![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

I read [url= http://info.moneyweek.com/urgent-bulletins/the-end-of-britain/?infinity=gaw%7EDISPL%2BSPCFC%2BThe+End+Of+Britain%7EDISPL%2BSPCFC%2Binterest%2BFinances%7E26002516509%7Eplacement%3Art.com%7Ec&gclid=CKLZ6NjphLoCFQTMtAod7TYAVw ]this[/url] earlier and, skipping past the obvious advertorial nature of the piece, it does highlight some very "uncomfortable truths".

I notice that the graphs don't appear to say if they include inflation or provide comparisons with the USA, France, Germany or Russia.

Is it time to be stocking up on firearms, fortifications and tinned goods??

I have a strange sense of déjà vu

when was that written?

Did you really read all that crap ? I scanned through it and picked up some deliberately misleading nonsense, that was enough for me.

Doom, Doom, DOOOOOOOOOOOOOOOOOOOOM!!!!!!

Have a look at the post be Eoin about the graphs here -

http://www.politicsforum.co.uk/forum/viewtopic.php?f=93&t=41768

I struggle with long sentences. Is there a summary? Preferably with kittens and rainbows to balance the doom mongering.

Right-wing propaganda designed to sell more copies of MoneyWeek

It should be on the new BBC channel soon then.

http://www.thedailymash.co.uk/news/arts-entertainment/right-wing-bbc-launched-2013101080225

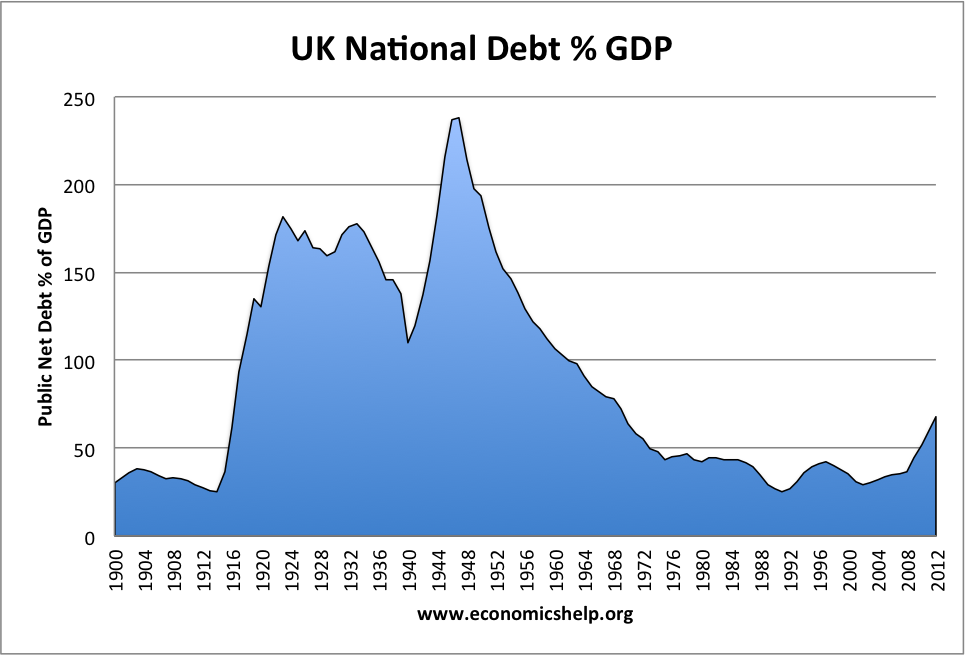

I particularly liked this graph which shows that Britain had almost no debt during and immediately after WW2 !

Of course when you look at one which expresses debt as a percentage of GDP, ie, actually means something, you get a somewhat different picture :

Nicely debunked ernie! 😀

Interesting that people seem to be so dismissive of the points made in this article. You may think that the conclusions are a bit exagerated in terms of the impacts but the big facts are basically true? Debt growing unsustainably, can't go on forever?

Ah OK! 🙂

Have I woken up in Greece?

The cynical amongst us might think that these people are trying to sell something with scaremongering shock tactics..... of course I wouldn't think such things...

The data is way out of date. eg. National debt as % of GDP. UK higher than the PIGS?? I think not! Ireland 108% in 2012, Italy 124% in 2012.... etc...

It's laughable to think that you'd subscribe to a economics magazine with numbers so out of date. Get an Economist instead.

The article has some elements of truth wrapped up in healthy hyperbole to sell you something - this is money week after all. The other link is probably more interesting as it points to the wider debt perspective in the UK but sadly misses the other one that at the global level, gov debts are close to all time highs (we do not compete for borrowers money in isolation.).

Why does all this matter? We are in the process of a major (albeit slow) deleveraging as people, companies and governments pay down their debt levels. This is why the total debt figure is so important. This is creating a major policy headache for gov's around the world. In most developed economies, the current policy mix is tight fiscal policy (although not as tight as austerity headlines would like you to believe) and ultra loose monetary policy. Put simply, if you increase money supply, this should lead to an increase in nominal GDP (ie real GDP plus inflation). But at the moment, the very large increases in Central Bank assets and the monetary base are not flowing through into higher output or income. Why, because what is called the velocity of money multiplier (crudely put, money supply x velocity = nominal income/output) has collapsed. There are various reasons for this, broken banks, people nervous and the high levels of debt outstanding (despite what STW naysayers claim).

So what is the problem? First policies are not working in the way that policy makers would like. So they keep adding more and more fuel to the fire. At some point however, the velocity of mone will pick up and then we risk a big rise in inflation. History is very clear on this. In the meantime, Gov's will now repress themselves out of debt (keep interest rates below inflation) to "steal money" from savers to pay for our debts. This is an old trick. At some point during and/or at the end of the period there will be a large rise in inflation. The timing of this depends on the "velocity." The money week article takes a relatively aggressive line on this (i think as the tone put me off) as it needs to sell you something!

But the basic message is very important when you consider pensions etc.

Can someone please explain to me this !

If there is so much much debt who the flippin bloodey eck has all the dosh and why are they so greedy ??

Is there a huge conspirital oligarchy (love that word) who hold all the dosh ? if they do hold all this dosh why cant we just form a huge happy collective and star trading goods and beans and fluck em off so their money is useless.

I think the message is clear - it my patriotic duty to invest my money in Orange, Renthal and Hope stuff asap before I lose it. I'll tell the missus, should go down well.

bullets, batteries and barricades it is then!

"debt as a percentage of GDP"

This - the value of debt is proportional.

It's a crappy magazine, sister publication to 'The Week' (Also shite).

For a more serious look at current affairs take The Economist

So thats what happend to Cressers!

How long until "the sickest man in Europe" rises again?

Sorry to say this but we have not reach the bottom yet the sliding down continues ...

The answer is no. He will not rise again as the sickest man is in slow death or decline.

It is a matter of making death less painful ...

i don't know the answer, but what is the off balance sheet debt like? How much is PFI worth in comparison to on balance sheet debt?

Love that you can buy a t shirt for it.