![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

"10 million quid to buy business that might net you 50k in profit a year"

As I already said, it just makes no sense at all for anyone to keep a business that runs on this basis. Sell it, retire, live a comfortable debt-free and work-free life. You could even volunteer to keep yourself busy, but don't make yourself out to be some sort of martyr. I mean, I don't have anywhere close to 10 million quid and I'm not working. I only kept on going for as long as I did because I genuinely enjoyed it, I never claimed to be slaving away for poverty wages and there weren't people queueing up to pay me millions to stop.

Isn’t there a bit of a circular argument going on with the land valuation?

The land is clearly not worth that as farmland in many cases, at least not in terms of income generation, but worth it if placed on the open market, perhaps for housing or other purposes.

Why can't covenants be attached to land passed from parent to child that if that enhanced value is ever realised (say you sell off a field for a new estate, or if the 'investor', or 'investor's beneficiary, who is holding farmland to avoid IHT wants to liquidate that investment), then the Treasury gets its slice at that point?

I struggle to understand how the lefty greens who make up the majority of people here ( Or to be fair, this is how it seems) can separate the eco issues with hammering farming. Harm our farmers and we make the world worse. Of course many here feel that as they don't have something the owners of what they want need a good verbal pasting. We need to protect our food producing industry in everyway possible. Lets double tax leisure cycling and reduce agricultural taxes by the same amount. Far more valuable. And Moral

I think supermarkets driving prices down when buying from farmers is also a problem, but it gets more complicated - Imagine the issues if things like milk went up to £2 a litre in the shops?

The supermarkets won't swallow the cost, they have shareholders to satisfy and bonuses to pay.

I used to work for a company selling a product with ongoing support contracts for said product, to retailers including large supermarkets (not food, but that's not really relevent)... Our senior account manager was bidding on a tesco contract, and was just totally exasperated by it, he said they were total ball busters on price, T&C's, attitude etc, and said he really didn't want to do business with them as he knew they would be nothing but a problem... very difficult to deal with, find excuses to pay late or argue for discounts, etc. it was a big money contract, but he was questioning whether the profit would be worth the manpower costs and effort in dealing with them.

So it's really a much bigger issue than just farmers.

I struggle to understand how the lefty greens who make up the majority of people here ( Or to be fair, this is how it seems) can separate the eco issues with hammering farming.

As others have pointed out, there is nothing green about modern farming.

I also don't see why people inheriting millions of pounds shouldn't pay IHT.

They see themselves as doing a vocation and custodians of the land, its been handed down through generations.

Presumably they could move the land into a trust, protecting it from IHT and for future generations... but not passing on their wealth directly to their children. From what I have seen round here the real value of the land comes when a property developer buys it up and builds a load of houses on it.

Sell it, retire, live a comfortable debt-free and work-free life.

So what happens to the land next? Do we just get all our food from other countries? If it's just sold on to a bigger company employing someone to farm, the bigger company will be looking to cost cut to maximise profit (monocultures, over-fertilising, lower animal welfare, re-development away from farming), and the person employed to actually farm it will have much less skin in the game to care for animals or land. Race to the bottom at that point. There is value in owner-operator in terms of food quality and land management.

FWIW I agree it seems an obvious personal choice, but it's not great for the rest of us

I hope no one is looking at Zimbabwe as a way of redistributing the farms for the greater good….

No because Britain stitched up Zimbabwe and didn't fulfill its obligations under the Lancaster House agreement, since we are talking about far-right racists and farming. Britain wasn't prepared to grant independence to Zimbabwe unless the interests of a tiny minority of white European colonialists were protected. It made all sorts of commitments with regards to providing financial support for the orderly transfer of land ownership away from the white elite (0.6% of the population owed the majority of the land) but that didn't materialise.

Britain could have helped not just financially but in terms of training and education for a majority owned agricultural sector, Britain did after all extract plenty of "blood and diamonds" out of that region thanks in a large part to the brutality of Cecil Rhodes. But instead British governments washed their hands helping to create the conditions for a corrupt regime to grab land and establish new ownership without any sort of practical plan.

https://www.theguardian.com/world/2002/jan/16/zimbabwe.chrismcgreal

Margaret Thatcher's government was largely interested in protecting the property rights of the white minority.

"A future government would be able to appeal to the international community for help in funding acquisition of land for agricultural settlement," he said. The liberation delegation was eventually persuaded.

Yet after 20 years of Mugabe's rule - until the "war veterans" began seizing land two years ago - the picture was not hugely different. Just 6,000 white farmers occupied half of Zimbabwe's 81m acres of arable land. About 850,000 black farmers were crammed into the rest. Since independence, only 10% of arable land has moved legally from white to black hands.

Do we? How?

Too many bees about.

Do people know so little about where their food really comes from? Just on this page:

We need to protect our food producing industry in everyway possible.

Do we just get all our food from other countries?

Presumably they could move the land into a trust, protecting it from IHT and for future generations…

You'll have a big tax bill, every 6 (I think, could be wrong) years or so. Which is why many don't. Theres two trusts in my area (I rent my home and business from one), one is a huge farm with multiple properties (that once would have been for the 'workers'). The other is a small farm, the farmer has no wife or kids so runs it as a trust with his sister.

Neither are what I'd call poor.

The supermarkets won’t swallow the cost, they have shareholders to satisfy and bonuses to pay.

A key factor in my wife's friend closing the family farm. Said she'd sooner supply McDonald's than Tesco in terms of price and animal welfare.

As for the "1000 years" as pointed out above, these exemptions came in under Thatcher. Plenty of estates were split and/or sold off for death duties in the 1970s, when they began to convert to trusts - looking at you, Chatsworth.

Said she’d sooner supply McDonald’s than Tesco in terms of price and animal welfare.

And that's their choice, no one is forcing any business to sell to anyone they don't want to deal with.

And that’s their choice, no one is forcing any business to sell to anyone they don’t want to deal with.

Absolutely. Her choice was to stop farming - barns converted to housing, land rented/sold to neighbours.

Our senior account manager was bidding on a tesco contract, and was just totally exasperated by it, he said they were total ball busters on price, T&C’s, attitude etc,

I once worked for a company that was quoting to clean their car parks. They wanted a cost per store, fine. But they wanted the cost splitting down further, to per parking space.

‘Do you have the details of how many spaces per store?’

‘No’

’Can you get that information?’

’No’

The sales admin team had to count them, using Google earth

We need to protect our food producing industry in everyway possible.

TBF I'd be more interested in protecting them if they actually made food

Agricultural Property Relief was introduced in 1984 because that was when Inheritance Tax was introduced, there were reliefs under the Capital Transfer Tax, its predecessor. I think it might have been said already but other family businesses can be passed down free of inheritance tax because of Business Property Relief. The tax expert interviewed by the Rest is Money is a lawyer, I have used many tax lawyers over the years and my experience is that doing numbers isn't a core competence.

"Why can’t covenants be attached to land passed from parent to child that if that enhanced value is ever realised (say you sell off a field for a new estate, or if the ‘investor’, or ‘investor’s beneficiary, who is holding farmland to avoid IHT wants to liquidate that investment), then the Treasury gets its slice at that point?"

They could be (lots of forest parcels are so covenanted) but obviously none of the famers want to render their land worthless!

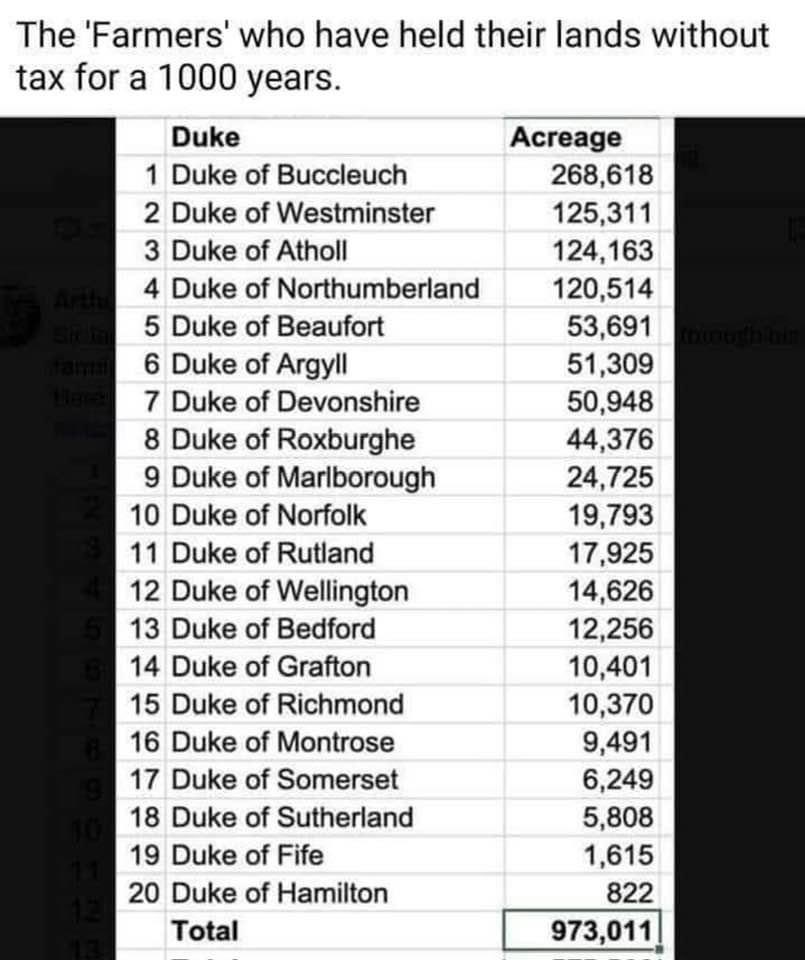

As for the “1000 years” as pointed out above

Most of them also acquired their land rather later in the early modern and beginning of the modern period when the common land got enclosed.

Plenty of estates were split and/or sold off for death duties in the 1970s,

Although quite a few got to use national land fund and other measures where the repurposed National Trust (always fun seeing the nutters shout and rave about how the NT should stick to looking after stately homes when that wasnt its original purpose) was used so the families could continue to live in their stately homes whilst avoiding inheritance tax etc.

Perhaps you would like to consider the view of a Cumbria hill farmer who is not an owner of huge tracts of fertile arable land and has spent years transforming his farming into a more ecological system.

James Rebanks here

@herdyshepherd1 on X.

Do the new tax break rules for farmers affect him more negatively than the old ones? Do they make it harder for him to do his work? Do they make it less likely that his work will carry on in some form after he is gone?

"Just for clarity… our farm value is under the IHT threshold and we aren’t wealthy in other ways… So I’m not a wealthy tax dodger I’m protesting because I think major progressive promises to farmers are being broken and this budget was the last (not the first act) in the play"

https://twitter.com/herdyshepherd1/status/1858497079011652061

I heard that it was unwise to hand down to your 35 year old child at when you’re 65 because there’s a chance they could get divorced,

Whereupon as it was an inheritance it wouldn't be included in any division of assets. If they subsequently marry it can be included as a prenup.

So I’m not a wealthy tax dodger I’m protesting because…

… it’s surprisingly easy to get normal people to cheer on tax advantages for the very rich, if you can encourage some kind of fake joint identity.

If the tax changes have been designed not to hit the normal farmer, but start to redress some of the long standing baked in inherited wealth and inequality in the UK, while also preventing rich entrants to farming to use land as a wealth bank yet avoid wealth taxes such as inheritance tax… perhaps a better response would be to welcome the changes and argue for other help for real farmers doing everything they can to make a living out of farming.

I’m surprised it’s as high as 15p in the £1 goes to the grower. The article makes for an eloquent read but anything that is money from taxpayers to a business is either a contract to provide something or a subsidy. If it’s the former and it costs more to do than you are paid then stop doing it. It’s an optional scheme. A contract with payments for delivery. I still don’t understand why farmers think they are special. The world has moved on since the end of ww2

perhaps a better response would be to welcome the changes and argue for other help for real farmers doing everything they can to make a living out of farming.

As you will have read in the article he is concerned not so much by the taxation implications of recent governments' announcements but by their inability to deliver on schemes and promises.

recent governments’ announcements but by their inability to deliver on schemes and promises.

Would that have anything to do with the loss of EU money since brexit? [insert smileyBruceForsythe.jpg]

double post - ignore

Let's assume farming should continue. Who should do it? Which model is going to best deliver on the things people in this thread care about?

1. Owning farmer

2. Tenant farmer

3. Companies i.e. agribusiness

4. Citizen collectives

5. Public sector and their subcontractors

Ignore - wrong thread

Farmer on Radio 2 today " i only make 12k a year" from a £10 million pound Farm... what the Farmer meant was after all my subsistence Costs (home vehicles all bills) I only made £12k disposable. I live among them and they still buy land at more than £10k an acre then stand in the pub and moan they can't make it pay..... full of manure.

Farmer on Radio 2 today " i only make 12k a year" from a £10 million pound Farm... what the Farmer meant was after all my subsistence Costs (home vehicles all bills) I only made £12k disposable. I live among them and they still buy land at more than £10k an acre then stand in the pub and moan they can't make it pay..... full of manure.

I thought STW was full of socialists? They see themselves as doing a vocation and custodians of the land, its been handed down through generations.

I don’t mean to be rude, but that isn’t socialism.

Amazing how the farmers have suddenly decided that it’s all gone to shit and they have to march on London after a few weeks of a Labour govt, when they were fine with it for a decade of Tory Brexit swivel-eyed lunacy.

@snotrag Ha. Did wonder if someone would share Sky News ‘take’ on the story that landed in the middle of my brothers shift! Ironically, he used to be a farmer before he became a news anchor!

Farmer on Radio 4 claiming that land value is through the roof.

Well sell some and pay your bill.

Claiming a return of 0.5% on farm value.Then the business model is broken. No other business asset can return so little and be viable.

Isn't that the point? The business isn't viable if you have to buy the land, or if you've got an extra few £100000's to pay IT on.

So sell up and do something else with your life.

I don't believe that the land price across the whole of the UK can be supported entirely by speculation that it will be built on.

An asset is only worth what someone is willing to pay for it.

Why is the land so valuable?

If it's only valuable because of being a vehicle to avoid IHT, then that is gone and the book price can be corrected.

If that's not the case, what is the high value based on?

Is it too soon yet for the IHT announcement to start impacting land prices?

Based on the current weather in London I suspect that the expected turnout by the Tommy Robinson Fan Club to be no more than a damp squib.

Which if my suspicions are correct will be rather ironic..... beaten by the good ol' British weather.

Its sure this isn't representative of all farmers but the small family owned ones I've noticed where I walk doggo are dumping slurry straight into the local river (seen the tankers with hoses discharging), burning silage poly wrap, dumping building waste in spoil heaps, driving the building waste tractors with no regards for other road users and generally have farms that look like something from the set of MadMax.

The ones that have diversified or bought them for tax reasons (eg. local brewery has a rare breeds pig farm) are spotless and look to be far better run because I'm guessing they don't need to make a profit.

An interesting article on the bbc website this morning

https://www.bbc.co.uk/news/articles/c8rlk0d2vk2o

It suggests that in reality the IHT threshold for farmers after the budget is actually £3m assuming not tax planning and it only affected around 100 farms in a year. I’m sure with some simple planning that could be much lower

12K profit a year is not a lot when you are putting so much capital in, a grand a month - i bet you wouldnt be saying that to someone who scimps and is able to save that as an employee, also are you saying that he should be able to make a profit and be able to have hobbies, holidays new clothes etc - are we now dictating the terms of how much a farmer should reasonably be able to make -are we dictating what consititues work, or how many hours they should do a week.

I find some of the reposnses baffling, almost as though it comes from jealousy and bitterness that how dare someone have something that i dont. The proposals will only make [cash] rich people richer as they will buy the land at reduced value (because the tax cannot be raised) and that will go to larger estates where they are happy to pay 20% on value and not 40% on their earnings.

I also heard an argument about how it's impossible fo new people to get into farming becuase the land is so expensive - yes, becuase of land owners, not farmers. So their view is that the 20% IHT was a good thing as it would force people to sell the lives just so someone else can 'have a go' - becuase we all know starting a new farm is mega easy!

All they need to do is hand it on 7 years before they die., which is very straight forward if it's truly a "family business".

There is some absolute nonsense spouted on the radio this morning.

if the business model is as bad as they say, why would you inflict it on the next generation?

Surely Clarkson attending this protest is doing more harm than good. He openly bought it to avoid tax according to The Times article "Jeremys latest plaything"

"Land is a better investment than any bank can offer. The Government doesn’t get any of my money when I die."

All they need to do is hand it on 7 years before they die., which is very straight forward if it’s truly a “family business”.

Are there different rules for farmers than the rest of us. If I pass on something to my kids then I can't have a beneficial interest from it- eg, passing on a rental flat means I can't receive rent from it, but I can't live in it rent free either. If a farmer passes on his farm, then presumably he can't receive any income from it, or even live rent free in any house that's part of the farm, or have I got this bit wrong?

Yes the limit is pretty high, this is from the Government page. I’m from a farming background I know how hard farming is and now hard they work but this is about landowners and the rich trying to avoid tax. It’s not about punishing farmers.

Are there different rules for farmers than the rest of us. If I pass on something to my kids then I can’t have a beneficial interest from it- eg, passing on a rental flat means I can’t receive rent from it, but I can’t live in it rent free either. If a farmer passes on his farm, then presumably he can’t receive any income from it, or even live rent free in any house that’s part of the farm, or have I got this bit wrong?

Nope, you've got it right - different rules to the rest of us.

ernielynch

Full Member

Based on the current weather in London I suspect that the expected turnout by the Tommy Robinson Fan Club to be no more than a damp squib.

Very dependent upon whether the swastikas are drawn on with felt tip or Sharpie.; -)

I would apologise for going ot but the far right element of the post has been subverted by you 'orrible lot! lol

presumably he can’t receive any income from it, or even live rent free in any house that’s part of the farm

Then... the farm is passed on without the "retirement" house. On death, that remaining house, if worth enough, gets taxed just like your home would be, if worth enough. I don't see a problem. Land worth many millions can change hands within the family, without inheritance tax. If the remaining home gets hits with inheritance tax, because it's worth lots... that's exactly how wealth taxes operate... and unless as a country we start to embrace wealth taxes, our upstairs downstairs cap doffing mentality will never be done away with.

I'm rather stunned by what I'm reading on this thread.

UK farming isn't green? Compared to what? Transporting your milk from across the continent? Flying your beef in from Brazil or lamb from New Zealand?

What's the high land value based on? Some developer whacking a load of shite quality houses on the land.

Why should farmers get preferential IHT rules? Precisely because it's not a 'normal' business, the land value does not directly reflect the productivity of the farm.

As for that list of dukes over the page, well this probably won't affect them, because they'll have top drawer accountants already putting the farms into trusts or whatever schemes to ensure they don't pay a penny.

The people it will really hurt are the small to mid size family farms where the land is passed down generation to generation and to whom the value of the land is really irrelevant anyway.

"Is it too soon yet for the IHT announcement to start impacting land prices?"

Not if it's a genuine thing, as opposed to a nothingburger whipped up by a few well-connected rabble rousers.

What’s the high land value based on? Some developer whacking a load of shite quality houses on the land.

Nope, most farmland cant be built on. That which can will have far higher land value and as a hint those keen custodians of the countryside and believers in handing down generation upon generation would have flogged it in that case.

Why should farmers get preferential IHT rules? Precisely because it’s not a ‘normal’ business, the land value does not directly reflect the productivity of the farm.

And now we get into the circular argument. The land prices have increased since the Dysons and Clarksons of this world use it as a way of not paying inheritance tax. If the prices do not reflect the land productivity then something external is skewing those prices.

The people it will really hurt are the small to mid size family farms where the land is passed down generation to generation and to whom the value of the land is really irrelevant anyway.

Well they managed before this exemption was put in so why not now? Also most if not all of those farms wouldnt be impacted.

What’s the high land value based on?

What's the high value of homes based on?

The value of land, of all forms, has gone up, and up.

If you owned lots of houses 40 years ago, your wealth is now vastly higher.

If you owned lots of land 40 years ago, your wealth is now vastly higher.

That increase in wealth, for the wealthiest, is fair game for taxation. Why shouldn't it be?

Only own a modest house, or a small farm... there are tax breaks still there to protect you.

Sort of reverting back to the far right thing raised by the OP. My facebook feed this morning was flooded by posts from "aggressively patriotic" groups supporting the farmers. The levels to which this stuff is being manipulated by others (in this case the wealthy i suspect) is staggering.

Well they managed before this exemption was put in so why not now? Also most if not all of those farms wouldnt be impacted.

I suspect that they may view the impact differently.

They may not have paid inheritance tax, but won't want to see their assets (however illiquid) fall in value.

A bit like house prices. Everyone agrees there's a crisis when it comes to housing and want more affordable prices for their kids etc. But they don't want it locally because that would push down the value of their house....

dissonance

Nope, most farmland cant be built on. That which can will have far higher land value and as a hint those keen custodians of the countryside and believers in handing down generation upon generation would have flogged it in that case.

Much of it can, and people are betting that more can in the future.

And now we get into the circular argument. The land prices have increased since the Dysons and Clarksons of this world use it as a way of not paying inheritance tax. If the prices do not reflect the land productivity then something external is skewing those prices.

Yeah so find a way to hit those people, not family farmers with a middling sized farm. Raising/tapering the threshold for example.

Well they managed before this exemption was put in so why not now? Also most if not all of those farms wouldn't be impacted.

Go and look at land values over time, machinery costs etc compared to farm earnings and you will see why this was not an issue.

But it's not just that it's being changed, it's also the fact it's being changed at very short notice (much like the private school VAT fees thing being introduced in the middle of a school year).

from jealousy and bitterness that how dare someone have something that i dont

I think it’s more how dare they not pay something I have to. Albeit that most estates do not attract IHT, and nor will most farms. IHT is a rounding error in UK finances, but an emotive one, clearly

Since 2004, the price of farmland has increased from £5k per hectare to £23k per hectare. That’s 8% per annum with declining prices from 2015-2022 factored in! The price rise is not from farming. Perhaps a reset will help farmers farm land.

BTW average house prices have increased by 3.8% per annum in England over the same 20-year period. So half the rate of farmland. Clearly demand for farmland has outstripped supply, and one should ask why that might be the case.

UK farming isn’t green? Compared to what? Transporting your milk from across the continent? Flying your beef in from Brazil or lamb from New Zealand?

Compared to how it was before the big agribusinesses took over and started ripping up hedgerows, filling the ground with chemicals and the cows with unnecessary antibiotics. The farms aren't some sort of rural idyll with chickens pecking about in the yard, there are thousands of them in massive sheds.

andrewh

Free Member

UK farming isn’t green? Compared to what? Transporting your milk from across the continent? Flying your beef in from Brazil or lamb from New Zealand?

Compared to how it was before the big agribusinesses took over and started ripping up hedgerows, filling the ground with chemicals and the cows with unnecessary antibiotics. The farms aren’t some sort of rural idyll with chickens pecking about in the yard, there are thousands of them in massive sheds.

And this inheritance tax change fixes that how exactly? In fact i bet this tax change causes family farmers to sell up and actually increase the amount of land that's in the hands of "big agribusinesses".

Nothing to do with the IHT debate at all, just pointing out that farming used to be much more environmentally sustainable.

It's weird how 'conventional farming' is now seen as the norm and 'organic farming' is the unusual way of doing it, when did that change? What's 'conventional' about changing the way we've grown food for thousands of years over the course of a generation or two? The quality of the food has not improved, the environment hasn't, animal welfare hasn't. Quantity, and the money made from it, have increased. Is that a better way of doing it?

The people it will really hurt are the small to mid size family farms where the land is passed down generation to generation and to whom the value of the land is really irrelevant anyway.

Then organise it into 'business' and 'personal' rather than trying to mix the two - just like the rest of us do when we've businesses.

The reason they haven't is that it's been more tax advantageous to not - and now it isn't.

Grow up and be adults.

The people it will really hurt are the small to mid size family farms where the land is passed down generation to generation and to whom the value of the land is really irrelevant anyway.

But it wont. There is no iht in reality til £3m in assets as myself and others have already pointed out. Even then a little bit of financial and tax planning makes that disappear if your estate is worth more then £3m

intheborders

The people it will really hurt are the small to mid size family farms where the land is passed down generation to generation and to whom the value of the land is really irrelevant anyway.

Then organise it into ‘business’ and ‘personal’ rather than trying to mix the two – just like the rest of us do when we’ve businesses.The reason they haven’t is that it’s been more tax advantageous to not – and now it isn’t.

Grow up and be adults.

No need for the patronising tone. The point is that it has literally not even been a consideration for a family farm, suddenly, now it is.

Something like 40% of farmers are over 65, it's a real problem to introduce this with a short deadline.

Slight tangent but I wonder if the powers that be are doing some red diesel checks in and around London today 🙂

And this inheritance tax change fixes that how exactly?

Well it would be nice if some of the money raised would go back into helping those farmers who want to do their bit to improve the ecology of their farms. They do exist.

I think it’s more why don’t they pay something I have to? And yet to see any valid reason other than guardians of the countryside.

becuase you're not trying to pass on a business, a very complex one at that to people who don't earn that much money compared to someone on payee. We're not comapring apples and apples, its apples and giraffes.

becuase you’re not trying to pass on a business, a very complex one at that to people who don’t earn that much money compared to someone on payee.

I have a sideline business with a lot of capital tied up in it which will be subject to inheritance tax and i’d like to pass to my nephew and nieces. It doesn’t generate masses of profit but it ticks by. It’s not complex but so what. Apples and apples here.