![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

So, what's the collectives thoughts on where it's going? Is there anything likely to happen in the next few weeks to cause the pound to dip back to the levels (1.10 to the pound) that it was at at the start of the year, or is it just going to keep getting stronger. Seems to be mixed views out there.

Not that I have some money say waiting to be exchanged back in to pounds and missed the best rates only to see it getting stronger each day, oh no, I wouldn't make such a mistake as to expect the pound to stay weak whilst Brexit rumbles on and on an on!

It's going to reflect the decisions we make, when you can pick them with certainty decide which currency to place your bet in.

Nobody knows anything any more.

Even mikew.

I reckon it’ll stabilise now that Parliament are pushing back on the Great Brexit Swidle that the conservatives are so self flagellating about.

It was 1.11 :1 the other day and actually rose when MayBots BillyBulshiteBrexitSwindle was voted down.

Now that set a precedent the city can relax a bit knowing any stupid retarded decisions get a kick in the teeth.

Even if there is a change in government, that will only go so far to appease the money markets.

I think we’ve moved away from parity, which is a shame because at one point I thought the BillyBullshiteBrexitSwindle was all about contracting the Pound to parity with the Euro,, then the UK adopts the Euro and fully aligns to The EU.

IMO, obvz.

And no, I’m not PercyPigTheCameronInflatable either 🤣💃

Was listening to Martin Lewis on 5live today, talking about house purchase/mortgages but the questions were the same, ie what’s going to happen?

He said he didn’t have a clue and if anybody tells you they know for definite they’re talking out their hole!

Actually I’m paraphrasing massively,but that was the sentiment!

I was looking to buy a place in Germany back in 2016.... Have funds in various accounts, but all in sterling.

I "lost" several thousand the day after Brexit. Now with the markets tanking I've "lost" several thousand more.

Can't see the pound bouncing back to pre-Brexit levels regardless of A Brexit deal or not.

Can’t see the pound bouncing back to pre-Brexit levels regardless of A Brexit deal or not.

The pound was always artificially kept at a higher than true value because the Treasury seem to think the UK is worth more than it actually is.

Ask Gordon about all that gold he sold off to prop the Pound up.

And Blair.

You’ll have your answer when they come up with a valid excuse as to why they played 8 ball with the Pound.

IMO, obvz.

And no... the Pound will never ever be back to the inflated value it was before BillyBulshiteBrexit.

The value for the UK Currency is quite close to its true value.

IMO, more obvz.

unless you're exchanging 4-figure sums (or more), tbh, I wouldn't bother trying to get a slightly better or avoid a slightly worse rate.

with the swings from 1.10ish to 1.15ish this year, if you're exchanging the amount for spending money for a holiday you're talking about the price of a beer or 2. sometimes you get a free beer, othertimes you lose a beer. if you're talking about exchanging leftover euro spending money, it's gonna be even less.

I changed a couple of grand of € into £ the other day, cos I needed some in the right a/c, and got about 80 more than I would have if I'd have changed the day after May scored the record defeat in the commons.

It would certainly make my life easier and cheaper if UK was in the € though. zero exchange rates and zero fees for every bank transfer, ATM use, card/contactless payment Europe-wide ftw 🙂

Nobody knows, and as stated above unless you're talking about changing many thousands it'll make three fifths of bugger all difference, but have a look here for some viewpoints

https://www.poundsterlinglive.com/eur

Unfortunately I'm changing 3 figure sums from a property sale. No big rush as still not found a property to buy, but just can't make the decision whether to jump now or hold my nerve. Lost 5K or so just in the time it took to clear the funds!

Sort of hoping for a bit of a balls up tomorrow so that the pound takes a bit of a step back from the 1.15 range for a bit and I can recover a little bit.

Despite not really knowing anything, I think I agree with bikebouy (it can be hard to tell what he's saying).

Brexit's looking more rocky and there's been evidence of firm opposition to no-deal. Sterling's more likely to go up than down, I'd have thought.

You'll get a better rate while no-deal is still on the table, surely?

🤣

I think I agree with bikebouy (it can be hard to tell what he’s saying).

🤣

I don’t know what I’m saying 90% of the time either..

👍

IMO obvz.

I’m changing 3 figure sums from a property sale

that must be one hell of a wendy house... 😉

yup... sterling was always over inflated thanks to the city. but it used to be nice when going to the continent and getting 1,40€:1gbp....

My guess will be the pound is going to tank as "no deal" becomes more and more likely.

In the OPs position I would probably change the money in chunks to limit the losses no matter which way the pound moves.

its like the good'ol days in here.

Just because someone has sterling or euros in their pocket doesnt mean they have any understanding of forex! 😉

The pound was always artificially kept at a higher than true value because the Treasury seem to think the UK is worth more than it actually is

no.

sterling was always over inflated thanks to the city

no

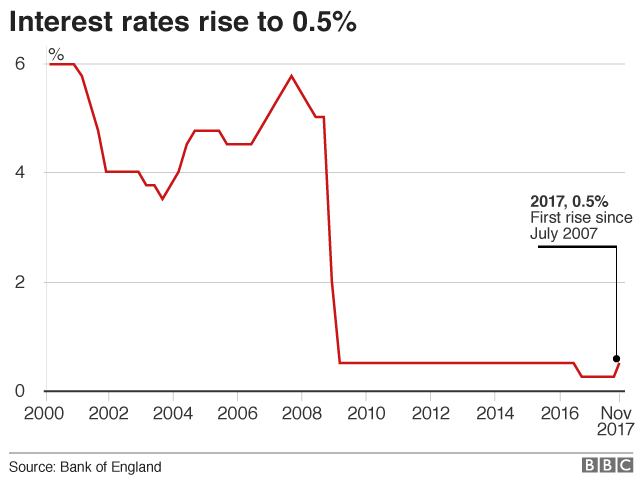

Demand for currency (and the resultant impact on its value/price) is a function of trade flows, tourism and geopolitical risk. But by far the strongest influence is interest rate expectation relative to risk. The Monetary Policy Committee sets interests rates (Bank of England) nothing to do with the treasury. And despite rates being low, even during relative strength in GBP vs EUR @ €1.44 during 2015-2016, relative risk between UK and Eurozone (think Greece 2015) kept demand for sterling high (it jumped from 3.7% of global reserves in 2014 to 4.7% in 2015) as € risk climbed v high compared to woeful interest rates for the privilege. That safety move slowly unwound to a certain extent through 2016 back to c.€1.30 which most would feel is a reasonable price for Sterling [i]in the absence of Brexit[/i]

Sterling is still a (minor) reserve currency being about 4.5% of global reserves. That can have an effect of over valuing the pound as its is it is being bought as a reserve asset not necessarily as a trading or speculative asset.

Since March 2017 vote, the market has priced a substantial risk of brexit into the impact on trade flows on GBP. However, inflation rise risk and so interest rate rise expectations are to a certain extent maintaining GBP value. Sterling bottomed-out at c €1.08 when the market had a really strong worry about a no deal brexit. Recent rises from €1.10 back to €1.15 are indicating hat market players feel the [i]risk of a no deal brexit[/i] is less likely than suspending A50.

If there is a crash out in March, I would expect sterling to drop almost parity with Euro but not much further, and then recover slowly back to €1.05 over coming months, and then slowly strengthening again. The initial fall a result of panicky trades and profit taking, bu then unwinding again as longer term sentiments return.

Bloody hell stoner, you with your facts and knowledge, youre project fear. After brexit the pound will rocket, and each individual eu nation will be desperate to buy sterling and trade with us. I know this because my instinct tells me so.

(While I’m taking the piss, I have heard similar comments from otherwise reasonable people.)

However, inflation rise risk and so interest rate rise expectations are to a certain extent maintaining GBP value

Whilst I agree that there is an inflation risk given the uncertainty around how we will be leaving the EU, I'm not sure that interest rates are an effective lever to mitigate that risk. Assuming a no deal, I would have thought that prices are likely to rise as a result of tariffs and increased import costs rather than there being too much money around so it's difficult to see what interest rate rises would do to reduce inflation (see the high inflation figures when the oil price was high). In fact if it were to strengthen the pound then it might have the opposite effect.

Other than that minor quibble I largely agree with Stoner.

I dont think the MPC will see it as an oversupply of money, more an opportunity to reign in cheap debt and so not compound inflationary pressures. But point taken.

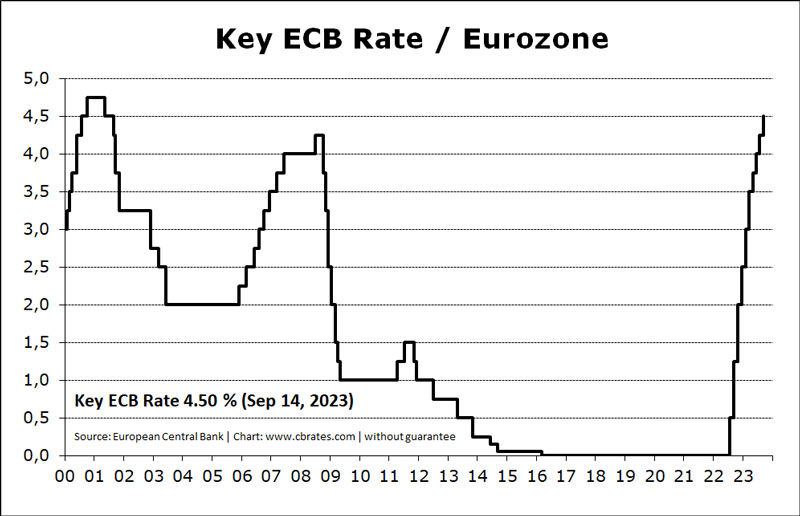

Just to add some comparison to the BoE base rates in Stoner's post, here's the equivalent for the ECB:

However, the issue for the ECB right now is that having only just stopped QE, and with base rates below zero, all three major Eurozone economies are showing signs of weakness. Where does the ECB go now?

I just use a p2p and change a few each day. Its c 1.15 today which is the best I got last year. Martin Lewis was correct last night, no one knows.

Strangely enough if you read the media about brexit options, the market sometimes moves in the opposite direction. As the rate is key just put some bids on for rates you want.

Stoner, you've just made an "Experts List" somewhere. Have you a plan for avoiding the roundup?

sterling was always over inflated thanks to the city

In the case of a no deal and no passporting rights we'll find out just how true that is. The UK economy is highly dependent on the City at about 11% and the strength of the pound even more dependent on the foreign revenue the City generates. Without the city bouying the pound it will sink as GDP fails to grow and foreign revenue declines.

So more importantly than any property deals I'm currently sat in Ireland, hotel was pre paid but tonight's dinner could be ordered before and paid for after the votes happen - should I up to steak and all the trimmings and hope the £ strengthens or go for soup?

Did you enjoy your soup?

kelvin, you might get an answer after Mike has finished the dishes!

I went bold, I'll blame the idiots when work spot the recipient!