![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

We cannot help ourselves, until there is a total change of our 'capitalist' system it will go on and on, tell me how did Cuba fare through the crash did anything much change for them? I haven't been out there lately.

You don't need to be anti-capitalist to avoid crashes eg Australia weathered the storm better than most, they just had a more robust banking regulation frame work in place. Obviously they still suffered the effects of global downturn in reduced demand for natural resources, but their financial system was a lot less impacted in the initial crash.

Well all your answers seem to be based around the premise that the banks can do no wrong and should be absolved of all blame

I'm not saying banks should be absolved of all blame at all. I'd happily see Fred and Appelgarth in jail as I posted but I don't see how you can jail someone for being incompetent. What I am saying is that banks where a big part of the problem but no means entirely responsible.

They already had access to the Fed through their US business, I am not sure they took over Lehman's licence they just acquired assets.

I could be wrong but they got significant uptick in their access and I think they did take the licences. Banks in London don't get automatic access to the BoE and neither do international banks in NY with branches there.

Has anyone addressed the massive use of certain derivatives and their inter connections between all the institutions, if not then we are likely to hit similar problems again in the future.

HSBC I'm sure will get some leniency from the government to stay.

Yes, Australia is less reliant on financial services but their main benefit is they are huge producers of natural resources and prices of those stayed pretty firm. The crises in US financial services was much worse than ours in the UK but they are less reliant and thus recovered quicker. I am all for the UK to be less reliant we just need to create more before we bash the sector which is paying a lot of the bills.

Has anyone addressed the massive use of certain derivatives and their inter connections between all the institutions, if not then we are likely to hit similar problems again in the future.

Yes capital charges have gone through the roof, banks have scaled down massively and in many cases withdrawn completely.

I have a fair amount of sympathy for the credit rating agencies, having worked for a similar type institution but in engineering. There are time when you know it's a bit sh*t but it isn't illegal and as they pay your bills you pass it. Often however, you are better informed than the regulator and are performing a balancing act, but can at least put a stop to some of the worst practices.

If the credit rating agencies weren't there, then it would either be a free for all, or the regulator would be crushed with the amount of work.

I am all for the UK to be less reliant we just need to create more before we bash the sector which is paying a lot of the bills.

Nothing wrong with bashing bankers, they've more than earned it. Their behaviour over the last decade or so has been completely immoral and in many cases illegal. Just look at the huge string of fines we've seen. The whole sub prime debt repackaging was just one massive scam, similar to the washing of out of date meat with bleach and repacking it as fresh cuts.

If they want to be respected they need to earn it by being responsible citizens. Just paying their taxes isn't enough. I don't expect huge respect just for paying the taxes due to me, if I act like a huge arsehole to everyone, I'd expect to be treated as one.

If they want to be respected they need to earn it by being responsible citizens

This does sound a lot like the crap thrown at cyclists because some jump red lights. Not all bankers are immoral or guilty of illegal behaviour. In fact, I'll suggest that the vast majority aren't. Just like cyclists.

tyrionl1 - MemberThe root cause of the crash was sadly political correctness and the assertion 'just because they are poor and have never exhibited an ability to repay debt' it's no reason not to loan them money. Blame Bill Clintons economic 'miracle' that was what created the debt that got rapidly repackaged and sold around the world.

Corporate America to blame, as per usual, everything else tumbled domino effect as positive perception of risk ran out.

Very good movie illustrating a Bank baling out was Margin Call.

The rest, the redundant Nasa scientists retrained to create money making algorithms no one understood, the lack of regulation and above everything our greed and desire for something for nothing did the rest. You cannot blame anyone other than the political correct brigade for what followed and will follow again once this next property bubble bursts.

We cannot help ourselves, until there is a total change of our 'capitalist' system it will go on and on, tell me how did Cuba fare through the crash did anything much change for them? I haven't been out there lately.

I think you're off the mark calling it PC nonsense, sub-prime lending is incredibly profitable - especially if a booming property market makes it a non-lose gamble - they pay you win, they don't pay you repo and sell for more than you're owed because of the rise in prices.

Let us not forget North Rock were offering 105% mortgages to first time buyers with defaults and CCJs and the major banks were allowing people to claim whatever income was needed through self-cert. It was nothing to do with being politically correct, it was hugely profitable.

The major differences was they the yanks managed to play the system to turn high-risk into low risk by mixing it with just enough prime lending and the whole thing unravelled, whereas we protected our overly indebted mortgage payers with a .5% base rate and some quick law changes which meant repo was much harder.

In short, the crisis was caused by reckless actions by over confident lenders and borrowers - the same as every other recession.

This does sound a lot like the crap thrown at cyclists because some jump red lights. Not all bankers are immoral or guilty of illegal behaviour. In fact, I'll suggest that the vast majority aren't. Just like cyclists.

Slight difference in end result though, cyclist jumps red light, no one harmed. Bankers crash 50% of world economy wiping out trillions in GDP and spreading misery to millions.....

If they want to be loved they should probably put their own house in order rather than just blaming everyone else for being unfair to them.

But presumably the majority I mentioned have no real power to actually do that.

In my view that expansion of credit was necessitated by the increasing redistribution of income and wealth from the poor to the rich. If they didn't have credit, demand would have dried up. It wasn't PC, it was 'sound' economics in a rising market.

As an aside, I think the Tories will do nothing about the housing shortage and rising prices particularly in London. Rising prices means a 'feel good' factor for home and land owners which can be politically rewarding even when other areas of the economy are underperforming. Groups that traditionally voted Labour who might also be landlords and small business owners can be won over in this way. A bit of Lady Porter-style social cleansing will reduce the Labour vote as in Westminster.

They can always change career if they don't like it, or just get over it and get on with their job of orchestrating the next financial melt down 😉

As an aside, I think the Tories will do nothing about the housing shortage and rising prices particularly in London.

No shit Sherlock. All of Gideon's housing policies have been designed to increase inequality by propping up / increasing the insane house prices to keep Tory voters onside.

But presumably the majority I mentioned have no real power to actually do that.

Are you confusing banker with bank cashier ?

[i]banker1

?ba?k?/

noun

noun: banker; plural noun: bankers

1.

a person who manages or owns a bank or group of banks.[/i]

They have real power, and far more power than any trade unionist.

Possibly, but like many things, the term "banker" seems to be in general use to mean a much wider range of people working for financial institutions than just those that 'manage or own banks'

The root cause of the crash was sadly political correctness

And this years winner of the economics Noble prize is

Genuine LOL

The brilliant thing about the banker created economic crises, if you are a Tory, is that while it all kicked off on 14 Sep 2007 with worried customers queuing outside Northern Rock desperate to get to their money :

and 11 days previously, on 3 Sep 2007, George Osborne had made a firm pledge to match exactly Labour's spending plans :

[url= http://www.telegraph.co.uk/news/uknews/1562023/Tories-vow-to-match-Labour-spending.html ]Tories vow to match Labour spending[/url]

[i]"The Conservatives sought last night to destroy Labour claims that they would cut public services by issuing a formal pledge to match Gordon Brown’s spending plans."[/i]

the Tories nevertheless managed to convince a significant and gullible section of the electorate with the memory span of a goldfish that the UK's economic predicament was caused by "Labour overspending".

And use it of course to attack what is left of the UK's social democratic past.

So......let the bankers off the hook, get the state to bale them out, blame Labour instead, and attack universally provided social provisions, it's got to be a win-win-win-win situation if you are a wealthy right-wing Tory. God bless the bankers.

Jambalaya - late onto this, but the original figures don't appear to account for inflation?

I also recall seeing something earlier today suggesting that Iceland has come out the other side rather well, having allowed banks to fail instead of bailing out (which I would stress would be the truly capitalist response.

Finally, Ernie - perhaps Osborne made policy based on published figures and forecasts - which in the halcyon days before the Tories set up the independent OBR were entirely set out by the Labour government...

Ernie - perhaps Osborne made policy based on....

And perhaps Z-11, with your bizarre admiration for Tories and bankers, you are desperately clutching to any straw you can.

Read the article in the Telegraph which I've linked, Osborne makes his position very clear :

[i]“Today, I can confirm for the first time that a Conservative government will adopt these spending totals,” the Shadow Chancellor said.

“Total government spending will rise by 2 per cent a year in real terms, from £616 billion next year to £674 billion in the year 2010/11.

“Like Labour, we will review the final year’s total in a spending review in 2009,”Mr Osborne wrote in a newspaper article.

He added that the effect of the commitment “is that under a Conservative government, there will be real increases in spending on public services, year after year”.

“The charge from our opponents that we will cut services becomes transparently false,” he said.[/i]

Of course Osborne has a track record of following Labour Party policy, even if it is unintentional. For example in 2010 he pledged to clear the deficit in 5 years and denounced Labour as being irresponsible for claiming that they would only clear half the deficit in 5 years. 5 year later Osborne had cleared half the deficit, the very policy which he had criticised Labour for.

Maybe that was the Labour Party's fault as well ?

But then again Osborne does some things very different to Labour. For example Osborne borrowed more in the last 5 years than Labour did in the previous 13 years.

Wait........ I bet that's Labour's fault too?

Wait........ I bet that's Labour's fault too?

If you're a Tory then everything is always Labour's fault.

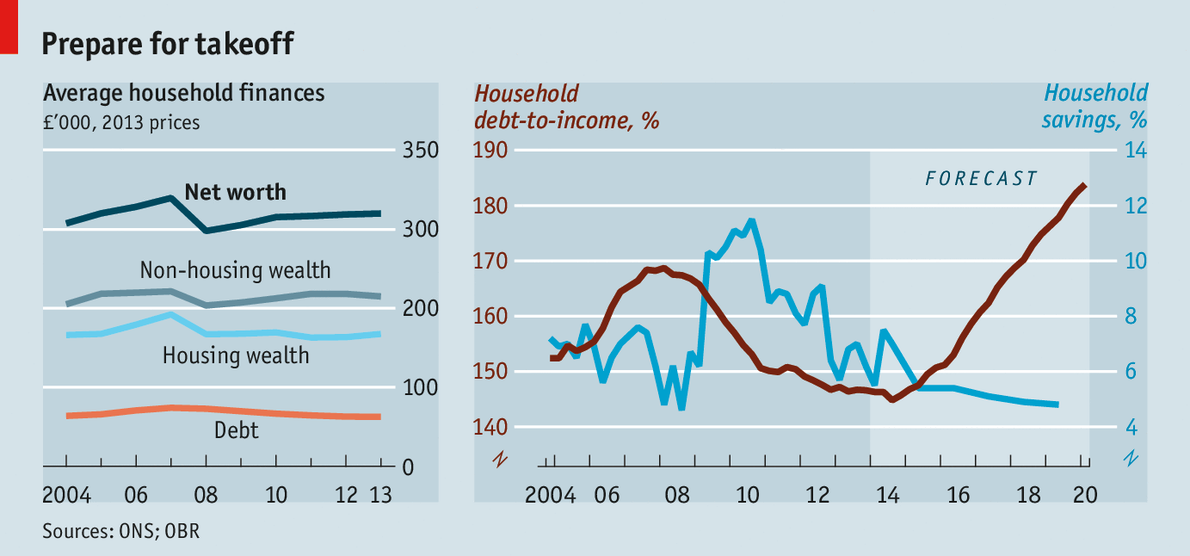

Cheery front cover of the Economist this week:

Ah the old Tories matching Labour spending mirage

So on average under lab spending rose 4% per annum before promises of lower rises going forward. And guess which ones the Tories promised to match? 4%?? Not on your Nellie, it was 2% ie half of the spending plans under labour.

What is it about stats and lies?!?

Like austerity, bank regulation has been all about delay and soft peddling. Was at dinner this week with ex-regulator who was talking about regulators perhaps going easy in the banks. Going easy???? Ok, so tighter capital requirements (still too low) but they will bottle Vickers and watch the sop to HSBC with a fudge on the bank levy coming at some point.

Still stupid for regulators to go after banks in the middle of the crisis when the policy option was to stuff them full of liquidity. Sorry guys you can't lend this because you want to deleverage you balance sheets. Hey presto, another asset bubble.

Fail to understand history.....

ninfan - Member

[img][/img]

If that's best response Z-11 you can up with when it's pointed out that Osborne pledged to match Labour's spending plans, failed to clear the deficit by more than half over 5 years after accusing Labour of being irresponsible for wishing to do the same, and borrowed more in 5 years than Labour did in 13, then that really speaks volumes.

For you politics is just a simple game of point scoring. In contrast while I rarely take anything too seriously I do have a keener interest in the truth. I am not a Labour supporter and would strongly urge people not to vote Labour so the "sore loser" retort is hardly appropriate. I do not however buy into this ridiculous Tory myth that the Tories/Osborne are any more competent than Labour when there is clear evidence to the contrary.

teamhurtmore - MemberWas at dinner this week with ......

😆

EDIT : I spent last Saturday with among other people Philipa Harvey - recently elected president of the National Union of Teachers, and Mark Serwotka, the general secretary of the PCS civil service union. We had a light buffet lunch.

If that's best response [s]Z-11 [/s] Ernie you can up with when it's pointed out that Osborne pledges to match Labour's spending plans are a gross distortion/spin

FTFY

Cheery front cover of the Economist this week:

Worth reading the comments below the story too... Economist readers are not an optimistic bunch right now!

Worth reading the stories and comments on the FT too - an equally doom-mongery bunch at the moment, and strikingly different in their views to that of the editorial team!

I reckon it's touch and go whether we hit another crisis soon... certainly anyone getting into BTL in the UK at the moment on the assumption house prices will keep going up is unwise... the pumping of housing suggests an acknowledgement of failure to provide any real economic growth or wage growth.

The problem with banker-bashing (as badly-behaved as the financial sector certainly was) is that it's a misdiagnosis of the problem, which is much more to do with the end of post-war growth and the effects of an ageing population and shrinking working age population. Looking back, we started getting offered loads of debt in the early 90's. this was to disguise the fact our ability to produce rising living standards was no longer there. Being stupid, we didn't spot this and just borrowed endlessly to buy shiny things without understanding it would all go bang at some point. Which it did in 2008.

We basically have fewer people to produce GDP, having to support more people no longer producing GDP whilst also having to pay off massive debts accrued over the last 30 years which takes up a chunk of today and tomorrow's GDP.

I also think we've got too fat and lazy and would rather spend our days dicking about on the internet and social media than work hard. I think we've lost our hunger and our drive which means we're not producing as much GDP as we used to. Not good in a crisis.

Anyone who thinks it was the bankers whatdunit is economically illiterate and anyone who thinks they can maintain our current super-materialistic standard of living is being naive IMO.

What might save us is new technologies making it easier to produce economic output with fewer people, new technologies and an entrepreneurial spirit allowing anyone with a smart idea to set up a business cheaply and easily, and immigration to maintain or grow the size of the working population. Even then we'll be hampered by having so much of this wealth taken away to pay off the debt we've accrued

You mean THM that you fixed it for the Daily Telegraph .........that newspaper well-known for its anti-Tory "gross distortion/spin" 🙂

[url= http://www.telegraph.co.uk/news/uknews/1562023/Tories-vow-to-match-Labour-spending.html ]Tories vow to match Labour spending[/url]

[i]

By Brendan Carlin, Political Correspondent

12:01AM BST 03 Sep 2007

The Conservatives sought last night to destroy Labour claims that they would cut public services by issuing a formal pledge to match Gordon Brown’s spending plans.

“Today, I can confirm for the first time that a Conservative government will adopt these spending totals,” the Shadow Chancellor said.

“Total government spending will rise by 2 per cent a year in real terms, from £616 billion next year to £674 billion in the year 2010/11.

“Like Labour, we will review the final year’s total in a spending review in 2009,” Mr Osborne wrote in a newspaper article.

He added that the effect of the commitment “is that under a Conservative government, there will be real increases in spending on public services, year after year”.

And Mr Osborne’s move, announced in an article in The Times, is designed to blunt Labour’s current jibes that an incoming Tory government would inevitably cut spending and damage public services[/i]

I also pointed out that Osborne managed to only half the deficit over 5 years after accusing Labour's pledge to do the same in 2010 as being irresponsible.

And I pointed out that Osborne borrowed more in 5 years than Labour did in 13.

But it's all just a "gross distortion/spin" to a committed Tory as yourself 😀

I do have a keener interest in the truth.

Except in the case of your chosen example. A self pawn....brilliant!

And to follow one repeated lie, with the "committed Tory" tosh.

Doubly falsifiable. At least "keener" is a comparative not an absolute term, so you can swerve out of it that way 😉

Still you are more entertaining than QT on the tele this evening

“Total government spending will rise[b] by 2 per cent a year [/b]in real terms

QED

Except in the case of your chosen example.

So the Daily Telegraph weren't publishing the truth 😀

And to follow one repeated lie, with the "committed Tory" tosh.

Oh yes I keep forgetting.....you're not a Tory supporter you vote Labour don't you ? No wait, you're a LibDem support ..... or is it Green Party? Or perhaps SNP?

No, I don't think it's any of those. Are you a UKIP voter? I'm running out of political parties. Which one is it?

It's obviously not Tory! 😆

Don't have another glass 😉

I reckon it's touch and go whether we hit another crisis soon

For those who bought bonds at negative rates or believed that bunds at 0.05% were risk free! this may have already started.

This time it's different...no really!

Spending commitments from 2007 seem like ancient history and a bit off topic ernie, I'll be mentioning Israel next 🙂 Osbourne's daftest comments (in 2006?) where when he was praising Ireland's Celtic Tiger economy 😯

Bankers have been bashed, rightly so, but there has to be a time for that to stop as it becomes counterproductive. As @brooness says the crises was not purely created by "bankers", there is significant collective responsibility.

The fact we have made a decent profit from the bailout and our economy has since recovered demonstrates to me that the bailouts where the right thing to do. The alternative would have been very ugly with much more hardship in the wider economy and a much deeper recession. If they had been allowed to fail the banks would have been re-launched and the financial sector would look much like it does now anyway. The same people would have been doing the same jobs in the same offices either way.

jambalaya is living in his own private fantasy world again I see.

P-Jay - MemberI think you're off the mark calling it PC nonsense, sub-prime lending is incredibly profitable - especially if a booming property market makes it a non-lose gamble - they pay you win, they don't pay you repo and sell for more than you're owed because of the rise in prices.

Let us not forget North Rock were offering 105% mortgages to first time buyers with defaults and CCJs and the major banks were allowing people to claim whatever income was needed through self-cert. It was nothing to do with being politically correct, it was hugely profitable.

The major differences was they the yanks managed to play the system to turn high-risk into low risk by mixing it with just enough prime lending and the whole thing unravelled, whereas we protected our overly indebted mortgage payers with a .5% base rate and some quick law changes which meant repo was much harder.

In short, the crisis was caused by reckless actions by over confident lenders and borrowers - the same as every other recession.

True (last para) but the root cause as I said dates back to Clinton in the nineties putting pressure on Freddie Mac & Fanny Mae to loan money to folk who really couldn't or even shouldn't afford it. This then aided their ability to avoid the then Fed regulation and set up the 'product' that was to be called "Sub Prime".

And the reason was Political and was described as Correct to treat the poor equally = Political Correctness

Which caused the problem just to remain academic here for the benefit of the ill informed on the matter.

[url= http://spectator.org/articles/42211/true-origins-financial-crisis ]2009 article on the subject there were many more[/url]

jambalaya - Member

...our economy has since recovered

a recovery in which we can't raise interest rates above 0.5%, is not a recovery.

a recovery fueled by personal debt, is not a recovery.

never mind, just keep on taking out those cheap loans, and we'll call it a 'recovery' - hooray!

jambalaya - MemberSpending commitments from 2007 seem like ancient history

Why? It is not "ancient history" it's 8 years ago. You want to talk about the banking crises which kicked off 8 years ago.

It's fair to talk about events which are clearly tied up to that crises. The Tories have used the crises, which significantly increased both government spending and the deficit, to justify slashing services and social provisions.

You might prefer that no one mentions the hypocrisy of the Tories but I think it's rather useful to do so.

Banker bashing belongs in the same category as austerity. Strip away the rhetoric and the notion falls apart. Very quickly under basic scrutiny. Implementation of reforms has been delayed and/or reforms have been watered down. Indeed a familiar (dinner 😉 ) complaint from CFOs is the fact that they still do not know what the final capital requirements will be. But they have lobbied very well and we shall see what happens with the levy going forward.

But, banks remain in denial that current challenges are not simply cyclical. They are structural and will not go away. The elephant in the room remains remuneration. The may not smell right, but it is strong and will not disappear

jambalaya is living in his own private fantasy world again I see.

Morning. Can you be more specific ? I am living in and commenting on the real world.

@awhile, it s a recovery. Perhaps not as strong we'd like but a recovery all the same and one the evny of most of the rest of Europe. Paying back debt is a slow and painful process be that for governments or individuals.

@ernie time to move on is what I am saying, whatever you say about Tory hypocrisy the electorate found them to be more trustworthy and competent than the alternatives.

It's a significant fact that the bailout has been profitable as well as delivering stability

Bankers have been bashed, rightly so, but there has to be a time for that to stop as it becomes counterproductive.

How about it stops when we become convinced that there is a shred of decency and responsibility within the banking sector? Are you really trying to convince me that the people responsible for:

LIBOR rigging

FOREX rigging

Misselling PIP

Money Laundering for drug cartels

Assisting Tax evasion

Gold Price fixing

as well as the reckless lending that cause the financial crisis have suddenly changed their spots and become decent people? This is the industry that we should base our economy on and bend over backwards to keep happy?

It's a significant fact that the bailout has been profitable as well as delivering stability

We've already established that this is nonsense, why do you keep saying it?

The elephant in the room remains remuneration.

Why be a bank CEO earning £3m-5m when you can make £10m at PIMCO as Ed Ball's brother does for example ?

@grum it's clear to me you and others will never be convinced. Osbourne thinks (knows?) that raising taxes on banks is popular (financial banker bashing) so he has once more raised the banking levy (6 times now ?) and now risks HSBC relocating it's HQ outside the UK = counterproductive. For every reckless lender there was a reckless borrower and a government turning a blind eye to excessive debt.

jambalaya - Memberit s a recovery. Perhaps not as strong we'd like but a recovery all the same and one the evny of most of the rest of Europe. Paying back debt is a slow and painful process be that for governments or individuals.

ok, it's an extremely fragile recovery, largely fueled by a growth in personal debt, which is in turn fueled by close-to-zero interest rates, which we can't raise, because the 'recovery' is too fragile.

we're not paying back our debts, they're growing, again.

@ernie time to move on is what I am saying, whatever you say about Tory hypocrisy the electorate found them to be more trustworthy and competent than the alternatives.

So why did the majority of the electorate vote for alternatives to the Tories then?

And I'll remind you that there was a time when most people thought the Sun revolved around the Earth, it didn't make it right.

I am fully aware of the power of Tory myths, such as taxation and spending, that's why I regularly comment when you spout them.

your graph only goes to 2013...

If you read the BOE quarterly bulletin no signifcant increase in 2014 either.

No significant increase since crisis

You wouldn't expect an increase in personal debt during a credit crunch/crises ! As your graph shows 🙂

ahwiles point is that the "recovery" of the last couple of years (which your graph doesn't show) has been largely fueled by a growth in personal debt.

PwC seems to agree :

[url= http://www.theguardian.com/money/2015/mar/23/average-uk-household-owe-10000-debt-by-end-2016 ]Average UK household to be £10,000 in debt by end of 2016 [/url]

So why did the majority of the electorate vote for alternatives to the Tories then?

They didn't, less than 37%.

They didn't

They did, less than 37% is what the Tories got. The majority of the electorate voted for alternatives to the Tories.

oops, missread that as the the majority voted for the Tories.

PwC seems to agree :

I'll stick with the Bank of England, the accounting firms often have an axe to grind.

whatever you say about Tory hypocrisy the electorate found them to be more trustworthy and competent than the alternatives.

This is what I said - I appreciate you say 37% doesn't show them to have a popular majority (ie 50+%) but they got more votes and seats than any of the other parties

I hadn't spoken of tax/spending here though, ernie you raised it. I think we should have done more to reduce the deficit in the good years but I appreciate the political reality of the Tories feeling they had to match Labour's spending plans in order to try and head off accusations of cuts putting services at risk. The recession meant the deficit ballooned and made it politically possible to make cuts. That wasn't really my topic here. It was about the bailout being profitable as much of the debate focuses around money being "given to the banks" whereas the reality is we lent them money/made investments and we are making a profit.

I think we'd all like to see lower levels of debt but paying back money you owe is tough especially in a recession. I would legislate for capped levels of credit card debt, compulsory proof of income for mortgages and minimum deposits (as they have in Singapore / HK for example) but I appreciate that's politically impossible. I suspect we'll see an increase in personal debt as people feel more confident.

A slip back into recession is very possible, a Greek default would almost certainly lead to that which is the card the Greeks are trying to play in the negotiations.

jambalaya - MemberI think we'd all like to see lower levels of debt but paying back money you owe is tough especially in a recession.

i thought it was meant to be a 'recovery'...?

🙂

We've had both since 2008

They did, less than 37% is what the Tories got. The majority of the electorate voted for alternatives to the Tories.

To be fair, the majority of the electorate voted for either the tories or 'even more extreme right wing' capitalist parties

It's a significant fact that the bailout has been profitable as well as delivering stability

We've already established that this is nonsense, why do you keep saying it?

Because it isn't nonsense to be fair to jambas. It was fundamentally important to restore stability into the financial markets and to avoid genuine market concerns about the impact on debt levels on our sovereign risk. Both have direct economic impacts on the rest if the economy.

This is one reason why they soft peddled on banker bashing. Why? Because it is foolish to do that int he middle of the crisis when you need the transmission mechanism to be working. As we exit that period, this is the time when they should be ratcheting up reforms and regulation but they will most likely succumb to banker lobbying instead. Plus the main instrument of policy (QE) requires banks to fulfil their transmission role effectively. At the moment, they are not which is why the policy is only mildly effective.

I hadn't spoken of tax/spending here though, ernie you raised it.

Of course you hadn't of course I did 🙂

Bankers have been bashed, rightly so, but there has to be a time for that to stop as it becomes counterproductive

They should have had their heads paraded through the streets on spikes for what they've done. Instead the 'banker bashing' has actually amounted to them receiving some not very favourable comments, and a bloke had to give his knighthood back, but not his enormous pension

The banking industry in this country is still completely unreformed, utterly dysfunctional, self-interested to the point of being psychopathic, and operates without giving a flying **** about the wider economic picture in the rest of the country. It still doesn't get the damage it did to peoples real lives through its limitless greed, corruption, and immorality. It doesn't show a shred of remorse! And why should it? There have been no real consequences whatsoever.

I think Will Hutton has it nailed by describing the entire industry as 'just money talking to itself'

The only people who defend it are people who work in the industry, and politicians looking to their future highly paid directorships on bank boards.

Well odd Binners that many SMEs are saying exalt the opposite and are desperate for banks to return to providing access to financing - working cap and investment. Why would this be happening if banking was just money talking to itself.

It has been reformed quite obviously and there have been major job losses. The former has not gone far enough, true, but the latter is on-going

ninfan - MemberTo be fair, the majority of the electorate voted for either the tories or 'even more extreme right wing' capitalist parties

If you are including UKIP's 12% of the vote as I assume you are it makes jambalaya's point even less valid.

I'll remind you what his point was : [i]"whatever you say about Tory hypocrisy the electorate found them to be more trustworthy and competent than the alternatives"[/i]

As you quite rightly point out even right-wingers voted for an alternative to the Tories, which hardly inspires confidence in the competence of the Tory Party.

Btw most of the electorate did not [i]"vote for the tories or 'even more extreme right wing' capitalist parties"[/i] as you falsely claim. One third of the electorate didn't bother voting at all.

Well odd Binners that many SMEs are saying exalt the opposite and are desperate for banks to return to providing access to financing - working cap and investment. Why would this be happening if banking was just money talking to itself.

Well you've sort of answered your own question there. All the money pumped into the banks was supposed to do exactly that. Provide capital to SME's. All those (our) billions. Except none of those tens of billions made it there, did they? They fuelled another housing boom, and supplied more cheap credit to consumers instead.

So they've changed their behaviour how exactly? Its all got an awfully familiar ring to it, hasn't it? Ignoring the actual needs of the economy, and pursuing its own short term interests instead, without a second thought for the long term consequences. Because for them there have been no consequences, have there? Unlike the rest of us. Who have paid for their greed and moral ambiguity in spades!

What could possibly go wrong eh? 🙄

You are missing the causal link - the authorities coincidently introduced regulations that meant that the banks couldn't extend this credit. They are being forced (correctly) to shrink their balance sheets. You can't focus all the blame not he banks either for the crisis or after. They are part of the transmission mechanism. Their actions reflect the activities of governments, central banks and regulators. All are flawed.

Couldn't agree more THM. It's human nature to push as far as you can legally get away with. The FSA want stringing up for the casual abdication of their responsibilities. The politicians want stringing up for their total failure to eatablish an even remotely effective regulatory framework, and for being so cheaply duped.

But what staggers me in both instances is the lack of curiosity as to what was actually going on. Vince Cable stood out as a tiny amount of voices pointing out that the Suns just didn't add up.

You forgot the * after the word regulators.

* the word is used figuratively in this instance, and does not imply any actual regulation or oversight.

It's human nature to push as far as you can legally get away with.

From all the recent fines, it seems the bankers were well past that point. It does seem they really thought that nothing / no one could stop them and anything, which made them richer, was OK. Way worse than just a bit greedy, completely immoral behaviour. They have collectively earnt a lifetime of bashing.

Yeah.... It does amuse me the terminology used... 'Mis-selling', 'wrong-doing' 'rate rigging' etc etc.

Can we not just refer to it as what it actually is? Systemic, institutionalised, Industrial scale fraud?

Mind you.... If you did that then you might have to start arresting people. And we can't have that now, can we?

Can we not just refer to it as what it actually is? Systemic, institutionalised, Industrial scale fraud?

Mind you.... If you did that then you might have to start arresting people. And we can't have that now, can we?

You can if you live in Iceland

Or Spain or even USA.

[url= http://www.channel4.com/news/parliamentary-banking-commission-bankers-jailed-financial-cr ]Fraudsters behind bars[/url]

Re levels of personal debt. This is scary...

It suggests no real rises in income, rising cost of living and an inability to deal with our addiction to shiny things/learn the lesson of 2008...

If there's one thing you need to do in a crisis, it's to stop doing the things that got you into the crisis in the first place...

Anecdotally, everyone I talk to who I think is a 'critical/independent' thinker - whether a Brit, Polish, French person is pretty negative about the future... deeply aware the problems have not been fixed and the massive levels of debt built and building up and the asset bubbles growing are just the preface to another crisis - except this time Central Banks will have no room for manoeuvre...

Just spend a bit of time on FT and Economist websites and read the comments in any story about the global economy and you'll see what I mean. Any 'recovery' is an illusion... the fundamental weaknesses remain

Psychologically the shock of this one to the population as a whole is likely to be worse than 2008 - too many people ill-informed or putting their heads in the sand and buying shiny things and going 'oh I'm loaded, my house went up £10k last month' 😯

Just spend a bit of time on FT and Economist websites and read the comments in any story about the global economy and you'll see what I mean. Any 'recovery' is an illusion... the fundamental weaknesses remain

Agreed, yet share prices are on a right roll at the moment. My ISAs have made >20% in the last year, some over 30%.

Interesting analysis of economic policy of the last 30+ years

In a wide-ranging analysis of Britain’s performance in the decades before and after 1979, economists at the University of Cambridge say the liberal economic policies pioneered by Thatcher have been accompanied by higher unemployment and inequality. At the same time, contrary to widespread belief, GDP and productivity have grown more slowly since 1979 compared with the previous three decades.

Anecdotally, everyone I talk to who I think is a 'critical/independent' thinker - whether a Brit, Polish, French person is pretty negative about the future... deeply aware the problems have not been fixed and the massive levels of debt built and building up and the asset bubbles growing are just the preface to another crisis - except this time Central Banks will have no room for manoeuvre...

That is the problem. The vast majority are not critical/independent thinkers and instead are sheep. Believing what they read in the papers on see on the news.

I think pretty much everything is overvalued at the moment. When it does eventually break it's not going to be pretty. I can't see the housing market breaking for a while, but the financial markets on the other hand........

At some point I'm going to try and persuade my parents to go to cash with some of their portfolio. 20% gains for years is just not realistic for any market.

FF. The Guradian piece is brilliant in its awfulness. Completely misses the causes of current issues and mistakes what Thatcher actually did - what were people saying about problems at the Guardia today on a different thread!

But there should be surprise about asset pricing. It's a deliberate outcome of current unorthodox policy - here and in China. Interest rates are being grossly distorted and mispriced (openly) in order to encourage more risk taking. This should have created a wealth effect (pass) and more bank lending (fail).

Crazy, crazy times. Which will be more painful the correction in bonds or Chinese equities. I am only long the latter but am exiting now.

At the same time, contrary to widespread belief, GDP and productivity have grown more slowly since 1979 compared with the previous three decades.

I thought it was a well-known fact that growth in the UK economy during the 1980s when Thatcher was PM was exactly the same as for the 1970s? Just like isn't it a well-known fact that the UK tax burden and government spending went up, not down, during Thatcher's premiership? Perhaps not.

...the liberal economic policies pioneered by Thatcher have been accompanied by higher unemployment and inequality.

Seriously, does anyone really need to be told that? ffs

I'm assuming you trade your own account THM? Reading your posts you seem to have that sort of mindset.

FF. The Guradian piece is brilliant in its awfulness. Completely misses the causes of current issues and mistakes what Thatcher actually did - what were people saying about problems at the Guardia today on a different thread!

They're only quoting the source, which was the Judge Institute (MBA deviant breeding school), so it's a bit unfair blaming the Guardian.....

Have you seen this, guys?

kudos100 - Member

I'm assuming you trade your own account THM? Reading your posts you seem to have that sort of mindset.

Yes but not too frequently - only big conviction trades and no ST stuff.

(It was a full time job quite a few years ago! 😉 )

Binners the money lent to banks in the crises was to allow them to maintain their lending commitments to SMEs etc, it wasn't extra money to lend more. Banks lent too much, the correct response to the crises is to lend less and the regulatory changes have made it tougher and more expensive to lend. This is then set against businesses asking for more loans. It's business reality that SMEs run on their overdrafts, not healthy. There are lots of calls to lend money to small business but it's very risky, highly labour intensive (ie inefficient) and in many cases not very appealing. It's why so much SME lending is really mortgages secured on the founders home, one of the things that really wouldn't work with the "positive money" idea is no one would lend money to SMEs, if the avg guy in the street looked at the business they'd say no thanks. Getting involved in bank loan portfolios inc SMEs is what I do for a living, the new regulations are making it very tough for banks an inevitable consequence of the chosen regulatory / government response to "this mustn't happen again"

@gofatster, I clicked in that but it's nearly 2 hours so won't be watching it. A quick summary from you or a link to a review ?

@brooes I agree once more with a lot of that post, I think the extrapolated graph of personal debt beyond 2015 is overdone however.

Their actions reflect the activities of governments, central banks and regulators. All are flawed.

Though presumably you're not suggesting the banks are passive partners in this relationship? Government, central banks and regulators are all directed by external influence too.