![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

https://www.confused.com/car-insurance/guides/has-car-insurance-gone-up

Confused. Com reckon the average fully comp price has increased by 58% since last year.

That’s if you can actually call them up

Which companies are good at answering their phones?

I’ve been with Hastings for years and have to say that they’re very good at answering their phones. I had the whole thing sorted in 5 minutes

Like others have said, I can’t get why they bumped my premium up by 40%, then immediately reduced it by 40% as soon as I called to cancel.

I guess some people must just auto-renew without questioning it, leaving them quids in 🤷♂️

Just insured my 911 C4S and was a bit worried. Ended up at £306.68 with Churchill!

It’s odd, Porsches always seem cheaper to insure.

Happy to be corrected but certain cars are cheaper as they’re less likely to be involved in a claim. In other words a sporty hatchback is more likely to end up halfway through someone’s living room than a 911.

Wife's 2.7 2014 Boxster always seems cheap. £172 last year, garaged, 5k, Hampshire.

Due for renewal in 6 weeks...

Son paid £3.5k for his first year of driving for a 15 plate focus. He’s 21 and didn’t want one of those boxes fitted. I know the younger generation are considered more at risk but they’re all taking the piss. But what can you do?

Well, we know they'll load in as much profit as they think they can get away with but notwithstanding that the premium will pretty closely reflect the risk. For all that people moan about half-blind oldies bimbling about on the roads causing a hazard to navigation it's young people that are more likely to crash big and often.

we know they’ll load in as much profit as they think they can get away

Most car insurers run at a 100% loss ratio across their book. Few will price in any underwriting profit. They try and make their money off investments instead

Most car insurers run at a 100% loss ratio across their book. Few will price in any underwriting profit. They try and make their money off investments instead

I knew profits on the industry were famously low despite the reputation for rapacity but I didn't realise that was the model. I still reckon they'll take it if they can get it though!

It's such a cut throat industry. Service matters little and price is king. It's a race to the bottom.

The government are the only winners here. 12% IPT on premiums that are increasing by 60%! £7bn in IPT in the UK last year. Significantly higher this year.

Mine went from around £550 to £700, Merc CLS, live in central Cardiff, so went on a few comparison sites which are always much, much cheaper and the best I could do was £15 less than my quote, so I just sucked it up, oh well.

4year old caddy,

41 years old,

£290, VED cost more

Admiral multi car

This year:

VOLVO V50 1.6d (Some mods) - £845.99, 2yr NCB, 22yr old son

BMW 335d Xdrive- £824.05, 11+ yr NCB, 53 yr old wife

MERCEDES VITO Tourer - £682.74, 11+ yr NCB, 54 yr old me

Last year:

VOLVO V50 1.6d (Some mods) - £936.75, 1yr NCB, 21yr old son

BMW 335d Xdrive- £487.05, 11+ yr NCB, 52yr old wife

MERCEDES VITO Tourer - £450.24, 11+ yr NCB, 53 yr old me

Are BMW parts suddenly massively more expensive? No accidents etc happened in the past year so it seems to have jumped massively.

Most car insurers run at a 100% loss ratio across their book. Few will price in any underwriting profit. They try and make their money off investments instead

Can you unpick that a bit?

What does 100% loss mean?

Are you saying they don't make any profit from the premiums, but stick the money in a stocks-and-shares ISA?

Fully comp policy on my van up from £478 to £552 (Aviva).

They've always been good to deal with, so I'll probably just swallow it and renew rather than shop around.

Can you unpick that a bit?

What does 100% loss mean?

Are you saying they don’t make any profit from the premiums, but stick the money in a stocks-and-shares ISA?

Loss ratio is the amount of money an insurer makes v's the amount they pay out. 60% loss ration means they pay out £60 for every £100 they take in premiums. Traditionally insurers were at 60 - 70% ish, most now are very close to 100% meaning they pay out as much in claims as they make in premiums. I know that some are over 100% which isn't sustainable long term but can be help for a short period of time if there were a lot claims events.

So they make money in wider investments and/or through sales of other products.

Most car insurers run at a 100% loss ratio across their book

Just to be clear, you mean a Combined Operating Ratio approaching 100% on private car insurance.

100% Loss Ratio would be around 120%+ COR at a guess, which is including the cost of operating the insurer plus commission/advertising costs. And that's very a low cost on car insurance, whereas on house or commercial policies the commission + operating costs are generally a much larger percentage.

zippykona

Full MemberThat’s if you can actually call them up.

Which companies are good at answering their phones?

IME Churchill are. And not just for taking your money but also for claims and stuff. It's mostly why I've stuck with them even when they've not been quite the cheapest, they were absolutely superb for the claims we made- a house fire, a series of breakins, and a written off car. Literally negotiated me upwards by a grand for one of the break-ins, fast payouts, no fuss with builders etc.

To be fair, that's a good point.. Years ago I was with hastings and they tried 1000% to palm me off to some pirate 3rd party claims managent company....

on a non fault claim... the 3rd parties insurers were much easier to deal with as it was a cut and dry case, hire car straight away, ( a brand new merc) where as hastings 'couldn't find a hire car'

Errm, no, you are my insurers, you sort it, that's what I pay you for.

The entire car insurance industry is a convoluted mess.

Just had my renewal through. Was £280 up to £411!

just done very quick quotes on confused and it’s coming out £600+ !

Subaru Legacy 2007. 4kmiles a year. Edinburgh 45yo male and 47yo female both full no claims and neither ever had a conviction. £350 up from £250

Nissan leaf 2015. 5k miles.a year £300 up from £240 for same people.

Oh and direct line, they tend to always be cheapest for us. Have occasionally gone to admiral or Aviva but no other companies get close.

Insurance companies really ****ing rip the arse out of consumers. Having said that I decided to get on the gravy train and bought shares in Aviva, Legal and General and they give great returns. I consider the share payments as rebates.

Its been a tough one this year and i expect it to continue.

Golf 1.4tsi up from £275 to £550

Audi RS4 up from £800 to £1500 (most north of 3k and up to 6k!!)

Both old low value cars though.

Thing is in the last year the wife got points (that i didnt find out about till renewal), The house roof went through the back of her car resulting in a claim for property and car and i wrote off an M3.

So yea sorry about that a lot of this is probably my fault....

My car insurance is half the cost of my van insurance. Car: 9yr old MINI Cooper SD (2ltr, 170bhp) with a few modifications. Van: 6yr old Transit Custom dual-cab (2ltr and slow...).

It shows the risk factors/cost of claims associated with vans are exceptionally high compared to what I'd class as a high-risk small hot hatch largely owned by nobbers. Even my previous car (17yr old Vauxhall Monaro - bascially a muscle car with a 400bhp 6ltr V8) was similar cost to insure as the MINI.

2012 Volvo c30 D2, currently insured by RAC.

I’m 52 with no points, 20+ years no claims; was £178 last year & just rocketed up to £195 this year. That’s fully comp’ with 5k miles (I rarely do over 3k in my own car), European cover, £0 voluntary excess & £150 compulsory excess.

Coupled with £0 VEL, & 50+ mpg from an asthmatic 1.6 diesel it’s about as cheap motoring as I could get.

Errm, no, you are my insurers, you sort it, that’s what I pay you for.

Er, no they aren't. Hastings is a broker, not an insurer. But yes, they should still be sorting you out.

The third party insurer helps you for two main reasons; it's cheaper if they just sort it; if you're impressed then you'll go to them for a quote.

Oh, and there's no regulator or ombudsman protection if the repairs are crap. You're on your own to take action in court.

My daughter has just had her renewal letter.

22 years old, 2005 1.3 Yaris, 6000 miles/year, 4 years NCB, black box (Tesco)

£403 last year, up to £437 this. The broker I often use can't get anywhere near this. This is the first time it hasn't come down in price.

Hmm, Just checked again as renewal for Aygo is due in a month, and the quotes are £1,200 up from £800. It's a 13 year old £2k car. Flippin heck. Daughter and son insured.

Aygo is due in a month, and the quotes are £1,200

You could buy them a bike each for that.

Just had a look on Money Saving Expert and there was a very interesting and Very relevant bit of info there, borne out by a test I did: the best time to get a quote is ~26 days before your insurance is due.

I just did a quick test checking for insurance to start on 19 Nov and it was almost half what I've been quoted assuming I wanted it to start before the end of October - £681 vs £1197

I was going to test the dates to see if it is a bit cheaper

Tried putting in November 18th and made no difference.

No difference here. Just awaiting the current insurer's renewal quote.

£680 for an Audi a5. (Up from £320 on my previous car which was 1/10 the value). Despite going for the least chavvy - and therefore hopefully less Nick able- configuration I assume theft is still the main driving force behind claims for my demographic. I know 2 people that have had cars stolen from their drives, a third nearly lost a motor home. No other major claims (that any of my friends would admit to at least) in the same period.

Back in feb when I first started idly window shopping I could have insured a £30k Cayman for £390. Regret passing that up now!

Ox - I did the same in that I got online quotes from 28 to 7 days before my renewal date; no meaningful difference.

Just had my renewal through

was £320 up to £510. No claims, convictions, nothing.. Even with the free £250 excess cover go compere offer nothing is coming in cheaper than my renewal cost..

That's bonkers...

Just renewed the insurance on the camper. Last year, £256. This year, £264. 🙂

67-S4 14yrNCB, last year Aviva £340, this year £680.

AABeam £450 same cover.

Cheaper available £250 but only 3* on trust pilot thus avoided.

Just renewed the insurance on the camper. Last year, £256. This year, £264.

I reckon you've done pretty well for whatever reason!

My renewal quote was £360, up from last year's £180. I hit the comparison sites and the best I could manage was £236. Not too horrendous I suppose, but still a 31% bump from last year. That's with mileage down from 10k to 8k, oldish driver in an oldish 320d so car value probably isn't a big factor.

I reckon you’ve done pretty well for whatever reason!

TBF it's only insured for 5k miles a year on a specialist camper/motorhome policy, and I've no third-party cover for driving other vehicles. But, yeah, happy with that.

Even with the free £250 excess cover go compere offer nothing is coming in cheaper than my renewal cost.

I'm sure there's a host of reasons why it's gone up.

Ox – I did the same in that I got online quotes from 28 to 7 days before my renewal date; no meaningful difference.

Yeah at this point I think they just push a big red random number generator button. Just had a prospective quote for adding a supercharger and taking it to ~725 bhp. £1100 on the nose, 7000 miles/year, fully comp with all the usual extras.

That's cheaper than some quotes I've had for the car as standard.

Note - I'm not adding a supercharger, that would be ludicrous

I’m sure there’s a host of reasons why it’s gone up.

Nicely done

was £320 up to £510. No claims, convictions, nothing.. Even with the free £250 excess cover go compere offer nothing is coming in cheaper than my renewal cost..

That's about what mine went to but managed to get £250 with comparison sites. Admittedly it's with a company I've never heard of but 🤷♂️

£987 fully comp on a Peugeot 208 110 Tech edition.But only started driving again in June. After years of year round motorcycle commuting.

£150 on a Kawasaki Ninja 1000 Sports Tourer. Been riding since 2003.

Ive pretty much gone the other way, ditched the car and commuting by a motorbike/moped and am worried about having no noclaims if I get another car in the future.

To maintain my no claims discount I'm insuring the family car in my wife's name one year, mine the next and so on. So that there's no more than a year's gap in qualifying bonus.

am worried about having no noclaims if I get another car in the future.

It's not too bad if you are on the wrong side of 40yo. with a sensible car, think honda jazz rather than M5.

I went ten years without a car as I commuted by train and seemed pointless to pay to maintain one.. I have my bike/taxis.

Typicaly you'll lose any NCD after two years if you don't have your own policy, not sure how it would work with a multi car policy, or as a named driver though, if you are not the 'main' policy holder I suspect it won't apply, but YMMV.

I spent a lot of money on taxis, but it was less than what I would have spent on maintaining and fueling a car, on balance.

Renewal in for my Vito van with direct line, £418 last year with zero ncb, renewal £582.

Quick scan on Confused.com and Admiral come in at £360, that'll do.

Thanks mattfez, yeah, that was my thinking but I'm exceedingly tight so although I've managed to prise the wallet open for a couple of trains so far I've never quite got up the courage for a taxi, instead walking the 3.5miles from the train station up into the village I live in. My logic being if I'd go for a walk in the woods for an hour, why not this to avoid a taxi fare lol

Daughter has her second test next week - 6 months between a minor failure. Insurance due at end of month. She's insured but hasn't been using the Aygo, son has as his 'track' car is in need of repair (big brake upgrade).

Quotes have jumped 50%, but will wait to see if she passes.

VOLVO V50 1.6d (Some mods) – £845.99, 2yr NCB, 22yr old son

...

Last year:

VOLVO V50 1.6d (Some mods) – £936.75, 1yr NCB, 21yr old son

Side note: this speaks to how wildly risky young drivers are. At a time when everyone else has gone up 50%, just making it from 21 to 22 alive made the premium fall 10%!

just making it from 21 to 22 alive made the premium fall 10%!

... and of course there's also the extra year's NCD.

I have just discovered that a much more valuable, VW Camper without any no-claims bonus is cheaper to insure than a Leon 1.4tsi FR estate with 10 years NCB....?

The camper does have a tracker and aftermarket alarm, but wow....

a much more valuable, VW Camper without any no-claims bonus

Valuable because it's old? Or new?

I can understand it easier if it's old. Newer might be a bit more of a stretch as I thought there was a healthy 2nd hand/dodgy market.

Maybe people just don't crash VW campers so much?

Which is surprising, because they're so busy waving at each other they hardly ever have their hands on the wheel.

Campers low risk of accidents probably, generally lower mileage, ours has always been cheap even when it’s been a daily driver.

Who have you insured with Matt? Brentacre have been good recently.

2 cars on due on same day (Weds this week!) with same insurer…now £438…renewal £543. Done a bit of option-finding elsewhere today and can’t it much better with like for like cover. They said on the phone today it was their best price - maybe they weren’t actually lying. Bollocks.

I’ve only owned 5 cars in 33 years but the insurance has always been around the £350 ballpark. My insurance stayed roughly the same this year.

There’s also only 3 years age difference between my first car and my current car.

Do the prices include many extras and add ons like legal insurance, breakdown etc?

What is this madness with insurance prices?

I'm trying to get a quote for my wife's car. She barely drives more than a few thousand miles a year (if that), it's on the world's most boring car (Toyota hybrid) and she's had zero accidents in the last 20 years.

£320 a year from a couple of places. What are we paying for? Last year was £188.

I'm tempted to start a thread on the bike forum "how to persuade my wife to give up on her car and switch to an ebike".

Might actually be cheaper just for her to use taxis tbh.

Just did a 16 (! Must get a new car!) Year old Mondeo estate fully comp, 9k a year, social+business+commuting. £210 with legal cover and courtesy car. Up from last year - adding my old man (78) upped the price for the first time (rather than decreasing it) so put the missus on instead and saved 20 quid.

adding my old man (78) upped the price for the first time (rather than decreasing it)

think you’ve done well there… for the first time in my life I’ve got a ‘nice’ car, coinciding with the insurance price rises. Tried a number of things to get the price down. Tried adding my (33) parents (65, own cars no accidents, nice postcode) and the quote was higher.

Might actually be cheaper just for her to use taxis tbh.

I wish more people would do that

14 plate Octavia. Gone up from £330 to £550. No additional drivers, convictions or accidents since last year. Cheapest I can get from the comparison sites is £430.

Seems crap but my 19 year old is paying £1600 for an MX-5.

*smug grin*

Zero

My car is invisible

For the first time I can remember, I can't beat my existing insurer's renewal price. 68 years old, Honda Civic 2015, 2 years NCB (many years with company vehicle), CA8 postcode, legal cover. £311 this year, £245 last. By contrast, 2021 Triumph Speed twin 1200 - £138 with legal cover and protected NCB. My partner's 2019 MX5 was £213.

Wifes car was £180, renewal is £250, not checked comparison sites yet

330bhp/ton fun car is less than £200

Motorbike is about £120

Apprentice at work pays £200-£350/month depending on which ibiza/fabia/mx5 he has on the road.

Adding parents at a different address used to decrease my price until certain ages where I guess they become higher risk

My 2007 1.4 Fester is going to be £226 on renewal. Up from £198 this year.

I think there's definitely a post code lottery going on, city centers or high crime areas, now more-so than ever it's probably weighted more... Also probably a bit of scalping on the insurance companies part as well, because they can, it would be naive to think they don't.

Just did a 16 (! Must get a new car!) Year old Mondeo estate fully comp, 9k a year

You could almost retain a private chauffeur for that sort of money, lol!

Well, maybe not, but pretty much unlimited standard taxi fares....

41 y/o, Full NCB, Modified but fairly worthless old VW Caddy covered for business/personal use is about £500. I use a specialist van insurer though which has always worked out cheaper for me.

2008 Ford Focus 1.6. 358 ****ing pounds with Hastings. Up from 261 last year. Nothings changed apart from 1 year of time. I completely missed the renewal notice.

2015 Peugeot Expert 1.6 £354

Fully comp on Abarth 595 Pista £305...and fully comp on 2018 vw caddy van ( Inc breakdown) £330

The only good bit about being old is cheap insurance

Just had our Admiral Home & Multi Car renewal. Up by 46%, with the portion on my car up by 58%.

Not claimed on the car for 15 years and never had a point on my licence in 37 years.

Time to have a conversation with them.

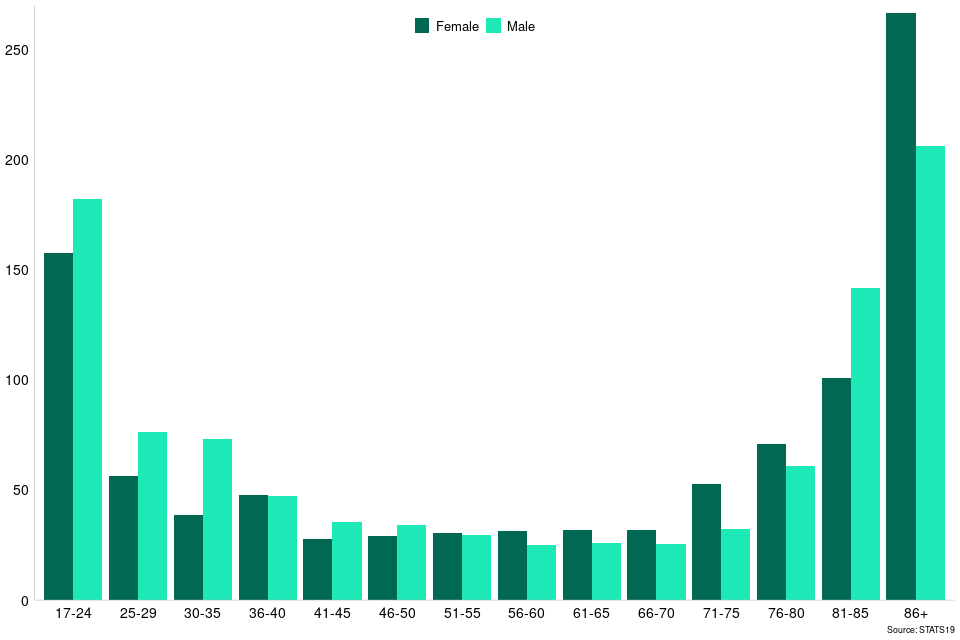

This chart (which unfortunately has lost the title!) is something like "driver casualties per million miles driven"..

I've got it saved on my desktop because, though the left of the chart is unsurprising, the right side really does show the risk of older drivers too!<br />I'm always having conversations with elderly drivers about "maybe giving up the car cos, you know, you're blind" etc, but they often feel they're low risk.. sigh!

<br />DrP

Just to give you an idea as to how localised it is, and how bad it's got, i reinsured the same make and model as our old second car (that was sold after the divorce ~7 years ago).

It was 4200 Sek/year (about 380 quid) which included european recovery, extra mechanical insurance and was fully comp and 50000 km/year.

It's now 4800Sek/Är for the same cover on the same age of vehicle with the same conditions, 7 years later.

Just done a bit of digging.

For my car on it's own.

Admiral (current insurer) £707 up 58%

Aviva £803

Direct Line £1,023

Farkin' Ell!

Both our cars renew at the same time, as we previously had Admiral multi-car.

My Wife's car (2 litre diesel Ibiza FR, 12 plate, ~10k miles/year) has come through from the RAC - last year was £299, this year £309 - so £10 more. That is with breakdown cover.

My car (2 litre diesel Leon estate, 18 plate ~14k miles/year) has come through from Churchill - last year was £300, this year £470. It does say on the renewal letter though "you been with us for a number of years, so you might get a better price by shopping around".

I think I'll stick with RAC for my Wife's car & see if I can get a better deal for mine.

Same with me. Wife's car up by 17%, mine up by 58%, but they have added onwards travel that I don't need as I'm already covered by the RAC.

I've a renewal email from Sainsbury's (they weren't the cheapest, but had good Which reviews for customer service), to remind me that my car insurance (2012 Prius+) is up for renewal shortly, but not to worry as they've made it really easy to renew.

Last year's total price: ~£654

This year's total price: ~£2108

WTF. That's quite the bump.

Renewed ours just before Xmas , Saga on the side of older people? Nope ! Went with Halifax £280 for a 2019 Focus estate wife and I , both retired low usage 7K a year . Then our local garage had a 2022 Focus estate in , same size engine and BHP only difference ST so a bit fancier . Halifax quoted over £500 !!!! Curiously underwritten by Aviva and I got the insurance from them for just over £300 ! 🤔🤔🤔

Just to confirm my suspicions that all insurance companies only differ from Dick Turpin in they don’t wear a mask when I cancelled with Halifax they charged me £76 for less than a months insurance when 12 months was £280 ? 🤔🙄On top of that they also charged me £35 “ cancellation fee “ 🤔😡😡

Just to confirm my suspicions that all insurance companies only differ from Dick Turpin in they don’t wear a mask when I cancelled with Halifax they charged me £76 for less than a months insurance when 12 months was £280 ? 🤔

Maybe more d*ckhead drivers choose to buy and then crash the schportier car?

I've got exactly this with our FR. It's seems it's both crashed and stolen more than the same engine & drivetrain 'less schporty' model.

Agreed that charges for changes to policy are just a scam.

£350 for 16 plate transit custom

Civic 1.8, I’m 51, live in a Hampshire town.

5 years Ncb. Was with esure, they wanted 500 squid this year so changed to Churchill at £280 fully comp. Edit to add: 6k miles a year.

zafira tourer up to £400, gt86 under £250, same conditions, drivers, the works.