![]() You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

You don't need to be an 'investor' to invest in Singletrack: 6 days left: 95% of target - Find out more

Ah, that's good to hear then. For a moment I was thinking that sounds like a nice little scam for drivers to pull. Glad they had the correct papers etc (although sorry to hear you didn't avoid the charges on this occasion!). :--)

Blimey who still uses cheques? Also, what would have happend if you didn't have enough cash, I never have any around as I spend it on shiv I don't need..

Also, what would have happend if you didn’t have enough cash,

They take the item away until you ring up and pay over the phone with a card. There’s a number on the invoice.

I’ve never been invoiced post delivery.

This seems like a good time to just say a hearty great big "thank you" to Brexit voters.

Well done.

Also, what would have happend if you didn’t have enough cash,

Pay by card over phone and they redeliver.... Apparently

I’ve never been invoiced post delivery.

Buisness address and invoiced to a buisness....

If anyone buys from a German site and they offer ups, you can pay the duty via the tracking whilst it's in transit from Germany.... But you'll definitely have to pay duty if it's over the £135 limit (Inc postage) as ups deal with the customs.

If you use DHL / parcel force you'll have more chance of the item getting through customs without checks.... But you may have to wait for 2 weeks (or more) once it's cleared for your bill.

I ordered some bits from R2 on Friday, arrived today (via ups), paid the duty on Saturday before it had even left Germany via the tracking on line.

Waiting on some brakes (€250) from Bike-discount. The wheel of luck hasn’t stopped spinning yet.

Got this yesterday (9 days after ordering). No VAT bill yet. DHL / ParcelForce.

If parcelforce have delivered, you won't get a secondary bill for duty/vat.

Slightly OT, but I’ve just had a text from DHL saying they won’t be delivering my package (from America) until the VAT, duty and their fee is paid...

🤬🤬🤬🤬🤬🤬🤬🤬🤬🤬🤬🤬

...and breathe.

What's the issue Tom? Were you hoping to avoid the taxes/fees?

Finally got a letter from parcelforce informing me of taxes fees to be paid over a month after I paid it. 🙄

Letter was dated 16/02/21 and states they would hold onto parcel for 20 days if not paid during the 20 days it would be returned to sender.

If you are expecting something watch the tracking info if its held in customs awaiting fee payment,call to pay fees dont wait for the letter or it maybe returned to sender

^^ this, no idea why but parcelforce letters seem to be having long delays. Last letter I had was 2days before the 20day limit. One of the reasons I've swapped to UPS where I can, I'd rather not do the fees roulette and actually have the items arrive than have the hassle of it being sent back to sender due to parcel force delays.

What’s the issue Tom? Were you hoping to avoid the taxes/fees?

No issue really, it’s just frustrating hearing about all the folk not having to pay, and I’ve always had to, regardless of who sends, from wherever, via whoever.

Spose I can sleep a little better...

So my forks arrived from Starbike today - DHL & Parcel Force.

No bill yet - should I be expecting one to drop through the door?

if you've got them in your grubby tax free hands I'd say no bill.

Sweet 👍👍

Not sure if I feel bad about not paying it though........

No, no I don't 🤣

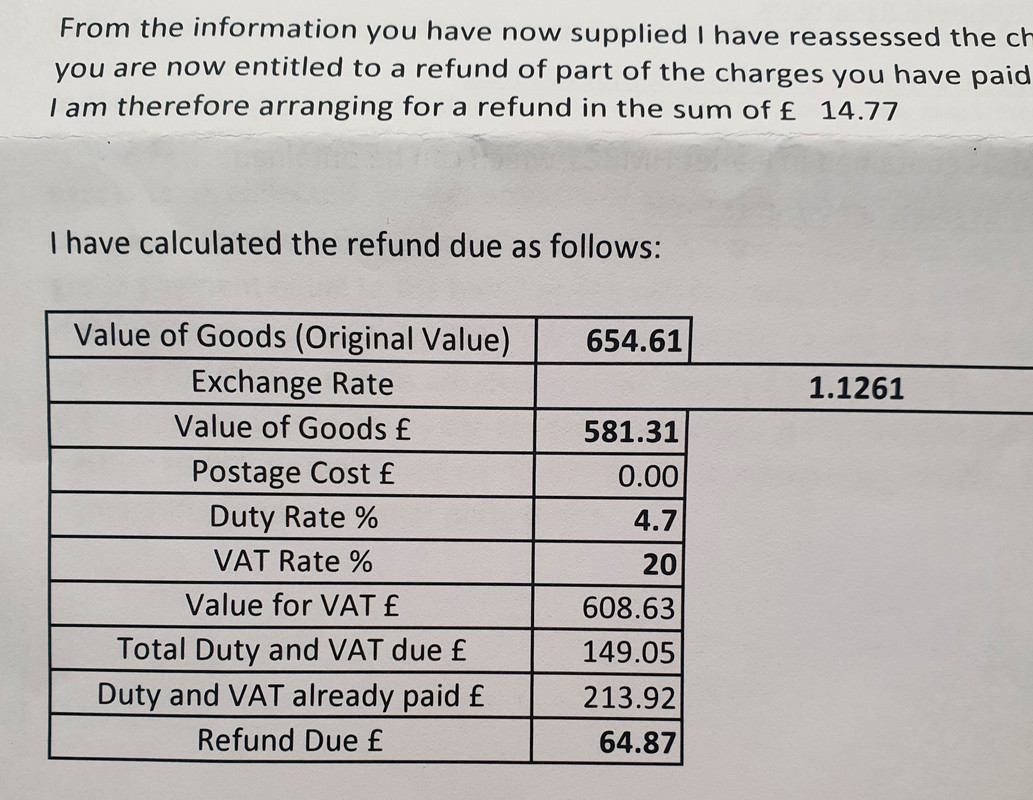

More letter communication from BF. They confirm I'm due a refund however the letter gives 2 different amounts one of £14.77 and another of £64.87. Obviously the latter is where my workings are.

What a painfully slow antiquated system that is in desperate need of modernisation.

Why is is 4.7% not 4% ?

Ah... I thought it would come under the general catch all 4% for parts.

@dirkpitt74 any update on fees from your starbike purchase. Just ordered some manitou forks from them. How long did it take to come?

@poah - no bill through post so assuming I got away with it.

They took a couple of weeks as they needed to order them in.

Ordered on 12th March arrived on the 26th.

@dirkpitt74 They apparently have the J-unit forks in stock so will see how long it takes. Not bothered about the duty as they about £100 with the extra tax than in the UK.

Anyone know how DPD handling fees compare to Hermes? I want to order an ebike battery from France as no UK stock, Alltricks let you choose at the same delivery price so apart from Hermes being more likely to lose it any financial benefit to using them?

Also if anyone knows if you can use tracking number to pay in advance as per UPS above that would be handy too

I'm in the process of buying parts for my new build - frame wont arrive until Aug, so doing this slowly. Its proving difficult to source parts from UK and mainland Europe.

I did a "test" purchase of a DT Swiss rear 240exp hub from Bike-discount.de As although they stocked more items, I didnt want an obviously expensive and large parcel - if that might have made a difference. The hub was £215 far cheaper than UK and not a lot available here anyway. It got stuck at customs and my bill was:

Customs Duty = £9.52

VAT = £42.42

Clearance fee = £12.00

Ended up paying about £280 and I have since found it at Bikester for £260. oh well.

That was with DHL and onto ParcelForce once in UK

I have since found it at Bikester for £260. oh well.

Bikester aren’t UK based either, so you’d have paid the charges, on top of £260, too.

https://m.bikester.co.uk/about.html?_cid=32_1__0_15_3_

any financial benefit to using them?

There shouldn't be any financial benefit from using one carrier or another.....

No idea how / if Hermes track items - wouldn't trust them to find the keys to their own vans....

I ordered a pair of Helm's from Starbike about 10 days ago, delivered by PF and managed to avoid any fees on this end. 👍

Bikester aren’t UK based either, so you’d have paid the charges, on top of £260, too.

https://m.bikester.co.uk/about.html?_cid=32_1__0_15_3_/blockquote >Christ, do we have to investigate each place we purchase from online to see if we are going to be charged duty or not? They have .co.uk and prices in sterling. No mention of being German upto and including payment. Surely something not right here? If so, we would have to check every purchase online to see if originates in Uk.

It's just one of the many many benefits you receive in the post-Brexit world. 🤔

If so, we would have to check every purchase online to see if originates in Uk.

We do. My other half keeps ordering stuff from UK sites only for them to arrive from Italy or wherever with customs details on them. No charges yet. Haven’t looked into why… made in EU, VAT collected at source and paid to HRMC…? Or just snuck through? No idea… but were paid for assuming UK stock and they then turn out not to be.

Tbf a few of the large European sites have UK depo's - Bikeinn, part of the tradeinn group, for example seem to import direct to UK warehouse/distributor and then post with royal mail from there - so no additional charges...

Postage can take a while though as it has to be shipped from where ever it is in Europe to the UK and then on to the customer- last item took 3 weeks.

I ordered a Reverb AXS from Bikester last week. It arrived (from Germany) within 5 days and the VAT was paid up front and was shown on the invoice.

Confirmation I'm due the £64 refund rather than the £14, the £14 was a typo according to the letter🙄

I just got some rockshox upgrades from bikediscount. Documents had been opened, country of origin listed as Taiwan. No fees, delivered in the UK by Parcel force

Got a dropper coming from bikester and forks coming from starbike.

The dropper has had VAT paid already and coming by UPS

The fork is coming via DHL with nothing paid yet.

Ordered some handlebars from Bikester last week and they arrived yesterday from Germany via UPS with an invoice that said duty paid.

No idea what that means, but just to add to the anecdotal advice pool.

Those people who are pre-paying with UPS, is there a handling fee to pay still?

Interesting how inconsistent this is!

I've finally had confirmation that my forks & Brakes have been shipped from R2-Bike via DHL. Let's see how the tax lottery goes...

Completely unpredictable ime. Ordered forks and brakes from R2 myself over the last couple of months in 2 separate orders. Forks sailed through with no charges, brakes got stopped and I got an invoice through from Parcelforce for the VAT and duty.

Also ordered some new rims from Bike Discount with no charges so it does seem to be a complete lottery.

Just waiting to see what happens with my frame from Pole now..........

how much were the brakes?

Brakes ended up being an additional £60.

£7 duty

£40 VAT

£12 admin fee

I think the brakes were £215 originally.

could you not have bought them as separate items?

Maybe but I needed a set so just ordered as such.

My forks arrived from starbike via DHL/parcelforce. No duty paid.

dropper arrived via UPS no duty but did pay VAT when purchasing.

Maybe but I needed a set so just ordered as such.

As did I when I got my G2 ultimates from R2-bike, but bought them separately as I worked out (with the help of a few forum folks) I'd have a better chance of slipping through the net so to speak. Worked out about tenner more than buying a pair before added fees, but they got through no issue at all as both were under £135, rather than a collective £260.

My forks arrived from starbike via DHL/parcelforce. No duty paid.

This is encouraging since I have forks coming via the same couriers.

I think it's just luck of the draw at the moment though!

It seems pretty likely still that a big part of it is that packages aren't being routinely checked so a lot of stuff is still passing through. "Taking back control". I get quite a lot of taxable/dutiable stuff from China and I'm pretty sure that more is coming through unchecked than before brexit.

Incidentally, I had a package delivered by DHL early in the year, and they sent me a bill afterwards for VAT and handling, and that "we've paid your tax so you have to pay us" I emailed them back and asked them if I was legally obliged to pay, since I had no contract or agreement with DHL and had basically been billed after the fact for a service I'd never agreed t. That was the last I heard.

Also,

bruneep

Full MemberWhat a painfully slow antiquated system that is in desperate need of modernisation.

They had your money for an extra 3 weeks, multiply that across every shipment they screw around with and it adds up. Then add in all the smaller payments where people just get pissed off chasing them around. And the customer is paying for the handling. I reckon it's working exactly as intended.

Not looking promising....‘ revised customs charges raised’

16/4/2021 10:40 International Hub Released from customs

16/4/2021 10:17 International Hub Revised Customs charges raised

16/4/2021 10:11 International Hub Customs charges raised

15/4/2021 19:22 International Hub Awaiting Customs clearance

That was the last I heard.

All they can really do is to stop delivering to you, and hold any more parcels for you hostage.

so, guess the Border Force Gods were not smiling on me. Just had to stump up 20% VAT & 4% import duty.

Not the end of the world as I was only buying from Europe because there was availability (Forks & Brakes). Had I been able to source them in the UK I probably would have & paid the VAT etc anyway.

Mildly frustrating it's seemingly random!

Ordered Di2 shifters (with calipers) from Alltricks in France on the 5th of May, selected DPD as courier . Arrived in the UK and cleared customs within 3 days, then landed with Parcelfarce. Supposed to receive a letter detailing duties, VAT and fee. Eventually tweeted them this morning (13/5) to get the reference number to pay the duties (who knows when their letter will arrive?!

According to their breakdown I got hit with duties @ 14% (I'm pretty sure according to trade tariff 871494 it should be 4% for brake levers and calipers as 14% is for complete bikes unless someone can enlighten me). Paid duties, Vat and their £12 fee online, never got an email confirmation. Fingers crossed parcel will turn up.

Also ordered parts from Bike-discount.de via DHL, should land in the UK over the weekend, will update how that one goes.

Parcel force seem to be really slow with the letters - last one I had on day 19 or so, only a day before the item was supposed to be returned to the sender. I've swapped carrier where I can. Luckily I know the parcelforce delivery guy and he got me the paperwork required to pick up the item.

I do have some eewings coming from the US , which will be parcel force,so that will be interesting.

I have a bike that I need to ride to the bank on . Therefore the shop needed to buy it for me. I don’t like riding on the road so it needed to be a mountain bike.

If I needed to buy some new forks for it and I got stung for vat can I claim it back as it’s for shop use?

Hi,

I'm thinking of buying an obscenely expensive pair of wheels from Italy to try to make up for my lack of fitness and talent, and was hoping to garner some recent opinion on the likelihood of getting stung for import duty and VAT.

They're priced sans EU VAT, so ticket price is relatively "cheap", but if I end up paying £230 VAT etc then it all starts to look a it unjustifiable.

What's y'all's recent experiences of buying from the EU?

Mostly having to pay VAT etc or not so much?

Also, anyone got any good or bad experience buying from gambacicli.com?

Grazie

sorry @thegenerallist cant help you with your question, but for others, I ordered from Mantel who have a max order limit including postage of £135, ordered some tyres which came to £80ish on Saturday and arrived Wednesday with no issues.

As others have said before, if you're not prepared to pay import fees, don't buy from the EU. Treat anything over £135 as being the price plus circa 25% and if you don't have to pay the fees it's a bonus. But generally best to work on just expecting to pay them on anything over £135.

Just about to pay £348 import bill for a groupset via UPS due next week from Germany, still cheaper than UK and was available.

If they are unavailable in the UK then it's prob worth the Dutta and vat.

I just bought a tune hub - last one available anywhere for £160 (£400rrp) duty was £40 with fees etc. Sooo still 1/2 price.....

Also remember you'll pay vat on the total price including postage costs.....

Right, a new challenge.

I want to send my fork to Germany, have some knackered bits of it replaced, then sent back to me. Is there a way of doing this without getting rinsed for the VAT of full value of the fork each way, rather just pay the VAT on the new bits on return?

Or am I better off just learning how to rebuild forks?

I've sent a Bulova Accutron watch to the US for repair and avoided duty by using words similar to below on the customs declaration. Worked fine on the way to the US, unfortunately the repairer didn't bother on the way back so I got hit for the duty (which he then refunded, he'd sent back the wrong watch too but that's a different story)

- Description: Wris****ch for repair

- Return within three months

- £0.00 No commercial value

Does putting zero commercial value not ruin any insurance I might take out for its journey though?

@tom Howard

We use a carnet for things like that, just imported a 130k microscope for 2 months using it.

Sorry Tom, not answering your question, but thought I ought to note the outcome of my purchase since its only polite to add to the data ( that's the plural of antidote (sic) isn't it):-)

Didn't pay and VAT or duty on the wheels from Italy.

New SRAM eagle XO cassette.

Customs Duty = £8.39

Import Vat = £47.01

Clearance fee = £12

Optional Farcelforce Saturday Deliver fee of £12 ???

Is there a way of doing this

Yes there is. But the likelihood of it going wrong in at least one direction, and wasting hours of your life, is very high. It would be worth asking if they'll pay someone in the UK to fix it.

Yes there is. But the likelihood of it going wrong in at least one direction, and wasting hours of your life, is very high. It would be worth asking if they’ll pay someone in the UK to fix it.

Further research has revealed this to be true. I’m gonna give it a go myself. (It’s not on them to sort it, its out of warranty)

Imagine being a small UK brand trying to look after your customers across our new self imposed barriers... 😶

My parcel has been held up in customs for almost a week now with the tag "awaiting clearance information needed from addressee" after a couple of calls got to someone who gave me a contact email, within 20 mins of sending that someone called me.

The reason it was held was the description of the goods were in German and they didn't know what was inside. 🤦♂️ Google translate isn't obviously a tool they can use in Parcelforce worldwide. Now I have to wait 7 days for the fee letter to arrive before I can pay what I'm due.

viva brexit

Just putting in my two penneth...

Bought a Joe Blow Booster pump back in November from BikeInn(.co.uk) for about EUR130 and £20 cheaper than the UK.

In May it went wrong, under warranty.

Oh my word, the returns process was painful.

If you have to return stuff then prepare for hassle, couriers, paperwork and cost.

Then, if it's exchanged, prepare to pay the VAT, duty and fees again.

Worth considering this grief before buying something from the EU.

Overall, I've sort of given up on Europe unless it's the only stock available and / or I'm not worried about writing it off if it goes wrong.