![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

I've just had a offer accepted on a house in Sheffield(157000).I have a buy to let property that I let to my brother for cheap, which I paid stamp duty on when I bought it.This property I'm buying is for me to live in.Do I need to pay stamp duty on this,as my solicitors are saying that I do but that it is my responsibility to check.Ive checked online but find it pretty confusing as I didn't think I had to pay it if the property is for me to live in.Just wondering if anyone can help with this,I appreciate im most likely wrong and will have to pay.Cheers for help

I'm guessing that you’ll pay 3% surcharge, but by no means sure.

yeah unless you sell the other place within whatever the time period is (3 years) you owe the standard stamp duty + 3% on your new house. Looks like its about £5k

Your paying a professional to advise you, and they've said you should pay it. Not sure on the arse covering you responsibility to check statement? Possibly worth paying for a second opinion if you don't trust the first

My solicitors made a mistake with our stamp duty, to the tune of costing us 10k more due to a rather obscure rule around granny annexes. I found out a year later as we were contacted by those no win no fee solitictors saying we'd overpaid. Our original solicitor was super keen to help and get sorted for 'free', as apparently they would have been sued by no win / no fee solicitor for providing incorrect advice. So no 'my responsibility to check' in that scenario

Your paying a professional to advise you, and they’ve said you should pay it. Not sure on the arse covering you responsibility to check statement?

Most property solicitors won't advise on tax clauses to avoid the exact scenario you accidentally wondered into. the op is paying a professional to advise on property law, not tax law, which is why he's been advised to check elsewhere.

I sold my flat (main residence )6 months ago.I looked on internet and Zoopla and couple of other sites state that if I'm purchasing my new main residence I'm not liable for the 3percent surcharge,even though I have a buy to let.🤷Very confused now as thought this was what I'm paying solicitors for,to confirm if I need to pay it or not.

It's a second property unfortunately, so you will have to pay £4700, if you sold the other property it would mean no stamp duty on this property.

Your property solicitor knows this well, they're just stating it's your responsibility to check, they will be able to pay this for you when you transfer funds to them.

You own another property, regardless of whether you live in it or not. After this purchase you will own 2 homes.

You will pay stamp duty/second home supplement (claimable back in a time period of you sell property no.1.)

Yeah, as above, ask the solicitor the period you can get a refund if you sell the other property, think it's 3 years but may have changed, the rules always change on this, hence why the property solicitors should be the main ones to ask, yes they will always caveat with 'it's your responsibility', but their advice should be in line with current policy.

Yes happened to me sadly, buying a main residence when you own another UK property. You can claim it back in the allowed window. It's the law so you have no choice.

When I bought a holiday house I paid stamp duty (Scottish equivalent) and the 3% additional dwelling supplement. Did you pay that when you bought the buy to let property? I then sold my main residence last year and bought another a few months later. I didn’t have to pay additional dwelling supplement on that as it was my main residence.

Main principle is if you have two houses or more you can only nominate one as your main residence. If you didn’t pay ADS on your buy to let you will have to pay it now on your second (in theory) house purchase.

There is a question here - when you bought the 'buy to let'. Where were you living? Did you have another house and the 'buy to let' was your second home?

As Aberdeenlune says, if the 'buy to let' was the defacto 2nd home when you bought it, then the transfer on the Principal Primary Residence - PPR - to this house (from the unmentioned previous one) could be intact.

However you have written your post as if the 'buy to let' is your only house (presume you rent/stay with parents/friends/abroad), and this second house is your second property. I also assume that you havent nominated to HMRC your PPR? ( https://www.taxinsider.co.uk/how-to-nominate-and-vary-your-main-residence-ta)

There is an arguement - as Aberdeenlune states, that the buy to let was your 'second home' at that point - if you owned another when purchased way back when....

I own multiple properties however and havent managed to 'get out of' the additional supplement yet, even with lawyer/accountant help (mainly due to written nomination to HMRC).

It's an additional property. You'll have to pay it.

Edit - In Scotland, the solicitor is on the hook for making sure the LBTT (stamp duty equivalent) is paid. You can't get the title registered without paying it.

Just be aware that you can offset the stamp duty against any CGT when/if you sell it.

Actually its not clear cut:

You owned a flat and paid stamp duty on purchase

You then bought a house for your brother and paid stamp duty + the 3% additional duty on it.

You then sold flat

You rented / whatever- but crucially did not go and live in the house with your brother

You are now buying another house to live in

So far as I understand you are going to live there you just pay the normal stamp duty not the +3%

However if you did go and live with your brother, then that house became your primary residence and your new purchase becomes your second home which you need to pay stamp duty + the +3% on

You should ring the stamp duty folks with a full explanation

You then bought a house for your brother and paid stamp duty + the 3% additional duty on it.

Where does he say that?

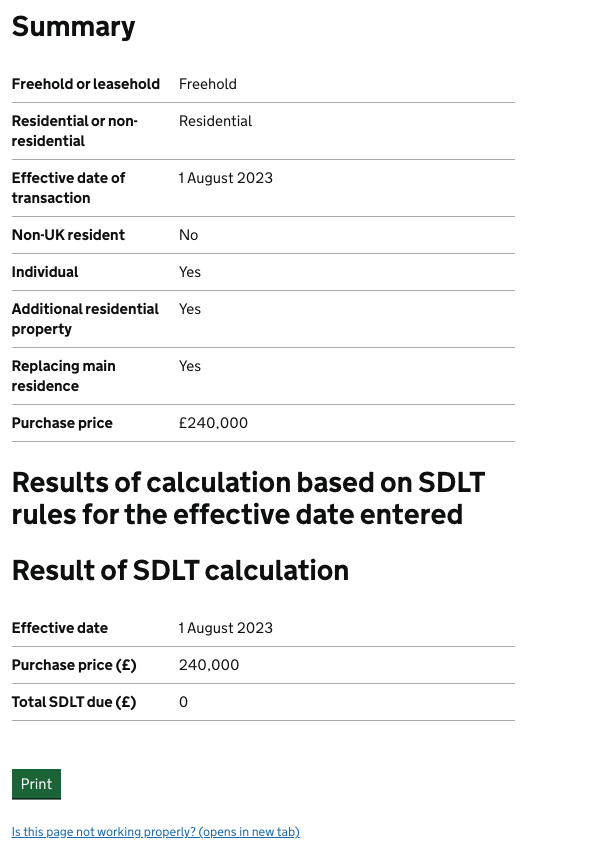

That calculator is good 👆

And I was wrong 🤦🏻♂️

Agree with OldTennisShoes.

Just read the post where OP states sold a PPR flat 6 months ago further up. The calculator states that its a replacement for PPR. So no additional 3% to be paid.

But id ensure you nominate the new property to HMRC soonest as PPR to avoid future CGT issues

Actually its not clear cut:

I thought they simply presume that your first home is your primary residence and anything you purchase subsequently is a second home UNLESS you officially designate it as your primary residence - this does not simply mean living there for a bit. What was your primary residence will then become liable for CGT.

You then sold flat

You rented / whatever- but crucially did not go and live in the house with your brother

You are now buying another house to live in

Surely as soon as the flat was sold the house [he rents to his brother] automatically became his primary residence so anything he then buys is a second home.

AFAIA stamp duty is basically only calculated on the number of houses you own - not which one you live in.

Surely as soon as the flat was sold the house [he rents to his brother] automatically became his primary residence so anything he then buys is a second home.

No, his main residence is where he lives, presumably he's renting.

Gets a little more confusing,

I ended up phoning stamp duty helpline HMRC.After being on hold for a hour finally got through to someone.I explained I have a BTL which I'm keeping,and sold my flat 6 months ago which I lived in but now buying another house to live in.She has said that the house is not eligible for stamp duty,even though it will be a second property as it is my residence and under 250000.She sent me a email with a link to government stamp duty details that says this.My solicitor says that there system is connected to hmrc and they just tick boxes to do with the new property and that automatically works out stamp duty for them.I showed him the email and he's as confused as I am because he say what the stamp duty helpline lady told me and has sent me in a link is saying that I'm not eligible.I don't know how to attach a link on here but it says this -hmrc internal manual SDLT condition D.

Use the calculator up there and print off the result. That should be all you need.

Cheers, tennis shoes.

Just checked using that calculator and apparently I don't need to pay it.Which is a big relief!!👍

Yeah, you can't even always trust a conveyance solicitors word. You'd think they would know this stuff backwards and inside out...

My circumstances were slightly different, but during the conveyance process, my solicitor said I was due to pay full whack Stamp duty... she then retired and the job got passed to her second in command I guess.. so I discussed it with the new solicitor, and we both used the calculator as above, and I ended up paying about £300 stamp, rather than the initial 5 grand or so, so that was a welcome relief.