![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

Given the noise being made this week by BoE about interest rates going up I'd be surprised if they don't this time as Mark Carney and BoE will lose all credibility...

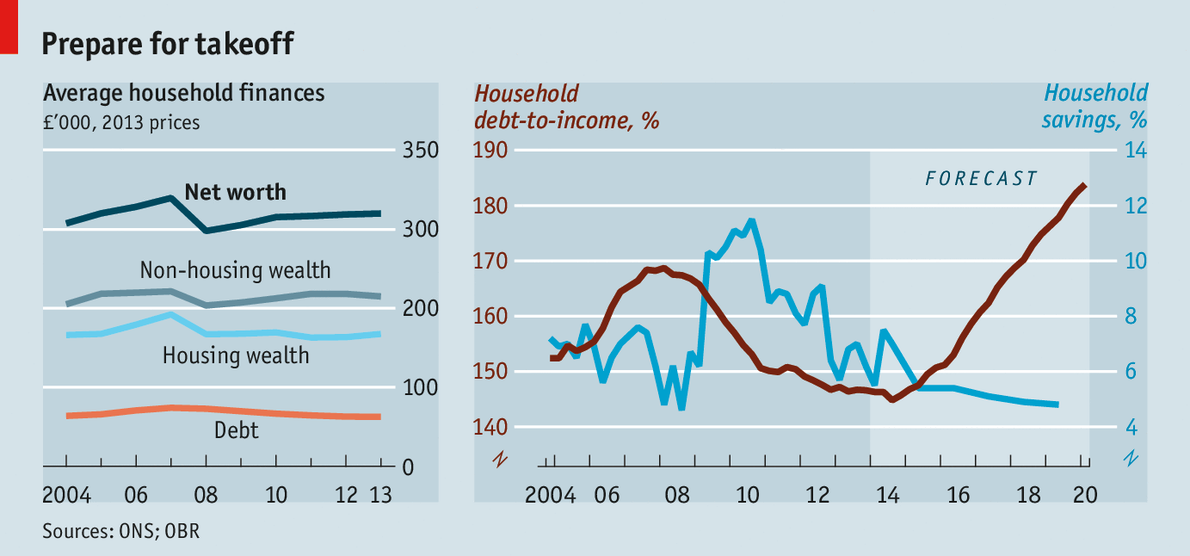

Question is, as we're still massively in debt (household debt = 90% of GDP) and the forecast is for this to get worse, not better... what's the outcome going to be for UK consumers... lower consumer spending, bankruptcy, another recession?

Or will it be a marginal e.g. 0.25 or even 0.125% for a few months, see how it pans out and then drop back down again to 0.5%...

[quote=brooess ]Question is, as [b]we're[/b] still massively in debt Speak for yourself sunshine. I just want to get a decent rate on my savings 😆

crystal ball time, but if we're guessing....

It wont be a big increase at the end of the year if anything, it will be just .25% or less.

Rates can only really go one way from where we are now and thats up, so expect a gradual increase over the next 2 years up to maybe 1.5% by end/mid 2017.

Speak for yourself sunshine

Yeah brooess. You personally might be approx £1,535,000,000,000 in the red, but that doesn't mean we all are 😡

The rise will be very slow and carefully managed so as not to crash the housing market as that is all that is driving the UK economy at the moment.

Someone on Radio2 a week or so ago reckoned it might get up to 2% in gradual steps over the next couple of years but will be carefully managed and there'll be no sudden interest rate hikes....

Carney said it would keep edging up slowly over the coming years, seems sensible to me. But I'm debt and mortgage free, I can afford to be smug.

Wasn't this the cause of economic crisis? Interest rates went up, everyone realised they couldn't afford the mortgages that were built on sand anyway... BOOM

Needs to happen, just slowwwwwwwly.

Yes we remain highly indebted.

Interest rates are being held at artificially low levels to deliberately distort the pricing of risk - shocking

When they normalise many will be hit very hard

Rock, hard place anyone

Rates rose through most of the mid 2000s to try to slow consumer spending and it sort of worked, however what wasn't know was the amount that consumers where over-stretched, mortgage co's allowed themselves to lend more than they should by using self-cert and finance co's rarely, if ever, asked customers to complete an affordability calculation before borrowing more and more - two things that are, at the moment anyway, not possible.

Consumers have been up to now protected at all costs to stop further decline of bank balance sheets and their liquidity - but they've been 'on notice' since 2008 to put their finances in order - anyone still sitting on a mortgage of 6, 7, 8 times thier income will be in for a shock in the next few years.

It's believed by some that even though we seem to be in a stable growth period now, the long awaited housing market rebalance will happen when rates hit 2% or higher. The BOE considers the 'new normal' base rate to be 3.5%.

Given the noise being made this week by BoE about interest rates going up I'd be surprised if they don't this time as Mark Carney and BoE will lose all credibility...

There's an old saying about central bankers:

'Don't listen to what they say, watch what they do'

'Don't listen to what they say, watch what they do'

Mervyn King I think it was, admitted that half his job was about setting and managing expectations through what he said publicly, as much as it was about what he did with interest rates and other tools...

For my money, Carney has been making noises about interest rates for so long without following through with action as a way to encourage people to pay down their existing debts, reduce their future borrowings and to get themselves onto fixed rate mortgages or out of BTL so that when they do put rates up, the ensuing recession and housing bust will not hit too many people, just those who've been too daft to stop using debt to fund a desired lifestyle, or think BTL is some kind of get-rich-without-working scheme.

Hopefully they have the data which shows now is the right time to go up. Anecdotally and looking at the levels of personal debt we have I'm not so sure...

As much as I want higher rates to give me a return on my savings and to bring house prices back down to where I can afford something, I don't think the situation's going to be very pretty at all...

As much as I want higher rates to give me a return on my savings and to bring house prices back down to where I can afford something, I don't think the situation's going to be very pretty at all...

realistically though, how many are seriously at risk here? (genuine q).

Anyone who took out a mortgage before 2008 will have budgeted for interest rates at 5% or whatever.

Anyone who took out a mortgage after 2008 will have seen their house increase in value (30% in Bristol since 2009) so they're not at great risk of negative equity & should be a few years into the mortgage too.

Perhaps people who took out a mortgage recently on a variable rate and stretched themselves to the limit? But I took out my first mortgage this year and made certain that we'd be ok if things changed, and I imagine most other boringly sensible people would have done too...

I can't see any major issues hitting homeowners. Possibly tenants who have their rent put up by squeezed BTLers?

Perhaps people who took out a mortgage recently on a variable rate and stretched themselves to the limit? But I took out my first mortgage this year and made certain that we'd be ok if things changed, and I imagine most other boringly sensible people would have done too...

That's what BoE are hoping too, but this debt projection suggests not. Plus the sheer amount of debt we have suggests not a high enough % of the population are as boringly sensible as you (and me) to prevent another bust...

A few recent articles from the FT too on the state of housing - well worth reading the comments for additional viewpoints. Maybe only pessimists read the FT?

[url= http://www.ft.com/cms/s/0/8e85675c-2648-11e5-bd83-71cb60e8f08c.html#axzz3gcxiDqIt ]Speculative investors head for the exit in Nine Elms[/url]

[url= http://www.ft.com/cms/s/0/739a3700-2eeb-11e5-8873-775ba7c2ea3d.html#axzz3gcxiDqIt ]QE feeding house price bubble[/url]