![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

@gofaster I think it's all ego for the European politicians and their quest for the European superstate.

@ernie Argentina has been lurching from one debt crises to another since the 70's, default or restructurings. The Greek don't want the same as they know how devastating it would be hence from Election day Syriza have made it clear their mandate is to stay in the euro. The PM just said today that they will honour the terms of the bailout. Argentina's experience also shows how fortunate Greece where to get an EU/IMF bailout where they can deal with organisations with political objectives rather than hard nosed business people, Argentina has fought and lost a number of court cases on its debt and has very little room for manouver.

As for Argentina why not post up some graphs of inflation or unemployment, I'll relate one the stories of my ex boss who's married to an Argentinian. When they visit he has to ensure he only has one or two bottles of beer an evening as that's all his wife's local friends can afford, those with jobs anyway. I'd wager very few people in Greece want to be in the same situation as the Argentinians

I wonder whether a defaulted / euro exited Greece could remain in the EU ? There would be no credibility and we have the old favourite issue of freedom of movement. Greece has seen a number of waves of emigration, to the U.S. to Australia etc. I could see a defaulted Greece leading to another big wave of emmigration.

Also poll in Germany showed 76% of the people asked where against a Greek debt restricting / bailout #2. Syriza aren't even bothering to go to Germany to meet the finance minister. Paris earlier me London this evening I understand

@ernie Argentina has been lurching from one debt crises to another since the 70's, default or restructurings.

The default was in December 2001. In the 70's Argentina was following neo-liberal right-wing economics (as was the rest of Latin America) precisely the sort of policies you incessantly champion on here.

.

As for Argentina why not post up some graphs of inflation or unemployment, I'll relate one the stories of my ex boss who's married to an Argentinian.

You claimed nothing had improved with the Argentine economy since they defaulted, this is clearly nonsense so I posted graphs to show that.

But now since you're asking here is a graph showing unemployment levels since Argentina defaulted :

Inflation in Argentina is very high, this is the natural consequences of the inflationary policies they have pursued, the spectre haunting Greece due to very different policies is a deflation - a far greater evil that truly destroys confidence/demand/jobs than inflation.

I'm sure your ex-boss can tell you some very interesting stories about Argentina - the policies followed there for the last 13 years have been very good for vast numbers of poor people (and a great many middle-class/professional people became penniless when the neo-liberal experiment collapsed in December 2001) and very bad for some very rich people.

I was in Argentina in January 2002 and saw the some of the utter despair caused by the collapse of the neo-liberal economic experiment. And I have more family in Argentina than anywhere else in the world. This doesn't make me right of course - someone with a right-wing point of view will argue the complete opposite to my conclusions, but I hope it will help you to understand that I don't give a monkeys what your ex-boss, or his wife, has to say 🙂

After devaluing and defaulting, it only took one quarter for Arg to start to recover. Greece should look here and to Korea not to Berlin.

Missstripes works in debt management. 'S pretty much what she thinks.

but I hope it will help you to understand that I don't give a monkeys what your ex-boss, or his wife, has to say

haha touché !

tmh Greece should look here, ie the UK ?

Finance minister in London, has made it clear to private lenders/investors that they will not default on the privately held debt. Makes sense as if they get a sniff they will start preparing legal action which will make life troublesome to say the least.

Syriza do seem to be dealing with the spending side, ie spending more/reducing asset sales without any plans yet for how they will pay for it including stating they don't wish to take the euro 7bn bailout payment due at end of Feb. It's just not clear how they expect to pay for these spending decisions, where's the money going to come from ? They has said they won't default on the EU/IMF debt. Nothing adds up.

Syriza aren't even bothering to go to Germany to meet the finance minister.

To be fair to them, they know full well what the German finance minister will say, as the German government do all their talking via leaks to the German press. I doubt they'd learn owt new, or make the remotest difference to German intransigence over everything in the Eurozone. So why bother?

“You cannot keep on squeezing countries that are in the midst of depression”“At some point, there has to be a growth strategy in order to pay off their debts and eliminate some of their deficits.”

Seems like Obama hasn't been listening to you ...

So why bother?

To drop off some money in Switzerland on the way? Oh no .. that was the last lot.

Seems like Obama hasn't been listening to you ...

Or perhaps he just has a grasp of Economics, that isn't clouded by inflexible Political Dogma?

tmh Greece should look here, ie the UK ?

No I didn't, I meant Argentina and Korea. But funnily enough our effective devaluation and exit from pegging to the D-mark was perceived as a disaster but was actually a blessing and major boost to the economy.

nothing adds up

Of course not!!! 😉

That's the fun bit to watch and analyse. Obama is correct. The current proposals condemn Greece to a downward spiral. But the solution is verboten. Hence the can gets another kicking....

Seems like Obama hasn't been listening to you ..

@PrJ Pretty easy political positioning for Obama, he wants a strong Europe to buy more stuff from the US and he and the US taxpayers aren't a lender. So he's free to say what he wants. If you'd ask him he'd be delighted to tell you the EU state spending is far too high, that's his primary policy suggestion to reduce the deficit. Americans see Greece as the perfect example of how left wing / socialist government spending ruins an economy.

Even if you assume the political "elite" and the bankers took a cut of the euro 340 billion borrowed by Greece it would be a tiny drop in the ocean of money that's gone "down the drain" (Syriza/Greek finance ministers words BTW)

that isn't clouded by inflexible Political Dogma?

Like honouring a contract you've signed, paying back money you've borrowed or at least the interest ?

Greece is not the problem per se. The numbers are small change. The issue is the secondary effects and that is what scares the Eurocrats.

Messy, messy, messy.....if only it was Messi, Messi, Messi.....although not with regards to tax affairs!!

Like honouring a contract you've signed, paying back money you've borrowed or at least the interest ?

Well, as has been stated a million times, they can't pay that money. It simply doesn't exist. So at that point, what do you do? Stick to your schoolroom principles and insist that the entire nation goes down the toilet, women and children first? Or come up with a pragmatic solution that results in everyone getting something?

In fact I am in that position myself. Someone owes me money. I have a signed agreement from made him in a court to pay me back x over y time. He hasn't paid me a penny. What shall I do? Bankrupt him, and get nothing, or give him time to get a job and back on his feet?

jambalaya - theres a degree of pragmatism needed here. We are where we are. And its a ****ing mess. But its not going to be improved by lobbing accusations about about who's fault it is/was. Theres blame on both sides.

Now we have to look to the bigger picture, and concentrate on the more pressing issue. How to resolve the situation. Since the imposition of austerity, the Greek economy has contracted by 25%, and is continuing to contract. That isn't sustainable. And you can't continue to service debts in that situation.

If you were the one who was owed all the money, surely you'd countenance a degree of flexibility, to ultimately improve your chances of ever seeing it again?

But they can't do that because they've painted themselves into a corner defending the indefensible. A single currency that was a disastrous idea to begin with, and whose effects continue to be catastrophic for a massive chunk of the European population. But we can't admit that now, can we?

Like honouring a contract you've signed, paying back money you've borrowed or at least the interest ?

Much as I admire your commitment to keeping by your word, in the real world circumstances change and contracts need to change with them. The case for changing the contract/agreements in this case are obvious to everyone but the most blinkered. Just shouting 'A deal is deal!' at the people you're contracted to isn't going to solve the problem.

Americans see Greece as the perfect example of how left wing / socialist government spending ruins an economy.

Uh, really? I thought it was lack of tax collection/declaration and dodgy backroom deals.

https://www.transparency.org/country#GRC

"

You are currently -

Home

What we do

Corruption by country

Corruption by Country / Territory

Country/Territory

Overview

Data & Research

Public Opinion

Legal Framework

Our work

Corruption challenges

Government and politics

The public sector suffers from substantial integrity gaps in both law and practice. Some public officials have acted without transparency or effective oversight for decades. As a result, there is a trend to demand and accept bribes. But these actions tend to go unpunished. A 2010 report indicates that only 2% of misbehaved civil servants are subject to disciplinary procedures.

Recent large scale corruption scandals also highlight the risk of conflicts of interest between public office and the private sector. Due to the volume of scandals, citizens’ distrust in public service has proliferated.

Tax evasion

A poor system of tax inspections, aided by an opaque tax code, allows individuals and companies to bribe inspectors and evade taxes. According to a 2011 survey, the cost of bribing tax inspectors to “arrange” tax audit activities is reported to range from €100 to €20,000. And estimates show that €120 billion may have been lost to illicit money from bribes and tax evasion in the first decade of 2000.

Private sector

The business sector’s complex legal and fiscal environment, excessive bureaucracy, and frequent policy changes create an atmosphere conducive to corruption. This in turn prevents effective competition, development and growth. Furthermore, while listed Athens Stock Exchange companies operate with reasonable corporate governance, non-listed firms function in a state of almost complete opacity.

Public procurement

Due to a lack of access to public contracts and procedures, public procurement in Greece remains vulnerable to corruption. Weaknesses are furthered by the country’s inadequate transparency requirements and enforcement. Effective implementation of public contracting rules and processes is also"

" Recommendations

Private sector needs stronger transparency requirements and tough rules obliging businesses to disclose information, especially on tax liability.

The revolving door between government and businesses needs to be stopped. Politicians and civil servants should make their private interests, assets and salaries public. These measures should also be enforced. A register for lobbyists as well as Parliament codes of conduct are also needed.

Online transactions between businesses and public authorities should be introduced. This can be done through the use of bank accounts, e-banking and the internet to lessen bureaucracy and reduce corruption risks.

Stronger penalties for tax evaders are needed. More independent tax administration, a simplified tax code and the implementation of alternative auditing functions will improve tax collection and enhance tax authorities’ accountability.

Public procurement corruption and bribery can be reduced by implementing Integrity Pacts. This pact is an agreement between government agencies and bidders for a public sector contract to abstain from corrupt practices. An independent external monitor also ensures the pact is not violated.

"

"

Corruption Perceptions Index (2014)

Rank:

69 /175

Score:

43 /100

OECD Anti-Bribery Convention (2011)

Enforcement:

None

Bribe Payers Index (2011)

----

Control of Corruption (2010)

Percentile Rank:

56%

Score:

-0.120842147

Global Competitiveness Index (2012-2013)

help expand

Rank:

96 /142

Score:

3.86 /7

Judicial Independence (2011-2012)

help expand

Rank:

85 /142

Score:

3.3 /7

Human Development Index (2011)

Rule of Law (2010)

Percentile Rank:

67%

Score:

0.615028759

Press Freedom Index (2011-2012)

Rank:

70 /179

Score:

24.00

Voice & Accountability (2010)

help expand

Percentile Rank:

73 %

Score:

0.898

"

Liars and cheats riot - gfs

etc

What shall I do? Bankrupt him, and get nothing, or give him time to get a job and back on his feet?

Obviously you should follow the example of Greece's creditors and break the legs of anyone who has ever completed a financial transaction with your debtor as they have willingly and culpably conspired with him to rob you of your money.

Obviously you should follow the example of Greece's creditors and break the legs of anyone who has ever completed a financial transaction with your debtor as they have willingly and culpably conspired with him to rob you of your money.

Oh. OK. I was just going to sell his children into slavery, but your way works too. Or as well.

jambalaya - MemberAmericans see Greece as the perfect example of how left wing / socialist government spending ruins an economy.

Except that it was right-wing Greek conservative governments whose spending ruined Greece, not left/socialist governments.

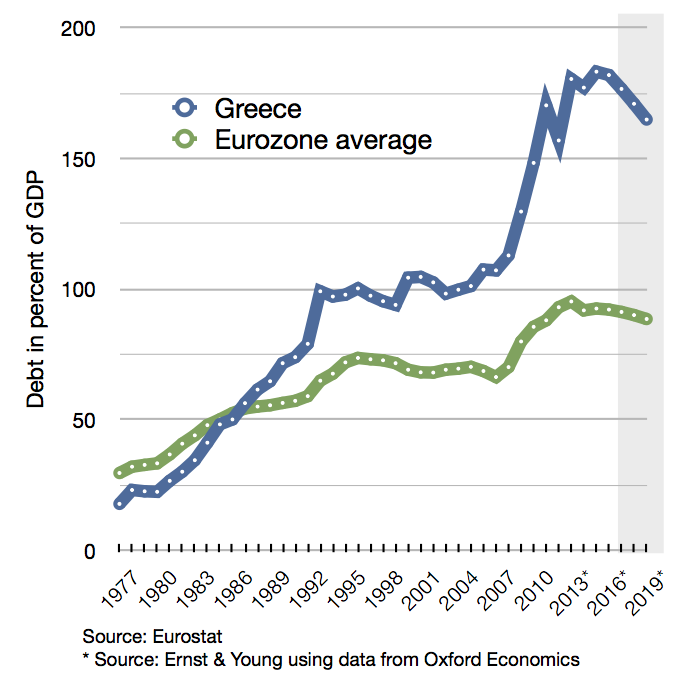

Since you apparently like graphs have a look at this one :

The Greek conservatives, the New Democracy Party, got elected in 1989. You will note how Greek debt compared to the Eurozone average shot up under their rule.

Then in 1993 PASOK got elected to government and stayed in power until 2004. Now you will note that Greek debt compared to the Eurozone average leveled off.

And then in 2004 the conservative New Democracy Party again got elected to government, they stayed in power until 2009. During this period Greek debt went through the roof leading to the present dire economic situation.

Contrary to your claim jambalaya Greece is a perfect example of how right-wing/conservative governments can ruin an economy.

As I said on the previous page jambalaya you need to be less causal with the facts - it might make your arguments more convincing 💡

Contrary to your claim jambalaya Greece is a perfect example of how right-wing/conservative governments can ruin an economy.

Sometimes I think that if the left could learn this skill of simply repeating the opposite of what is true ad infinitum so that everyone begins to believe it then the world would be a much better place.

Maybe the key bit was

Americans see

In which case

"Who cares if it's true - I dun saw it on Fox news" is probably the issue 😉

@gofaster and @ernie - I don't think you could find a country with more left wing spending policies than Greece. They have had a series of governments who have been happy to borrow and distribute the money to the population via various benefits, early retirement etc etc. The population liked the handouts so they kept voting them in. You can find coverage in all sorts of American publications, remember the Democrats are to the right of the UK Conservatives, a refelction of the political landscape there. A country founded by poor immigrants with nothing has determined that's the correct orientation for their nation.

Greece indeed has an level of debt which is likely unsustainable - no dispute there. The EU, and the Greek government, signed a deal in 2009 which allowed Greece to remain in the EU/euro without defaulting. They really where doing Greece favour, all concerned thought so.

If Greece doesn't want to pay they can default and exit the EU. I personally would not be in favour them remaining in the EU having defaulted and been kicked out of the euro.

Greece is the perfect example that the euro doesn't work without complete financial integration. Ultimately without a European superstate.

We'll see the real ability of Syriza if they can actually collect some more taxes like they've promised. The change which was part of the EU's requirement when the bailout was signed. There is no need for the Greeks to sell their children, they should collect some more taxes and address the rampant corruption at all levels of their society.

76% of Germans in a poll said, no debt reduction.

I don't think you could find a country with more left wing spending policies than Greece. They have had a series of governments who have been happy to borrow and distribute the money to the population via various benefits, early retirement etc etc. The population liked the handouts so they kept voting them in.

So now you are claiming that the policies of the New Democracy conservatives, that got Greece into this mess, were the most left-wing of any country in the world !

Your claims are getting more and more ridiculous and fantastic jambalaya.

And as for your claim of spending on "various benefits" for the population, the most significant area of spending when the Greek conservatives went on a spending spree was the military, I'm not sure how that benefited the population.

From the Wall Street Journal :

[url= http://www.wsj.com/articles/SB10001424052748703636404575352991108208712 ]The Submarine Deals That Helped Sink Greece[/url]

Note :

[b][i]"Greece, with a population of just 11 million, is the largest importer of conventional weapons in Europe—and ranks fifth in the world behind China, India, the United Arab Emirates and South Korea. Its military spending is the highest in the European Union as a percentage of gross domestic product. That spending was one of the factors behind Greece's stratospheric national debt".[/i][/b]

Just like here in the UK, where according to the Tories we have all the money we need to spend on Trident replacement, for the Greek conservatives money wasn't a problem when it came to military hardware.

And as for your claim that the Greek population "kept voting them in" that completely flies in the face of election results. Greek were clearly dissatisfied with their politicians which helps to explain why their governments changed!

I don't think you could find a country with more left wing spending policies than Greece.

Comedy gold even Jive would not type that

Its really hard to believe you mean the stuff you type on here

A country [USA] founded by poor immigrants

Your history is just as accurate

Even a stopped clock is correct twice a day

Let's discet the budget then when we have time. Greece spends heavily on the military due to its history of conflict with Turkey. It certainly provides a lot of jobs, soldiers stationed on every island, at least there was when Inlast visited 28 years ago.

Binners of course the economy has contracted hugely as such a big part of it was based upon borrowing which had to stop.

Ultimately Greece's fate will be decided by the voters of the EU, I think the tax payers of Germany, France, Italy and Spain won't be willing for stump up the lions share of €120bn for Greeks when they have their own domestic needs.

Greece spends heavily on the military due to its history of conflict with Turkey. It certainly provides a lot of jobs, soldiers stationed on every island, at least there was when Inlast visited 28 years ago.

Ah, just like any self-respecting Tory you are quick to defend massive spending on weapons

[i]"provides a lot of jobs"[/i] ...... that sounds like a rather left-wing argument.

lol

Sounds like the Lazard boys have been hard at work.

Ultimately Greece's fate will be decided by the voters of the EU, I think the tax payers of Germany, France, Italy and Spain won't be willing for stump up the lions share of €120bn for Greeks when they have their own domestic needs.

If the Greeks default they won't have a choice, they should have just bailed out their banks directly rather than through the medium of the Greek restructuring, which has neither served their taxpayers nor the Greeks well.

Or let them fail, like Iceland.

(No idea how that worked TBH)

So will Moodys call Varoufakis' bluff?

Or will Lazard and co pull a subtle fast one? Clever if they get away with it......at least they have used their brains.

@mefty it wasn't about bailing out the banks in 2009. It was the country which was bust. Given the finance minister was a university lecturer he's proven to be a fast learner politically in not answering the questions; are your banks bust, how will you not default ?

My faith in him comes from his success at Valve 🙂

Have you guys not been reading the FT? The latest stunt is to promise a haircut that isn't a haircut. Quite smart superficially but the ratings boys should see it for what it is ie "event of default."

Shouldn't be allowed really as creating false markets in Greek banks debt. This got mullered late today again despite this stunt. Very poor distortion of markets yet again. Plus ca change...

Well I'm starting to change my opinion, especially the more I hear Yanis Varoufakis speak. I had previously thought that if EU conservative politicians and bankers weren't prepared to throw a lifeline to the Greek conservative government and ease the pain they were inflicting on the Greek people then there was an even less chance that they would do so to a Syriza government.

But the more I hear the Syriza leadership talk the more I'm realising just how pro-EU and pro-Euro, and therefore ultimately bourgeois and anti-revolution, they really are. I did previously wonder whether Syriza's pro-Euro rhetoric was something of a ruse so that when the inevitable eventually happened and they were forced out of the Eurozone (Greek public opinion is strongly pro-Euro) they could blame EU politicians/bankers and deflect criticism away from themselves.

I am now starting to realise that Syriza's commitment to the EU and the Eurozone is actually even far greater and deeper than I had imagined, within the leadership at least.

Therefore it would be somewhat foolish if the right-wing EU politicians/bankers were determined to make the Syriza government fail. The consequences politically and economically cannot be accurately predicted, of course, but one thing which is fairly certain is that in the event of the government collapsing support for the fascists and communists parties will increase (support for the fascists dropped very slightly and support for the communists increased a little in last week's general election) something which should be of some serious concern to the EU (quite apart from the fact that they are both anti-EU).

While they are still very small parties both the fascists and the communists enjoy more support today than Syriza did two general elections ago - so clearly things can change fairly rapidly in Greek politics.

Of course coming to an arrangement/agreement with the Syriza is highly likely to encourage anti-austerity parties in other Eurozone countries such as Spain, a dangerous situation. But I think there is now the slow and gradual realisation that austerity isn't working, in fact rather than solving the problem it's simply making it worse. So the argument in favour of deferring austerity at least until the Greek economy has experienced some substantial level of recovery is gaining ground.

For those reasons I am now starting to believe that some sort of accommodation [i]might[/i] be reached with the new Greek government.

.

Have you guys not been reading the FT?

I know it's very hard to believe THM but I strongly suspect that the answer might be "no".

I can't believe that some people don't read the Morning Star.

🙂

Edit to my previous post :

On reflection I suspect that support for the fascists has probably peaked, they lost one MP in last week's election, and with many of their politicians arrested (including all their MPs) and waiting trial there probably isn't many more people who are prepared to vote for them. In contrast the communists gained 3 more MPs last week despite the fact that many potential KKE voters quite likely decided to throw their weight behind Syriza and give them a chance, so there is a fairly strong potential for an increased communist vote - if Syriza are screwed.

Edit

The German, French etc. banks

@ernie - Syriza and the Greek people are very pro-EU / euro as they need it badly. They recognise how great the EU has been for them in terms of being able to borrow and get subsidies/grants and they know that the alternative (default & euro exit mostly likely, I doubt the EU would kick them out entirely) is much worse. I think in Greece people voted for the longshot that Syriza could deliver a miracle, the question is once reality sets in and its shown they cannot will the people continue to support them, they may well do, depends how Syriza play their failure to deliver a 50% debt write-off. Perhaps if they can tackle corruption and collect more tax from the middle classes they will.

@tmh, I did indeed read the FT piece, IMO total nonsense what is being proposed. I wouldn't touch any of it with a barge pole but then I haven't bought any Greek debt/cash flow (even secured/payment rights) for 25 years so I am not the target audience.

Varoufakis is fast discovering the need to communicate properly. So folk (except the FT) saw through the haircut that wasn't a haircut and now the locals are getting confused.

Banks shares bounce 20% when nothing has actually happened. So a fin minster creating false markets!!!

Grown ups need to be careful when playing with twitter!!

I think in Greece people voted for the longshot that Syriza could deliver a miracle

You might wish to characterize it as voting for a miracle but most pundits agree that the vote last week was a vote against austerity.

Will Syriza deliver ? Well against the odds it seems that they might, their strategy of linking debt repayment with growth appears to be gaining support, both the US President and the UK chancellor yesterday expressed sympathy calling for growth and jobs to be a priority for Greece. Neither are representative of a Eurozone country of course but both are major players in global finance which adds additional pressure on Germany.

The markets also appear to like Syriza's plan :

[url= http://www.rttnews.com/story.aspx?Id=2450496 ]European Shares Rally On Greek Deal Hopes[/url]

.

Banks shares bounce 20% when nothing has actually happened.

This is what happens when people don't read the Financial Times !

The strategy (from Lazard) sounds good as a headline but the devil is int he detail which is coming out today. This would still be a default event and the ratings agencies would have to be clear on this. Plus the Germans have seen through it straight away.

So beware dead bounces.....the FT missed the key point too

A haircut is still a haircut and Greek banks still need to tap the ELA.

A for effort but C- for execution. Still messy times ahead but the politicians will love the implied fudge.

To be honest every time I've seen Varoufakis on the telly he hasn't appeared to need a haircut.

🙂

Have you seen the Steve McQueen mockups from the Great Escape ?

I think the market has bounced as Syriza is stepping back from their hardline rhetoric, they have said they won't default which during the election campaign was very much on the table. I meant miracle in terms of a 50% debt write off. Greece cannot service it's debt without the budget cuts its already made and the terms of the bailout where budget cuts and reforms (ie collect more tax). People may have voted against budget cuts / austerity but they need to square that with the agreements they signed and the fact that the country basically cannot borrow any more money.

TMH I think the FT was so keen to print it's exclusive they switched their brains off. "Growth" bonds and perpetuals 😯

Greece cannot service it's debt without the budget cuts its already made and the terms of the bailout where budget cuts and reforms (ie collect more tax).

Blaa blaa blaa. Greece cannot service its current debt, period. Question is whether it could service some reduced or restructured debt, and whether the extra money that requires is worth it to avoid a failed state on the European mainland. That is a moral(*) and political question more than an economic or financial one.

(*) Given the German experience as a recipient of debt relief, it does not reflect very well on Merkel that she adopts this hardline stance.

Greece is servicing it's debt as it was granted very generous bailout at a below market rate. The population isn't happy at the cuts that have had had to be made in order to service that debt and I can appreciate it. The alternative is much worse, however.

A couple of anecdotes from yesterday's meeting in London. The "growth bonds" where just an idea floated at the meeting, the FT reported it like it was a real proposal. As I understand it Syriza have no firm policy/proposal as of yet, they intend to develop that over the coming weeks. My favourite story is related to state asset sales, finance minister said certain assets had been sold too cheap and that such sales have been halted, they would however be interested in selling loss making assets like the railways where they would be happy to accept €1, haha in their dreams

They said they would do all it takes to stay in the euro, quite conciliatory

My favourite story is related to state asset sales, finance minister said certain assets had been sold too cheap and that such sales have been halted, they would however be interested in selling loss making assets like the railways where they would be happy to accept €1, haha in their dreams

Why do you think that they should sell off profit making assets, surely they should keep stuff which generates a profit and brings them revenue ? The Greek government needs revenue, does it not ? Can you explain ?

I do share you lack of faith in the ability of privateers to turn loss making railways into a profit making venture though, you only have to look at the UK for example of that. The most obvious example is the state-owned East Coast line which last year paid £225million to Treasury - the privateers gave up trying to run it.

Today the British taxpayer subsidises the privitised railways about 5 times more than when they were nationalised. And many of the "private" companies which now run our railways, and receive British taxpayer subsidy are in fact French, German, and Dutch, state owned companies. Such is the lunacy of British right-wing political thinking.

And one of 'my favourite stories related to state asset sales', since you brought it up, and since you are apparently interested in Argentina, relates to the railways in Argentina. When the right-wing politician Carlos Menem, who was more thatcherite than Thatcher, and whose right-wing economic policies laid the foundation for the catastrophic economic crises in Argentina was President, he decided to privatise pretty much everything, this of course included the railways.

Unsurprisingly the private sector was not prepared to invest in Argentine railways but as a true disciple of Milton Friedman he wasn't prepared to accept the almost socialist solution of government subsidies. All free-marketeers know that the market always knows best so if this was not a viable business venture then it should allowed to go to the wall.

IIRC Milton Friedman argued that had the stagecoaches been nationalised they would still be operating today (at a loss of course) because nationalisation stifles development and progress (he very conveniently ignored the fact that arguably the most advanced railway system in the world, French railways, was nationalised over 70 years ago)

So Carlos Menem's solution was simple......if the private sector couldn't turn Argentina's national railway into a viable business then it had to cease operations - the market knows best. In the 1990s most of the rail system was closed leaving just a few urban commuter lines such as in Buenos Aires.

Today despite once having one of the most extensive railway systems in South America (mostly built by the British I believe) and being the eighth largest country in the world, Argentina has no rail link between its major cities. If you want to travel from Argentina's second largest city, Cordoba, and Buenos Aires, you have to go by road or air. Argentina has to import most of its oil/fuel requirements. It's a free-market paradise.

However the naughty left-wing government now in power in Argentina plans to rebuild a state-owned national railway.

@ernie, interesting comments, on the topic of public ownership of public transport I think you and I are on the same side. I have experienced public and private systems commuting over 30 years, all are better than the UK which has gotten materially worse since I started in the 80's and much more expensive especially once you add in the unregulated stuff like carp parks and on vs off peak ticket pricing. The privitisation of public transport in the UK has not been a success but when looking at the economics you need to include the fact the UK government / taxpayer no longer has a liability to fund all the pensions, this is a huge "hidden" expense in the public sector.

When you are in distress financially whether as an individual, company or country you have to sell assets and usually these are the assets you don't really want to sell. The good assets are worth something, but will of course trade cheap as there is a real risk Greece leaves the euro and they become worth 25-50% overnight. the bad assets like the railway have a massive negative value, ie you have to subsidise them to hand the liability to someone else.

No one can realistically turn the Greek railways round except the government and I doubt they will do so as its too difficult politically. If they are going to rehire 600 cleaners and reestablish some of the highest minimum wages levels in the EU they are not going address the huge structural issues with e railways which go back many many years. Part of me wonders whether it was a joke but I suspect it was another piece of bravado.

Greece has said no more EU money ... but .. they want to issue more Greek government debt the only buyers of which are the Greek banks and the only people lending money to Greek banks are the EU. Smoke and mirrors.

reestablish some of the highest minimum wages levels in the EU

Eh? Minimum wage in Greece is EUR 3.41 per hour. Not princely, I'd say.

DrJ - admittedly I am blindly repeating what I read online, perhaps they where referring to minimum wage levels for certain jobs. I will check.

However the naughty left-wing government now in power in Argentina plans to rebuild a state-owned national railway.

Ah, it's been a while since you've regaled us with tales of the economic and social miracle going on under CFK Ernie... Credit default and double digit inflation, with people keing knocked off for threatening to expose the governments dirty dealings:

It's like the old days! Still, at least she's gonna make the trains run on time 😉

Greek minimum wage (quoted monthly at 680, previously 750 the level they wish to restore it to) is higher than the following

Portugal, Croatia, Turkey, Poland, Hungary, Latvia, Czech Republic, Bulgaria

Greek minimum wage about the same as Spain and really only lower than the richest EU countries.

Well, it's generally lower than the western European countries and higher than the eastern ones. More or less what you'd expect.

Well to me it shows Greek minimum wage is indeed way too high. Why is it 750 in Greece and 525 in Portugal ? At 680 (current) it's poverty yet that's 30% more than in Portugal. (note 750 was the original level, cut to 680 and not they will return it to 750)

Syriza need to come good on their word and break up the cartels, tax avoidance and the black economy.

Oops, what time will the queues begin outside the banks tomorrow?

Very messy.....stay long vol!!!

Why is it 750 in Greece and 525 in Portugal* ?

I have no idea why you think they should be the same

You have to be employed to get minimum wage. Thanks to "austerity" there's a lot less people eligible, and hence not getting a minimum wage, not getting medical care and not getting a roof over their heads. Still, that's all their own fault, so f"ck em, right?

Oops, what time will the queues begin outside the banks tomorrow?

Dunno, but surely Draghi and Merkel are making a better argument for staying out of the EU than Nigel Farage ever did.

The comments section in the FT following the news looks like here on a bad day!

Forget the min wage, the serious stuff is imminent after today.

"BLUFF"

Sadly this is no joke...batten down the hatches.

Anyone know who has the contract for printing Drachma notes?

Sadly this is no joke...

and yet various Euro politicians and bureaucrats don't seem to take it very seriously. They prefer to risk the future of a people as well as their European project just for the sake of pedantry. Sad.

True but every side is living in cloud cuckoo land.

Lazard tried a punt, it's failed, Eurocrats have upped the anti. Banks are screwed, get your money out now.

When you are in distress financially whether as an individual, company or country you have to sell assets and usually these are the assets you don't really want to sell.

So you obviously fully support the re-privatization of the East Coast line despite of the fact that publicly owned DOR (Directly Operated Railways) has handed over £1billion to the Treasury since 2009. Whereas the previous privately owned operator, National Express, only managed to run it at a loss, until they finally gave up altogether.

Where's the logic in that ? Where's the logic of ideological dogma over commonsense ? And you want the Greek government to follow that sort of loopy narrow-minded right-wing thinking ?

.

Why is it 750 in Greece and 525 in Portugal ?

You said, quote : [i]"...some of the highest minimum wages levels in the EU"[/i], your own graph that you posted at the top of the page shows that claim to be false. And why is the minimum wage lower in Portugal than Greece ? Have you considered that the cost of living is lower in Portugal than Greece ?

In fact your graph probably also reasonably reflects the cost of living in the various European countries, eg, Albania probably has the lowest cost of living on the list and Luxemburg the highest. Had that thought really not occurred to you ?

What has probably also not occurred to you is that raising the minimum wage to stimulate a struggling economy makes sound economic sense. Giving a poor man an extra dollar does significantly more to stimulate economic activity than giving an extra dollar to a rich man. The worse sort of consumers are those with hardly any money to spend. In 2013 for the first time in 45 years Greece experienced deflation, this what happens when demand is so low. Don't underestimate the negative effects of deflation.

[url= http://www.telegraph.co.uk/finance/economics/9981843/Greece-enters-deflation-for-first-time-in-45-years.html ]Greece enters deflation for first time in 45 years[/url]

And here Nobel Prize-winning economist Paul Krugman explains how a recent study in the US shows that each dollar spent on food stamps in a depressed economy actually raises growth by about $1.70

[url= http://www.nytimes.com/2013/05/31/opinion/from-the-mouths-of-babes.html?nl=todaysheadlines&emc=edit_th_20130531&_r=2& ]From the Mouths of Babes[/url]

Finally jambalaya, you have repeatedly suggested that Syriza and the Greek people are in denial and yet it is you who appears to be in denial. The first troika brokered austerity package was introduced in Greece in 2010, when that failed another troika brokered austerity package was introduced, when that one failed another one was implemented. Ever since 2010 the answer to the failure of austerity has been to implement more austerity. Greece has now had SEVEN austerity packages, far from having the desired effect the situation is now in fact worse. And yet you want [i]more[/i] austerity.

It's [u]you[/u] who is in denial.

I have no idea why you think they should be the same

Greek minimum wage should be lower than Portugal in normal circumstances and substantially lower given the reforms Greece have to make.

@ernie the chart from the EU absolutely confirms my statement, itself taken from the Guradian, that Greece has ludicrously high levels of minimum wage. Greece has mismanaged it's economy so badly they cannot afford measures like increased spending commitments. The spending of the past has caught up with them and they are facing the hardsh lesson about what happens when you over extend yourself financially

The comparison for Greece should be Turkey with regard to appropriate level of minimum wage

Syriza will soon have to face reality that their future lies in internal reforms and tax collection and not asking the tax payers of Europe for gifts.

Austerity around Europe has not failed, it's actually been a success in getting debt levels under control. No one suggested austerity was going to lead to short or medium term improvements in growth. It was about the always painful process of deficit reduction.

and yet various Euro politicians and bureaucrats don't seem to take it very seriously. They prefer to risk the future of a people as well as their European project just for the sake of pedantry. Sad.

The Greek people have made their bed, and whilst they may not like it, it's time to lie in it.

Some European countries may be worried about a loss of face with a Greek default and expulsion form the euro but the project will be stronger if they have the courage to follow financial and political reality and kick Greec out.

It's hardly pedantry to decline a €120bn gift to Greece at the European taxpayers expense.

@ernie the chart from the EU absolutely confirms my statement, itself taken from the Guradian, that Greece has ludicrously high levels of minimum wage.

It does no such thing, it places Greece exactly where you would expect to to be relative to other countries. It certainly does not have [i]"some of the highest minimum wages levels in the EU"[/i] as you falsely claimed.

And your claim that the Greek minimum wage is [i]"ludicrously high"[/i] is a betrayal of your political bias rather than a statement of fact.

Greece has mismanaged it's economy so badly ......

And yet throughout this thread you have incessantly attacked Syriza, and the left generally, despite the fact that Syriza have only been in power in Greece for just a few days, while completely ignoring the equally important fact that New Democracy, whose conservative economic policies you obviously share, have been in power in Greece for most of the last ten years.

The spending of the past has caught up with them .....

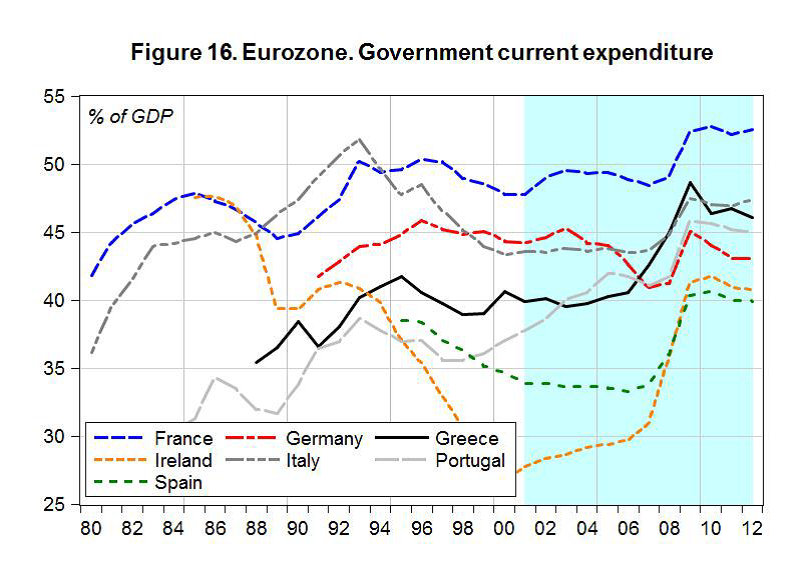

And yet again you ignore the facts. In this case that Greek government spending as a percentage of GDP was not high in the years leading up to crises, in fact it was lower than France, Italy, and Germany. Yes that's right, Greece spent less of their GDP on government spending than Germany.

It only went up when things went pear-shaped.

[b] [i]"The spending of the past has caught up with them"[/i][/b] ❓

Greek minimum wage should be lower than Portugal in normal circumstances and substantially lower given the reforms Greece have to make.

You have just restated your view with no explanation. I still know what your view is and I still dont know why you hold this view.

Because of dogma.

JY my view is pretty easy to understand if you take the time to think about. Portugal, for example, is an developed economy not subject to endemic corruption, a huge black economy and rampant tax avoidance. Whilst it has had its problems it has managed its affairs far more professionally than Greece. As such it is a more attractive country for investment, an much more robust economy. As such it is a much richer country than Greece. High wages in a poor country make no sense. Greece should be at a similar level to Turkey, ie back to where it was before it joined the EU a time when it basically had to stand on its own two feet and not rely on handouts from the rest of the EU.

Financial reality starting to kick in, no surprises the ECB says it will no longer accept Greek bonds as collateral - they are not of sufficient quality and Syriza's stated policies are in direct breach of the previously agreed commitments. Unless Syriza commits to follow the previously agreed bailout terms and conditions, at least temporarily, they could default as soon as mid/late Feb. Greek government debt now at 20% (note they borrow from the ECB 2%). Some simple maths shows that;

Greek debt to EU 240bn at 2% = 4.8bn pa interest

At current Greek debt levels 4.8bn would support only 24bn and that doesn't factor in the fact that post a euro exit, interest rates would probably be higher and the new currency further devalued. So if 4.8bn is unsustainable now whilst Greece feels half of that amount is, post a Greek exit the Greek economy could only support the equivalent of 12bn in debt.

@ernie, I am attacking Syriza because their policies are financial suicide for Greece. I am attacking the country as a whole for the way it has managed their affairs over many man years.

Syriza needs to pedal back from it's current stance. IMO its going to do exactly that as without the EU support its financial armageddon for the country.

The Greek people have made their bed, and whilst they may not like it, it's time to lie in it.

FFS! How many times? Your lack of compassion for the poor ordinary fold who are pawns in the games of bankers, technocrats and politicians astonishes me. I'm not going to repeat the opposite this time as I think it's obvious to everyone that you're engaged in an exercise blinkered denial of the facts so serious that you could probably get a job as a pundit on Fox News.

So a country with [i]"endemic corruption"[/i] was not only allowed to join and remain in the EU but also to join the Euro, I wonder how its EU partners failed to notice that ? Can you explain ?

And have you any evidence to offer that Portugal [i]"is a much richer country than Greece"[/i] ?

High wages in a poor country make no sense.

I thought we were talking about the [i]minimum wage[/i]

my view is pretty easy to understand if you take the time to think about

Pretty sure its your fault for not explaining it at all but thanks for talking to me like I am a small child unable to work out your deep musings

Thanks for actually explaining it this time as I understand why you think this though i disagree.This sums it up for me [ and pretty much every debate woth you] and made me lol

I'm not going to repeat the opposite this time as I think it's obvious to everyone that you're engaged in an exercise blinkered denial of the facts so serious that you could probably get a job as a pundit on Fox News.

Why focus on the trees (min wage) instead of the wood?

Overall cost competiveneess is more important than one input. Within the € you have had some countries where unit about costs have converged and others including Greece where they have deteriorated. The impact on Greece has been dramatic as every sector has seen a subsequent deterioration in their levels if competitiveness. This has resulted in a sharp deterioration in the trade balances as result even in sectors such as clothing where Greece used to enjoy trade surpluses.

So you take counties that have relatively high and uncompetitive unit labour costs and lock them into a fixed exchange rate. DOH.....what happens? You have compensatory wage deflation and/or unemployment*. As clear as night follows day. How much pain do people want Greece to take before they address the folly at the heart of this. It's got bugger all to do with party politics, it's transcends that spectrum. It's real stuff......not party political BS.

Dead cat bounce for sure earlier this week. Banks down @25% today. More false markets with politicians speaking before engaging brains.

Sad, sad, sad......

* and lefties who think this is a good idea (or don't understand basics of labour market economics!!!)

Corruption?

How about how many countries satisfied and satisfy the conditions of entry????? Germany (cough).......?

Varoufakis on meeting with Schaeuble - "we didn't even agree to disagree!!!"

What a state of affairs.

Just listened to the press conference. Couple of thoughts.

Debt haircut was not on the agenda, it is "off the table"

Greece was given support at the limit of what was reasonable and possible. it was given support to allow Greece to help itself. Greece must help itself.

Germany recognises the Greek election mandate given to Syriza but Greece should recognise the mandate given to the German government. Any substantial changes to agreements will need national parliamentary approval throughout the EU and chanegs to the EU treaty. that will be a long and slow process.

Schauble said Greece must reform and collect more taxes, especially from the wealthy. Germany recently offered to send 500 tax inspectors to Greece, this was unfortunately declined. German remains willing to help with tax collection.

Voroufakis again said that the largest loan in history in 2009/10 was given to an insolvent country, Greece. "Nothing concrete was agreed or disagreed".

and lefties who think this is a good idea (or don't understand basics of labour market economics!!!

Thanks Alex been a while since you popped in I would ask for a quote but what would be the point in that ? We all know the truth , even you, but dont let that stop you making the slur.