy international cabal.Seriously, just read this (non fiction) book, it's only a couple of quid:

[url=www.amazon.co.uk/Public-Interest-Devastating-Governments-Manufacturer/dp/0316877190]

In the Public Interest: A Devastating Account of the Thatcher Government's Involvement in the Covert Arms Trade[/url][b]Bear in mind it details the same methods and players (BAE and Midland Bank (later HSBC)) as mentioned in relation to the Carroll Trust, which is alleged to have involved the Cameron Family's Blairmore Holdings[/b]:

Further sources have revealed that Gerald Carroll’s Farnborough Aerospace Aerospace Centre in Hampshire England was “targeted” by BAE Systems and HSBC International within the framework of a systematic break-up embezzlement operation

Fair bit about Arms to Iraq and Al-Yamamah in there too...

Bear in mind also that Cameron has some very dodgy links to Astra Holdings, which was also targeted in such a manner, as detailed extensively in the book I've linked to.

Chambers has it. I think thats the issue here. If Dave just said 'ok guv. Its a fair cop guv! It was me dad wot dunnit' then it'd blow over.

But he didn't. For a PR bloke he's handled it spectacularly badly. Telling everyone it was a 'private matter' just looked aloof and arrogant. As if he was saying "how dare you question me?!"

He just left himself looking evasive and leaves everyone with the distinct impression that there's more stuff he's hiding. George Osbourne has been equally vague about his families tax affairs when asked too

However that doesn't mean that his actions (or indeed his father's actions) have been anything other than entirely appropriate.

Not even Dave agrees with you hence why he tried to hide it and why he sold them before he became PM.

It's only 'toxic' because as per usual no-one understands what the hell they are talking about.

Except you of course eh - even though Dave himself dumped ot because he could se

Its about trust and double standards. Dave knows this hence why he was "evasive" this week and why he dumped them before becoming PM.

I am amazed you need this explaining to you, again, seeing we dont understand it.

The underlying issue is how the public will perceive it - badly clearly- though if course that is because they are stupid and dont get it- I assume a PR strategy Dave wont be embarking on.

Why on earth is everyone bleating on about a perfectly legal bog standard fund which the PM had a minor stake in,

The little people, who dont avoid tax, view this as immoral even if it is legal[ see also Google, Starbucks, etc] why have you had to ask this ?

Why do you think the PM did not try this approach?

I love the fact that people seem to think we should believe the facts (as we know them today)...after the way this has played out (initial leaks followed by four different statements) ...you can hardly call Dave Cameron a standup honest guy can you...

Cameron's greatest folly? Being afraid/ashamed of his past. Rich or poor, that is a sad state of affairs. You are what you are, and you do the best with the hand that you are dealt with.

But "poor" old Dave is tormented by the fact that he/his family is well off. So what? Denying the same education to your kids. What's the point?

But he seems lost in this social/political wilderness where it's almost impossible to know what he stands for. Like most people he is inconsistent (hypocritical) in his approach to tax avoidance largely driven by his phobia of the rich tag.

He should have been straight from the past. Yes my old man was rich, yes BH was registered in Panama, yes the old man once sold some painting for a shit load of money, yes his income helped fund my excellent education etc. So far not illegal....

A strange bloke all in all. But what do they say about all political careers. At least he promised that his wouldn't be undone by Europe!!!

Couldn't agree more THM. I really don't get why he needs to indulge in his tragically unconvincing 'Man of the People' routine (what football team do we support this week then Dave? Villa? West Ham? Same colours. I suppose its easy to get confused)

You're an uber-privilidged posh boy. Everyone knows you are. Spare us the act! Its fooling no-one. Least of all yourself.

Why on earth is everyone bleating on about a perfectly legal bog standard fund

It's only bog standard for the very wealthy, to allow them to pay much less tax than much less wealthy people.

JY - so we agree it's nothing more than a PR issue and our time/opprobrium is better spent elsewhere.

the real story is the embezzlement of BILLIONS by kleptocrats across the globe.

For me its this and UK is the big cheese in making it happen.

@thm - be careful in your quick excuses...you're straying dangerously close to social theoires that believe people are the result of their surroundings and therefore cannot be held truly accountable for their actions....that is the opposite of the Tory ideology of individualisation...unless of course I got you wrong and actually you are a Corbyn supporter? 😀

The Problem Dave also has is what the Panama fund says about the company you keep. It says daddy was happy using the same lawyers and bankers who were at the same time happily laundering money for drug cartels and blood-stained dictators

@Grum - I'm going to put my head above the parapet here because I'm not a tax expert, but you are entirely wrong in your statement. As said above, Cameron has paid the same tax as he would have if the fund didn't exist and he had directly invested in shares.

I will go further and say that there is a chance that even you have an indirect investment in an Irish UCITS via a pension scheme.

You are what you are, and you do the best with the hand that you are dealt with.

Dave is not ashamed of it he just knows it wont help his "all in it together " message he spins to the masses. In this case it wont help him look like a the ferocious tiger taking on the tax avoidrrs - not that he was that was, as the EU letter shows, nothing but PR spin and BS.

Essentially no politician whatever hue, is going to make a massive thing about the part of them that makes them least appealing to the electorate

Its not like Gideon wears his inheritance on his sleeve either but we all know his background to. Same reason we dont really want to be ruled by our social netters anymore so they do the man of the people shtick. In both their cases it is clearly BS but fools some of the electorate.

Its way OTT to try and suggest that him playing to the masses is him "ashamed"

Here is an [url= https://www.politicshome.com/news/uk/economy/financial-sector/opinion/73541/top-lawyer-ian-camerons-investment-fund-was-not-tax ]article [/url]by Graham Aaronson QC, who is a very eminent QC, who chaired the Tax Law Rewrite Committee (appointed by Labour) and was involved in putting forward the GAAR. He is a serious expert and has been at the top of the tree for a very long time.

His conclusion in the article was that there was no tax avoidance.

Why on earth is everyone bleating on about a perfectly legal bog standard fund

Because the Prime Minister concealed it.

Why on earth is everyone bleating on about a perfectly legal bog standard fund

How does everyone know it's all perfectly legal?

Who told you that?

How does everyone know it's all perfectly legal?

It's highly unlikely to be illegal. There's a question around whether it's avoidance, which I would leave to the experts. The more interesting point is why the Prime Minister felt the need to conceal it.

It's highly unlikely to be illegal.

How do you know that?

What has the money been invested in?

Handy thing this offshore secrecy...

JHJ there's probably a key facts doc showing the major investments given its a UCITs. Just search on google with the fund name.

JY - so we agree it's nothing more than a PR issue and our time/opprobrium is better spent elsewhere

Half right, it was a PR cock up, but London and our tax havens dependencies are the trusted global brand in money laundering, millions around the globe are robbed through evasion and the problem is that our own PM is perceived to be in it up to his nuts himself.

This proposal was put to the EU parliament exactly a year ago

Tory and UKIP MEPs voted (in line with their parties) [u]against[/u] it

the European Parliament proposed concrete measures to tackle immoral tax practices, including making companies report where they make their profits and where they pay their taxes. It also proposed an agreed Europe-wide definition of tax havens that would allow tax dodgers to be named and shamed.

Because the Prime Minister concealed it

Or no requirement to declare at the time as it was below the threshold

I'm looking forward to the explanation of why the Guardian avoiding tax on the sale of Autotrader was OK but paying tax on the proceeds of an offshore trust isn't

Or no requirement to declare at the time as it was below the threshold

I don't recall saying that he was required to declare it. I do recall him having quite a lot to say about offshore funds, and I do recall him being asked several times about whether he had financially benefitted from such funds.

I'm looking forward to the explanation of why the Guardian avoiding tax on the sale of Autotrader was OK but paying tax on the proceeds of an offshore trust isn't

Well sure, but I'm kind of glad that its journalists are allowed to pursue this kind of investigation, regardless of the tax affairs of their parent company.

JHJ there's probably a key facts doc

[url= https://cryptome.org/pp-mf/cpi/Cameron-Iandoc2-cpi-16-0330.pdf ]Indeed there is[/url]... thanks for that, good info~ [url= http://www.cryptome.org/2012/01/cercle-pinay-6i.pdf ]find all sorts of handy stuff on Cryptome[/url]

At a quick glance, it confirms many of the links suggested in relation to the Carroll Trust have a factual basis.

Interesting how closely linked Blairmore Holdings is to [url= https://en.wikipedia.org/wiki/Hambros_Bank ]SG Hambros[/url] Bahamas:

Brent Haines

. [b]Mr Haines is Senior Manager, Fiduciary and Client Services of SG Hambros Bank & Trust (Bahamas) Limited.[/b]

James Hoar

. [b]Mr Hoar is Director, Marketing for SG Hambros Bank & Trust (Bahamas) Limited,[/b]

Betty Roberts

[b]. Mrs Roberts was until August 2004 Managing Director of SG Hambros Bank &

Trust (Bahamas) Limited. [/b]

ADMINISTRATORThe Fund has retained SG Hambros Bank & Trust (Bahamas) Limited as Administrator.

SG Hambros, part of SG Private Banking, is a private bank providing a comprehensive wealth management service. The SG Hambros Group employs more than 400 people and manages over £5 billion of assets from its offices in the UK, Guernsey, Jersey, Gibraltar and The Bahamas.

BANKER & CUSTODIANThe Fund has retained SG Hambros Bank & Trust (Bahamas) Limited as Banker & Custodian.

The Banker & Custodian will receive all subscription monies, transfer all redemption proceeds, maintain the Fund’s bank accounts and pay from the Fund’s accounts such bills, statements, taxes, calls or liabilities in respect of the securities in the Fund, custodian fees or other obligations of the Directors in respect of the Fund.

Also worth noting the ties to Coutts Bank:

As well as the London, Jersey, Guernsey and Gibraltar operations, a subsidiary of Coutts Bank in the Bahamas also became part of the SG Hambros Group.

Wonder if we can find more in relation to this aspect:

The Carroll Foundation Trust files are held within a complete lockdown at the FBI Washington DC field office and the Metropolitan Police Scotland Yard London under the supervision of the Commissioner Sir Bernard Hogan-Howe who has an intimate knowledge of this case which stretches the globe.

Why is that interesting?

I'm looking forward to the explanation of why the Guardian avoiding tax on the sale of Autotrader was OK but paying tax on the proceeds of an offshore trust isn't

Is it because the Guardian doesn't legislate or enforce tax law?

No its because everyone loves a bit of whataboutery and when deflecting from our dear right wing leader it best to have a pop at a weak left wing target as it means folk start discussing that rather than Dave

Its been a reasonably successful strategy even if most of the replies were just mockery of the "point"

big_n_daft - Member

Because the Prime Minister concealed it

Or no requirement to declare at the time as it was below the threshold

This ^^

Crazy thread..

Crazy thread

It's not the thread though is it?, is the front page of every paper today

It's blown up because he tried to cover it up, and the Eurosceptics have seized on this and are hammering him for it

Why are folk surprised that people dont like to think our PM is a bit of wheeler dealer tax dodger?

He was political savvy enough to make sure he was not and politically savvy enough to realise why it would create a shit storm if/when it came out.

He was not politically savvy enough to handle the moment when it did come out well and has appeared to be be [ wait for it] evasive

People who say this is nothing - can you explain why the PM keeps changing his story?

And are you happy with our government voting against EU laws to crack down on tax evasion/avoidance?

I mean, I don't actually expect an answer just more whataboutery and straw men, but I thought I'd ask anyway.

This ^^Crazy thread..

Well, yes. Anyone who thinks the argument is limited to "a requirement" has a very narrow perspective.

Junkyard - lazarusWhy are folk surprised that people dont like to think our PM is a bit of wheeler dealer tax dodger?

He was political savvy enough to make sure he was not and politically savvy enough to realise why it would create a shit storm if/when it came out.

He was not politically savvy enough to handle the moment when it did come out well and has appeared to be be [ wait for it] evasive

getting bad media advice isn't a crime,

He paid tax on the earnings from the scheme, ditched it prior to being PM

it's a non story being whipped up to try and create a bigger story

And are you happy with our government voting against EU laws to crack down on tax evasion/avoidance?

UK Governments of all colours have a poor record on this, the EU has a poor record, Junker turned Luxembourg into a tax haven and has screwed the rest of Europe

UK Governments of all colours have a poor record on this, the EU has a poor record, Junker turned Luxembourg into a tax haven and has screwed the rest of Europe

You went for the whataboutery option - good choice.

he's finished now, I'd just take the money, his shattered reputation and put me feet up and watch the others mess it all up. I'm sure he has enough to live on.

Hope they don't change the rules on hedge funds as thats my and many others pensions knackered.

Cameron's and the tories real problem is not that he got 30k from a tax-dodging investment fund, it's that at a time where he's cutting benefits to the disabled and saying the government can't afford to protect thousands of jobs in the steel industry, he's so rich he doesn't even know where the money came from.

[img]  ?oh=d84fabe510d07d72bf444f8d336d46e2&oe=5787777B[/img]

?oh=d84fabe510d07d72bf444f8d336d46e2&oe=5787777B[/img]

And are you happy with our government voting against EU laws to crack down on tax evasion/avoidance?

No, but they didn't - they voted about against a motion in the European Parliament which has no ability to introduce such legislation - this motion was more akin to signing a petition.

he's finished now, I'd just take the money, his shattered reputation and put me feet up and watch the others mess it all up.

Or just watch Glastonbury at home in front of a warm fire, in June.

[url= https://www.express.co.uk/news/politics/659233/David-Cameron-Glastonbury-Downing-Street-politics ]Cameron mocked after claiming he watches Glastonbury in front of 'warm fire'... in JUNE[/url]

Or just watch Glastonbury at home in front of a warm fire, in June.

Big houses in the country are notoriously difficult to heat.