![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

I've just had my annual renewal quote arrive. A whopping 40% increase! No details have changed other then I'm a year older. Same car, same mileage, same location, no accidents or claims of any kind. OK I thought, that's the usual game the insurers play.. . Try and rip off the lazy or loyal customer. So I open compare the market which helpfully has all my details saved, confirm they are correct and hit the button to get quotes. CRIPES! Not a single cheaper quote!

Cost of living crisis or greedflation? Feels like the latter. Pass me the vaseline please, while I bend over...

Mine has barely gone up. Only a few percent.

We have a multi-car with LV and it seems to help.

Mines not changed. Maybe your postcode has been reclassified as higher risk if all the companies are similar.

Mine went up by 25%, it always does.

So, like for the past six or seven years I phoned them up and asked if they could do any better. ‘I can see you have been with us for xx years so as a goodwill gesture…’ back to within a fiver of last years quote. Five minutes conversation worth £80

It’s a game. Have found making sure it’s not on auto renewal and phoning as soon as the quote arrives helps.

TLDR: ask if they can improve the offer- you might be lucky

EDT: I do check out alternatives each year, so far the current provider is still the best balance of cover and price, after the annual’discount’

If my provider sticks the renewal up, I’m going no matter what deal they will give me for being a ‘loyal customer’. In my experience there is always a decent alternative.

Yes I can only think the postcode has been reclassified as higher risk. There was a spate of catalytic converter thefts around, although not specifically this or neighbouring streets it was close enough.

Either that or turning 50 has made me tip into another risk box but that seems unlikely.

I'll make a phone call tomorrow but I always swap back and forth between 2 providers that always seem to best the rest, so I've only been with them 1 year. We shall try though.

Ours went up by nearly 100% .

10 minutes looking we had equivalent cover for the same as the previous years quote

Back down to 200.

What have you got and how much are you paying?

Mine is £327/year on an '07 Civic Type R - includes protected no claims, legal expenses and road rescue.

And a bit over 50!

Mine went down by £20!

That was leaving it on an auto-renew with the same company as well - I was prepared to wait until their "we'll auto renew and it'll cost xxx more" then phone up or just leave but nope, got a cheaper price!.

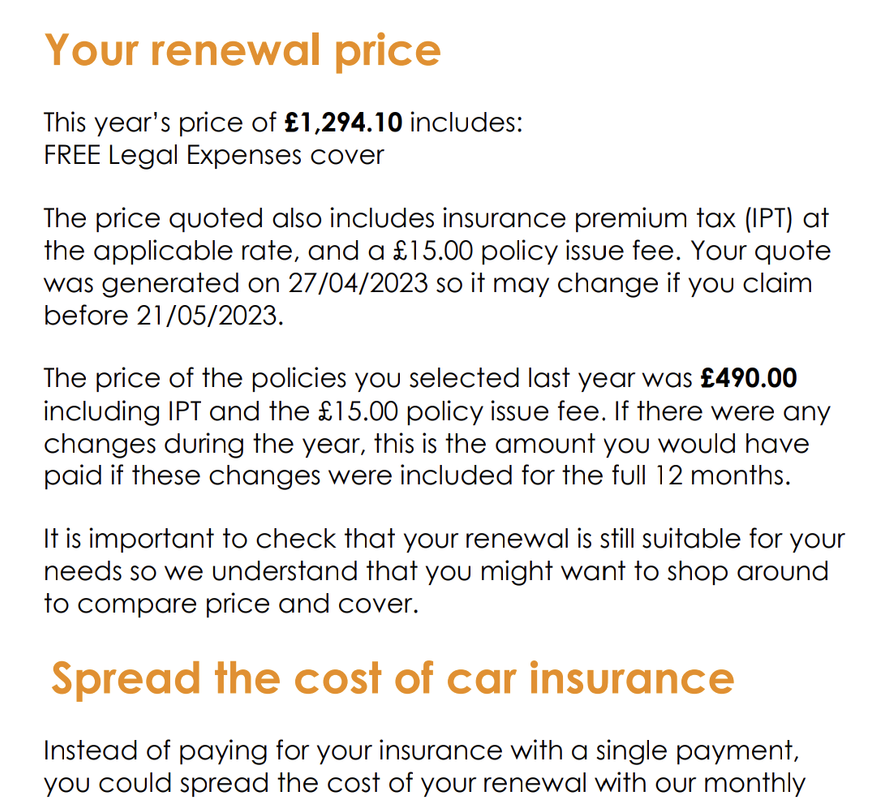

Ours was £490 last year. The renewal is £1285. We were hit by an unlicensed, uninsured driver in October. He was driving a borrowed car insured by someone else so we've claimed against them and it was a straightforward no fault claim. Nothing else has changed.

I can only imagine they don't want our business this year. The worrying thing is how difficult it's been to find anything else for less than about 700 quid.

14 plate octavia. Petrol vrs. Full ncd, a bit of voluntary xs, comprehensive, protected ncd and basic breakdown cover. South East London (that is the costly bit I think). Last year, £347, renewal is £491. 6000 miles annually and my wife as a named driver (might as well take her off as she refused to share any driving... adding her only cost about a tenner though).

Same here, renewal quote was for about 30% more. Loads of blather about cost of everything increasing, and this in turn making Insurance more expensive. Did the go-compare boogy-woogie and came out with a decent policy cheaper than last year's. So, it does (usually) pay to shop around.

Anyone commenting on this ought to consider themselves lucky that they're not trying to find cover for a Range Rover...

Excesses are heading to £10k for theft. If you can get cover at all...

Oddly my insurance has been around £350 since I started driving 30 years ago. It’s like inflation went up as my risk went down.

Either that or turning 50 has made me tip into another risk box but that seems unlikely.

Mine went up about 40% last year which coincided with 0 in my age.

Partly but not completely I think that was something to do with a change in insurance tax &/or regs which you might have been the correct side of at renewal last year? Ended up with "flow" who were the best I could find but still about 25% higher than the previous year.

^ my heart bleeds

Yes how dare you have nice* things?

*not sure on that but it's not my car so not my opinion that matters.

johndoh

^ my heart bleeds

I can tell you one thing Rich isn't driving a Range Rover 😉

He is just in the know

Excesses are heading to £10k for theft. If you can get cover at all…

No, I'm sorry but wtf?

You have ten grand excess on a car?!?

When did this become a thing?

I drive the most boring car imaginable, a Honda Jazz.

'Naice' postcode, for Burnley.

£300 fully comp via LV.

Yes, I have to do the phone call every year to get back to that, but includes everything.

Nurse, unlimited mileage, business use, recovery, curry spillage cover, alien abduction etc.

https://www.autocar.co.uk/car-news/new-cars/insurers-refusing-cover-london-based-range-rovers

I heard about the 10k excess yesterday. It's not actually 10k, but it's 10% of the vehicle value. Since some of them are over 100k that means...

The company involved is Aviva.

Honda Jazz

Top wheels 👍

You do know jazz’s are often targeted for cat theft?

Needs a ‘No Cats left in this Jazz overnight’ sticker.

Or is it a bit like the Transits used to be used for bank jobs?

You do know jazz’s are often targeted for cat theft?

Anecdotally I think it's mainly hybrids that are targeted for that. Toyota mainly - Pious and Lexuses? I could be wrong - it's just what I've come across.

If anyone touches my Jazz’s cat, I'll scratch their eyes out.

Our Leon FR estate jumped up about 25% even after a hunt for a better deal. Nothing changed in terms of cover or incidents.

Our Ibiza, same cost as last year with existing insurers and same cover.

No, me either 🤷♂️

Aren't jazzs all cats?

Mine went up from around £400 to £750 on the renewal price back in February but managed to find somewhere else with "only" a £120 increase. I'm certain the higher prices are due to theft and how easy it is with all this keyless entry bollocks, as the premium adjustment for some high end modifications and a 50-60% increase in bhp was only £26.

Mine went up from £320 to £390 so I switched to LV (who seem to get well rated) for £230 for exactly the same cover. I am 55, full NCB and drive one of the lowest group cars out there.

Mine up 25%. Straight onto GoCompare and got the same price as last year from a different insurer.

Also have to change insurer for house and contents. Amazed how much cheaper than car insurance it is for massively greater coverage (in £s). Goes to show what the comparative risk must be.

There's the issue of cheap cars now being worth a lot more to consider too. My Fabia was valued at £2100 in 2020, just had it assessed after an accident and the new value was £4000! Means it's getting repaired rather than written off but if all other cars are doing the same thing then repair costs are going up massively.

My renewal is due in 2 months and I'm dreading having a fresh claim on it, especially as it's unlikely to be settled by then either. I'm changing company anyway as Esure have been a bit crap over the accident, insisting I use a claims management company that have been taking the piss on lots of stuff, so will be hitting the comparison sites soon. I'm expecting my current £225 premium to double or more.

I can tell you one thing Rich isn’t driving a Range Rover 😉

He is just in the know

I had assumed that 🙂

As i'm over a certain age SAGA have insured my cars over the past few years and have been very reasonable.

Called them and got a better quote about £60 less. I'll likely have to take that however I need to think about multicar as an option. I was told If I added my wife's car it would save a further £82 from my car's cost, and she would receive a similar discount. Her policy isn't due for anther 4-5 months but they would pro rata the cost, have her car added when due and end next year at the same point as mine. So unless her insurance with my provider were to be £160 ish more than she could find elsewhere, we would likely save a little more. Are there any draw backs with multicar? I assume she is still the policy holder on her car and earning her own no claims? And in the event of an accident or claim it's against one car/insured not the both of us?

My car is as old as I am. It costs me £95 a year to insure with 8000 miles and commuting if needs be too.

Insurance companies made a killing during lockdown as everything was insured but nothing (we'll relatively speaking) got claimed.

I suspect they liked the profit margins a bit too much.

I got this little nugget from Adrian Flux. They must be trying to get rid of us.

How much! That looks like they don't want your custom as you say! Oouch.

Also have to change insurer for house and contents. Amazed how much cheaper than car insurance it is for massively greater coverage (in £s). Goes to show what the comparative risk must be.

Houses don't usually smash into other houses causing thousands in damage and potentially lifelong care costs for the occupants!