![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

It is frustrating that Mrs FD works so hard, and then gets all her money taken off her,

Overall it's about 34% of her wage in tax and NI, every pension contribution helps her out more than the poorest in society. It's hardly all her money.

http://www.moneysavingexpert.com/tax-calculator/

A very constructive commentMy heart pumps purple piss for them...

£50k earned by a single earner takes home far less than £100k earned by a single earner.The comparison is irrelevant

No its not. A couple each earning £50k have greater take home than a parent supporting his non working partner and their children. Clearly an anomaly.

Tax policy has increasing treated high earners paid via PAYE as sitting ducks, thats a dangerous approach as a relatively few people provide a very significant portion of the tax revenue. Under out current system ts par more attractive to set up and run an business than have a well paid job.

Also Labour plan a significant raid on higher earners with re-introduction of the 50% tax rate (which makes total tax take 64.8% with 50% tax, 2% NI and 12.8% emploers NI) and capping pension contrinutions tax relief at 20%

@kimbers £100k a year isn't the top 1% of earners, quite far from it

The minimum wage is low pay, no doubt. People on it are supported in terms of pensions, NHS and welfare by higher earners. I think the minimum wage should be much higher and regionally calculated

Hard Work. You don't get paid just for effort, business pays for results/talent/potential. I tend to work 55 hours a week plus some stuff at weekends, I do not see myself getting rewarded for hours in the office or effort

every pension contribution helps her out more than the poorest in society

I find these comments on higher rates of tax relief on pension contributions very odd. Encouraging people to save more helps a country. It does so as they will be less reliant on the state in their old age, they will pay tax on their pension income and they will spend more money in their retirement. there is also the small matter of creating and sustaining jobs in the pension fund industry.

Minimum wage take home pay: £1,073

Median wage take home pay: £1,759

50k take home pay: £3,027

100k take home pay: £5,444My heart pumps purple piss for them...

@ninfan why not post up total tax and NI paid by each of your 4 examples ? I'll do the calcs later but last week I posted an example than someone on £250k pa posts 47 times more tax/NI than someone on £17k - 14 times more gross pay, 47 times more in payments to the government

I'm in this category at the moment (and no I'm not after sympathy) but here's the thing. I'm actively looking to reduce my taxable income so that I drop below this figure. Frankly I'd be an idiot not to as a £100 pension contribution will only cost me £40! If the tax was graduated as it used to be I'd likely be less bothered but the total amount of tax I'd pay would me more.

But jam was just telling us all how personal pensions were an act of altruism on your part designed to help the state out, pay tax and keep people employed in the pension industry

Is it really the case that its just done out of self interest to reduce your tax burden 😯

I dont know what surprises me more this news or Jam being wrong

It's not either or, it can be both. There is a benefit to me, obviously, but also making that money available for investment is also a benefit to the economy.

Jambalaya - if you are earning £100k those talents surely are a given.

JY Altruism is what Americans do with their tax deductable donations to charity. In the UK the government just takes the money. Providing tax incentives for saving is smart policy. A GPs pension is worth well over £1m and that's paid for by the state, ie taxpayers. It makes sense for people to be given an incentive to save. Have a look at some of the calculations for the cost of state pensions over the next 50 years.

Some examples (using online calculator)

Gross net/month Annual Deductions Average Tax Rate

12,500 966 913 7%

25,000 2,880 4,913 20%

50,000 9,403 13,674 27%

100,000 5,444 34,674 35%

250,000 11,924 106,914 43%

500,000 22,965 224,414 45%

So as earnings go up the tax rates go up. Plus of course higher earners will be paying higher VAT and property taxes. A person on 250k earns 10x more than "national average" of 25k and pays 20x more taxes.

Jambalaya - if you are earning £100k those talents surely are a given.

Agreed, I was just responding to the "hard work" comments as a justification for high earnings.

So as earnings go up the tax rates go up.

I don't think anyone's disputing that. We have a progressive tax regime.

@ninfan why not post up total tax and NI paid by each of your 4 examples ? I'll do the calcs later but last week I posted an example than someone on £250k pa posts 47 times more tax/NI than someone on £17k - 14 times more gross pay, 47 times more in payments to the government

There is another way of looking at this that I suspect will be lost on those feeling sorry for themselves/others paid significant wages and paying significant tax. Your employer knows you are paying lots of tax, it's no secret and they are not stupid. Employees are incentivised by the take home not the top line and wages are therefore set to take this into account - i.e. if you want an employee to feel 10% more 'worthy' than the pay scale below you are going to need pay more than 10% extra if the pay increase takes you over a threshold. The higher tax is effectively a tax on the employer not the employee. If suddenly higher tax tax thresholds were abolished or increased do you really think wages would remain as they are?

In your example is the employee on £250K actually 'worth' 14 times more than the person on £17K or working 14 times harder? I doubt it - you just have to pay that much more to make the take home for the two role reflect the true worth.

If the tax was graduated as it used to be I'd likely be less bothered but the total amount of tax I'd pay would me more.

@gonefishing, exactly. I too am fortunate enough to be in that position. I've posted here regularly that around 40% tax people are happy to pay it and take the money, somewhere around 50% people actively look to change their behaviour to minimise tax even if it means less money in their pocket in the short term.

A couple on £50,000 each will each take home £36,326 a year (£3,027 per month). That's £72,652 combined (£6,054 per month).

A single earner on £100,000 will take home £65,326 (£5,444 per month).

(All according to http://www.moneysavingexpert.com/tax-calculator/)

So, the couple are £610 a month better off, which is about 11% and I'm pretty sure that two people on £50k will do more than 11% more work than one person on £100k.

it can be both

I am not sure, given the meanings of the words you really can be altruistic and self serving its like being helpful and unhelpful at the same time.

I get your broad point here but your original post made it clear you were doing it for yourself. that the money is then used "well" is incidental to the reasons that you do it.

Your original post made it clear that you were doing it out of self interest [ not a dig to be clear].

JY Altruism is what Americans do with their tax deductable donations to charity. In the UK the government just takes the money.

Well that certainly answered the points I made about you being wrong 😕

I guess that is how you retain your always correct 100% ? Just ignore the evidence that contradicts your view ,say something unrelated and then reassert your original point.

Have you considered politics as a career option?

Have a look at some of the calculations for the cost of state pensions over the next 50 years.

[b]Again the state pension is not income related[/b] A private pension is not offset against the state pension Can you highlight the savings you think we make as I have explained why that is false. Re asserting it again without negating my points is [I cannot finish that point in a polite manner will unwise do ?]

Whether one has or does not have a personal pension does not alter the fact one will get a state pension.

I get your broad point here but your original post made it clear you were doing it for yourself. that the money is then used "well" is incidental to the reasons that you do it.

Your original post made it clear that you were doing it out of self interest [ not a dig to be clear].

Oh my primary motive IS selfish, I want to increase my pension pot and the tax break makes it very advantageous. I also don't think that when I retire there will be a universal state pension. That being said even though my interest is selfish it doesn't mean that there isn't a wider benefit. If I were to do the same thing by buying more leave rather than a pension investment I doubt there would be quite the same reaction in spite of it being purely selfish with no wider benefit.

£100k a year isn't the top 1% of earners, quite far from it

Top 2%, according to https://www.gov.uk/government/statistics/percentile-points-from-1-to-99-for-total-income-before-and-after-tax

£150k puts you in the top 1%.

(Edit: based on income tax payers)

[b]The minimum wage is low pay, no doubt. People on it are supported in terms of pensions, NHS and welfare by higher earners.[/b]

Hang on, the state pension is linked to contrubutions through national insurance (and everybody who works for long enough gets one). I worked a minimum wage job for years and received no welfare (either from the government or the rich). Also, last time I checked, the NHS was there for all of us, not just the working poor...

Forgive me if I'm misquoting, but this makes me quite uncomfortable. If you are talented or lucky enough to be earning £100k plus a year then bloody good luck to you, you've clearly done well and no one should begrudge you your salary. Also, I get that tax is a pain in the backside, but it is fundamentally untrue that the tax paying rich support people on lower pay.

Employees are incentivised by the take home not the top line and wages are therefore set to take this into account - i.e. if you want an employee to feel 10% more 'worthy' than the pay scale below you are going to need pay more than 10% extra if the pay increase takes you over a threshold.

With that reasoning, I hope you don't own your own company or employ too many people. Quick question, where does the tax come from? (Edit:actually you have just answered that)

In your example is the employee on £250K actually 'worth' 14 times more than the person on £17K or working 14 times harder?

So who should decide what anyone is worth? Certainly NOT the government.

And what is working hard?

And what has that got to do with the determination of wages?

THM - remember this is STW forum chat, rational thinking and logic are not considered to be relevant. Subjective analysis is king!

but it is fundamentally untrue that the tax paying rich support people on lower pay.

I'd be really interested to know the actual figures on that.

What does it cost from birth to death to be an average UK citizen? By that I mean how much does it cost to educate you, pay for your NHS treatment plus an equal share of local and national expenses (roads, local government, emergency services, defence etc). Assuming you were averagely well, claimed no benefits throughout your life but contributed an even share towards national non person specific costs what does your existence cost the nation?

It would then be interesting to calculate how much you have to earn throughout your life to pay enough tax to cover your share, and therefore how many of us are net contributors and how many not.

What does it cost from birth to death to be an average UK citizen?

Anyone earning less than £47k isn't "paying their way", IIRC. However, those earning more wouldn't be able to do so without those earning less doing their jobs.

Mashiehood, I'm not arguing that the rich don't contribute singnifantly more to the pot, of course they do, I'm arguing with the belief among the rich that people on low pay are a great tax burden. During my time earning minimum wage I was no greater a burden on the taxpayer than someone earning £100k. During my working life I will contribute enough NI to cover my state pension, it is not a gift from the tax paying rich...

So who should decide what anyone is worth? Certainly the government.

And what is working hard?

And what has that got to do with the determination of wages?

Assuming the 'Certainly the government' is a typo and what you actually mean is NOT the government....

Who should decide - I guess in the society we live in that'll be market forces. But you knew that already. My argument is that the market forces link to salary has more to do with the take home than the headline figure.

Hard work and what's that got to do with it - tricky isn't it. But by christ you would have to hope that hard work was rewarded or at least in the mix alongside skills & experience. But looking at the hard work for minimum reward that some folk have to make it's clearly not always the case. I personally find that quite depressing.

It's a gift from future generations, the government will have spent your money well before you retire. It's a Ponzi scheme don't forget and one that will collapse. So be prepared!

Assuming the 'Certainly the government' is a typo and what you actually mean is NOT the government....

Indeed that was a false edit earlier. Now corrected

Who should decide - I guess in the society we live in that'll be market forces. But you knew that already.

Indeed ^2 but only where relevant

My argument is that the market forces link to salary has more to do with the take home than the headline figure.

As someone who employs people, let me just say that I doubt this is the case. Never had that conversation in my life. Most people are very, very hazy on their take home pay. They think and negotiate on their headline number.

mashiehood - MemberYou sure about that?

Once again fixating on direct tax paid and ignoring all other contributions.

Some people need a reality check.

It's a few years old but, according to the IFS, earning £35,345 per year puts you into the top 10% of earners in the UK and earning £99,727 puts you into the top 1%.

([url= http://www.ifs.org.uk/publications/4108 ]IFS report[/url], [url= http://en.wikipedia.org/wiki/Income_in_the_United_Kingdom#High_income ]summary table on Wikipedia[/url])

I don't quite earn enough to pay 40% tax, but I'm probably still in the top 10% and I'm very comfortably off.

1. It's not a frickin savings scheme

2. Without the state you wouldn't have currency, infrastructure, markets, banking, law and order. If i wanted what you had I'd take my club and smash you over the head with it and take whatever it happened to be.

3. You live in a SOCIETY you are not gods blessed special little snowflake unique in talent and capability and if you fell down a hole tomorrow the world would keep spinning

4. Yes it's prbably quite annoying but in light of the above, you can either live with it or make representations to those with the capcability to change it or belt up.

negotiate on their headline number.

Agreed, but I know what my headline number 'feels' like in my take home. I guess there are some folk naive enough not to appreciate that negotiating a £10K pay rise won't mean £10K more in the bank but most aren't and even if it is at a subconscious level know what such a pay rise would 'feel' like despite not doing the calcs.

Once again fixating on direct tax paid and ignoring all other contributions.

Are you going to link to that massively problematic report that tries to argue that the "poor" (for want of a better word) pay more in tax as a percentage of their income than the rich whilst simultaneously acknowledging that the same group receive more in benefits than they pay in taxes?

Hard work and what's that got to do with it - tricky isn't it.

Yes it is. As an aside my older son worked in a pub last summer on min wage and as an intern in a law firm on a different one!!

Cue, "Dad, working in the pub is much harder work that working in the law firm. It's exhausting."

Response, "And the lesson is.......?"

gonefishin - MemberAre you going to link to that massively problematic report that tries to argue that the "poor" (for want of a better word) pay more in tax as a percentage of their income than the rich whilst simultaneously acknowledging that the same group receive more in benefits than they pay in taxes?

No, don't know what report you refer to and it doesn't sound like it addresses my point anyway. (though I don't see why you'd say "tries to argue", those 2 points obviously aren't exclusive?)

Apologies, there was a report that is widely circulated to show that those on low earnings pay a higher proportion of their income on tax, although closer analysis shows quite a few problems with it.

It's far from obvious to me why those two points aren't exclusive. If on a net basis you receive more money from the state than you pay in taxes (based on your earnings) then to me that says that you effectively don't pay any tax. Nothing necessarily wrong or bad about that but to argue differently seems wrong to me.

Drac - the gap isnt that big.

I based it on £42.5k Vs £100k and yes that was the difference.

The point I am making is that there are a lot of people who now earn £100-£200k who work very very hard for it. There are people who earn a figure higher than that, well lets say £500k + who do not work any harder for it.

Yeah and there's those who earn £12.5k who work extremely hard whilst there's those who earn £100k who don't work any harder. It's a mute point.

So who should decide what anyone is worth? Certainly NOT the government.

Why not? and if not what then and why ?

Serious question would it really be worse than a market*? A market that decides that Joey Essex** or wayne Rooney is worth more in a day or week than a nurse earns in a year? In rooneys case I assume he earns more in month than a nurse will in a lifetime.

I doubt many of us think this is right even though we can explain why it happened.

I dont look at the market and go you know what all the decisions you have made on wages are correct. I doubt anyone does.

* I accept they would both be crap

** i only heard about him on here but I assume he earns well

Cue, "Dad, working in the pub is much harder work that working in the law firm. It's exhausting."

It's funny, some people who go to work every day and have to completely bust a gut, use the "I graft for my money" badge as some sort of argument that trumps the those who sit in an office all day "doing nothing".

My other half works "harder" than me and I earn more in a day than she does in a week. This upsets me at times, but then I realise its just because physical effort is one of the few tangible ways we can demonstrate what is required to do a job. But obviously, it's much more complicated than that. I'll never come home physically knackered after being rushed around on my feet all day, but then again she'll never go for days without sleep or with diarrhoea trying to work through something complex where a mistake will lead to job losses.

My advice to any youngster planning their future career would be to either find something they love, or find a skill that will pay well. they might get lucky and the thing they love will also pay well I suppose, but betting your future on that is risky IMO.

Worst case scenario, for me anyway, is doing something you hate for low pay.

It's obvious why Rooney earns way more than a nurse. He is allegedly one of the best footballers in the world and, hence, he brings in massive amounts of revenue and PR for his employers. If football fell out of fashion he wouldn't get those wages.

Compare that with there being nearly 400,000 nurses in the UK. The majority of which won't be world class and worse (for them) are working for effectively one employer who dominate the market and hence, their pay conditions.

It's obvious why Rooney earns way more than a nurse.

😀

However, those earning more wouldn't be able to do so without those earning less doing their jobs.

@mike, Whilst I agree that any venture needs team work and contributions from many people from and economics/taxation perspective this isn't true. At the extreme all the "lower paid jobs" could be outsourced abroad.

In your example is the employee on £250K actually 'worth' 14 times more than the person on £17K or working 14 times harder? I doubt it - you just have to pay that much more to make the take home for the two role reflect the true worth.

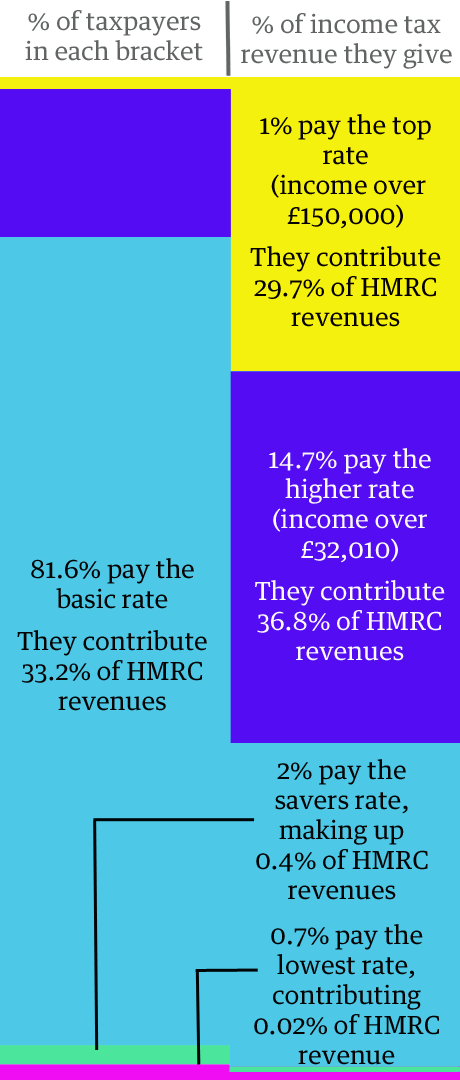

@convert - the question of "worth" is very subjective, in my view it doesn't really matter it's what the market/society is prepared to pay and as per the graphic posted earlier the higher earners [b]absolutely do indeed[/b] support the wider community with their taxes.

At the extreme all the "lower paid jobs" could be outsourced abroad.

Where the money they earned ends up in shop keepers pockets on another continent and the VAT in another government's coffers. The tax burden on the wealthy would be even higher if it wasn't for the VAT paid by the poor(er).

Jambalaya - Who would be your market then?

@mike, Whilst I agree that any venture needs team work and contributions from many people from and economics/taxation perspective this isn't true. At the extreme all the "lower paid jobs" could be outsourced abroad.

Eh? How would street cleaners and the like get outsourced abroad? Wouldn't UKIP's collective forehead vein explode if thousands/millions of people turn up at the ports each day?

@fin25 - we live in a society with a generous welfare state, that's part of the "contract". What I resent is this notion you get from some posters on here that somehow the better off are getting a free ride.

JY, you are certainly consistent with the deliberate misquotes. Some threads I have a 100% track record, others not so. I am struggling to recall one where facts I have posted have proven by you to be incorrect. We can all have different interpretations you don't seem to be able to grasp that.

However, those earning more wouldn't be able to do so without those earning less doing their jobs.@mike, Whilst I agree that any venture needs team work and contributions from many people from and economics/taxation perspective this isn't true. At the extreme all the "lower paid jobs" could be outsourced abroad.

Really? The cleaners, the binmen, the nurses and doctors, the teachers, the road builders, the military.

I'm not sure what you do, but could your company exist if the country wasn't defended, your workforce wasn't educated and healthy, if the roads were just dirt tracks and there was rubbish strewn about the streets?

Jambalaya - Who would be your market then?

The example was an extreme one. There are plenty of state employees and people on welfare, you could be in a business focused on international clients ? You see it in many retail businesses now, there is little UK manufacturing but retail staff still their goods to someone. Plus of course you have the online phenomenon where there isn't even a shop or perhaps any UK staff. The founder of such a site could make quite a lot of money and employ virtually no one in the UK

face - palm.

The example was an extreme one.

To say the very least!

there is little UK manufacturing

Not true, plenty of UK manufacturing at all levels. Thank goodness. The death of UK manufacturing is a myth.

@mike, I agree all those jobs have to exist but the lower paid jobs or those need not be in your business. My post was "at the extreme" and in responce that higher paid workers relied on the efforts of lower paid workers to justify their position.

You're debating with yourself. Everyone else is talking about the whole of society NOT one organisation.

You're debating with yourself. Everyone else is talking about the whole of society NOT one organisation.

This.

We're not talking about the minimum wage workers in the widget factory being needed for the head of widget sales management to earn £200k + bonuses, we're talking about the health care worker on minimum wage who is getting the head of widget sales management's mum out of bed and fed on a morning, the teaching assistant looking after and educating his son, the sexual health charity helping to stop his daughter getting knocked up, the labourer who repairs the roads that his widgets travel along to his customers, the postman who delivers the invoices....

It's obvious why Rooney earns way more than a nurse

I think you [ and THM in his glee] missed this bit of my original post

I doubt many of us think this is right [b]even though we can explain why it happened[/b]

I did not say I could not explain it.

We can all have different interpretations you don't seem to be able to grasp that.

Until reading this I had not realised that folk had different interpretations so thankfully you are still 100% correct and I have not disproved that one 😕

Once again fixating on direct tax paid and ignoring all other contributions.

yes, lets not lets fact get in the way of a good argument!

It is a slight digression to what I originally posted about, but it was touched on by an earlier post and relates to what each person's existence costs the state. I firmly believe that each and every household should be given an annual statement from the government breaking down the costings for everything they receive. I agree that in principle it would cost a huge amount to implement such a process, but it might make people open their eyes to the fact that most take more from the state than they pay in.

I am trying to find the illustration where it shows the split of tax payers who take the most and least from state but can't find it, it's quite an eye opener..

Not the illustration, but the Nick Robinson program that showed tax paid vs benefits received

[url= http://www.bbc.co.uk/news/uk-politics-13633966 ]Nick Robinson Documentary[/url]

An interesting thread.

I'm lucky enough to fall into the "60%" threshold, though am far more concerned about the increase of the minimum wage to a living wage (my employer pays the living wage to the few who find themsves earning at that level) than I am about shaving my tax contribution.

I'm lucky, and I know it. And I'm content to know that there's more to life than measuring my fellow man (and woman) by the amount of tax they pay. If that's our only relationship then we're doomed.

[i]In 2010-11 the Treasury paid out £692bn in public spending. This adds up to £22,000 being spent on behalf of each family, according to the Institute for Fiscal Studies. [/i]

and with income at £589bn...

Although I reckon the £692bn is ALL public spending; welfare, defence, Govt, education etc - so a pretty meaningless number, except that it is far greater than income.

Maybe i should ask for a massive pay rise on the basis that I would then be a net tax contributor, which, not only being better for everyone else, would also make me bloody Jesus...

“There is nobody in this country who got rich on their own. Nobody. You built a factory out there - good for you. But I want to be clear. You moved your goods to market on roads the rest of us paid for. You hired workers the rest of us paid to educate. You were safe in your factory because of police forces and fire forces that the rest of us paid for. You didn't have to worry that marauding bands would come and seize everything at your factory... Now look. You built a factory and it turned into something terrific or a great idea - God bless! Keep a hunk of it. But part of the underlying social contract is you take a hunk of that and pay forward for the next kid who comes along.”

? Elizabeth Warren

Was she pissed at the time?

Was she pissed at the time?

The former Harvard professor, now US Senator? Possibly, though she's a Methodist and I don't think they're meant to drink?

Oh dear, wrote that sober?

"The rest of us paid for...." Gets you into Harvard?

You may be confusing something said in a speech with Harvard entry qualifications.

Quote from the Nick Robinson piece

"The top 10% of earners pay 5 times more in tax than they get back in government spending (education/nhs/welfare etc). The problem for politicians is that those in the middle of the earnings scale simply do not believe they receive more in spending than they pay in taxes"

@br it's not meaningless as the bills have to be paid, we all have to contribute towards defense. Agreed on the spending vs income deficit

The problem for politicians is that those in the middle of the earnings scale simply do not believe they receive more in spending than they pay in taxes

ah the whats in it for me brigade. The Elizabeth Warren quote is very good, at times it's like the I pay too much tax/why can't we have amazing cycling infrastructure and pay our nurses/soldiers and firefighters like premiership footballers.

The top 10% of earners pay 5 times more in tax than they get back in government spending (education/nhs/welfare etc).

Which is what anyone would expect; I'd have assumed it was more than that, to be honest.

The problem for politicians is that those in the middle of the earnings scale simply do not believe they receive more in spending than they pay in taxes

I get loads in return for mine. I have two kids at state school - that costs the government £5k per child per year which is [i]way[/i] less than I'd pay to send them private if there were no state schools. In fact, that probably takes all of my income tax payments, so everything else I get is free 😉

I don't quite earn enough to pay 40% tax, but I'm probably still in the top 10% and I'm very comfortably off.

+1. Plus people do like to forget that it's the poor who pay a disproportionately high percentage of their income in tax, which matters rather a lot when you don't have much to start with.

I love this thread, it starts with some wealthy people complaining that they pay too much tax and then morphs into some wealthy people telling us how we would all be screwed if they didn't pay their taxes.

You can't be Scrooge and Jesus at the same time folks...

Can anyone tell me if Labour are going to reverse the university fee situation? Not a loaded question, I'm genuinely interested.

Edit; just GTS'd

Cutting tuition fees from £9,000 to £6,000 will reduce average graduate debt by nearly £9,000. And because our plan is fully funded, it means £40 billion less government debt by 2030-31, or over £10 billion less government debt over the next Parliament. We will also help students from lower and middle-income families by increasing student grants by £400, so that the full grant goes up from around £3,400 to around £3,800. More than half of students will benefit. We will pay for the grant increase by asking the highest earning graduates to pay more: increasing the interest rate on the loan from 3 to 4 per cent for those earning over £41,000. This will make the overall system of repayment fairer, but all students will be better off overall as a result of our plan – with less debt, and less to repay.

So, by a [i]bit[/i] is the answer and it'll be funded by stopping tax relief on pensions for high earners.

Which one wrecker? The ones they introduced or the ones the coalition introduced?

Can anyone tell me if Labour are going to reverse the university fee situation? Not a loaded question, I'm genuinely interested.

They're proposing lowering the fee from £9k per year to £6k per year, which will make no difference to the majority of graduates as most won't ever pay off their loans fully regardless of their level.

taking Mikes point it's a clever idea... loans at that level (if still backed by the government overall) are just a way of paying the university the money but pretending it will all get paid back. The government still forks out up front and pays the fee's just has a mechanism to tax graduates a higher rate.

They're proposing lowering the fee from £9k per year to £6k per year, which will make no difference to the majority of graduates as most won't ever pay off their loans fully regardless of their level.

Yes, the system introduced by the present government is actually costing more than the old one.