![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

I'm thinking of buying at the moment, and purely from a selfish point of view, can't help wondering what the effect of cutting the housing benefit is going to be in the near future.

Prices at the moment seem a bit bonkers, and despite a decent salary and healthy deposit, i can still only *just* afford a tiny place. Which means a large section of people are priced out of the market, yet prices aren't dropping?

And if housing benefit is propping up the market, whats everyones reaction going to be when their house prices start dropping? Is it actually benefiting the landlords and homeowners?

I don't know but I have a suspicion that housing benefit has helped house prices reach the stupid levels they did. Cheap borrowing and high rents make buy to let very attractive and a cycle of increasing house prices and rents follows. Until the bubble bursts.

I'd say probably not. House prices are an auction. As long as there is more than one person looking to buy a given property then they have to bid against each other.

The seller will sell to the highest bidder who ever they are so there only needs to be one person prepared to pay more than you for you not to be able to afford it. It doesn't matter if there are hundreds who can't afford each house - only one needs to buy it to set the price.

There might be areas with a large letting population where house prices can be inflated but even then housing benefit claimants are the only people renting. An landlord still wants the best price they can get, and again they only need one tenant.

Housing benefit is going to be cut, room allowances reduced, council tax allowance for benefit claimants being removed, private rents going up etc etc

If you are thingking of buying to let, then seriously consider if your tenants will be able to pay the rent, ie will they be eligible for enough benefit to cover your mortgage costs.

The governement want to reduce benefits, but this will have a massive impact on how much money property owners will be able to charge their tenants. Its not a pretty picture

As for the effect of capping (I don't think it's being cut as such is it?) housing benefit, I see a lot of houses being built along the south coast, maybe ready to take the refugees from London. There will be winners and losers for sure.

Prices aren't dropping because people still think that houses should automatically increase in value, year on year, regardless of the economic situation. I've been to look at lots of houses in the last couple of years, and they're all still for sale, largely because they are over-priced (and mortgages are harder to get).

It's going to be carnage in the buy to let market in Brighton if housing benefit is stopped for the under 25's

Private profit, public subsidy , has been the defacto policy for many years, you now have a situation where a worker cannot afford to rent a modest property in london on the average wage-- the private rental sector would collapse without 'housing benefit' subsidy, once rental controls are removed this is the resul, so what do the govt say--council housing is too cheap- lets get rid !

Prices aren't dropping because people still think that houses should automatically increase in value, year on year,

Which leads to a self fulfilling rise in prices does it not?

People won't sell for less then they paid, ergo prices will continue to rise. Even if this is slowly as the volume of sales drops due to affordability of mortgages.

Too many people have too much invested for house prices to drop long term.

If it helps I rent two houses out in Bradford and one is to a girl who gets the maximum housing benefit which is £392.00 every 4 weeks.

This figure was £414 last year but has been reduced twice.

Which is self fulfilling is it not?People won't sell for less then they paid, ergo prices will continue to rise. Even if this is slowly as the volume of sales drops due to affordability of mortgages.

Too many people have too much invested for house prices to drop long term.

Absolutely. The idea that the housing market is inflated and will drop to early 90's levels is a false one.

Anyone who's bought a house in the last 15 odd years with a mortgage would be unable to service their debt (as prices drop, the interest will rise). There would be loads of repossessions, bankruptcy's

and the stock not worth what the banks lent against them, the banks would lose out too. It would be instant recession.

Never happen.

And to add to that...

i)As house ownership becomes less obtainable more people will be forced to rent.

ii)Rental incomes need to be at a certain level to make the owners mortgage payments.

iii)The country is over populated.

So rent won't drop either.

lots of hopers on here-- it will never happen-- but it can and does, you play with markets, then you are also beholden to them- look across the pond in the good ole US of A -- happened there on a massive scale-- check out detroit-or whats left of it !

Suppose it also depends how long you are staying put - if long term not an issue.

I rent as cheaper than buying having done the maths and my contract expires in 2014 and could end up anywhere.

Suppose answer is it's what suits you. Have a chat with an IFA?

what phil.w says - spot on.

I've been to look at lots of houses in the last couple of years, and they're all still for sale, largely because they are over-priced (and mortgages are harder to get).

I've been to look at 10 houses in the last two weeks. All have sold pretty much instantly for very near or full asking price.

I've also sold my flat in Manchester for only 5% less than asking...it was on the market for less than 2 weeks.

Depends where you are in the country and whether people want to live there.

No one remember interest rates hitting double figures? Plenty couldn't afford their mortgage repayments, houses were repossessed and sold at auction. Prices came down. I got my foot on the property ladder, until then a house was an impossible dream.

lots of hopers on here

There certainly are, but not the ones you're looking at. The US market was and is massively different to ours. The housing market in the UK will never crash. It won't be allowed to.

As rubber buccaneer states, it happen once. They learnt their lessons from that.

Why do you think the BOE have kept the interest rate so low?

Maybe i'm being thick here, but surely if there are less people around who can afford the rent then rent will either have to come down or landlords will have to get rid of their houses. Simple supply and demand is it not?

Maybe we need a housing crash before we get out of recession? Because the current plan doesnt appear to be working.

Maybe we need a housing crash before we get out of recession?

I'm beginning to think the same. The people who *can* afford the rents have less disposable income left to spend in the shops etc.. All our money has flooded property where its not really doing very much.

If you are thingking of buying to let, then seriously consider if your tenants will be able to pay the rent, ie will they be eligible for enough benefit to cover your mortgage costs.

That makes an assumption that everyone who rents is on housing benifit, plenty of people don't see the point of borrowing money to 'invest', gaurenteeing the bank it's return on £200k whilst taking the risk that it may/may not go up slightly or down horribly over the next few years. That and i like being able to move house without feeding bloodsucking estate agents and solicitors. £200 for a van and some diesel and I could move anywhere in the country in a months time.

That makes an assumption that everyone who rents is on housing benifit

No it doesnt. It simply states that there is a proportion of people who are on housing benefits. For housing benefit changes to have no effect, there would need to be a tenant for every property who could afford it without housing benefit - and that's not going to happen unless prices drop dramatically.

The idea of buying a house certainly makes sense rather than a lifetime of renting but i fail to see why the housing market in this country is so expensive? for that reason I guess i'll never have enough money to buy a house in this country.

For example : A friend has just bought a restored farmhouse with open plan massive kitchen and living area, stone flags on the floor and rustic looking walls etc (gorgeous) and outbuildings in the south of france, 4500 sq/ft or thereabouts with 6 acres of land and a woodland, large pond which is fed from a burn and the sort of views over the countryside that most folk dream off, all for the princely sum of £185,000, you'd be lucky to get a poky little shoebox of a house in this country for that amount.

I would estimate that in 99% of cases housing benefit would only sustain values of properties in the sub £100k range i.e. it is not profitable to buy a house for more than that and rent it out to a tenant on benefits and make a profit.

Therefore yes it does impact but only the bottom end of the market. Differentials for nicer areas / housing stock are already massive so the middle and upper end of the market is disconnected, if your after a nice house it will have no or very little impact.

The UK housing market is very mature where usual market forces apply, currently lack of finance and consumer confidence is restricting activity and has led to falls in value of up to 30%, regional and micro market factors apply such as the London prime market is booming as finance and confidence issues do not apply to cash rich buyers who have little other alternatives when looking to invest. Regional markets with a high reliance on benefits and high unemployment have taken some of the biggest falls.

Two factors are critical in restoring an active market, finance where the Banks are still dealing with massive issues and consumer confidence where job security remains a big issue for many. Until these issues are resolved (which will be years down the line) the market will just bobble along with low levels of activity and minimal levels of growth.

Maybe we need a housing crash before we get out of recession?

You think that the Banks losing more money will help? 😯

check out detroit-or whats left of it

Yeah, houses for sale for $0.99

😯

uwe-r - I used to live in a £250k house which was paid for by housing benefit. I know plenty who have done or do the same.

As an aside - I wonder what effect the tuition fee changes will have on house prices in cities with huge student numbers.

Wrecker - what got us out of recession the last time?

is the problem just not enough houses?

i really cant see that benefit caps will reduce demand by very much

living in london maybe my view is skewed

It simply states that there is a proportion of people who are on housing benefits.

Sure it'll efefct some but it won't cause a crash in the market (sales or rental) If it was a significant portion of the rental market then the government wouldn't make the benefit cuts.

Like I said before, too many people too much invested. (why do you think Northan Rock, RBS etc weren't allowed to collapse)

The only thing that would bring rent/prices down would be to flood the market with new homes. Again, this isn't going to happen.

not profitable to rent out houses worth more than 100k.. I service several properties with £1750 plus per month rents..

Housing benefit is propping up the market to an extent, at very least the rental market, which is propping up the rest of the market through buy to let and a huge number of private landlords. I believe that the plan is not to cap housing benefit at a particular value, but at 80% of market value, so the recipient always has to pay the remaining 20% if their rent is deemed to be "market value" for their property. Seeing as they won't have the money to pay that 20%, particularly not if its 20% of a high rent, then I guess they will be looking for cheaper places. You'll probably just end up with a two-tier rental market, landlords will either look after their properties a bit and rent them at 100% market value, or just let them deteriorate and rent them at 80-90% of market value, knowing that people are desperate enough to put up with almost anything for that little extra discount

It may well drop prices of larger houses and push up the prices of the smallest/cheapest properties, particularly in more depressed areas. I can't see it making much difference in say, London, where the private market is so oversubscribed that people will pay almost anything asked.

The only thing that would be likely to drop housing prices would be home building, and it would have to be on a huge scale to counter owners views that prices should always keep increasing. Something like the council house building of the 50/60/70s would do it, and provide a much cheaper long term solution to housing benefit costs, providing they didn't sell them all off again this time!

Don't underestimate the significance of the 0.5% base rate in preventing a significant house price crash in this recession. Repo's / defaults on mortgages would have been significantly higher without this.

I think a slow correction in prices is occurring, but for some of the aforementioned reasons stated on this thread, a catastrophic crash as the doom sayers predict is highly unlikely.

Comparing our market to France or America does not quite work, we have restricted house building for years and have had a massive population growth where as in the US and France they have masses of land that could be developed but not enough demand to do it.

The French think we are mad when we buy up there old barns and sink thousands in to doing them up when a new build in the village could be had for a fraction of the price. They have a different mentality though, we all dream of big country houses with nice views and lots of land they just want to be 5mins from the patisserie.

In the US they build houses out of wood and plastic and they have a short shelf life so they are not used to the concept of ever appreciating capital values.

Wrecker - what got us out of recession the last time?

The recession isn't the same as last time though is it? How are we to have a lawson boom this time? Tax cuts? Can you imagine anyone proposing tax cuts? 😀

As above - are tuition fees going to impact - if you graduate with 30-50k debt you are not buying a house for a long time?

And surely banks asking for 40% deposits on best rates implies they don't predict prices going up?

Tell me I am wrong - just asking!

I was thinking of the decrease in numbers going to university, but your point is probably going to have a greater impact than mine right enough.

you seem to be oblivious to world markets-- they are very volatile-- living in a uk bubble does not exempt you from winds from afar-- there is huge problems in world capitalism-- yet some think the Bank of England is immune to them !!!

House prices won't level out until the baby boomers are all dead. Which will be so long away that no-one will remember a time when houses weren't investments.

As an aside - I wonder what effect the tuition fee changes will have on house prices in cities with huge student numbers.

I suspect the cost of uni won't affect those that go's ability to pay rent, the impact will be from less students redueing demand. And the ex-polytechnics and collages will suffer more than the bigger universities with a lack of students.

We were seeing the start of it while I was in Sheffield, in my last 2 years the number of empty hosues went up noticeably, always the crap ones and the nice ones got nicer as they had to be good to attract students.

Round these parts there are no shortages in property for sale. In fact there are so many for sale (including loads of empty new builds) that the number of for sale signs are a real eyesore.

The only houses selling seem to be at the top end where money is still no barrier and at the sub £100k where people simply buy, then stick someone on benefits in there. It's easy money at the moment and a lot of my friends have been into it for ages. In my opinion two things need to happen firstly the profit being made by the BuyToLet guys fleecing the benefit system need curtailing somehow and then priced NEED to fall.

As it stands, first time buyers are being constantly outbid by BuyToLet guys and no matter how many starter houses are built this will continue until the easy profits from houseing benefit rental dissapears.

Some segments of the housing market will be affected, but by no means all. It is not one market.

2 up 2 down back to backs, for example, will drop further in price as rents are forced to reduce and house prices adjust accordingly, probably city centre new build flats.

Conversely at the other end of the market I bet there will be a recovery in prime suburban property soon as liquidity will return to the mortgage market imminently.

I bet the two markets are only tenuously linked at best

The idea of buying a house certainly makes sense rather than a lifetime of renting but i fail to see why the housing market in this country is so expensive?

Lots and lots of people, very small space.

As alluded to by others, the ratio of supply & demand is the major factor impacting on UK property prices.

We need to either:

a) Build loads more.

b) halve the population.

There's always the option to restrict the number & size of houses individuals

Feel free to pick holes in this theory.

Would it make sense to buy a buy to let as your investment but then rent yourself?

That way you do up the rental house with renting in mind then keep it in decent nick but you rent a house for you which is a lot more flexible to your ever changing needs (growing/shrinking family, relationships, job relocation).

I think we all kid ourselves that houses are a good earner but fail to take into account all the time & money we spend on renovations. If you rent you can just move if you want a new bathroom or kitchen.

& in Bradford, the council are expecting another 100,000 peeps over the next 10yrs...

The whole policy of using housing as 'investment' is nuts, surely they are places to call home, places of community, places of security-- the morality of using a basic human need , shelter , as a method of extracting money (profit) is wrong.

The idea that someone should struggle all their lives, working long hours to pay for a roof over their heads seems very odd.We did invest in communal housing after the war, but that does not fit 'free' market ideology-- it also restricts exploitation.So the great thatcherite con trick is coming home to roost.

Prices aren't dropping because people still think that houses should automatically increase in value, year on year, regardless of the economic situation.

Well everything else keeps getting more expensive, so why not housing?

If you rent you can just move if you want a new bathroom or kitchen.

Yeah, but you can never pay off your mortgage.

In theory, if you buy a house you fix the monthly payment until the house is paid off. If you rent you will have to roughly have inflation increases over that period. So you will be paying significantly more of your monthly outgoings in rent after 20 years of renting than if you had bought.

Djglover - you are also renting out a property that is being paid off by tenants in my example.

Whilst demand exceeds supply, house prices will rise to the maximum people can afford. The only circumstance under which they'll fall sustainably is if we build significantly more and balance supply and demand.

house prices will rise to the maximum people can afford.

My point here is that they've risen to MORE than people can afford, with the extra bit being paid by the government in the form of housing benefit (5 million people receiving it, 93% of whom are working).

"you seem to be oblivious to world markets"... Bingo

Foreign investors are buying up lots of London/SE. When have filled their boots there they will move onto the next big towns and the ripple effect will be felt by most.

"The idea that someone should , working long hours to pay for a roof over their heads seems very odd."

Really? .... Which world do you live on where, the vast vast majority of people have not been "struggle all their lives" for pretty much the whole of history.

Foreign investors are buying up lots of London/SE.

Rich, successful foreign investors? Investors who obviously recognise a good investment?

Well everything else keeps getting more expensive, so why not housing?

Housing is not just getting more expensive, it's getting more expensive as a %age of salary, and has been, at a huge rate since at least the 70/80s, if not (as a general trend) long before that. Most other things have actually dropped in price as a %age of salary over that period (hence a general improvement in living conditions), it's only in the last few years that they have become more expensive.

Somehow, while we have tried to spend less and less on everything else, pushing manufacturing to China, forcing out small businesses, replacing small farms with massive, automated productions, we have been willing to spend more and more money on housing.

talking basic human need-- have we advanced as a species ?

housing does not need to be a commodity, the fact that it is does not make it right !

Foreign investors are buying up lots of London/SE. When have filled their boots there they will move onto the next big towns and the ripple effect will be felt by most.

In Nottingham, a lot of the new build flats were supposedly bought off plan by 'investors from Eastern Europe'. They then promptly crashed in price by ridiculous amounts (like £100,000 in some cases - this bit is definitely true, although who the first buyers were is just what everyone said at the time). It only makes any difference if they are buying things that there is a massive demand for (houses in extremely fancy areas in the South East), rather than being ripped off by our estate agents & developers (buying flats in city centres in the rest of the country).

"Rich, successful foreign investors? Investors who obviously recognise a good investment?"

You could argue that... or you could argue that.... in some quarters, there is soooo much money around that is almost boredom trades... Nowhere else to park that money.

A bit like when someone comes on STW and say I've got 100 quid spare what new bike part shall I buy? Just on a slighly larger scale

Housing is not just getting more expensive, it's getting more expensive as a %age of salary, and has been, at a huge rate since at least the 70/80s, if not (as a general trend) long before that

But that fails to take into account the effect of interest rates.

I think that when you calculate the monthly payments that you would have had to make in 1980 to buy the average house, that it would make up a similar percentage of overall take home pay to that of today. Simply put, lower interest rates helped drive prices up, but affordability remained broadly the same.

"housing does not need to be a commodity, the fact that it is does not make it right ! "

You may well be right... but that's a fight you will NEVER win.... Sorry

Rich, successful foreign investors?

I'd guess with this, you could argue that stamp duty is making houses at < 250k a much better investment than the higher end stuff for investors.

If you've got say, just over 2 million to invest, you could buy 8 or 9 250k flats/houses and pay 20,000 in tax or 1 place for over 2 million and pay 140,000gbp in tax.

This will further reduce the availability of low end housing.

It's all Robbie Fowler's fault. He bought all the cheap houses.

Foreign Investors are primarily buy up parts of Belgravia & Westminster because of the weak pound. It makes the houses cheap(er) and these assets are seen as a safe haven during a time of ecomomic volatility.

They're not buying on the fundementals of the UK housing market and its potential growth over the next 5 years.

They're not buying on the fundementals of the UK housing market and its potential growth over the next 5 years.

They're also quite clearly not betting against it or to a lesser extent have directly bet against a pricing crash.

The market peaked because of easy credit and very low deposits. The cost of housing is related to what people could borrow as opposed to what they could afford. You've effectively got the same people in the same size houses as you had 15 years ago, the difference is the supply and demand side of the market got out of control when people were able to borrow more than they could afford. The low interest rates have sustained the bubble, housing benefit will also be having some affect, as will poeples reluctance to understand that their property is only worth what someone else is prepared to pay for it which today is severely limited by what they can borrow. For those poor sods who didn't buy before the prices went mad in the early noughties I fear the future is bleak as the government isn't going to want to allow a sudden correction in prices, hence the current interest rates. When they go back up there will be a property blood bath.

Lots and lots of people, very small space

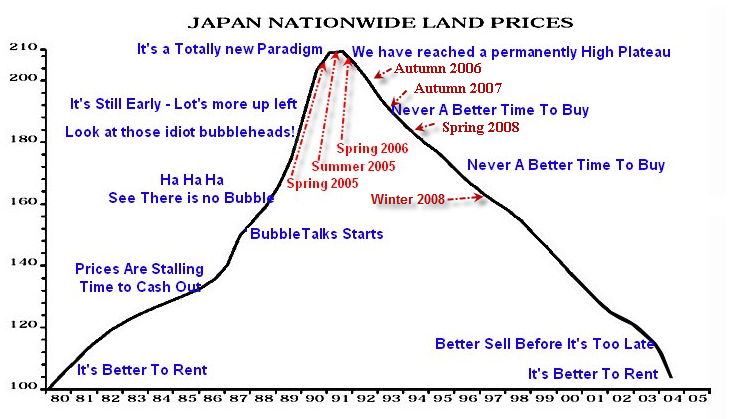

Bit like Japan.

The thing that's unique about the housing market in the UK is that we're the only country that had a credit/debt boom that hasn't had house prices reset to historical norms yet. The government's approach - current and former - seems to be "not on my watch". [url= http://www.power-to-the-people.co.uk/2008/09/gordon-brown-house-price-inflation/ ]If only someone hadn't let house prices get out of control in the first place...[/url]

The thing that's unique about the housing market in the UK is that we're the only country that had a credit/debt boom that hasn't had house prices reset to historical norms yet.

I'm not quite sure that's true. A lot of northern europe has experienced huge rises in house prices over the last 20 years, and while a lot have fallen in the last few years, I'm not sure that many have fallen to 'historical norms' yet. Certainly places like Spain and Ireland have, but Sweden/Denmark, and even the US are still much higher than before the bubble.

Ours have certainly grown the most (apart from Ireland), and have barely fallen at all, instead pretty much plateauing since 2007-8. To fall to 'historical norms', even accounting for inflation, you'd be looking at wiping probably 50-70% or more off UK house prices. Obviously that would be bad for homeowners and disastrous for those with outstanding mortgages.

Obviously that would be bad for homeowners and disastrous for those with outstanding mortgages.

I wonder what percentage of the population bought at the peak of the housing bubble as opposed to the numbers forever now locked out of the market or even locked into unsellable property due to a failed market.

I doubt the gov are thinking of the average man.. more the banks balance sheet.

Obviously that would be bad for homeowners and disastrous for those with outstanding mortgages.

As well as apocalyptic for the UK economy as a whole. This recession would look like a blip in comparison.

more the banks balance sheet

The capital adequacy stress-test scenarios included a significant drop in house prices - about 30% I believe, and my impression is that the banks could cope with this. But given the obsession in this country with property prices no government wants to let the opposition point to them as the one that caused the rollercoaster to stop, and of course they won't want their own property portfolios devalued!

Edit:

As well as apocalyptic for the UK economy as a whole. This recession would look like a blip in comparison.

Probably worth reminding people that average house prices dropped by about 35% between 1989 and 1995 and the world didn't end.

One difference between the US and the majority of Europe is that when you buy a house with a mortgage there the only 'colateral' that the Bank holds is the house. Consequently if you can't afford the payments, go bankrupt or it just loses all its value and not worth paying for you just give the Bank the keys and walk away. Here and most other places the debt follows you.

And I'd agree that Housing Benefit is one factor in maintaining house prices, but IMO the lack of availability of houses/land where people want/need to live is number one.

We bought in 2001 for £150k and sold this year for £250k, and the rate of pay for my role is pretty much where it was in 2001...

As well as apocalyptic for the UK economy as a whole. This recession would look like a blip in comparison.

Theoretically, low, stable house prices would be good for the economy. The price of houses now is so much more than the price of building them that lower prices shouldn't have to mean lower wages in the construction sector. People paying much less for houses would mean much more disposable income to spend on other things, so theoretically the price of food and other manufactured goods could rise enough to support UK production. Obviously we can't get from where we are now to low house prices without a huge disaster, and even then, there would be no acceptable way of keeping house prices at that low, or of getting people to pay more for other things.

However, I can't see how things can stay like they are now either. If they do then in a few generations time we'll be back to the middle ages, with a few huge landowners and everyone else spending their entire working lives trying to pay them.

Its all about the interest rates...

Who sets the interest rates?

Theoretically, low, stable house prices would be good for the economy.

Theoretically. But we know what happens when prices drop; interest rates shoot up. The problem is not necessarily that people can't take a hit on the value of the property, it's that they could not afford repayments with interest rates at 8%. Obviously, they'd all default, go bankrupt and their houses would be repossessed. The banks would then own hundreds of thousands of houses worth half of what they'd lent against them so they'd perhaps need bailing out and certainly wouldn't be in any hurry to lend money. Only cash rich investors would be buying (to let, and there would be no shortage of newly homeless tenants). Which leads us back to the middle ages......

But we know what happens when prices drop; interest rates shoot up.

I think you've got cause and effect the wrong way round. Usual process is that interest rates go up (for various reasons) and [i]then[/i] prices drop because people can't afford repayments - one of the mechanisms by which interest rates can affect inflation. Investors then stay out because prices are dropping leaving the market for people who need homes to live in. And don't forget, not everyone is mortgaged up to the hilt.

Feel free to pick holes in this theory.Would it make sense to buy a buy to let as your investment but then rent yourself?

No because any rent you receive will be subject to income tax (probably at the higher rate if you have a half decent job), thereby adding on a possible 40%.

I think you've got cause and effect the wrong way round.

Maybe, but the nett affect is the same. People become homeless and the banks lose money.

Result; entire country in dire straits.

Lots of greedy capitalist ispired people bought cheap houses as buy to lets and saw them as an investment, sadly a lot failed to factor in void propeties and the effect it has on the repayments, so if the flat or house is empty for a month youve lost say 400 quid, per month its empty, your repayments are 350 or hopefully lesss.But you still have to make the repayments.

You decide to rent to benefit claimants, some who dont care, and they wreck it bit by bit and move on, but hopefully you get your rent, but with the new bedroom tax next april, there will be enforced downsizing, and that means either reductions in rent to keep the good tennants or put in dont care tennants who will get a higher rate of benefit due to haveing bigger families.

Result a lot of reppos, and cheap homes, with whole areas decimated as the metal thieves move in, or the ex tennants just vandalise them.

In contrast to some saying no crash, the house i am in at the height of the boom in 2007 was selling for £170k, next door went for £107k a few months back and while the house i am in is currently on the market for £135k, it has had one viewing in two months.

The market is dysfunctional at the moment, some places are good, some are apauling, fundamentally very few people ever buy a house with their own money. They are given money by a bank and house prices are controlled by how much banks are willing to give out.

They are given money by a bank and house prices are controlled by how much banks are willing to give out.

Yep, a good argument for a statutory limit on lending at a fixed ratio x gross salary.

there seems to be a lot of people here making a link between housing benefit and high rent..

Am I missing something here..? Because in my experience housing benefit claimants are very much in the very lowest end of the market.. I didn't think that is was very likely that a rent covered by housing benefit would be anywhere near enough to cover a buy to let mortgage, or that people on housing benefit could afford to rent in the private sector..?

Round this way at least it's nigh on impossible to find a private landlord that will take on tenants on housing benefit, aside from the occasional well established slumlord..

Is there a glaringly obvious point that I'm missing..?