![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

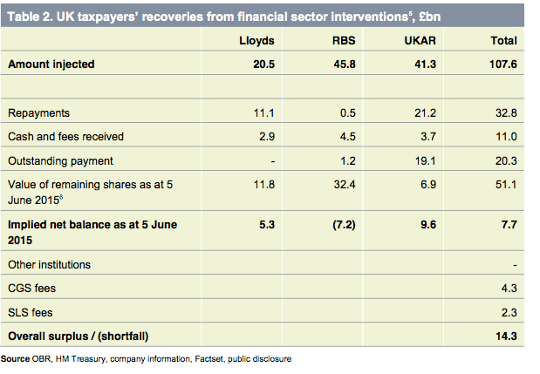

The bank bailout looks to have delivered a profit of £14bn to the nation. The RBS sale announced by the chancellor last night will result in a loss (the bank was rescued at too high a price) but overall we have a healthy profit. The guaranty scheme was never used and it delivered significant fees

The banks have shed many jobs (over 100,000) and paid billions in fines for inappropriate behaviour. New regulatory rules make a repeat of the excessive lending which lead to the crises unlikely.

This week's news that HSBC will re-brand its UK retail bank is very significant. Its a very sensitive decision and HSBC spends a lot of money promoting its global brand (eg airport advertising pretty much everywhere) so to move away from that in the UK is significant. Creating a seperate UK identity gives it the flexibility to sell the UK unit and it is IMO a move to ensure the bank levy does not apply to it's international business which represents the vast majority of the business. Continual increases in the levy have seen it rise to £700m per anum. It's my view that unless the UK agrees that the levy will apply only to the UK retail bank they will move from the UK with the loss of 10,000's of high paid jobs and a lot of tax revenue will be lost (£1bn-2bn pa ?). If HSBC moves it will be impossible for Standard Chartered to remain in the UK as shareholder pressure will be too great for a bank with only 2,000 of 90,000 employees based in the UK. Aside from the employee jobs there are huge amounts of support businesses be they accountants, lawyers, IT consultants or sandwich sellers.

So when is enough enough ?

So when is enough enough ?

When there isn't a massive industry making obscene profits doing stuff with other people's money, with no risk of failure.

Every generation, we take it into our heads to wipe out an industry or two. Last time around it was the turn of coal mining and the steel industry, this time it's the bankers.

In ten years time we'll be congratulating ourselves that our children are no longer being forced to work in the finance industry, just as now we're pleased they don't work in coal mines.

Just get over it already, it's an english thing.

And yet there seems to be the need to save £12billion that will undoubtedly (again) unfairly target the poor, and no-one has been jailed for causing us to be in this shit storm in the first place.

I would suggest that largely the individuals in privately owned institutions that drove us very nearly to edge of bankruptcy can rightly think that they got away with it.

In the meantime folk are being penalised for daring to have hones with a spare room

I think society hasn't been more unfair.to paraphrase Micheal Foot, I couldn't give a shit about bankers they always find a way to make money

i have no problem with people making 'obscene' profits, go for it, nice one, just remember to pay the taxes.

i don't even have much of a problem when the profits are built on a financial model that relies on loaning people money they obviously can't afford (and then selling that debt as a high risk/return investment).

i do have a problem with our governments routinely basing expenditure/borrowing on an assumed 3% annual growth - that's just stupid.

anyway, i heard that HSBC would probably wheel out the old 'Midland Bank' brand. But 10p of my very own money says they'll be back to HSBC within 5 years.

When there isn't a massive industry making obscene profits doing stuff with other people's money, with no risk of failure.

Well let's build up our other industries first and face the reality for example that the Germans are much better at making cars than we are.

Banking is no longer very profitable, the regulatory rule changes have seen to that although it's always been a poor earner). Retail and small business banking is particularly poor. Banks have pretty much never had my money, I've always owed them more than I have had on deposit. this is true for almost all working people, it's generally only pensioners who deposit more then they borrow. So the "other people's money" argument is misguided.

no-one has been jailed for causing us to be in this shit storm in the first place.

So do you jail the CEOs/senior execs of HBOS, RBS, Northern Rock and Bradford and Bingley for making very poor decisions ? The fact is they did nothing illegal that would warrant going to jail. The root cause of the financial crises was excessive borrowing (individuals, companies inc banks and governments) and the worst excesses where in the US, how do we jail Americans ?

And yet there seems to be the need to save £12billion that will undoubtedly (again) unfairly target the poor, and no-one has been jailed for causing us to be in this shit storm in the first place.

@nick I think I've remembered this correctly from last night but Housing Benefit is £26bn and tax credits £30bn pa - given the electorate want to protect the NHS and education the cuts have to come from somewhere. As per the Newsnight discussion it makes no sense to be paying in work benefits to people working in supermarkets on low wages - the wages should be higher and we should be paying more for our food. The alternative is we pay via higher taxes required for fund benefits or we try and hide from the truth by borrowing more (which we did for years under Labour)

They didn't just make "poor decisions" they made money from selling broken loans to people they knew couldn't afford them and made bets with each other about who would fail first, all presided over by a regulatory body that allowed and even encouraged it, in many opinions that are better placed than us, they broke numerous laws knowingly

So yes, I would jail them.

International finance won't be destroyed overnight by the goaling of some executives, but it may serve to "encourage the others"

...maybe for the shareholders but it is all rather jolly for those on mega bonuses and rewards for failure. Oh to be in 'Sir' Fred Goodwin's shoes. I'm always astounded by the people on here volunteering to be apologists for these parasites.Banking is no longer very profitable

Immorality is legalised even encouraged at the top of society while poverty is being criminalised.

As a former Banker, when is it enough? When they're much, much smaller.

The Banks, and the profits they make are an economic cancer - they generate something like 15% of the UKs GDP and a huge proportion of total tax income - which on the face of it sounds great - but it's no way to run a country.

What do we really want? a large GDP, a figure most people don't fully understand and has little impact on their day to day lives or a higher standard of living?

Relative to their financial size they employ relatively few people and they're concentrated within a relatively small geographical and they make the UK a fantastic place for foreign investment - but not tangible investment - it's financial alchemy - huge swathes of money comes to the UK a couple of people piss about with it and then it leaves again, slightly bigger than when it came in - nothing practical is produced, nothing is sold. but it pays the bills.

What does that mean for the UK - well it makes our currency very valuable - which is great if you want a cheap pint in Spain or a crap toaster for a fiver in Tesco - but a bit of a nightmare if you want to make something in the UK or heaven forbid export it afterwards - since the march of deregulation (from both sides of the house) started in the 70's our economy relies on the banks making the money and the rest of us doing staff for each other we're too busy to do ourselves. We're facing a housing crisis because we can't build enough houses because the Banks would rather we didn't as it was hurt their balance sheets and now the crisis is over and they're falling out of the spot light it's only going to get worse.

Your analysis misses out the cost of funding the bailouts which would pretty much wipe out the profits.

I'm always astounded by the people on here volunteering to be apologists for these parasites.

I've worked in financial services for 35 years including for a number of banks. I am putting the other side of the argument. We live in a capitalist society and without banks we'd be battering food and goods and all be a lot lot poorer. Banks generate huge amounts of employment and many billions in taxes. Hundreds of well paid Americans, Germans, French, Italians work in their bank's London offices putting large amounts of money into the UK economy. They do so as we have world class financial services. As I posted retail banking is far from parasitic, its not a money maker, the return on capital is very poor.

@P-Jay our econonmy is unbalanced but let's not destroy banks/financial services before we've built up the rest eh ?

Bonuses bring in £8bn pa in taxes FWIW and there are many lawyers, accountants and advertising execs who make more than the bankers and get paid larger bonuses.

Your analysis misses out the cost of funding the bailouts which would pretty much wipe out the profits.

@mefty not at all. It absolutely does count the cost of funding the bailout. The repayments/cash and fees account for this. For example, the guaranty scheme was never called upon, ie the banks never made a claim of a single £ and the government collected billions in fees.

Now that the banking industry has been completely reformed, and is now staffed by responsible individuals, who believe in behaving in a responsible manner, within an ethical framework, and seeing themselves as a useful, socially responsible vehicle for delivering growth and change in society and business... all for modest reward... I can't see what the issue is any more

Oh.... wait... hang on a minute....

So when is enough enough ?

when the greed and incompetence of those that ran the banks, ok'd the sub prime deals, repackaged and sold on the debt they didnt understand etc etc and sent the worlds economies into a tailspin that has impacted the lives of millions are rewarded with the jail time they so richly deserve?

You're all missing out the continuing costs of the endless QE, both now and in the future.

So aside from all the fluffy jargon that can be manipulated to tell a pretty tale, how is it that the Rich have got considerably richer since the financial crisis, whilst austerity continues for 'hard working families'?

[quote=jambalaya ]For example, the guaranty scheme was never called upon, ie the banks never made a claim of a single £ and the government collected billions in fees.

Well clearly the government should be doing more of such profitable business.

is it reasonable not to mention the 375 billion of QE, which was essential in returning the banks to health, and dwarfs the figures mentioned in that chart at the top?

edit - too late!

Mark Carney made me laugh. Talking of 'increased prison sentences for wrong-doing."

Couple of issues here.....

a) Its not 'wrong-doing', its fraud. Pure and simple. Its systemic. And on an industrial scale

b) Yeah... longer prison sentences would be good. Slight hitch here is that no-one - absolutely no-one - ended up in a court room. They just trousered their enormous bonuses and waltzed off into the sunset

You're all missing out the continuing costs of the endless QE, both now and in the future.

Who do you think bears that cost?

@mefty not at all. It absolutely does count the cost of funding the bailout. The repayments/cash and fees account for this. For example, the guaranty scheme was never called upon, ie the banks never made a claim of a single £ and the government collected billions in fees.

Whilst the guarantee scheme were unfunded exposures, the cost of buying equity £100 billion was not and there is no interest line in that analysis.

what about jail time for those involved in

LIBOR rigging

FOREX rigging

Misselling PIP

Money Laundering for drug cartels

Assisting Tax evasion

Gold Price fixing

...................................

[quote=mefty ]Who do you think bears that cost?

Isn't it us capitalist bastards who have savings rather than spending every penny we earn?

So when is enough enough ?

Surely it's a pretty simple answer, which is:

When the financial industry has been sufficiently reformed that a repeat of the credit crunch will not reoccur or at least, if it does will only impact those who benefited from the poor practices, not the whole country. Essentially, the big banks need to be able to go bust without bringing the country down.

So, have we done that yet?

Stop propping up failed businesses with taxpayer's money. If they fail, let them.

Capitalism, like nature, abhors a vacuum. There'll be another one along to fill the gap - probably run by people who won't repeat the same mistakes that led to the previous failure because there's nothing from the Free Money Tree to make failure worthwhile.

Life will go on. Ho hum.

aracer - gold star.

when the greed and incompetence of those that ran the banks, ok'd the sub prime deals, repackaged and sold on the debt they didnt understand etc etc and sent the worlds economies into a tailspin that has impacted the lives of millions are rewarded with the jail time they so richly deserve?

But @kimbers you cannot send someone to jail for making bad business decisions and a lot of what you've posted here occurred in the US. The list below we could well see some criminal prosecutions and potential jail time.

what about jail time for those involved inLIBOR rigging

FOREX rigging

Misselling PIP

Money Laundering for drug cartels

Assisting Tax evasion

Gold Price fixing

Stop propping up failed businesses with taxpayer's money. If they fail, let them.

The tricky part of this is that has HBOS and RBS been allowed to fail many small and medium sized businesses would have failed as their overdrafts would have been withdrawn immediately. Its generally seen now that it cost the US much more to let Lehman fail than to have rescued it.

QE doesn't cost that much as interest rates are so low. What it has done is inflate the equity markets which is good for anyone invested in them, like our pension funds. How the "unwind" occurs is important though, what happens when QE stops ?

@binners it's fraud to lie about your income on your mortgage application too. Idiotic of course for HBOS to never make any checks.

Every generation, we take it into our heads to wipe out an industry or two. Last time around it was the turn of coal mining and the steel industry, this time it's the bankers.

Utter tosh, no one is wiping out the bankers, they're just reigning them in so they can't do so much damage again.

As for the losses of jobs in retail banking, that's just the long term trend of less cash transactions in person and more electronic transfers / online payments.

The job losses in the investment arms are just a correction to a huge over expansion pre financial crash.

QE doesn't cost that much as interest rates are so low

It is why interest rates are so low, do you really have this little understanding or are you being disingenuous?

@scotroutes, we made a profit of £14bn on the bailouts and saved 100,000's of thousands of small businesses from going bust as a result. If you want to send Ferd the Shred to jail and Applegarth the CEO of Northern Rock that's fine by me but pointless really.

Pour encourager les autres

we made a profit of £14bn on the bailouts

Ignoring funding cost.

The bank bailout looks to have delivered a profit of £14bn to the nation.

Also utter crock. The loss in GDP caused by the crash since 2008 has cost the Exchequer 10s of billions in lost taxes and increases benefit payments.

It is why interest rates are so low

Exactly, that's why it's worked so well and why the EU (Germany) after watching it be successful in the US has finally started doing the same. Central banks set short term interest rates directly and long term rates indirectly.

Ignoring funding cost.

No mefty see my post above, the profit INCLUDES funding costs.

Also utter crock. The loss in GDP caused by the crash since 2008 has cost the Exchequer 10s of billions in lost taxes and increases benefit payments.

Sorry @footflaps buy the losses in GDP etc we would have had anyway. The bailout stopped them getting much worse and has been profitable.

tbh Irrelevant of anything lumping all banking activity together and then trying to deal with it (or even discuss it) in a single/simple solution is just plain daft. Same as blaming everyone who works in banking for the problems.

And I don't remember the UK Taxpayer bailing out HSBC, so as a private company they can really take the path they decide - ie the one that suits their Shareholder objectives best.

Jambo, if you have such a long history in the financial sector, how come you didn't realize we operate under a fractional reserve system?

It is inherently flawed

No mefty see my post above, the profit INCLUDES funding costs.

See my post explaining why it doesn't, which you seem to have ignored.

Whilst there is a strong case for the benefits of the financial sector, you are a hopeless advocate as you seem to have very little understanding, are you a fifth columnist?

Sorry @footflaps buy the losses in GDP etc we would have had anyway. The bailout stopped them getting much worse and has been profitable.

Only if you absolve the banks of any role in the actual crash, which is like saying it's OK for someone to mug you and put you out of work for 6 months as long as they cover the cost of the bandages, plus say 5%.

you are a hopeless advocate as you seem to have very little understanding

Just like yourself then, in restricting your definition of 'profit' to a tiny spectrum ie the cost of funding the bailout, ignoring all the other huge costs also associated with the crash (caused by the banking sector).

for the love of god JHJ, not now, it was getting interesting. 🙄

But @kimbers you cannot send someone to jail for making bad business decisions and a lot of what you've posted here occurred in the US. The list below we could well see some criminal prosecutions and potential jail time.

Yes you can, when the consequences of those bad decisions have serious real world consequences.

Imagine a company constructing a large bridge. The bridge falls down, people get hurt and investors money is lost.

The CEO comes out and says "Yep we made a bad decision. We really should have designed it a bit better, and maybe not used that second rate concrete. Anyway, we won't do it again and cheers for underwriting our losses so we can carry on". Aye no bother better luck next time.

The banking levy has delivered £700m to the nation?

Good! Let's get some more out of the greedy bastards.

Just like yourself then, in restricting your definition of 'profit' to a tiny spectrum ie the cost of funding the bailout, ignoring all the other huge costs also associated with the crash (caused by the banking sector).

I was just pointing out an obvious flaw in the analysis. Looking at the cost to economy is really difficult. Whilst the unwinding of the overleverage has had a huge cost, in the years before there was credit fuelled economic growth that was taken for granted and banked. Separating this out from the economy as a whole can be attempted, but I fear consensus in any analysis will never be achieved.

The banking levy has delivered £700m to the nation?

Great, shame the cost of the recession, in lost GDP, was more than £400 Billion!

Looking at the cost to economy is really difficult.

Agreed, but he wasn't even trying, just looking at the P&L on the bailout is the most myopic analysis possible.

Whilst the unwinding of the overleverage has had a huge cost, in the years before there was credit fuelled economic growth that was taken for granted and banked

Also true, GDP was artificially high before hand. However if you consider the OP's argument and take it to it's logical conclusion, we should be encouraging more booms and busts from the financial sector as they are obviously such a profitable endeavour!

We should have handled it like Iceland (the country did). Let some banks fail, prosecute and jail bakers for fraud ...

Strangely, it leads to a more bouyant economy - with more responsible bankers

jambalaya - Member@P-Jay our econonmy is unbalanced but let's not destroy banks/financial services before we've built up the rest eh ?

Who said anything about destroy? Left to their own devices human weakness / greed would have ensured the self-destruction of investment banking long ago.

The UK, interested as ever only in economic plans that offer less pain now, or at least before the next election - conspire to maintain the status quo - we've wasted the opportunity to rebalance our economy that we had during the banking crisis - we could have let the free market economic mechanism which created such massive financial power houses "self regulate" them in to oblivion - but it seemed like too much to bear - so we took on another generate of debt to save them, now they're back on their feet we're going to let them carry on as before - their has been some lip service about regulation, but it won't stick - the more we try to regulate them, the more they'll say they're leaving - I say, set correct legalisation to at least try to save them from themselves and if they go, let them go - yes it will hurt if one of the big 4 leave the UK, but the pain won't last long - a year, maybe two - but it will devalue our currently and allow other industries to get a foothold - call me a bleeding heart lefty - but I'd rather help create 100 new jobs paying £30k a year rather than 10 paying £300k or 1 paying £3m.

Is the Iceland economy the same as the UK one (specifically the impact of letting banks fail)? If not, that's a pretty pointless comparison.

jail bakers

What kind of sick animal are you?

Iceland had no choice, a bailout of their banking sector could simply not have been funded by a population of 300,000 odd, i.e similar size to Coventry

The banking levy has delivered £700m to the nation?

Good! Let's get some more out of the greedy bastards.

That's the per anum cost to HSBC only, the total raised is much more (I think Stan Chart pays $300m/£200m). The point I was making is that by increasing it you run the risk of collecting a lot less as HSBC relocate.

@jive - that fractional reserve banking thing is total bollix, just like the positivemoney idea which simply would not work

@mefty - it does seem that I missed a post from you, let me take a look

@footflaps the recession was happening whether we bailed the banks out or not and my view is that without it the recession would have been far worse. So trying to include the loss of GDP etc into the cost of the bailout makes no sense at all which is why I am making no reference to it. A lot the pre-crises GDP was false, it was based upon excessive debt so losing it was inevitable IMO.

As for the rich getting richer, many wealthy people lost a lot of money ion the crises. Madoff alone cost the wealthy $50bn. Many people where ruined totally. Those wealthy people in business, especially oil and gas and technology have done very well as those businesses where largely unaffected, Apple shares have gone from $28 to $128. Also as many previously wealthly people where forced to sell assets at low prices and those assets where bought by others who have since done very well as a result, you can see that in prime London property

So jambalaya, what you are saying is the financial problems the UK suffered was part of a worldwide financial crisis largely caused by the US banking sector, and thanks to Gordon Browns incisive leadership at a difficult time his decisions has delivered a profit to the nation.

Hooray for Gordon and the Labour party.

ps. The final loss to madoff was under 20 billion, and was an illegal ponzi scheme.

@footflaps the recession was happening whether we bailed the banks out or not and my view is that without it the recession would have been far worse. So trying to include the loss of GDP etc into the cost of the bailout makes no sense at all which is why I am making no reference to it. A lot the pre-crises GDP was false, it was based upon excessive debt so losing it was inevitable IMO.

So what you're saying is as long as we absolve the banks for any responsibility on their original crime and ignore all the subsequent damage that caused (to the tune of trillions worldwide), the fact we made a small profit on the 'fines' means that we should stop bashing them and be very thankful that they plunged us into the deepest and longest recession in modern times.

Certainly an interesting point of view.

Going back to your original question:

So when is enough enough ?

When they've paid back, with interest, all the subsequent loss in GDP (IMHO).

IMO the recession was long over-due, the US sub-prime scam crash was merely the straw that broke the back - recession is a normal part of any economic cycle and shouldn't be feared, in the same way a bush fire is hugely destructive - it's needed for new growth.

When the UK, and the rest of the Western World to a lessor extent move too much in the favour of Finance and Services and too far away from production and manufacturing we tried to stop the growth / recession cycle - but it didn't work, it just made the recession bigger and nastier.

Where was I saying we should absolve the banks of responsibility ? They've been fined billions, had billions in taxes imposed on them, shrunk employment by 100,000s, pay inc bonuses is down substantially and new regulations make banks much safer (and make it harder for them to lend btw).

We need to look at the collective failure of governments in regulating banking and to individuals in lying on mortgage applications as well as bankers making irresponsible loans.

Our well run banks did pretty well, HSBC, Barclays, Standard Chartered and Lloyds who where only crippled by the acquisition of the failed HBOS.

Hooray for Gordon and the Labour party.ps. The final loss to madoff was under 20 billion, and was an illegal ponzi scheme.

In some respects yes, "hooray". With the exception of Merkel the incumbent governments left or right got the blame for the crises, Bush in the US, Blair/Brown in the UK, Sarkozy in France. The solutions where pretty universal, Mark Carney got hired as governor of the BoE for the great job he did in managing the crises in Canada.

Madoff, yes I could believe the final total was $30bn not $50bn. The fact it was a ponzi scheme and one which had been repeatedly reported to the US regulators as such demonstrates my point that it was a failure of regulation which allowed the crises.

recession is a normal part of any economic cycle and shouldn't be feared

Not so much fun when you're the bush getting burned. Easy to say when you're not affected.

@P-Jay broadly I agree with you. We exported all our manufacturing to Asia reducing those costs dramatically whilst charging the same price with the difference made up in retail staff costs and business rates. It seems only a matter of time before we buy stuff direct from China at 30-50% of the cost and don't bother with the High St at all.

The financial crises was severe as the boom had been excessive

Madoff, yes I could believe the final total was $30bn not $50bn. The fact it was a ponzi scheme and one which had been repeatedly reported to the US regulators as such demonstrates my point that it was a failure of regulation which allowed the crises.

The final figure was 18 billion 🙄

If it proves anything it is that the wealthiest and most powerful people in society, the ones we are meant to laud and favour in the hope of some imaginary trickle down, are in fact a bunch of greedy morons with no more financial nounse than the average man in the street. The masters of the universe are just a bunch of self serving retards and the quicker we dethrone them the better.

The financial crises was severe as the boom had been excessive

I doubt that. Complex systems normally over correct, so the crash is always worse than the boom preceding it. I'm sure someone has written a paper on this somewhere. Even if it was exactly 1:1 the psychological toll is much worse (by a factor of 2), as many studies show that the loss of £1 is equivalent to the gain of £2 in terms of perceived gain/loss.

The thing that confuses me is that credit agencies seem immune. They're directly culpable for the industry-wide fraud of repackaging and reselling debt- they made the entire bullshit-trading industry possible, and were responsible for the intentional rating-laundering and overvaluing/overrating of CDOs etc.

And yet when the entire thing turned out to be about taking nightmares, rebranding them as dreams and selling them for a fortune, their response wasn't to tighten standards, but to threaten countries with reduced credit scores. And governments fell in line, and scrambled to retain their precious ratings, despite them having shown themselves to be fundamentally incompetent at credit rating countries- Greece were still A-rated by Fitch and by Moodys until 2009 frinstance.

These companies continued to profit through the financial crisis- had their most profitable decade ever, according to some reports. And now they're defending themselves in court in the states by pleading the 1st amendment- "We have the right to free speech! It's our god given right to tell investors that this sub-prime mortgage is in fact an asset worth a fortune even though we know it's a liability"

Court cases and threats of regulation rumble on but frankly the rational response is to hang them from lamp-posts.

I've always owed them more than I have had on deposit. this is true for almost all working people, it's generally only pensioners who deposit more then they borrow.

If you work in finance, of course you know that this isn't how it works. Banks don't borrow money from lots of little old ladies, then lend it out again. They lend it first, creating the money out of thin air, on the assumption that they'll get it back with interest.

It's the "getting it back with interest" bit that generates all the profits - and all the risks too.

Where does it stop? It hasn't even started.

see, that's where folk are getting the "gambling with other peoples' money and no risk of failure" thing fromThe tricky part of this is that has HBOS and RBS been allowed to fail many small and medium sized businesses would have failed as their overdrafts would have been withdrawn immediately. Its generally seen now that it cost the US much more to let Lehman fail than to have rescued it.

You can't just blame fraud (and IMO criminal negligence on the part of global investment banks at the most optimistic interpretation) on lack of regulation - they still had to act like ****s to make it all happenMadoff, yes I could believe the final total was $30bn not $50bn. The fact it was a ponzi scheme and one which had been repeatedly reported to the US regulators as such demonstrates my point that it was a failure of regulation which allowed the crises.

Absolutely agree - to have that much influence and apparently zero culpability is laughableThe thing that confuses me is that credit agencies seem immune. They're directly culpable for the industry-wide fraud of repackaging and reselling debt- they made the entire bullshit-trading industry possible, and were responsible for the intentional rating-laundering and overvaluing/overrating of CDOs etc.

...

frankly the rational response is to hang them from lamp-posts.

Anyone taking bets on RBS returning a profit the year after being sold off.

[URL= http://www.independent.co.uk/news/business/news/three-charts-that-show-icelands-economy-recovered-after-it-imprisoned-bankers-and-let-banks-go-bust--instead-of-bailing-them-out-10309503.html ]Iceland appears to have got it right sending their bankers to jail[/url]

[quote=onehundredthidiot ]Anyone taking bets on RBS returning a profit the year after being sold off.

I'd imagine there's quite a simple way to place one...

Earlier reply got lost, I'm sure you're all gutted 🙂

When they've paid back, with interest, all the subsequent loss in GDP (IMHO).

Who is they ? HSBC, Barclays, Stan Chart didn't fail - should they pay for the idiocy of Northern Rock, HBOS, RBS, Alliance and Leicester, Bradford and Bingley ?

Also banks may take the view that if they get the credit financially for the 100 years of growth in GDP they might be willing to pay back for the more recent losses.

If you work in finance, of course you know that this isn't how it works. Banks don't borrow money from lots of little old ladies, then lend it out again. They lend it first, creating the money out of thin air, on the assumption that they'll get it back with interest.

@Ben this really isn't true, there are many banks whose ratio of deposits to assets/loans is close to 100% or even above. When you start a bank the capital comes from investors as real money, then you start lending that out. Banks without retail depositors (commercial and investment banks) of course borrow more but they also take large corporate deposits. This notion that money in the banking system is just created out of thin air is nonsense.

@Northwind if you hang the bankers from lamposts who made a bad loan who is going to lend you or your company money ? I don't have accurate figures to hand but the percentage of bad UK mortgages was less than 5%, so 95% of the time the bankers got it right. Aside from RBS who made a disastrous acquisition of ABN Amro complete with it's large US business (with exposure to sub-prime) the majority of failed UK banks where ex Building Societies from the regions who had poorly diversified businesses and weak lending criteria. So we should be hanging people in Newcastle, Halifax, Bingley and Leicestershire who didn't check applications properly ?

jambalaya - Member@Northwind if you hang the bankers from lamposts who made a bad loan who is going to lend you or your company money ?

If you read an entire post about credit agencies then respond as if it was about bankers, who is going to pay it any attention?

Who is they ? HSBC, Barclays, Stan Chart didn't fail - should they pay for the idiocy of Northern Rock, HBOS, RBS, Alliance and Leicester, Bradford and Bingley ?

The only reason the banks didn't fail is that their respective governments pumped billions into emergency liquidity funding as bank inter lending had effectively dried up. Had governments not drastically intervened, and interrupted market forces, a much larger number of financial institutions would have folded.

The only reason the banks didn't fail is that their respective governments pumped billions into emergency liquidity funding as bank inter lending had effectively dried up. Had governments not drastically intervened, and interrupted market forces, a much larger number of financial institutions would have folded.

Whilst a pedantic point, it is an important differentiation, the Bank of England provided the liquidity support, as you would expect a central bank to do, and the income it earned is not included in the original analysis.

EDIT: How I am pretty sure HSBC and Standard Chartered could have ridden out the crisis without these - Barclays would have gone though.

and the income it earned is not included in the original analysis.

Neither is the $trillions in loss of GDP worldwide over the following 6 years....

The root cause of the crash was sadly political correctness and the assertion 'just because they are poor and have never exhibited an ability to repay debt' it's no reason not to loan them money. Blame Bill Clintons economic 'miracle' that was what created the debt that got rapidly repackaged and sold around the world.

Corporate America to blame, as per usual, everything else tumbled domino effect as positive perception of risk ran out.

Very good movie illustrating a Bank baling out was Margin Call.

The rest, the redundant Nasa scientists retrained to create money making algorithms no one understood, the lack of regulation and above everything our greed and desire for something for nothing did the rest. You cannot blame anyone other than the political correct brigade for what followed and will follow again once this next property bubble bursts.

We cannot help ourselves, until there is a total change of our 'capitalist' system it will go on and on, tell me how did Cuba fare through the crash did anything much change for them? I haven't been out there lately.

@Northwind 🙂 brain overload on my behalf ! The credit agencies just publish their opinion, the disclaimers where always a mile long. Its tough to hang someone for being bad at their job.

@footflaps banks stopped lending to each other and started putting their money with the central bank who in turn lent it out to the other banks. The central banks where in large part re-cycling money given to them.

@mefty - I would agree Barclays would have been pretty close, its UK deposit base wasn't large enough to support it's global and investment banking business. Plus by buying Lehman they got access to the Fed which was a smart move at the time.

mefty - Member

The only reason the banks didn't fail is that their respective governments pumped billions into emergency liquidity funding as bank inter lending had effectively dried up. Had governments not drastically intervened, and interrupted market forces, a much larger number of financial institutions would have folded.

Whilst a pedantic point, it is an important differentiation, the Bank of England provided the liquidity support, as you would expect a central bank to do, and the income it earned is not included in the original analysis.EDIT: How I am pretty sure HSBC and Standard Chartered could have ridden out the crisis without these - Barclays would have gone though.

And do you know what 'they' did with the first tranche of the billions of Q.E.?

Invested it in Brazil.

Neither is the $trillions in loss of GDP worldwide over the following 6 years....

Yes and how much of that trillions was created by excessive debt, my answer is almost all of it. That's why governments where happy for the game to continue and turned a blind eye to the risks, they where playing the short term game of getting re-elected.

my answer is almost all of it.

Well all your answers seem to be based around the premise that the banks can do no wrong and should be absolved of all blame, so unless you can point me towards a more reputable work on the subject, I'll just assume you're talking nonsense.

@footflaps banks stopped lending to each other and started putting their money with the central bank who in turn lent it out to the other banks. The central banks where in large part re-cycling money given to them.

Given that central banks can create as much money as they want at any time eg QE, they weren't reliant on the banks for the money at all.

The credit agencies were paid by the banks to rate the CDOs they were creating so no doubt they were very objective in their analysis.

Plus by buying Lehman they got access to the Fed which was a smart move at the time.

They already had access to the Fed through their US business, I am not sure they took over Lehman's licence they just acquired assets.

And do you know what 'they' did with the first tranche of the billions of Q.E.?

QE is another matter.