![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

With Gideon set to raise retirement age [url= http://www.theguardian.com/uk-news/2013/dec/05/state-pension-age-raised-to-70-autumn-statement ]to 70[/url], retirement seems to be taking on the air of Yossarians 25 missions in Catch 22.

I've pretty much given up on the idea that I'm ever going to retire. I think by the time I hit that age, it'll be viewed as a quaint little thing anachronism, that happened briefly for a golden generation of baby boomers. Are we going to have to face the reality that we'll be working until we drop?

Does anyone believe they're going to have a retirement that in any way resembles what it is today? Is anyone actually that naive?

I'll tell you in 6yrs 3mths and 2 days

I fully expect to retire using my private pension and savings earned and not spent over a lengthy working career to do so.

Dont you?

I already have.

I'm reckoning on 70. I'm hoping not 75.

I don't expect to able to rely on any state provision.

Depends on your age now, I suppose.

I'm 36 - I'm assuming I won't be retiring.

I can't imagine being retired for 25 years, tbh, which it looks like I might be based on the average life expectancy is for someone my age.

What do you do for 25 years? Watch Jeremy Kyle? Think I'd rather carry on working, tbh.

Plus having enough savings for a 25 year holiday doesn't seem likely.

My drug cartel is showing a nice return at the mo,so I am in no rush.

🙂

Lucky escape bruneep. I was set to go in 12 but im going to do 20 instead now (at least) thanks to lewis and his cronies

I don't expect to able to rely on any state provision.

+1

And it's not something I'm in a position to do much about. Fingers crossed for a wealthy, elderly relative out there somewhere.

If you look at how life expectancy and other factors have changed since the introduction of the state pension, reform is inevitable and essential. But I do think we'll look back on the post-war generation as having eaten all the cake...

Never have, despite constantly bitching about work I enjoy it and would miss the banter that you don't really get anywhere else. I'm of the opinion that retirement is bad for most unless you've got enough money to be out and about traveling and generally keeping yourself very active.

I don't expect to make it to that age, but if I do I fully expect to be working for a living, at least until the day I die.

I don't expect to able to rely on [to even SEE, in my case] any state provision.

I agree. Fortunately I'm building a decent private pension, but I don't hold out much hope of seeing that either given the catastrophic pensions meltdown we're due in the next 50 years.

binners - in the future retirement will become an urban myth, a story of old told to kids to help them sleep at night like tales of unicorns and castles.

I'm just happy now when my dad asks how my pension is going I can look him in the eye and say its crap, my generation has to keep working to support him and his mates living longer and enjoying a sunny life on a final salary.

What do you do for 25 years? Watch Jeremy Kyle? Think I'd rather carry on working, tbh.

If you were lucky enough to be a baby boomer like my Dad who retired a couple of years ago, the answer seems to be 25 years of doing all the things you'd have liked to have done if you didn't need to earn a salary. I reckon he's busier (and happier) now than he's ever been.

clubber - MemberI'm reckoning on 70. I'm hoping not 75.

This.

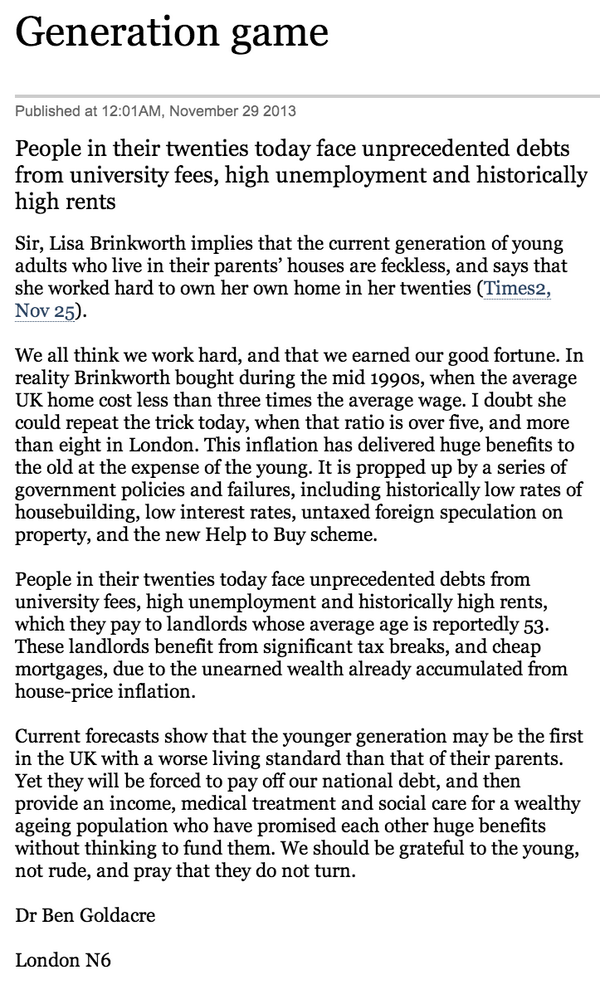

Did anyone read Ben Goldarcre's letter in the times regarding the old stealing from the young? (It was all over twitter but I can't link to it at the moment)

Very compelling stuff. Can't anything changing though as old people vote and turkeys 'aint gonna vote for Xmas.

Thats my thoughts Flaperon. I've packed in paying into my private pension, as I reckon the whole private pension system will implode before I get a sniff of anything from it. And I'm taking it as read state pensions will be long gone by that point

Yes I shall retire and all you young people will paying for it. He he!

If you were lucky enough to be a baby boomer like my Dad who retired a couple of years ago, the answer seems to be 25 years of doing all the things you'd have liked to have done if you didn't need to earn a salary. I reckon he's busier (and happier) now than he's ever been.

I was going to post something very similar to that in response to what I see as a lack of imagination. There's more to life than work if you're lucky enough...

I did on October 31st, 38 years at the same company and the offer of an early leaver package was too good to refuse

Don't know how I found the time to go to work, loving every minute and feel so much better physically and mentally

Can't be a good thing all the oldies staying at work, how about jobs for the youngsters. Maybe the government should offer a scheme where you can voluntarily pay more into the state pension so you can retire at a sensible age

I don't expect to able to rely on any state provision.

Why? pensioners vote as long as that remains the pension will remain

FWIW minimum for a single person on unemployment is less than £80 if over 25 and the minimum for a retired person is over £150 per week.

Plenty of other benefits available as well

The real issue is that the current retired folk , who got free education , full employment and cheap housing are the ones who have not paid enough to cover their retirement costs and we have to pay for them and us.

As the poster above shows they really care about shafting their kids and grandkids from the position of being the richest folk to have ever lived and getting others to pay for it

Says something about humanity that does tbh.

The fundamental problem is people are living too long. When the state pension was introduced, there were about 20 people working for every retiree - now it's about 3.

You don't need to be a mathematician to see that's a big problem.

TBH, I don't have a problem with working longer - I'll also live longer, so it evens out.

The real issue is that the current retired folk , who got free education , full employment and cheap housing are the ones who have not paid enough to cover their retirement costs and we have to pay for them and us.

Everyone gets free education until the age of 18 and can't remember full employment in the Thatcher years. Houses were certainly not cheap either with mortgage interest rates far above those of today.

I don't expect, or want to retire.

Retirement in general is a weird concept. Originally you retired when you were about to die. They screwed up badly using that age rather than using about to die -1.

The fundamental problem is people are living too long. When the state pension was introduced, there were about 20 people working for every retiree - now it's about 3.

The fundamental problem is that current retirees won't change their "package" in relation to this change in life expectancy. Instead choosing to force the young to pay for "what they were promised" but they failed to fund.

I'd say ****-em. Means test the state pension, tax private pensions to the hilt, make people pay for their own care homes if they can even if it means selling their house (since they no longer need it) and force them to spend their savings by increasing inhertiance tax.

It will be good for the economy since all that grey cash will be released into circulation and its nothing less than they are doing to us by clinging onto their unaffordable benefits.

Never going to happen though as all of the polictical parties need to pander to the grey vote to be in power.

I'm 33 and full expect to work for another 40 years. I also expect the state pension will be long gone. You have to remember the state pension age of 65 was introduced when life expectancy was something like 53 so by the same theory it should be be around 90 years old now.

How will we work out 'about to die -1'?

Easy to do on average.

The original retirement age set at 65 because very few people lived that long.

even if it means selling their house (since they no longer need it) and force them to spend their savings by increasing inhertiance tax

Problem is, I'm kind-of relying on what I'll get from my parents to fund my old age...

but they failed to fund.

Well they didn't really did they. The organisations (be they corporate or government) told them what they had to pay to get X benefit. It's hardly suprising that they paid what they were asked to and expect to get what they were promised.

The problem really is that like so many things, governments never made the hard, correct but unpopular decisions that they should have done and this in turn is down to all of our faults in making them behave that way by voting them out if they do those things...

Jfleth, interesting idea. Basically those who have saved and prepared for their retirement financially should be taxed to pay for those that didn't? Hmm, I can see a debate on political ideology coming on...

Well they didn't really did they.

"They" as a generation/cohort, whatever you want to call it failed to put enough asside to pay for what "they" as idividuals were promised.

Well they didn't really did they.

Yes they really did pay in not enough to cover what they would get out and passed this on to future generations who do not get free education nor the pensions they recieve

The organisations (be they corporate or government) told them what they had to pay to get X benefit. It's hardly suprising that they paid what they were asked to and expect to get what they were promised.

No its not surprising they are cross but we could just say you know what there is not enough money as you have the misfortune of living longer than expected, your weel off and you need to make some sacrifices........Would you say your parents were poor? Mine are not even close to it tbh

Of course they could say **** off, you pay for it you bastards - I was not even alive when the "promise" was made so it seems entirely reasonable I fund it and get less than they get and for a shorter period. Thanks richest retirees we will ever have who retire for th elongest time.. Happy to pay for what someeone else promised you

That is the fair solution here to this problem I assume

Its does show the power of voting [ and the weakness of democracy]no one messes with them as they vote just like car drivers

Problem is, I'm kind-of relying on what I'll get from my parents to fund my old age...

Chicken and egg though isn't it.

The reason our generation isn't able to save for our retirement is that the baby boomer generation stole all the money (in the form of house price rises and unaffordable pensions). If we stop them hoarding all the stolen money then you would be able to save, rather than relying on you getting your own individual slice of the stolen money.

to be honest with the size of inheritance I've got coming and by selling of some of the family lands and estates, I'll be sitting on my arse and taking it easy before I'm 50.

The reason our generation isn't able to save for our retirement is that the baby boomer generation stole all the money (in the form of house price rises and unaffordable pensions). If we stop them hoarding all the stolen money then you would be able to save, rather than relying on you getting your own individual slice of the stolen money.

Falling birth rates and not enough house building.

Shag more and get rid of planning restrictions and you could solve the problem in 20 years.

The whole system relies on endless growth so it has to collapse eventually.

I've pretty much given up on the idea that I'm ever going to retire.

Based on the amount you post on here I'd always assumed you must have retired already. 🙂

The reason our generation isn't able to save for our retirement

What about the younger generation buy to let landlords who will use that income to provide for their old age

A colleague at work has just suggested that when you turn 65 , punch your line manager in the face and have a couple of years signing on..... 🙁

😀

What about the younger generation buy to let landlords who will use that income to provide for their old age

The vast majority of BTL landlords are old, funding the purchase from capital in their existing mortgage free properties and capitalising on low interest rates and the inability of young people to borrow money to charge high rents. Its one of the most obvious ways the old continue to steal from the young.

There are a very small percentage of you people who are "couldn't sell" to let landlords who were unable to sell their first home at the peak of the housing bubble and used the banks willingness to fund 100% mortgages to move up the property ladder. Mostly these people are now saddled with unafforable debt and house they can't sell and are reliant on tennants to fund the interest on the mortage.

I'm 40, and my wife 38.

I've got a pretty reasonable job in Engineering, and my wife is a teacher.

We both pay into workplace pensions, for every 5% I put in, my company does the same. So I figure that even if it goes properly wrong, the pot should still be worth something in the region of what I personally put into it.

While I realise we're not going to fair as well as we would if we were 20 years older, I still think that a combination of 2 x state pensions, 2 x workplace pensions and a few other bits should allow us to retire at some point.

many of my friends don't pay into any sort of pension, so if nothing else surely I've got to be slightly better off than them?

Blame education and blame medicine.

Seriously.

With people staying in education until their 20s and wanting to retire at 60 it gives the state 30-40 years to collect tax from an individual.

But with no tax being paid by the typical person for the first 20 years of their life and actually the government spending out on their education instead you are already in debt to the government when you start work.... then you retire at 60 and expect the government to spend on you again until you die, which is typically 80-ish these days.

So with the state spending out on an individual for roughly 40 years of their life and that person paying into the coffers for roughly 40 years their isn't always going to be enough money, particularly as the health and care costs for older people sky rocket as their bodies fail in old age.

People are living to long.

We used to retire at 60 and die at 70, that was affordable.

We used to go out to work at 16 and pay tax straight away but today this seems to mark someone out as a failure unless they are at university until they are 21.

The current system doesn't add up.

People of all wage brackets need to get used to the idea of paying more tax or perhaps the government gives people an option of a decent pension but you'll have to take out private health care cover instead?

Either way, the baby boomers created a system that worked well for them and sod the generations that followed.

As somebody else said, the 'system' is really a pyramid scheme that relied on the next generation to fund things but with house prices putting people off starting families and the resulting low birth rates we have managed to stuff that up too.

Society needs to stop being so precious about planning laws and start building loads of cheap houses so young couples can go back to living normal lives where you bred like rabbits and created a workforce to replace you and at the very least some sprogs to look after you in your dotage.

I know there was an interesting idea muted as part of universal credit. Basically there is no state retirement. You work until you are no longer able to work then claim incapacity benefit.

The origianl retirement age was set at average life expectancy and is only changing now to fall back in line. I fully expect to recieve no support from the governemnt in 38years time.

Thread title response

No

Society needs to stop being so precious about planning laws and start building loads of cheap houses

Indeed. But I'd hazard a guess that the NIMBY's that are preventing this happening, are also mainly the baby boomers too. Seeing as they've gained, and continue to gain, enormously from property prices being artificially inflated, as they continue to be with the help to buy scheme. Even now, with the pensions crisis growing ever darker on the horizon, economic policy still seems to be dictated by this gilded generation, at the expense of everybody else

@kimbers - life expectancy by geography is heavily weighted by factors like;

employment (i.e. doing risky jobs such as construction)

health (i.e. diet, alcohol consumption)

crime (i.e. getting shot / knifed)

Yes I will be retiring at some stage, it depends upon the lifestyle I want to live in retirement really. My father was an electrical engineer, nothing fancy, he stopped working at 52.

The retirement age of 65 was set based upon life expectancy being close to that figure. As we will all live longer the age at which you can draw your pension has to rise. We can stop working when we like, we just have to save for it

[i] If you were lucky enough to be a baby boomer like my Dad who retired a couple of years ago, the answer seems to be 25 years of doing all the things you'd have liked to have done if you didn't need to earn a salary. I reckon he's busier (and happier) now than he's ever been.

I was going to post something very similar to that in response to what I see as a lack of imagination. There's more to life than work if you're lucky enough... [/i]

Both my parents have final salary schemes that mean they have an income of about 60% of what they had before the retired. Both from schemes which are now running *massive* deficits and are closed to new entrants. They both retired at 60.

They can afford to indulge themselves in doing all the things they wanted to when younger but didn't.

They put in 10% of their salaries during their working lives. If I do the same I'll be lucky top end up with a 25% pension. Chances of pootling away at anything for a 25 year retirement is likely to be hampered by a lack of funds.

[s]Society[/s] Baby boomers need[s]s[/s] to stop being so precious about planning laws and start building loads of cheap houses

This is just another example of the old stealing from the young. My house was built in the 50s as infill between some other houses which would have been surrounded by fields. The people who lived in it from then until I bought it saw its value climb at well above wage inflation for 60 years at least 20 of those 60 years will have been as retirees. I then bought it at a ridiculous multiplier of our wages so that we had space for our familiy and will still be paying for it well into my 60s.

Meanwhile if anyone dares to try an build on any infill in the village today they are blocked at every turn by NIMBY baby boomers with too much time on their hands due to early retirement. All while living in huge houses that they don't need.

How is this stealing?

id say my parents fall nicely into the baby boomers both late 70s both healthy both havent worked for over 20 years .. nice house nice cars nice holidays.. fancy public sector pension.. er no actually niether has anything but a state pension but my mum was the biggest saver ever.. when i was pre school we d do the weeks shopping and she d put the change there and then in the building society and she kept that up till they retired.. worked hard saved end of.

I'd been wondering how feasible it'd be to entirely restructure the pension thingummyjig.

Mayhap we could have the option to trade in our "til death" entitlement in exchange for a short early pension period during working life. IE you could take, say, 5 years at 30, with longer available the later you take it. Then hand yourself in at the biofuel plant at 65-70. By the time it came to working out figures and examining all the gaping holes in the idea i'd sobered up and couldn't be arsed, but possibly it'd be cheaper to fund a working age person (let's say this pension is the national average income) for a predetermined amount of time, than the elderly for an indeterminate one, with all the associated medical and care costs that become inevitable. Maybe the pension age could stay reasonable for those that don't opt in this way.

Admittedly, I'll be an absolute wreck if i live to retirement and this has informed the theory. This aside, raising the pension age won't mean there'll suddenly be more jobs to go around, unless B&Q are making a comeback. Geriatric bladder in an Amazon.co.uk warehouse anyone?

worked hard saved end of.

The point is that they had the oportunty to save as housing was cheap in comparision to wages.

These days it is much harder to do that and in large part that is due to the unafforability of the lifestyles of people who are currently retired or due to retire very shortly and the benefits they have reaped due to an explosion in house prices.

There'll be compulsory death camps by the time I get to 55/60, as old people will be too much of a drain on resources and there will be too many of us/them as well.

The rich will no doubt be fine though.

Not sure everything was as marvellous for those of a slightly older generation

I lived with my parents in a rented east end flat, left school at sixteen and got a job. Nobody I knew went to university, bit more important to go to work and earn a few quid.

Saved up for a deposit then bought a small house with older colleagues saying how expensive they thought the mortgage payments were.

Had a small family, bought a slightly bigger house and paid even more out on mortgage with interest rates twice hitting 15%. This in conjunction with crazy high poll tax payments, living within our means such as one cheap holiday and one secondhand car.

Paid our bills along with a works pension which after forty years would hopefully provide funds so we could retire.

How exactly have I robbed anyone, never taken a penny in handouts apart from child benefit and still won't get the state pension until i'm 66.

Many younger people on here have no doubt been treated very well by their parents and have had opportunities that I didn't even dream about.

Every generation thinks they have been dealt a bad hand by their predecessors when in reality its no worse. Think yourselves lucky you have an expected longer life expectancy, all the money in the world can't buy that.

I certainly won't be relying on state pension to help me through my retirement.

A private pension and rent from a couple of properties should see me alright.

I'm 46 and ideally I'd like to retire from work in 15 years.

esp jfletch and re baby boomers comments - a balance (*I'm not entirely disagreeing by the way, merely pointing out that not everybody got to float in the gravyboat)

my dad was born illegitimate in the early 1930s in rural Scotland, being blunt him and his mum didn't get many state handouts or much community help in those days, my dad has since worked from 14 till 65, as an uneducated man he has had low pay jobs (farm worker, lorry driver, street sweeper, lighthouse keeper etc etc) and all his life as an employee (the least tax efficient form of employment - which is another point you might want to question regarding retirement/taxation) so if you think he's swanning around on a massive final salary scheme with a huge house proft you could be wrong.

I hope my health stays good enough to work in some capacity for my whole life.

Both my parents have final salary schemes that mean they have an income of about 60% of what they had before the retired. Both from schemes which are now running *massive* deficits and are closed to new entrants. They both retired at 60.They can afford to indulge themselves in doing all the things they wanted to when younger but didn't.

They put in 10% of their salaries during their working lives. If I do the same I'll be lucky top end up with a 25% pension. Chances of pootling away at anything for a 25 year retirement is likely to be hampered by a lack of funds.

THIS + so many.

Late 40's here, good job in private sector, with about 15% gross going into a pension fund which is projecting a retirement pension that is tiny. Have a neighbour who is a couple of yrs older, similarly qualified educationally and professionally, similar salary, similar working life pension contributuons. He retires at 51 next Spring from a senior role in emergency sevices after 30 yrs service, with a lump sum of around 250K and an index linked pension of £40k plus PA. Some folks still have it going thier direction 🙂

Then hand yourself in at the biofuel plant at 65-70

There'll be compulsory death camps by the time I get to 55/60

I'm strongly of the view that we [i]need[/i] voluntary euthanasia rules. My suspicion is that this is currently blocked by the baby boomers this thread has been complaining about. To get around this, we need to set a time limit, so that no-one who is over, say 60 now will be able to opt for it, but anyone under that age has the option. I am certainly regarding it as an important part of my retirement planning.

One thing I wondered about is the 2nd state pension - SERPS. Some contracted out of that but it's all changed now and looks to me that those that didn't are losing out big time - anyone understand this stuff?

mortgage interest rates far above those of today

and mitigated by MIRAS

Yes I contracted part of my state pension contribution to my private pension. You will still get the basic part of your state pension, you don't contract out of the whole thing.

Yes but looks like those who didn't contract out are losing out on the 2nd pension right?

Oh well, I'm building up a private pension and anything the state gives me will be a bonus really.

Tijuana Taxi - I'm not saying the entire older generation has it easy and the young are all go getters who would be fine if only someone whould give them a chance. Far from it.

But as a generation these things are undoubtedly true.

Someone in your situation now will not be as well off when they retire as you are now, no matter how hard they work. Yes you had your own individual hardships but all of the baseline measures are in your generation's favour and your generation have, maybe inadvertently, raised the drawbridge.

I'm with Binners... burn the baby boomers 😈

I have 2 elder sisters who qualify...

now where are the matches

Plan........ (currently 27)

Currently paying 15% into my private pension, turn contractor at some point when it seems like a good idea and be working 6 months on/off by the time I'm mid 40's.

Bet it doesn't work out like that though!

6 months on/off? think I'd rather do 12 months and stop working x number of years earlier.

We'll be all right. Got saving in our 20s with Equitable Life. Also when we took out our endowment mortgage they told us it's going to give us a lump sum surplus at the end about the same value as the house. 😆

That previous stuff is going to pale into insignificance next to whats going to happen when the yawning chasm between what private pensions promised when sold, and what they [i]actually[/i] deliver, comes to light.

I get the feeling a lot of people are in for a very rude awakening. But, as with the banking crisis, those responsible for it will have long since trousered their mountains of cash, and skipped off into the distance, kicking their heels

My dad is one of theses thieving oldies you are all referring to. He got brought up hungry in a small mining village and started work in a mill, moving on to the coal face when old enough. He still has his worksheets from this time and often did consecutive double shifts on the face for years - proper hard graft in the early 1960's.

He became self employed when I was little and I can never remember him not working at least 6 days per week to pay for a biggish house and savings.

He retired at 60 and is not short of cash.

However, throughout his working life he didn't have a Mac costing a months wages, a phone costing 2-3 weeks wages, a £25,000 car and a bike that cost in excess of 2 months of my wage. He also, for much of his working life, could not have afforded to have or run a central heating system, bought stuff with abandon from all over the world nor spent money he did not have.

It seems to me that if we actually only bought the goods his generation did then for many of us making provision for retirement would be more than possible.

However, our generation and the next now see 'luxuries' as necessities and are not prepared to do without them. Everyone wants to be middle class with the trappings that they think they deserve.

Is my dad better off than I will be when I retire - YES.

Am I much better off than he was through his working life - YES.

Maybe it's me (and others in the same boat) who need to cur back a bit on luxuries now to have a better retirement rather than just blaming someone else.

My dad is one of theses thieving oldies you are all referring to. He got brought up hungry in a small mining village and started work in a mill, moving on to the coal face when old enough. He still has his worksheets from this time and often did consecutive double shifts on the face for years - proper hard graft in the early 1960's.He became self employed when I was little and I can never remember him not working at least 6 days per week to pay for a biggish house and savings.

He retired at 60 and is not short of cash.

However, throughout his working life he didn't have a Mac costing a months wages, a phone costing 2-3 weeks wages, a £25,000 car and a bike that cost in excess of 2 months of my wage. He also, for much of his working life, could not have afforded to have or run a central heating system, bought stuff with abandon from all over the world nor spent money he did not have.

It seems to me that if we actually only bought the goods his generation did then for many of us making provision for retirement would be more than possible.

However, our generation and the next now see 'luxuries' as necessities and are not prepared to do without them. Everyone wants to be middle class with the trappings that they think they deserve.

Is my dad better off than I will be when I retire - YES.

Am I much better off than he was through his working life - YES.

Maybe it's me (and others in the same boat) who need to cur back a bit on luxuries now to have a better retirement rather than just blaming someone else.

Couldn't have said it better myself. I am mid thirties and think my generation have it way, way better than my parents or grandparents.

He retired at 60 and is not short of cash.

You are missing the point.

If your Dad was born now, did all the same things, passed up on what luxuries were available at the time he would not be able to retire at 60 and not be short of cash.

You have chosen to make different choices and spend your money now but that is because relatively you are better off than your Dad. That does not mean your entire generation is better off than your Dad's entire generation.

I can't argue with that at all db. I have a severe dislike for everyone's need to be middle class, and spend all their money on aspirational goods to end up looking like every other family.

Don't get me wrong, I've got a high end phone, a laptop, a playstation, a rally car, a mountain bike, a shotgun, dslr camera, motorbike etc etc, but it's all bought and paid for with money I earn, none of it on finance or loans, and I have a modest amount of savings in the bank. I plan to reduce my hobby portfolio (typing the above out really makes me think.....) and save more money, but I currently have no children, not married, and reasonable fixed outgoings.

Most of my peers seem on the otherhand to be spending ALL of their income (or joint incomes) every month, with mortgage, credit cards, finance, store cards, loans etc all right up to the limit of what they can afford so they can keep up with everyone else, and for what, to have no real identity or happiness, just desperation to have stuff, for the sake of stuff. And not good, fun stuff, not on hobbies or the like, just new cars, big tv's, clothes, and general crap that doesn't actually make you any happier or give you something to do.

I work in local government, have just been auto-enrolled onto my pension, (having been here 4 years as a trainee), and this year promoted. I'm 99% sure I'm going to opt out though as I just can't see it being worthwhile in the long run, I won't be eligible to claim it until I'm about 75 probably (25 now), and can't see my line of work staying in-house in for more than 10 years (being optimistic). So what use will 10 years worth of council pension to me when I can finally jack in work? Probably better off having my 6 1/2% now and doing something with it privately. Am going to speak to friend's dad who is a financial advisor though........

I think the only people who will end up with a retirement are farmers and business owners, as they're the only people who'll be able to afford to!

I collected my 40 year long service award last week and have around 18 months left till I finish paying into my 40 year final salary pension.

I'm just keeping my fingers crossed that government or my employers don't find some way of stealing it from me in the mean time.